Join Our Telegram channel to stay up to date on breaking news coverage

Three Arrows Capital (3AC) has emerged from bankruptcy and rebranded itself as 3AC Ventures. OPNX, a bankruptcy claims exchange, made the announcement, sparking interest and discussion within the cryptocurrency community.

3AC Capital Rebranded 3AC Ventures

On June 21, OPNX announced its latest collaboration with 3AC Ventures as a key partner within its ecosystem. The primary objective of this partnership is to allocate investments toward the development and expansion of projects within the OPNX ecosystem, with a shared vision of fostering a decentralized future.

3AC is dead, long live 3AC Ventures https://t.co/61s8uQquOZ

— Kyle Davies 🐂 (@KyleLDavies) June 21, 2023

In April, OPNX (Open Exchange) made its debut as a claims exchange. This venture was co-founded by notable personalities, including Kyle Davis and Su Zhu from 3AC, along with executives from Coinflex. It is worth noting that the platform was originally known as “GTX,” but rebranded itself to OPNX.

The exchange focuses on its scalability. It supports a user base of 20 million individuals, and is working to solve $20 billion worth of claims entangled in bankruptcy proceedings. Presently, OPNX is handling claims from Celsius customers, and it plans to extend its services to other platforms such as FTX, BlockFi, Genesis, Voyager, and 3AC.

“Open Exchange serves as a reliable and secure platform for individuals adversely affected by crypto crises, offering a solution and a supportive environment. It enables claimants to swiftly access their locked claims, convert them into cryptocurrencies, or utilize them as margin capital,” said OPNX.

3AC Ventures Revival Hope

Currently, 3AC Ventures has a website page with a brief message stating, “3AC Ventures focuses on superior risk-adjusted returns without leverage.”

While the website offers little information about the new entity, it indicates that 3AC Ventures is the successor to an extinct crypto venture company.

In June of the previous year, the 3AC crypto hedge fund, which had suffered significant losses, filed for bankruptcy following the the collapse of the Terra/Luna ecosystem.

Following the bankruptcy, Davis and Zhu, former associates of the previous company, disappeared. The bankruptcy proceedings also revealed that 3AC Ventures had creditor claims amounting to $3.4 billion. However, the current status of these claims and ongoing legal matters remains undisclosed.

Although there is a need for more specific information, 3AC Ventures has expressed its commitment to supporting projects that are striving towards a decentralized future. However, the details surrounding this support and the specific projects that they will target remain unknown at this time.

Announcement of 3AC Ventures Sparkes Reactions

There have been contrasting responses within the crypto community regarding the demise of 3AC, with various individuals expressing their opinions.

Arthur Hayes, the former CEO of BitMEX, inquired about the reasons behind 3AC’s downfall, stating, “Why did 3AC die? Please tell us.”

Why did 3AC die, please enlighten us? https://t.co/mfQzGq4OP8

— Arthur Hayes (@CryptoHayes) June 21, 2023

Another user, @LilMoonLambo reacted with surprise and amusement, exclaiming, “holy crap this is real lol.”

holy shit this is a real tweet

— LilMoonLambo (@LilMoonLambo) June 21, 2023

In response to the mixed reactions, Davis, one of the figures associated with the previous company, retweeted a comment from “@quamfywhale.”

3AC was the biggest victim of FTX manipulation of using client collateral to trade against them which they used to liquidate 3AC. Why are clowns mad at 3AC and calling them scammers. People’s brains are so easy to program they don’t give anything a deep look and believe anything https://t.co/3SVvdU5U6J

— quamfywhale (@quamfywhale) June 22, 2023

This tweet claims that 3AC was heavily impacted by alleged manipulation by FTX, wherein customer collateral was supposedly used to trade against them, resulting in the liquidation of 3AC. The tweet suggests that these individuals are questioning the accusations of scamming, pointing to 3AC, and attributing the downfall to external factors.

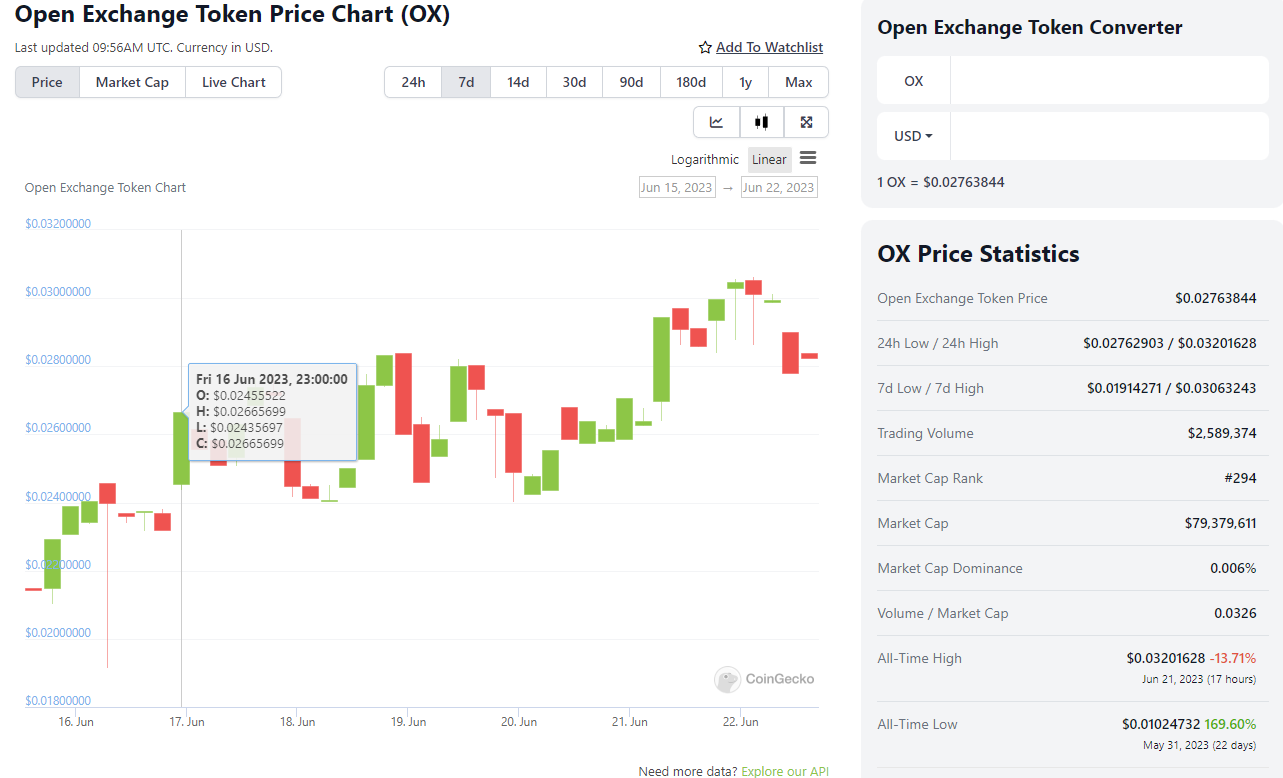

On June 21, following this news, the Open Exchange Token (OX) reached a milestone by achieving an all-time high price of $0.032. However, according to CoinGecko the price retraced slightly in the hours following the peak and, at the time of writing, is trading at $0.027.

Related News

- Atom Faces Zero Prospect as SEC Labels COSMOS a Security, While a Sustainable Crypto Emerges as Potential Explosive Asset – Explained

- Ripple-SEC XRP Lawsuit Takes Surprising Turn as Hinman Emails Emerge

- Terra Luna Classic (LUNC) Rebounds from SEC Lawsuit Slump – What Lies Ahead for LUNC?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage