Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – May 25

The price of Ripple (XRP) has been moving in a tight range with a short-term bullish bias.

XRP/USD Market

Key Levels:

Resistance levels: $0.220, $0.230, $0.240

Support levels: $0.170, $0.160, $0.150

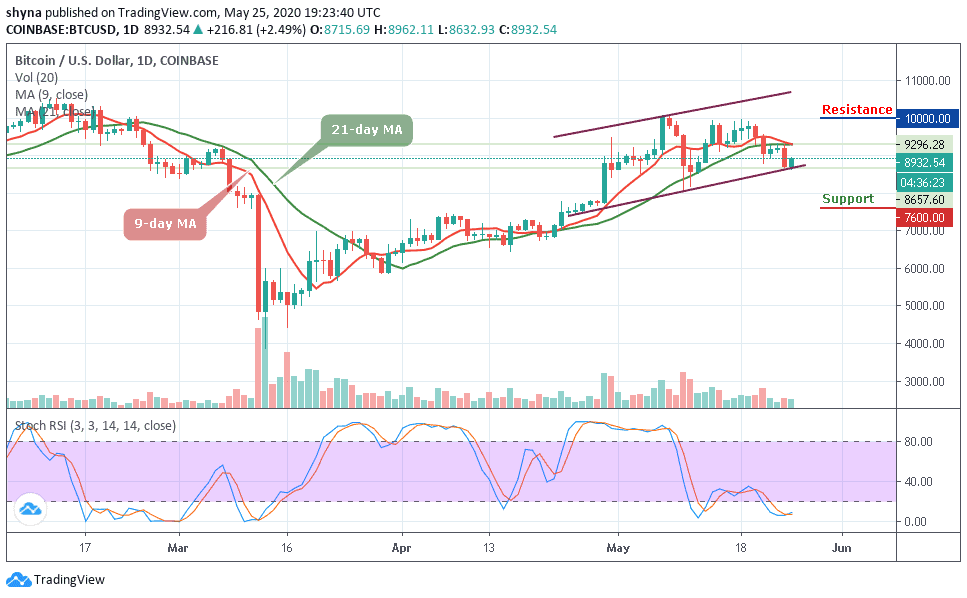

In the meantime, Ripple is currently trading at $0.195 as reveals by the daily chart. If you buy Ripple and intend to hold the price above the 9-day and 21-day moving averages in readiness for more bullish action following the current consolidation period. The crypto asset has been range-bound since a week ago. Meanwhile, the immediate downside is also supported by the ascending trend line.

According to the technical indicator stochastic RSI, Ripple is currently moving sideways. However, the coin lacks a catalyst to sustain a breakout above $0.200. Meanwhile, the bulls may remain in control in the coming sessions ahead of a possible breakout in tandem with the bullish cryptocurrency market. However, traders should keep an eye on the $0.200 and $0.210 levels before creating a new bullish trend at the resistance levels of $0.220, $0.230, and $0.240.

However, if the market experiences any slight drop during this movement, it may cross below the lower boundary of the ascending channel to hit the nearest support at $0.180 and a further drop could push the market to $0.170, $0.160 and $0.150 supports. More so, the stochastic RSI moves around 30-level, which may cause the market to follow a sideways movement.

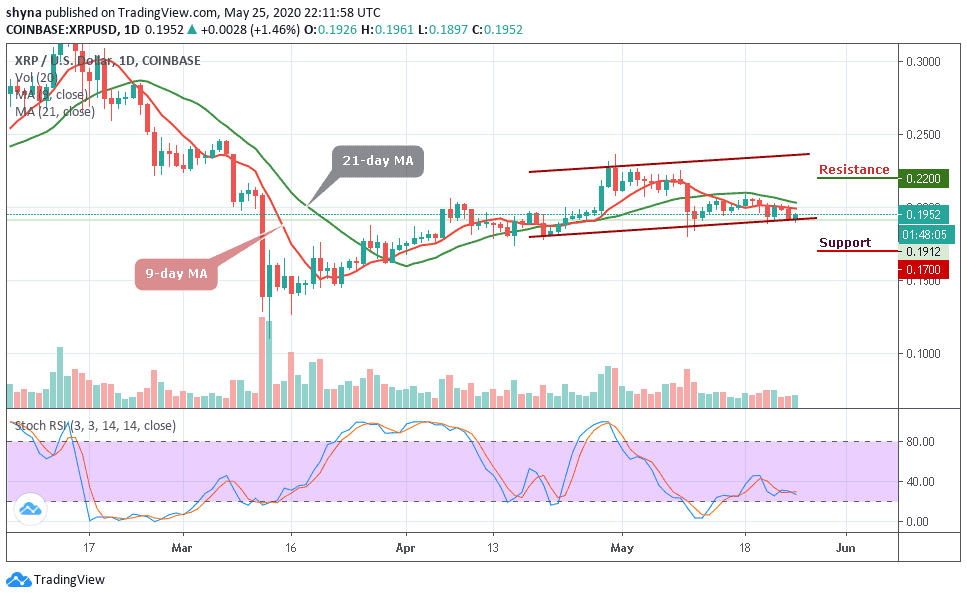

Against Bitcoin, the pair is trading within the descending channel and above the 9-day and 21-day moving averages. The Ripple (XRP) is currently hovering at the 2190 SAT. However, from the upside, the nearest levels of resistance lie at 2200 SAT.

However, if the bulls can break above 2300 SAT, further resistance is found at 2400 SAT and above but if the sellers push the price beneath the moving averages, the next level of support is located at 2100 SAT, further support is found at 2000 SAT and below. The stochastic RSI is seen moving within the overbought zone, which indicates more bullish signals.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage