Join Our Telegram channel to stay up to date on breaking news coverage

San Francisco-based blockchain startup Ripple recently posted results for the third quarter, detailing its progress across a variety of sectors. The company talked about reducing XRP sales and misinformation spread about its activities during the three months.

XRP sales decrease

Sales for XRP reduced considerably during the quarter and were worth only $66.24 million, a 74% drop as compared to $251.51 million recorded in Q2. The company proposed programmatic sales to be 10 basis points of the CCTT volume benchmark, but it achieved 8.8 basis points. It dropped the idea of programmatic sales halfway through the quarter. Now it is focusing more on OTC sales, targeted at Asia and EMEA regions.

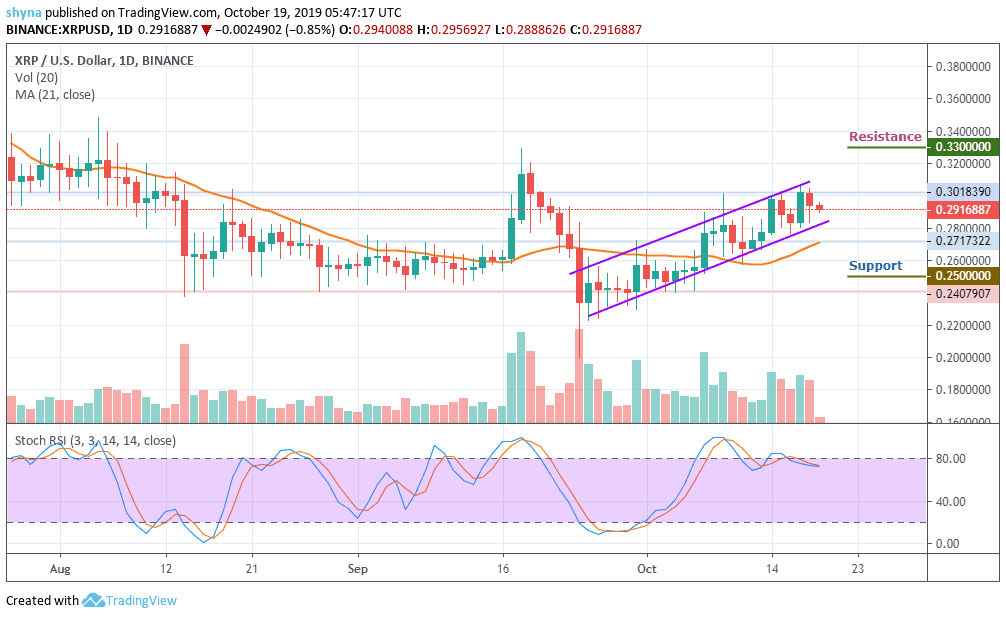

During the quarter, the price of XRP declined by 35.4% and the coin lost 30.4% of its market capitalization. The company released 3 billion XRP from escrow but sent 2.30 billion coins back to an escrow account. As of Q3 2019, it is available on 140 cryptocurrency exchanges and has taken a 180-degree turn from sales figure bifurcation from the previous year. While programmatic sales contributed a majority of the total XRP sales in Q2 2019, it is merely a fraction of direct institutional sales now. The volatility of the coin, however, was lower than other prominent digital currencies.

FUDs and misinformation

Ripple also talked about allegations against the company in detail. It said that FUD and misinformation against the company went up during the quarter. Ripple was blamed for dumping XRPs on users and manipulating prices. Note that Ripple’s price decreased while most other prominent digital currencies faced a bull period during the year.

The company cited research from Indiana University, which pointed to increased activity from bots on Twitter, which amounted to 50% conversations about XRP on the platform. It said that dumping allegations against the company increased during the period with tweets from bots including the phrase “flooding the market” and “dumping XRP” increasing by 179%.

It clarified that most large movements being talked about are simply transfers between escrow and treasury accounts of Ripple itself. It also suggested that XRP whales may exist, but they are not working differently from BTC or ETH whales.

It also clarified that Ripple doesn’t control the price of XRP as it is a token traded on independent markets. XRP doesn’t need Ripple to exist as it is an open-source public ledger.

Join Our Telegram channel to stay up to date on breaking news coverage