Join Our Telegram channel to stay up to date on breaking news coverage

Polygon (MATIC) price has plunged almost 50% since the beginning of the year and 40% from its monthly high of $0.955. The downtrend has seen MATIC revisit levels last seen during the May crisis when the Terra ecosystem collapsed.

The decline in the market price for Polygon comes in the wake of actions by the United States Securities and Exchange Commission (SEC). As reported, the financial markets regulator recently labeled MATIC, among other tokens, a security. They include Solana (SOL), Cardano (ADA), and Decentraland (MANA).

MATIC (@0xPolygonLabs)

A major part of the web3 ecosystem, MATIC is now considered a security by the SEC.

Information disseminated by Polygon has led MATIC holders to expect profit from Polygon’s efforts, says the commission.

— nft now (@nftnow) June 6, 2023

The move sent a chill across exchanges, inspiring the decision to delist the tokens. For Polygon’s case, platforms like Robinhood have already committed to delisting MATIC beginning June 27. This means that customers whose MATIC holdings will still be in their Robinhood accounts at the time of the delisting will have the platform sell them automatically on the market. The same will apply to exchanges that will delist the token.

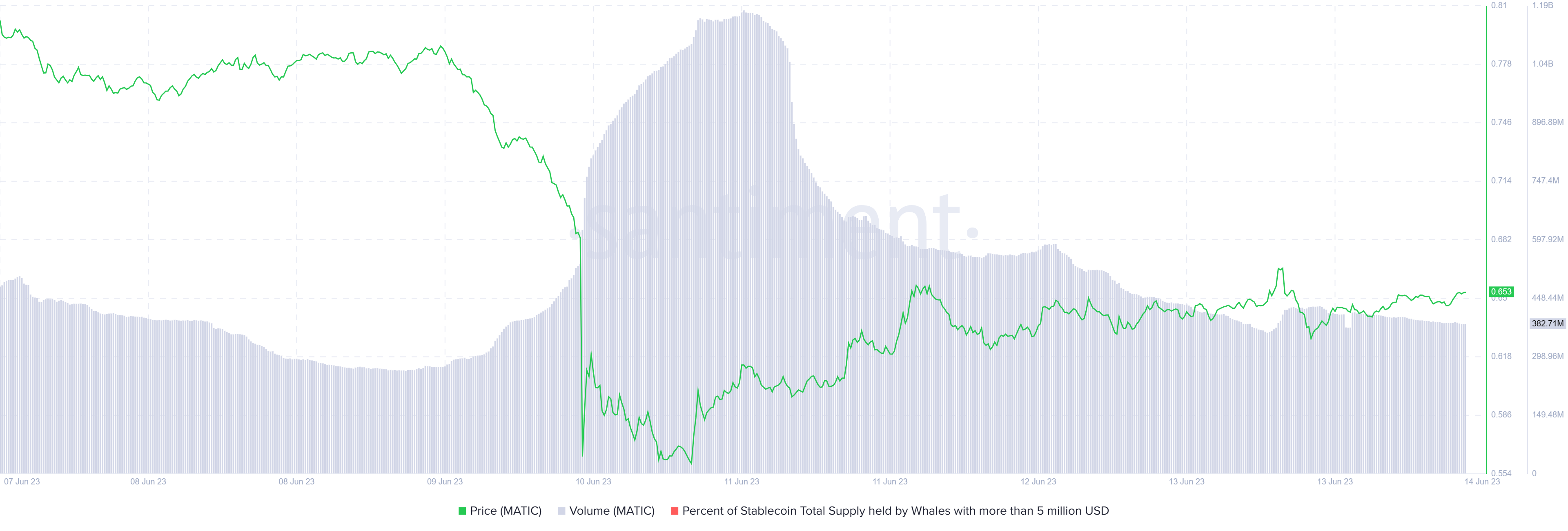

Users have been actively withdrawing their MATIC before the delisting date. This is indicated by the fall in the volume of exchanges in the chart below. The more conservative investors choose to transfer their MATIC to cold wallets to avoid selling them at a loss. However, others prefer to hedge them against other tokens with better prospects.

It is worth mentioning that Robinhood did not explicitly associate the move to delist the altcoins with the recent clampdown against Binance and Coinbase exchanges. Nevertheless, the odds favor this narrative. This holds considering that Robinhood intends to delist all the three crypto assets referred to as unregistered securities in the SEC complaints against the two giant exchanges.

Polygon Labs Responds To SEC’s Security Label On MATIC

Polygon Labs responded to the regulator branding MATIC a security, stating that while it ensured the altcoin was available to an expansive customer base, it ensured that the altcoin did not target the U.S. clientele. Nevertheless, the team appreciates that most of its clients are actually outside the United States, hence their gratitude to the global stakeholders.

We are proud of the history of the Polygon network – developed outside the U.S., deployed outside the U.S., and focused to this day on the global community that supports the network.

Acknowledging the importance of MATIC within its ecosystem, the Polygon Labs team further noted, “MATIC was a necessary part of the Polygon technology from Day 1, ensuring that the network would be secure – and remains so to this day.”

We are proud of the history of the Polygon network – developed outside the US, deployed outside the US, and focused to this day on the global community that supports the network. MATIC was a necessary part of the Polygon technology from Day 1, ensuring that the network would be…

— Polygon (Labs) (@0xPolygonLabs) June 10, 2023

Polygon Price Attempts Recovery

Polygon price is brewing a recovery rally, having gained almost 30% since the intra-day low of $0.508 recorded on June 10. In tandem with this uptick, the Relative Strength Index (RSI) also tipped north to suggest growing momentum, presumably, as visionary traders buy the dip.

However, MATIC remains bearish, evidenced by the Parabolic SAR indicator that continues to track the Polygon price from above.

Therefore, unless bulls overpower the bears, Polygon price could correct lower from the current position. Potentially, this could see MATIC lose the immediate support at $0.559 to the zone around $0.400, denoting a 40% downswing.

The bearish thesis is bolstered by the Awesome Oscillators (A.O.) position, which was still in the negative zone to show that the bears are still in the lead.

Nevertheless, an increase in buying pressure from the current level could see Polygon price flip the $0.754 resistance level into support. Further north, MATIC could break above the 50-, 200- and 100-day SMA at $0.873, $0.990, and eventually the $1.008 levels.

However, invalidation of the bearish thesis would only happen once Polygon price records a decisive daily candlestick close above $1.377. This level was last tested around February 22. Notably, the RSI indicator was in the oversold region, suggesting an incoming pullback. Investors are advised to wait for confirmation of a bull run, as there is currently no actual catalyst to sustain an uptrend.

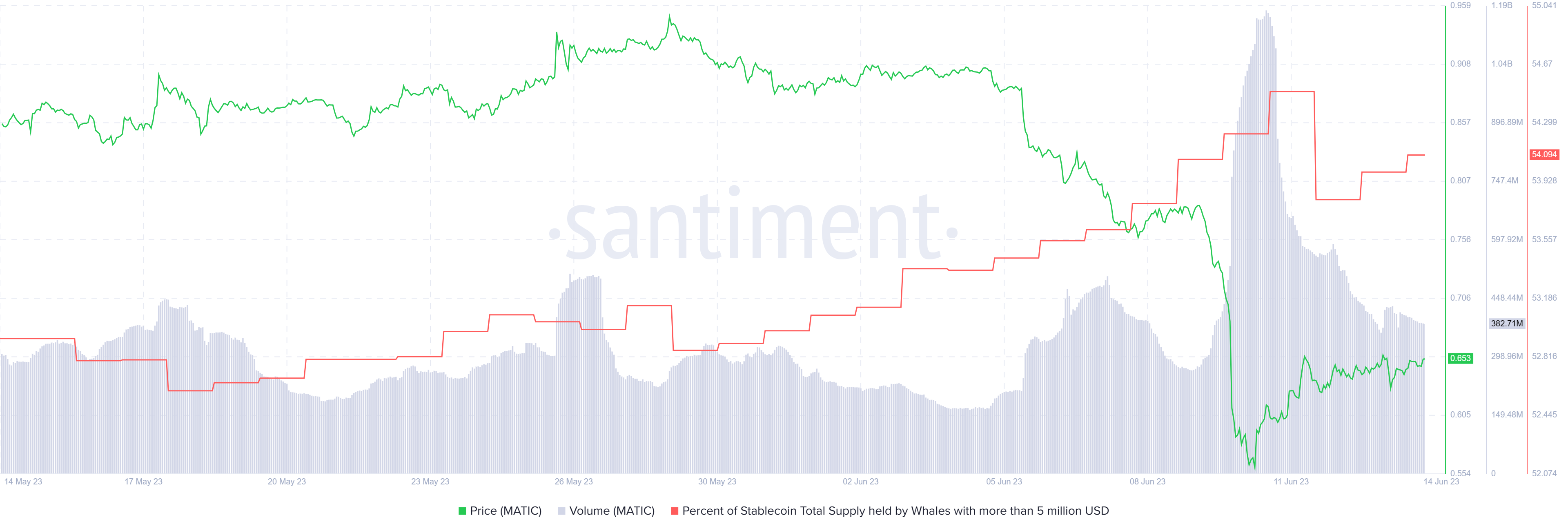

On-chain Metrics: Santiment

Santiment data shows that Polygon price is held afloat by activity among whales. According to the representation below, the percentage of total supply held by whales with more than $5 million has witnessed a noteworthy increase. On June 1, 52.97% of whales held the coin, whereas as of June 14, the percentage went up to 54.09% at the time of writing. This marks a 2.11% rise.

MATIC Alternative

While Polygon price remains in the thicket, investors can consider a more promising alternative, ECOTERRA, whose recent $5 million funding has reinforced investor confidence.

A NEW MAJOR MILESTONE ACHIEVED 🚀

🎉 $5 MILLION RAISED 🎉

Let’s celebrate with ecoterra and continue to participate in our #Presale. Together, we can make a positive impact and shape a better world 💚✨https://t.co/1fYkPOsPYG pic.twitter.com/69sK1QCaWF

— ecoterra (@ecoterraio) June 12, 2023

How Ecoterra’s Recent $4.9M Funding Stirs Sustainable Crypto Movement

The token is the native asset of the Ecoterra ecosystem, a Web3 platform designed to promote sustainability and fight back against climate change. After its presale debut, the project raised over $28,000 in less than 24 hours.

This eco-friendly platform is committed to rewarding individuals and businesses for recycling. At the same time, it incentivizes investment in alternative energy and tree planting projects. Ecoterra stands among the most promising blockchain-based solutions to the global concern of sustainability.

The world is constantly evolving, and so are we 💫✨

That’s exactly what ecoterra is doing, revolutionising sustainable living through the power of #Blockchain and #Crypto concepts 🔥

Join our #Presale now and be part of the movement ⬇️https://t.co/1fYkPOsPYG pic.twitter.com/H3hYqkedwn

— ecoterra (@ecoterraio) June 14, 2023

This explains why it touts itself as a crucial pillar in the fight against climate change. In the current stage of the presale, investors can buy Ecoterra’s native ERC-20 token, $ECOTERRA, at a price of $0.00925 USDT.

The project’s innovative recycle-to-earn Web3 app forms its core, incentivizing individuals and businesses to recycle plastic and aluminum packaging materials. The incentives come as they are paid for each item they save from the landfill.

Users only have to scan the barcode of the items they plan to recycle to earn. The Web3 app features a database of materials, some showing users the reward for individual items. It also contains an interactive map that helps users find the nearest recycling center.

After depositing one’s recyclables, the user can take a photo of their receipt directly from the Ecoterra app. The project will then credit $ECOTERRA rewards directly to the user’s wallet. Another way to earn rewards is through other green activities. Specifically, individuals with solar panels installed on their buildings, homes, or businesses can take a photo of their electric bill and earn $ECOTERRA.

Related News

- Polygon 2.0 Revolutionizes Internet’s ‘Value Layer’ with Cutting-Edge Upgrades

- SEC’s Clampdown Sends Binance Coin Tumbling, Yet Ecoterra’s Eco-Friendly Endeavor Surges to $5 Million – What’s the Explanation?

- Ecoterra’s Pre-Launch App Demo Fuels Presale Rush, Nearing $5 Million for Its Innovative Recycle-to-Earn Web3 Platform

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage