Join Our Telegram channel to stay up to date on breaking news coverage

Two days ago, on June 12th, BTC price started a slow but steady recovery from the June 10th drop that took it from $26,450 to $25,500.

The recovery progressed smoothly for nearly 24 hours, allowing Bitcoin’s price to reach $26,291 before it suddenly crashed again.

This time, the drop took the coin’s value to $25,762 at its lowest point in the last 24 hours. Since then, BTC has started recovering once again, reaching the $26k level. However, since the price dropped below it, this level turned into a strong resistance that rejected the price back to $25,883.

At the time of writing, the price is recovering again, taking another attempt to breach the $26k resistance, currently sitting at $25,969.

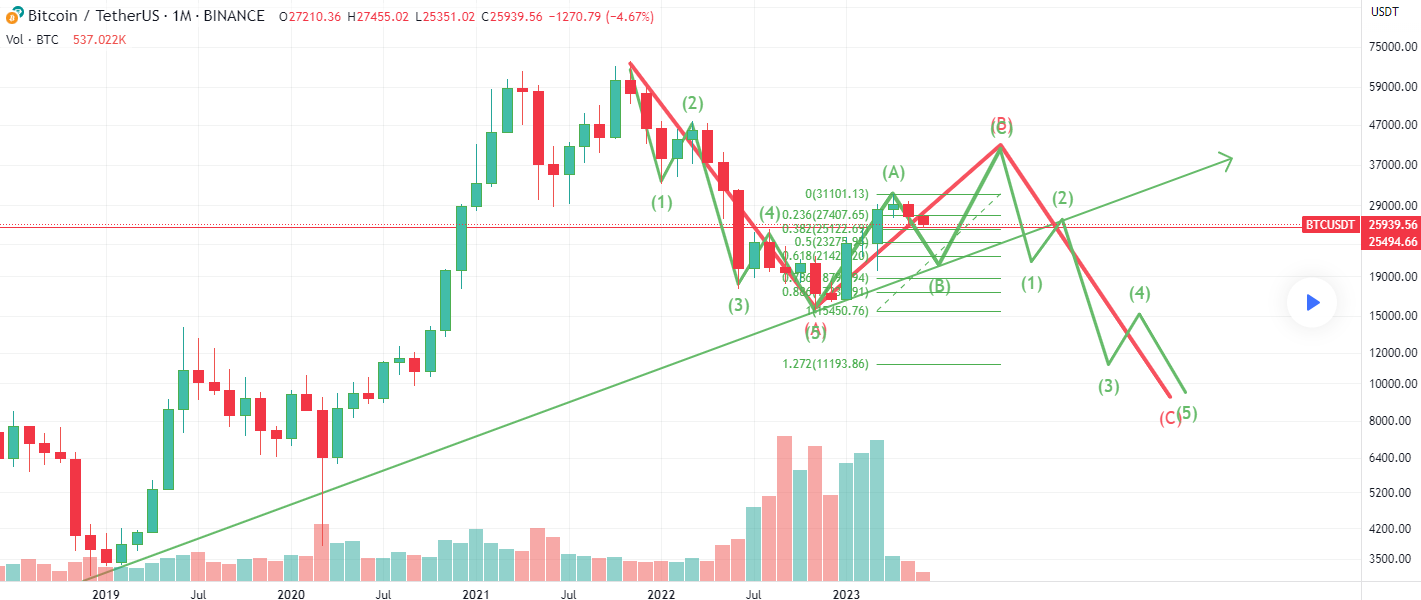

According to analysts, the correction was not too damaging to the coin’s price, and Bitcoin can still grow back up. Some of the more optimistic predictions expect it to go up to $41k. However, analysts also warn that a further correction to $21.5k is still a possibility.

They recommend that users focus on sales transactions for the time being. However, the bad news is that even if BTC reaches the ceiling of $41k, that would mean the completion of the ABC pattern. As a result, the coin could see a massive bearish wave that would put the bottom at $9k.

Bitcoin’s drop caused by new Binance rumors

Bitcoin’s recent price drop may have been caused by a new rumor surrounding Binance. The exchange has been making headlines for days now after the US SEC filed a complaint against it and Coinbase.

Now, rumors emerged that the world’s largest crypto exchange has been selling large quantities of Bitcoin to keep the price of BNB coins from dropping below certain levels.

Binance’s CEO, Changpeng Zhao (CZ) immediately addressed the rumors, denying them. He said that “Binance have not sold BTC or BNB. We even still have a bag of FTT. It is amazing they can know exactly who sold based on just a price chat involving millions of traders. FUD.”

4. Binance have not sold BTC or BNB. We even still have a bag of FTT.

It is amazing they can know exactly who sold based on just a price chart involving millions of traders. FUD. 🤷♂️ pic.twitter.com/M3MUH2bFRE

— CZ 🔶 Binance (@cz_binance) June 13, 2023

More mixed news for Bitcoin

Another bad news for Bitcoin comes from Apple, which allegedly wants Bitcoin tipping feature removed from Nostr. The company claims that the tipping feature violates its policy, requiring all tips to come via in-app purchases.

On the positive side — at least for Bitcoin, MicroStrategy co-founder Michael Saylor said that the crypto industry is forced to be Bitcoin-focused due to the regulators in the US.

Enforcement actions on crypto firms, primarily by the SEC, could lead to the Bitcoin-focused US.

Regulatory clarity is going to drive #Bitcoin adoption by eliminating the confusion & anxiety that has been holding back institutional investors. Bitcoin dominance will continue to grow as the #Crypto industry rationalizes around $BTC and goes mainstream. pic.twitter.com/Foq4lpderj

— Michael Saylor⚡️ (@saylor) June 13, 2023

Wall Street Memes presale closing in on $7m raised

As Bitcoin continues to struggle, a lot of investors are seeking new opportunities. Their search led them to a new hit on the meme coin market — Wall Street Memes (WSM).

The new meme token is in the middle of its presale and has already raised $6.88 million at the time of writing. Each token is being sold at a price of $0.0286 million, which will be the case for another day. After that, the price will grow to $0.0289 per WSM.

The asset was inspired by WallStreetBets, an investment-oriented subreddit that challenged institutional investors in early 2021 when they attempted to short the stocks of several firms, including GameStop.

Amateur investors decided to help the companies by engaging in massive stock purchases, causing institutions to lose money as a consequence of their greed.

Related

- How to Buy Bitcoin Online Safely

- Bitcoin Shows Negative Momentum, Drops 5% Amid SEC Concerns – Time To Buy The Dip?

- Unveiling Secrets of a Successful Trader: Bitcoin (BTC) Bulls Set to Roar, Expert Opinions Inside

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage