Join Our Telegram channel to stay up to date on breaking news coverage

Crypto.com, a Singapore-based cryptocurrency exchange with over 80 million users per 2023 data, is about to close its institutional exchange facilities in the US. It has cited the current market landscape and limited demand for this decision.

That announcement has come hot on the heels of the SEC’s recent lawsuit against Binance and Coinbase.

Crypto.com Shutting Down US Exchange – Retail Services To Continue

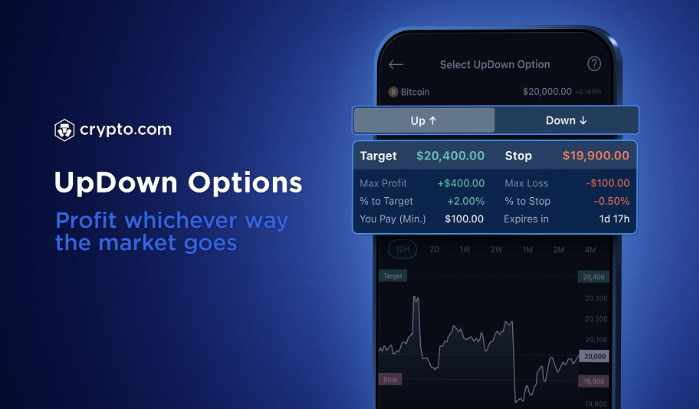

While institutional investors would have to look elsewhere, retail investors don’t have to worry. Crypto.com has said that its complex investment services, including UpDown Options, will still be active.

UpDown Options is a structured investment option that ends once the underlying asset hits a predetermined target – or the stop price. Crypto.com states that it is a good option for risk-averse investors who want to limit their exposure to losses.

Crypto.com’s Prominent Presence in Crypto Industry Hurt By Crypto Winter

While we can lay all the blame on Crypto.com’s recent decision on SEC’s recent move to sue the biggest players of the crypto industry, it is the crypto winter that’s mostly to blame.

Crypto.com had already made a name for itself within the crypto industry in 2021. Known for its marketing tactics that led to overspending, this cryptocurrency exchange had Matt Damon as one of its spokespersons.

However, the arrival of the crypto winter caused a lot of issues for Crypto.com’s ecosystem. First, it was the diminishing of rewards that people got from Crypto.com’s credit card. And then came the winding down of other offerings of Crypto.com’s soft-staking services.

Also, during a time when most cryptocurrency exchanges were conservative about their spending. Crypto.com resorted to spending more on marketing. Their hope was to offset the losses by bringing in more customers. But that didn’t play out as they envisioned, which led to one of the biggest lay-offs in the crypto industry.

And by 2023, it was reported that Crypto.com had laid off 20% of its workforce due to the recent FTX collapse. That meant removing 490 out of the 2450 employees that the company had. Crypto.com cited “prudential financial management” as the reason behind this decision.

Overspending was one of the reasons why Crypto.com had to take this measure. This cryptocurrency exchange has made a massive $700 million dollar deal for the naming rights for the former Staples Center in Los Angeles.

Is Crypto.com’s recent move to remove institutional services from the US part of the same “prudent financial measures”?

What Could Be The Reason Behind Crypto.com’s Decision?

There could be multiple schools of thought behind Crypto.com’s recent decision. But getting the right answers through Twitter is difficult because of the spam-filled comment section.

However, one of the Twitter users @MilkRoadDaily, that was one of the first ones on Twitter to break the news about this recent closer, gave us some insights through its comment section.

According to Milk Road, it is the financial mismanagement that went into overspending on marketing that played a role in the recent shutdown. Most commentators agreed with this matter, while others were mostly talking about the Staples Arena.

However, there are a few who think Crypto.com’s decision to pull back its institutional services from the US is because of the current regulatory landscape. The exchange has listed many of the same tokens that the SEC (Security Exchange Commission) has marked as securities. Also, it may not be long for SEC to look at Crypto.com the same way as it does Binance and Coinbase.

Crypto.com is not the only firm that’s moving its operations out of the US. Galaxy Digital, the owner of Candy Digital NFT firm, has also made the decision to move out of the US due to the recent circumstances. In his interview with Decrypt, the CEO of Galaxy Digital said that it is looking at how fast we can move people offshore.

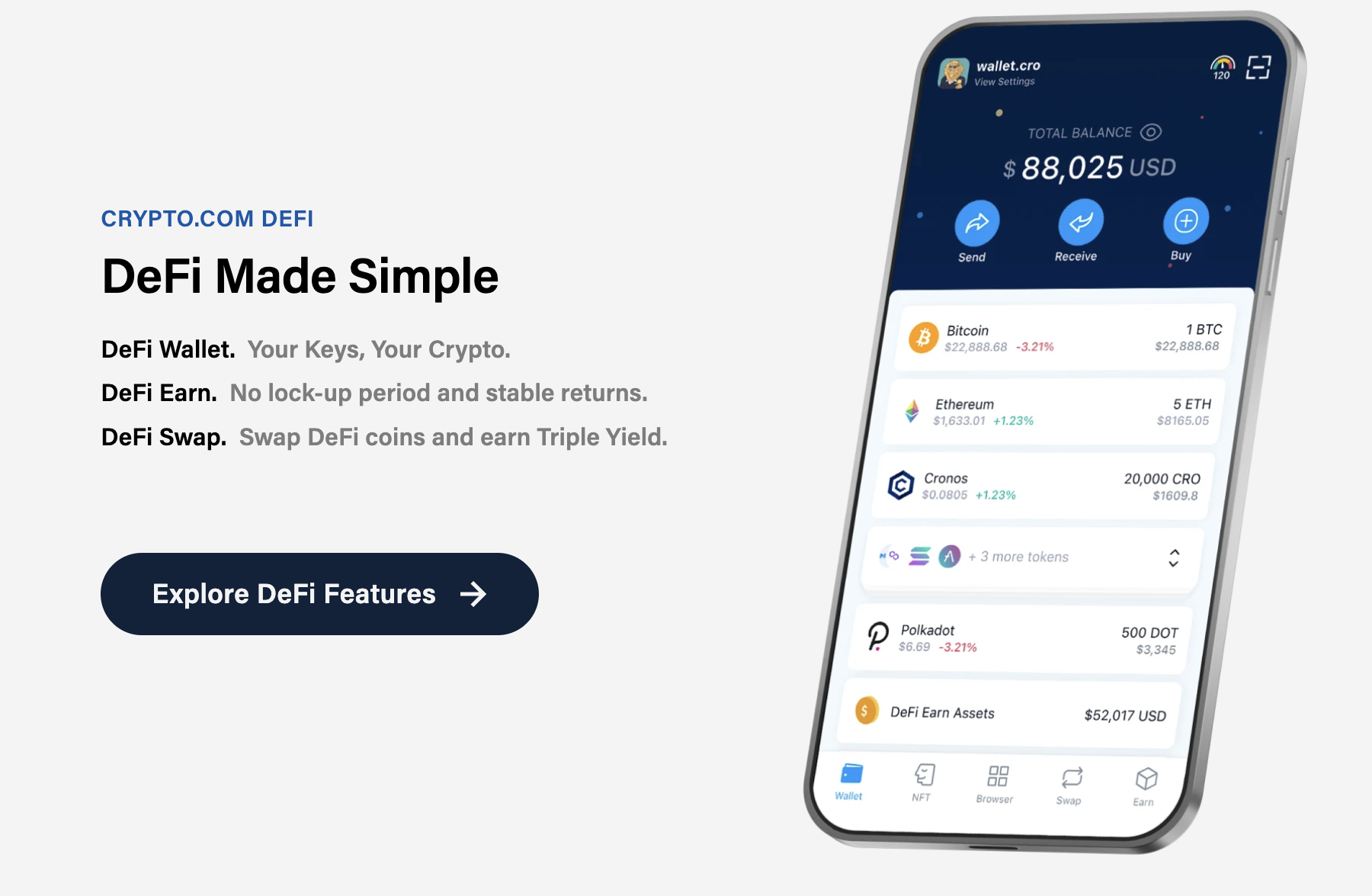

Amidst the recent lawsuit of Binance and Coinbase and the recent pullback by Crypto.com, there are reports that many investors are taking a decentralized route for their crypto investment needs.

Related Articles

- Crypto.com review

- Binance Review

- SEC’s Chairman Gary Gensler’s 2018 Video Contradicts His Current Crypto Views

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage