Join Our Telegram channel to stay up to date on breaking news coverage

After a disappointing performance in 2022, the recent substantial increase in Optimism’s value, with a 41% gain and hitting new all-time achievements, may signal a promising trend for 2023. Investor holdings have increased 147% over the past 30 days, and OP is now worth 479% more than it was on June 18, 2022, when it was at its lowest value of $0.40.

The price of Optimism has dropped 6.7% from that surge to a fresh all-time steep around $2.50 on Jan 25, 2023, as it deals with mounting selling pressure as investors sell for a profit. The 24-hour exchange volume has increased significantly, according to CoinMarketCap, to $700 million.

Large trading volumes, according to analysts’ previous findings, are a sign that investors are taking on bigger risks, suggesting that many people are anticipating OP to reach yet another record high. Simply put, there is anticipation that the price of OP will rise above its recent high.

What Causes Optimism’s Price Rally?

In addition to a positive market overall, several layer-2 protocols, such as Polygon and Optimism, are thriving in 2023. Despite being relatively young, the network has already attracted the interest of investors and developers.

An Ether layer 2 mechanism called Optimism is renowned for helping scale solutions. The network explains that increasing transaction throughput while lowering costs is the only way to scale blockchain transactions, which is the “end game” strategy for making cryptocurrencies widely used. As a Layer 2 protocol running on Ethereum, Optimism publishes off-chain transactions in batches. These transactions are presumed to be correct and legitimate until they are refuted by additional processes known as fraud proofs.

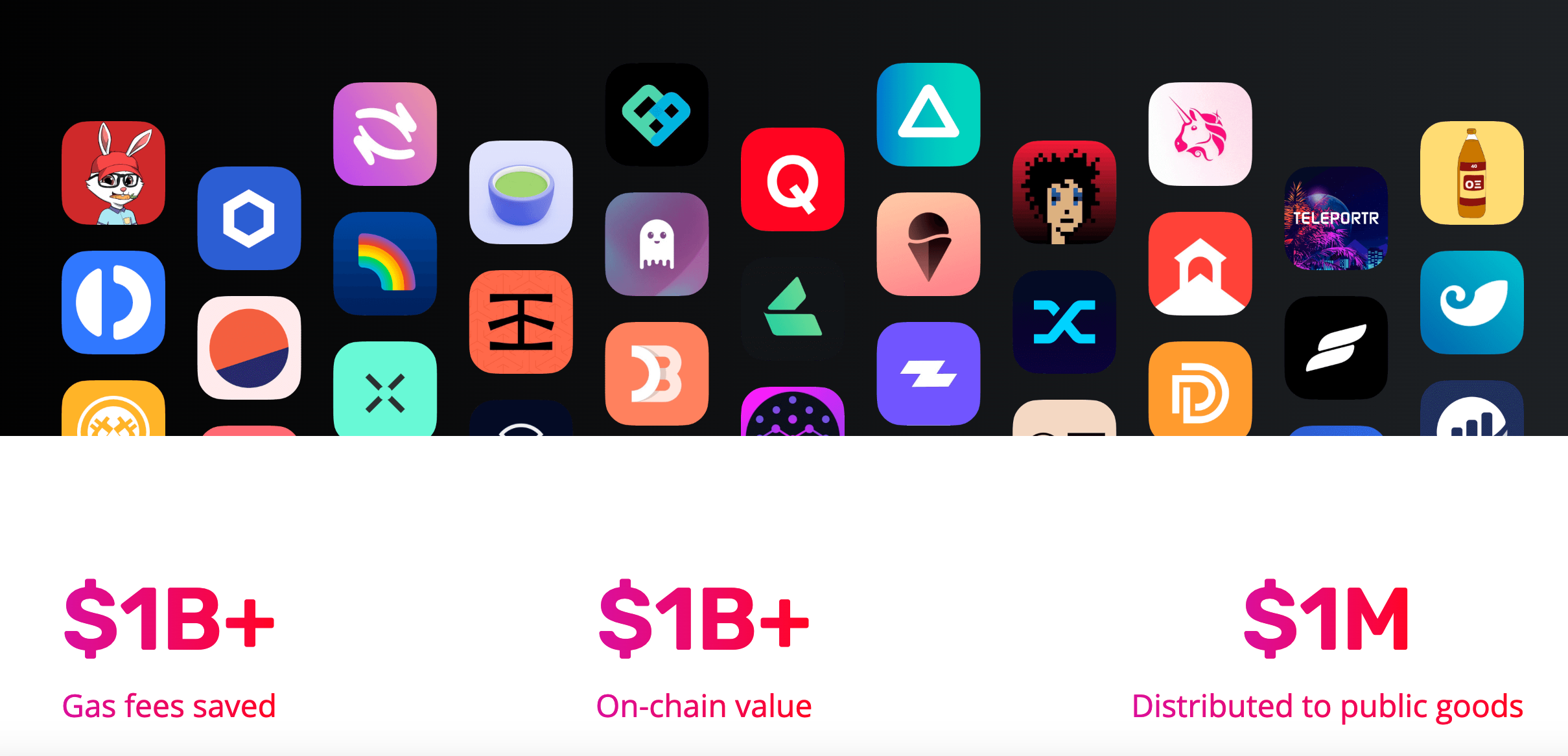

To put it another way, optimism facilitates off-chain transactions, enabling better throughput. The same operations are then recorded on the Ethereum network. By using Optimism as its primary mode, it is possible to avoid the need for main net gas and the resulting network congestion. The ability of the network to conduct more than 800,000 operations in 24 hours shows that Optimism usage has sharply increased in recent weeks. This number outperformed both the Ethereum mainnet as well as Arbitrum put together.

According to data from Dune Analytics, Optimism saw numerous notable increases in the number of active account addresses, with more than 110,000 addresses trading on December 22. Even when reduced to between 80,000 and 100,000, the figure remained higher than arbitrum.

A persistent increase in the total amount of assets suspended in smart contracts may also be responsible for the price rebound’s positive direction. The network has $692 million in overall locked value, up 8.13% in a day, according to Defi Llama. With $126 million, Velodrome represents the majority of the TVL, with $125 million trapped in Synthetix as well as $86 million on AAVE V3 staking systems.

What is OP (Optimism)?

A Layer 2 mechanism called Optimism (OP) provides cryptocurrency users with quick and inexpensive payments on the Ethereum (ETH) network. It is intended to deal with the high gas costs and transaction bottlenecks in Ethereum. On average, Optimism’s transaction costs are almost a hundred times lower than Ethereum’s. Since its inception, the protocol has grown quickly and steadily, becoming one of the most well-liked Layer 2 alternatives for the Ethereum network.

Additionally, optimism provides customers and organizations with a far more scalable alternative to utilizing Ethereum directly. The Ethereum network can handle 15-25 TPS, whereas Optimism can handle at least 200 TPS. The platform could eventually be improved to the point where it reaches 2,000 TPS.

Optimism was established in 2019 and eventually began operating its network in 2021. It didn’t have a crypto coin of its own at first. The ERC-20 token OP, the native cryptocurrency of Optimism, was released in May 2022.

What is The Goal of OP?

The main purpose of the OP token’s introduction was to be used for governance. This task is shared by the newly established Optimism Foundation, the principal organization in charge of managing the project, as well as the Optimism Community, a decentralized group of OP token owners and delegates.

Holders of tokens can take part in the official voting system on Optimism to determine protocol updates, funding for new projects, and more. Any OP token user may choose their favourite delegate to cast votes on their behalf using the delegated voting approach used by optimism.

The delegates actively participate in platform decision-making and are supported by other users’ OP tokens. The quantity of OP credits backing each delegate determines how much influence they have in the voting process. The OP cryptocurrencies used for delegation are merely taken into consideration throughout the voting process and are still freely accessible to the user.

On Optimism, all processing costs are paid in ether instead of the OP token, which is used for transaction fee payments. If the platform’s governance community decides to convert to OP for processing fee payments in the future, this may change.

When the Optimism Price Retraced From $2.50, Was it a Good Idea to Buy the Dip?

The price of OP has dropped from its record high, maybe as a result of investors taking gains out of the market. Investors who missed the opportunity to profit from the upward trend that began in early January might wish to hold off while the optimism cost rises over the crucial $2.50 level.

Additionally, there’s a risk that the OP may correct, allowing those who were waiting to profit from the trend to do so. According to the MFI indicator, there remains a larger volume of money flowing into OP markets than money leaving them.

Optimism pricing may take a break from the rise to enable other macro variables to follow up with the fast move as the stochastic analyzer dips into the neutral space from the overbought position. Since $2.00 security is still present and the OP can resume the surge, investors shouldn’t panic.

Optimism (OP) Price Prediction

Investors may be compelled to accept lower support offered by the 50-day EMA (in red) around $1.50 if the pressure building on the optimism cost as a result of excessive profiteering overwhelms the bullish trend.

Holders will require the support offered by the 50-day EMA at $1.50 to hold (shown in red) to prevent additional selling if the positivity for Optimism’s cost is overridden by strong selling pressure. To confirm the bullish hold and create the stage for the subsequent rise to $3.00, the optimism cost must break as well as hold above $2.50, the upper yellow band.

From the standpoint of the MACD indicator, the very same daily chart confirms the upward trend. Observe how bulls have held onto a buy indication since the beginning of January, as well as how they seem likely to continue purchasing OP in the sessions to come.

Waiting for the blue MACD sign to pass underneath the red signal point, signalling a sell signal, may be prudent for traders thinking about shorting optimism. The $2.00 trend line might signal a potential rise to fresh highs around $3.00, so they should be wary of any potential comeback there as well.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage