Join Our Telegram channel to stay up to date on breaking news coverage

Monero (XMR) has been sealed in a downtrend since early July, but the price is beginning to show signs of bullish energy. At the time of writing, XMR was hovering at $140, down 1% over the last 24 hours.

Its daily trading volume has soared 31% over the last 24 hours to $40 million, and with a live market capitalization of $2.58 billion, Monero is ranked 24th on the CoinMarketCap ranking.

Monero Price Stares Into an Abyss As Losses to $125 Loom

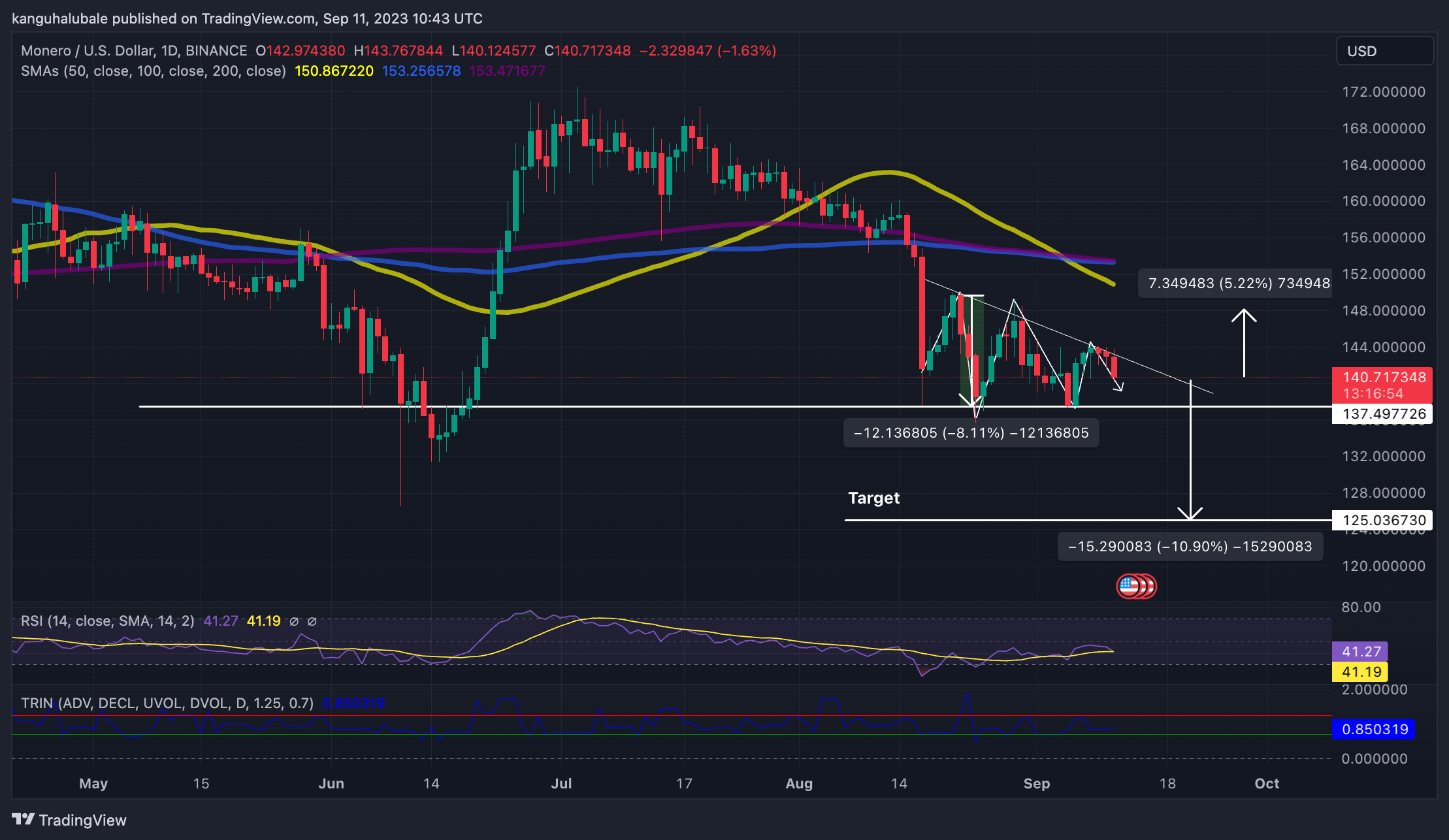

After turning away from the $160 psychological level, XMR experienced a rapid descent that was stopped around the $135 zone. Since then, the price has formed a series of lower highs and relatively equal lows, leading to a descending triangle on the daily chart (see below).

There have been several attempts by the bulls to initiate a recovery, but their efforts have been frustrated by the triangle’s descending trendline, which acts as XMR’s immediate resistance.

The ongoing correction may be extended if the Monero price drops to produce a daily candlestick close below the triangle’s support line at $137. Such a move would initiate massive see orders that would see XMR drop toward the $132 significant support level.

A lower drop would bring the bearish target of the governing chart pattern at $125, representing an 11% decline from the current price.

XMR/USD Daily Chart

Apart from the bearish triangle, several technical indicators validated Monero’s pessimistic outlook. These include the Relative Strength Index (RSI) facing downward. The price strength at 41 suggested that the market sentiments were negative.

In addition, XMR traded below all the major moving averages, which meant it faced stiff resistance in its recovery path. These were supplier congestion zones defined by the 50-day Simple Moving Average (SMA), the 100-day SMA, and the 200-day SMA at $150, $153, and $154, respectively.

This means immense selling from these regions would meet any attempts to increase the price. As such, Monero’s upside appears to be capped around the $150 area, representing a 5% uptick from the current price.

On the four-hour chart, the price action has led to the appearance of a symmetrical triangle chart formation. The downfacing 200-period SMA and RSI at 41 gives a clear advantage to the bears.

If the price slips below the psychological level at $140, the bears will try to pull the pair to the triangle’s support line, currently at $137. This is similar to the descending triangle’s x-axis on the daily timeframe. This reinforces the importance of this level that the bulls must aggressively defend to avoid more losses.

XMR/USD Four-hour Chart

Conversely, if the price produces a four-hour candlestick close above the 50 SMA, the pair could reach the resistance line at $143, embraced by the 100 SMA. A break above the triangle could signal the start of a trending move upwards.

The Arms Index (TRIN) at 0.8 suggested that more buyers in the market could take advantage of the lower levels and buy more, pushing the token higher.

Crypto analysts are bullish on Monero, with one of them going by the name Adam Santos on the social media platform X saying that Monero remains bullish. He posted a daily chart that showed that XMR has maintained an ascending trendline. According to Santos, Monero could recover toward $150 or $160.

#Monero ( $XMR) maintains its uptrend line, finding support near the 20-day EMA ($143). A move above this level could result in a sustained recovery towards the 50-day SMA at $151 and $160. pic.twitter.com/6l0YbubZFD

— Adam Santos (@adamsantos456) September 11, 2023

While market participants await Monero to escape from these triangle chart patterns and begin to recover, new cryptocurrencies are capturing the interest of investors because of their impressive performance in presale. Bitcoin BSC (BTCBSC) is one of these cryptos and can potentially make 10X returns in 2023.

XMR Alternatives

BTCBSC, the native cryptocurrency for the Bitcoin BSC ecosystem, is performing well in presale, with $1 million already raised within less than a week of launching its presale.

https://twitter.com/Bitcoinbsctoken/status/1701145442904404340?s=20

The project aims to give investors who missed out on Bitcoin when it was cheap a chance to benefit from a BTC-like token. BTCBSC is currently going for $99 in presale, the same price Bitcoin retailed for in 2011.

Bitcoin BSC is a BEP-20 token that allows investors to earn daily income with daily price gains. It also allows users to earn passive income through staking, achieved through ultra-high annual percentage yields (APY).

According to the latest update from the team, the staking pool has recently opened and remains relatively small, offering an impressive estimated Annual Percentage Yield (APY) of 615%. However, it’s worth noting that this APY is expected to decrease as more tokens become locked in the pool.

Visit Bitcoin BSC here to understand how to participate in the presale.

Related News

- How To Buy Bitcoin BSC On Presale – Alessandro De Crypto Video Review

- Monero Price Prediction for Today, November 1: XMR/USD Maintains Bullish Trend; Price Still Needs to Break $160

- Best Crypto to Buy Now September 4 – Stellar, Rocket Pool, Monero

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage