Join Our Telegram channel to stay up to date on breaking news coverage

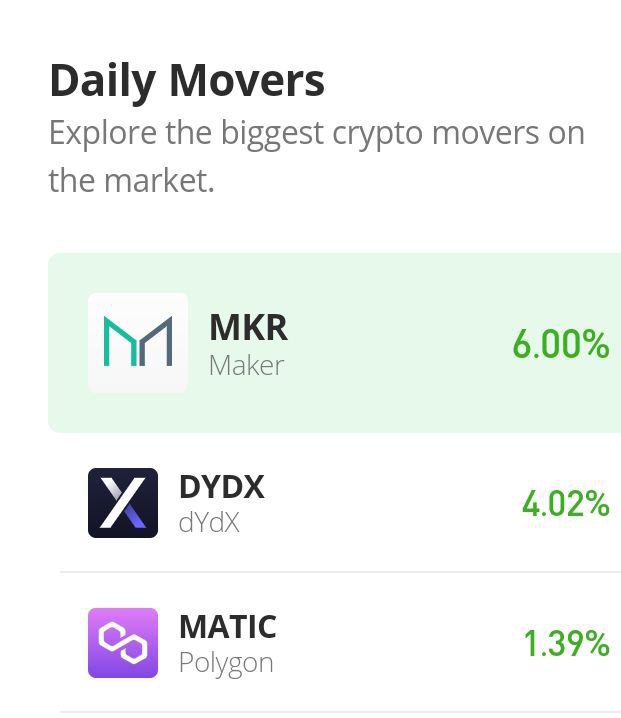

Maker (MKR) Price Prediction – October 10

As the value of the crypto trade rises in price valuation over time, there have been changes in the MKR/USD market operations. About six years ago, the market’s all-time low value stood at $21.06, while the all-time point was $6,339.02 since May 3rd, 2021 (a year ago).

MKR Price Statistics:

MKR price now – $937.45

MKR market cap – $916.5 million

MKR circulating supply – 977.6 thousand

MKR total supply – 977.6 thousand

Coinmarketcap ranking – #52

Maker (MKR) Market

Key Levels:

Resistance levels: $1,100, $1,300, $1,500

Support levels: $800 $700, $600

On the daily chart, the MKR/USD trade rises in price to the point where it has crossed over the SMAs’ trend lines and moved northward. The 14-day SMA indicator is at $795.22, underneath the $891.39 value line of the 50-day SMA indicator. In the past downward-correcting movement, variant bearish candlesticks surfaced to the level of $600 to find a baseline for support. Hence the reason for the horizontal line at the value point. The Stochastic Oscillators are in the overbought region, trying to cross southbound at 97.52 and 93.39 range values.

Your capital is at risk

Will the MKR/USD market garner more upward-moving momentum above the SMA Value points?

Gathering buying momentum capacity possibility of the MKR/USD trade over the SMA value lines appears not to carry much weight to suffice further upward moves even though the crypto trade rises in price worth on buying signal side of the indicators. Buyers may have to back out of the transaction activities at this point for some period that another trading pattern, suggesting the reading of the Stochastic Oscillators in a lower range zone to signify other round sessions for a northbound direction before executing new buying orders afterward.

On the downside of the technical analysis, A long top shadow candlestick has emerged closely beneath the $1,200 resistance level. And that has created enough technical insight into getting an ideal zone to execute a selling order instantly. A sustainable breakout of the point will likely give rise to panic-buying execution orders that can lead the market to a peak. And that kind of scenario may attract massive retracement moves in no time in the process.

MKR/BTC Price Analysis

In comparison, Maker’s has maintained a firm trending worth against Bitcoin to the extent of making a breakout of some high-resistance value in most of the previous sessions, around B0.05000 above the trend lines of the SMAs. The cryptocurrency pair trade rises in price to reach a notable zenith point over the trading indicators. The 14-day SMA has managed to curve northwardly to touch the 50-day SMA underneath. The Stochastic Oscillators are in the overbought region, trying to cross southbound at 98.92 and 96.75 range values. Some retracement moves are imminent in the pairing crypto that can lead the base crypto to revert to a debasing mode against the counter-trading crypto.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage