Join Our Telegram channel to stay up to date on breaking news coverage

LTC Price Prediction – June 19

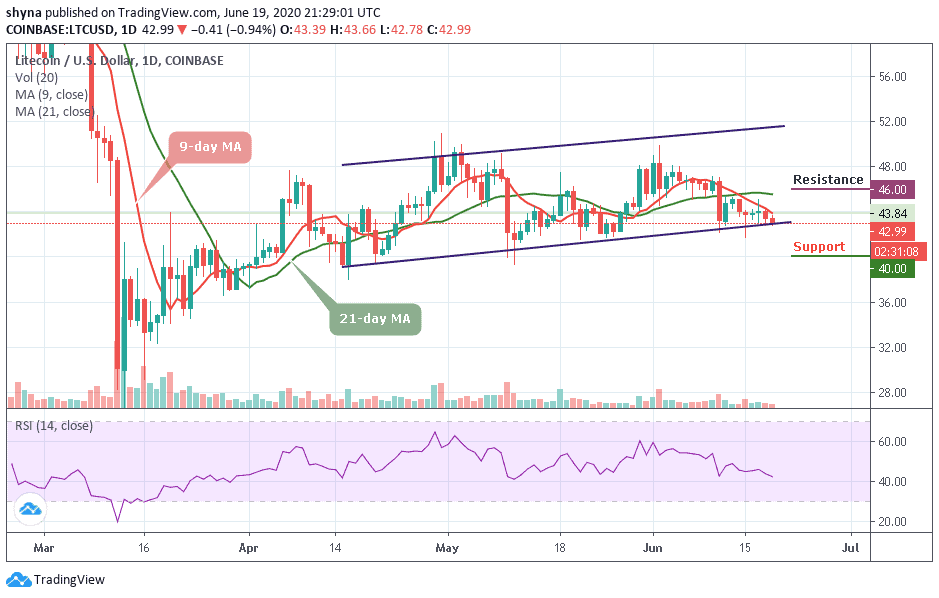

In the recent price fall, LTC/USD is losing around 0.74% and a new wave low is been formed.

LTC/USD Market

Key Levels:

Resistance levels: $46, $48, $50

Support levels: $40, $38, $36

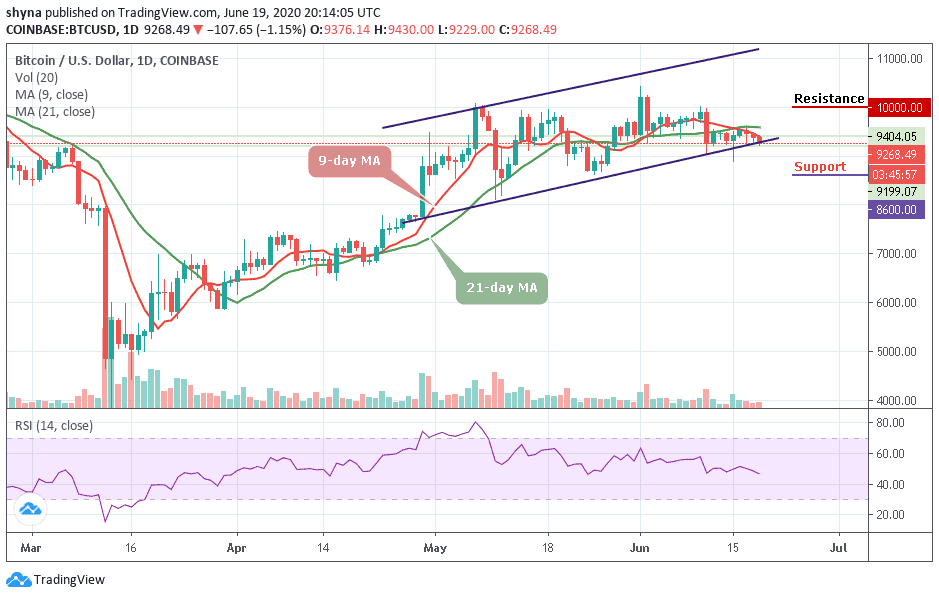

LTC/USD has taken the downhill road. After touching the daily high at $43.84 today, LTC/USD is seen dealing at $43.49 where the coin started trading, and now hovering at $42.99 where it is currently trading. The tremendous loss in the price is indicating a delayed recovery. However, LTC/USD has given some great results in the past. But the coin is speculated to retain the same momentum in some time. The current market pressure may need to take a while, but once it is lifted, the coin could once again shine.

Moreover, in as much as the coin fails to rally from current trading levels, the greater the chance that we may see the cryptocurrency falling to a new month trading low. A break below the $32 support level may provoke an even deeper decline towards the $40, $38, and $36 levels. The short-term technical analysis shows that the $43 and $42 levels remain the strongest forms of technical support.

Similarly, looking at the daily chart, a break above the $44 level may propel Litecoin to a high of $46, $48, and $50 resistance levels. Meanwhile, the RSI (14) may likely cross below the 40-level, indicating that the bears may continue to control the market.

Against Bitcoin, the price of Litecoin is clearly experiencing difficulties, especially in the past few weeks. The coin is trading below the 9-day and 21-day moving averages and may continue to fall through subsequent support levels to 4400 SAT while the critical support level is located at the 4300 SAT and below.

However, if the bulls manage to power the market, traders may likely find the resistance level at 5000 SAT and above. Moreover, the Litecoin (LTC) price is currently changing hands at 4625 SAT and a surge in volatility may occur as the RSI (14) may cross below the 40-level.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage