Join Our Telegram channel to stay up to date on breaking news coverage

Litecoin (LTC) price started a rally on December 20, soaring 58.93% to the $96.95 level. The breakout was attributed to a positive accumulation pattern among investors. This led to the formation of a bullish wedge chart pattern, and now bulls are working on a 17.53% breakout to $114.12.

At the time of writing, LTC was trading at $97.06 after gaining almost 4% on the last day. The token’s market capitalization had also gained 3.31% to $7.022 billion, in tandem with the price surge. Market activity for Litecoin was also up by an outstanding 26.26% to $513.8 million. This points to increasing interest among investors, and with good reason, as the network has been proactive on ecosystem growth.

Litecoin Embraces Partnerships For Ecosystem Growth

Litecoin (LTC) crypto was designed to provide fast, secure, and low-cost payments by leveraging the unique properties of blockchain technology. The network prides itself on never sleeping, as it has never been down.

Litecoin never sleeps.. in fact it never has.. the #Litecoin network has #neverbeendown #SundayMotivation $LTC ⚡ pic.twitter.com/7kGPU6cHge

— Litecoin (@litecoin) February 26, 2023

The bullish outlook for Litecoin comes as the network has been doubling down on ecosystem developments. The most recent move was its new partnership with Metalpha Technology Holding Ltd, a leading digital asset manager. The two entities are coming together to “support research institutions in developing hedging solutions and sustainable mining for the Litecoin ecosystem.”

They will work with universities and research facilities to enhance sustainable blockchain innovation. This will also be an enabler in supporting public education around the Litecoin blockchain. Moreover, it will help improve network awareness, adoption, and scalability.

Metalpha and Litecoin Foundation Partner to Develop Hedging Solutions for Sustainable Crypto Mininghttps://t.co/cPUxBz87by#Fintech #Banking #Paytech #FFNews pic.twitter.com/YuCQBIB6el

— FF News | Fintech Finance (@fintechf) February 24, 2023

The collaboration, focused on sustainability in the crypto mining space, will see the parties develop hedging products for LTC miners.

'Litecoin Foundation Partners With Digital Asset Manager Metalpha to Develop Hedging Products for $LTC Miners. The partnership will jointly develop the #Litecoin ecosystem to hedge risk and lower carbon emissions.' – @CoinDeskhttps://t.co/VqtXzdWBKr pic.twitter.com/kwZLP2VvQw

— Litecoin (@litecoin) February 25, 2023

Based on the announcement, the collaborators will jointly develop the Litecoin ecosystem to hedge risk and lower carbon emissions.

…to support crypto miners with hedging products against market risk and lowering crypto mining’s environmental impact.

The expanse of the partnership will cover “developing derivative products, facilitating renewable energy use and energy efficiency.” It will also enable the reduction of carbon emissions from blockchain mining in the Litecoin Network.

The collaboration will leverage Metalpha’s expertise as a market leader in innovating financial derivative products for digital assets. This means creating financial derivative products for LTC tokens and supporting cryptocurrency miners with hedging products. The products will work against market risk with the objective of reducing the impact of crypto mining on the environment.

Beyond that, the partnership has also revealed an additional collaboration with Hong Kong SustainTech Foundation Ltd.

Hong Kong announced its intention to open markets to the retail crypto trading public on Feb 20. Retail cryptos must be classified on at least two of five indices for Hong Kong's SFC approval. Only 4 cryptos have four or more, one of which is Litecoin⚡https://t.co/SbfddutvdN pic.twitter.com/i7CYTikV34

— Litecoin (@litecoin) February 28, 2023

Together, the three will focus on implementing sustainable blockchain technologies across various industrial sectors.

Litecoin Bulls Planning A 17.52% Breakout To New Range Highs

LTC price is showing a bullish setup on the daily chart (below), which is preparing for a breakout. If market participants play this technical formation correctly, the accumulation pattern could see Litecoin traders enjoy significant profits. Playing right would mean using the ideal leverage and risk approaches.

Judging from the long green bar on the daily chart, there was massive trading activity in the Litecoin market. At press time, LTC was trading at $97.06 as the price confronted the immediate resistance at $100.

An increase in buying pressure from current levels could see the price break above this level and make a 17.52% run for the $114.12 target.

LTC/USD Daily Chart

The price was sitting on immediate support offered by the 50-day Simple Moving Average (SMA) at $92.86. This was a critical support system as it was moving in tandem with the lower boundary of the chart pattern.

The upward-facing relative strength index supported the bullish outlook for Litecoin price. This, coupled with the upward trajectory of the 50-day SMA, indicated more buyers flocking to the scene. The price strength at 54 and the Stochastic RSI at 52 further bolstered the positive thesis, suggesting the possibility of a continued uptrend.

Besides the 50-day SMA, the 100-day SMA at $83.12 and the 200-day SMA at $69.79 also provided support for LTC price. These were potential breathing zones for the bulls in case their buyer momentum wore out.

Notice the RSI had just sent a signal to ‘buy LTC’ when it crossed above the yellow line of the Stochastic RSI. Traders probably heeded this call, as evidenced by the long green candlestick on the day’s trading session. This signified massive buyer activity.

Litecoin Bullish Outlook Supported By The IOMAP Model

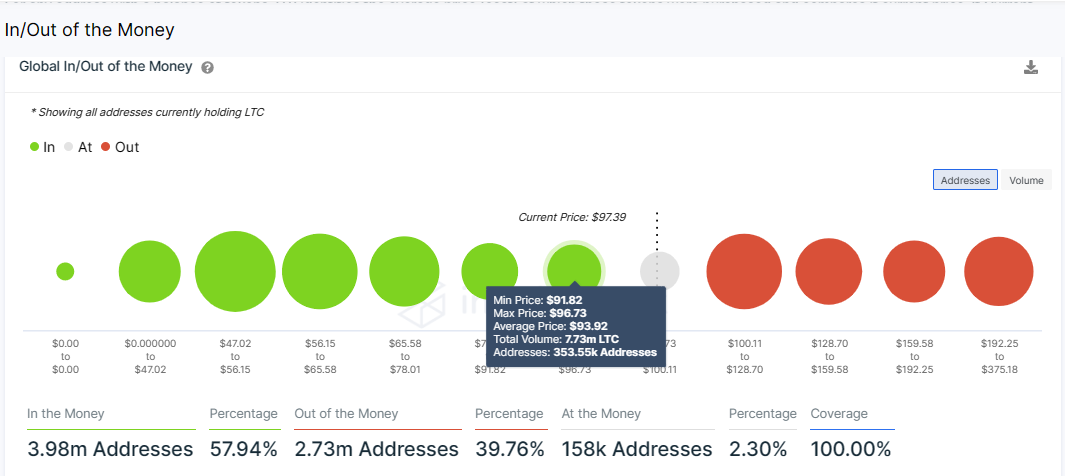

On-chain metrics from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model also support the bullish outlook for LTC price.

The model showed the LTC price had more substantial downward support than the resistance faced on the upside. The immediate support at $92.86 is stronger than the immediate resistance at $100. This was the zone where 353,550 addresses previously bought 7.73 million LTC tokens.

On the downside, if investors started booking profits at this level, Litecoin price could plummet. Such a move could see the price lose the 50-day SMA support, which embraces the ascending trendline of the chart pattern.

Below this level, LTC price would be exposed to a cliff that could see investors recording massive losses. In this direction, they could find potential U-turns at the 100-day and 200-day SMAs. However, this was highly unlikely, given a fall below the ascending trendline would have dented the bullish accumulation pattern.

To support the flipside, the moving average convergence divergence (MACD) was moving downwards towards the zero line. The histograms were also in the red zone. These suggested increasing overhead pressure from the bears.

Therefore, bulls should strive to maintain the price above the lower trendline of the chart pattern, as staying above it will keep investors at a profit. The goal is to maintain the bullish accumulation pattern.

LTC Alternative To Buy

Other than Litecoin, other tokens are also demonstrating bullish accumulation patterns. One example is FGHT, the native token for the Fight Out ecosystem. Despite being in the presale for just a few weeks, the FGHT token has already collected more than $4.87 million in presale sales. The presale is slated to end on March 31.

https://twitter.com/Fight0utCS/status/1628716169455697920

As reported earlier, the Fight Out ecosystem introduced a 5% referral bonus, giving community members more income streams. Joining the program is easy. Connect your wallet to the Fight Out website, then click the ‘5% Referral Link’ icon at the bottom of the pop-up screen. To start earning, share the link and earn whenever anyone with your link makes a purchase.

Analysts are also very positive about the FGHT token. Watch this video for expert insights.

Read More:

- Solana Price Prediction – SOL’s Breakout To $40 Imminent Despite Network Outage Woes

- Is Ethereum’s V-shaped Recovery Leading To A Rise To $1800?

- Biden Administration Was Keen To Launch Digital Dollar

Join Our Telegram channel to stay up to date on breaking news coverage