Join Our Telegram channel to stay up to date on breaking news coverage

Eight popular celebrities were charged by the SEC last Wednesday, for illegally promoting a cryptocurrency “without disclosing that they were compensated for doing so and the amount of their compensation.” These celebrities have agreed to pay a massive settlement, to close the matter.

Lindsay Lohan, Logan Paul and Six Others Charged By SEC

On Wednesday last week, the Securities and Exchange Commission (SEC) filed civil charges against multiple celebrities for misguiding crypto investors and profiting themselves.

The list of these celebrities includes actor Lindsay Lohan, YouTuber Jake Paul, adult film star Michele Mason (Kendra Lust), DeAndre Cortez Way (Soulja Boy), Miles Parks McCollum (Lil Yachty), Austin Mahone, Shaffer Smith (Ne-Yo), and the popular musician Aliaune Thiam known as Akon

These celebrities, with the exception of Soulja Boy, have agreed to collectively pay a settlement of more than $400,000, as a penalty for settling the charges. The payment, however, does not reflect any admission or denial of guilt.

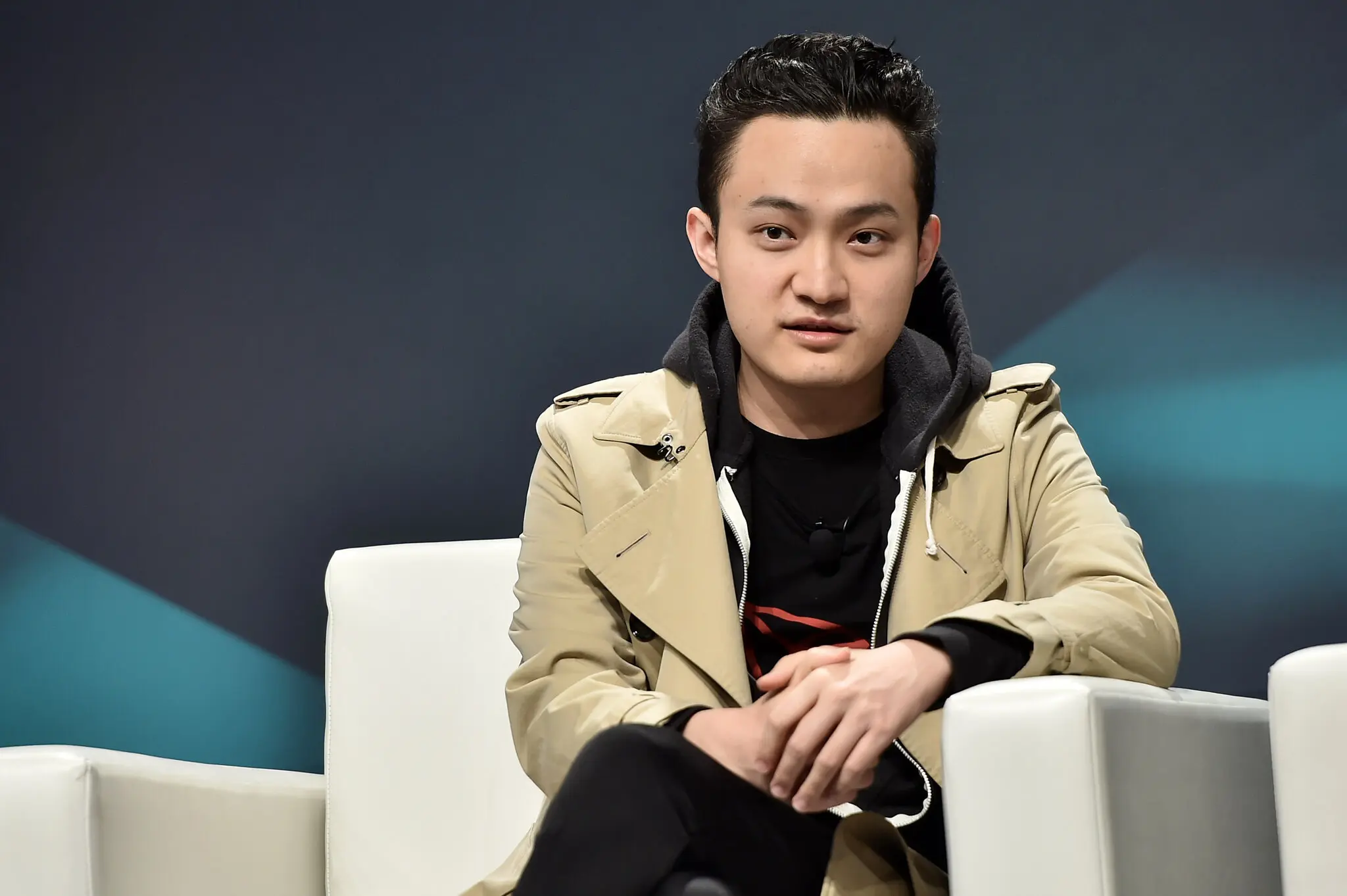

The SEC has also brought charges against Justin Sun and his companies, namely Tron Foundation Limited, BitTorrent Foundation Ltd. and Rainberry Inc. (previously BitTorrent). He was accused of the unregulated sale of securities, and charged with securities fraud and market manipulation of the market by wash trading.

Sun had been manipulating the trading activity of the tokens, and making it appear as if there was active trading happening when in reality it did not exist. These charges were similar to the charges filed by the SEC on crypto exchanges such as Genesis, Gemini and Terraform Labs.

According to SEC officials, Sun allegedly instructed his employees to execute more than 600,000 wash trades of Tronix on two crypto asset trading platforms he oversaw, resulting in an illicit profit of $31 million from the sale of his crypto token.

SEC Chair Garry Gensler commented on the matter saying “This case demonstrates again the high-risk investors face when crypto asset securities are offered and sold without proper disclosure,”

He further added that Sun allegedly induced investors to purchase TRX and BTT tokens by “orchestrating a promotional campaign in which he and his celebrity promoters hid the fact that the celebrities were paid for their tweet,”

The SEC alleges that Sun and his companies offered and sold Tronix and BitTorrent “as investments through multiple unregistered ‘bounty programs,’ which directed interested parties to promote the tokens on social media, join and recruit others to Tron-affiliated Telegram and Discord channels, and create BitTorrent accounts in exchange for TRX and BTT distributions.”

SEC enforcement chief Gurbir Grewal said that this behavior from Tron and its supporters is part of an age-old playbook to mislead and harm investors.

Grewal further added that “At the same time, Sun paid celebrities with millions of social media followers to tout the unregistered offerings, while specifically directing that they not disclose their compensation. This is the very conduct that the federal securities laws were designed to protect against regardless of the labels Sun and others used,”

A spokesperson from Tron commented on the matter saying that “The SEC’s civil complaint is just the latest example of actions it has taken against well-known players in the blockchain and crypto space. We believe the complaint lacks merit,”

This isn’t surprising as the SEC has been making strong actions in the crypto space to establish regulation. NBA Hall of Fame Paul Pierce was charged by the SEC for misleading statements about a crypto asset in February.

Pierce failed to disclose that he was being paid for the promotion of EthereumMax’s EMAX tokens and proceeded to settle the allegations by paying a penalty of $1.1 million with no admission or denial of the charges.

Not The First Time For Influencers To Misguide Investors

In December last year, Seven social media influencers were charged with securities fraud by the Securities and Exchange Commission (SEC) in a $100 million scheme to manipulate the price of small-cap stocks using multiple social media channels.

Although not widely known, these influencers had over two million followers across various platforms, showcasing their lavish lifestyles in pictures. The accused included PJ Matlock, Edward Constantin, Thomas Cooperman, Gary Deel, Mitchell Hennessey, Stefan Hrvatin, and John Rybarcyzk, each with at least 100,000 Twitter followers.

These individuals were charged with promoting stocks to their followers without disclosing that they intended to sell them while they were promoting them. The scheme, known as “pump and dump,” was conducted in three phases which included identifying a stock and purchasing it at a low price. Then promote it to followers and inflate the price, then selling the shares at a profit while deleting old tweets and Discord chats to conceal their actions.

Individuals are required to disclose the amount they’re getting paid as well as what they source to the public, according to the law. And it’s unethical to promote crypto assets under the disguise of security as per an SEC official.

SEC To Tighten Regulation To Protect Investors’ Interest

The cryptocurrency industry has faced what is recently referred to as a “regulatory Big Bang” as the US Commodity Futures Trading Commission sued Binance for allowing customers to trade on Binance’s offshore platform even though doing so is not allowed. Binance is the biggest crypto exchange in the world and this move indicates that regulators aren’t going to compromise on establishing regulation in the crypto space

Decentralized projects too are under a keen eye and will need to rethink their operations. While DeFi-based exchanges are run by computers and with the support of the community, and don’t require a person in charge like traditional companies. The SEC has still managed to subpoena Jared Grey, the head behind the Sushi exchange, demanding that both centralized and decentralized exchanges will need to register with the SEC.

Recently, the SEC has been implementing stricter regulations on the crypto sector, coinciding with the upheaval in the US banking industry. Earlier in the year, the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, and the Federal Deposit Insurance Corp. cautioned banks about the potential risks associated with crypto assets and clients involved in crypto-related activities.

As a result of this warning, numerous banks have decreased their involvement in digital assets, and banks that were previously supportive of cryptos, such as Silvergate and Signature, have faced significant setbacks, making it more challenging for crypto businesses to function.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage