Australia is poised to enhance its cryptocurrency investment framework by introducing the nation’s first spot Bitcoin exchange-traded fund (ETF). This product will allow for direct Bitcoin holdings, aligning Australia with other countries like the United States, Canada, and Hong Kong that offer similar investment opportunities. Scheduled to commence trading on the Cboe Australia exchange on Tuesday, June 4, the Monochrome Bitcoin ETF (IBTC) represents a significant development in Australia’s approach to cryptocurrency investments.

Australia Embraces Direct Bitcoin Investment with New ETF

Previously, Australian investors had access to various exchange-traded products that provided exposure to Bitcoin, yet these did not hold the cryptocurrency directly. The launch of IBTC by Monochrome Asset Management marks a pivotal change, as it is the inaugural ETF of its kind approved under the new crypto asset category by the Australian Financial Services (AFS) licensing rules established in 2021. This approval permits the ETF to store Bitcoin holdings offline in secure, internet-isolated devices, adhering to stringent Australian institutional custody regulatory standards.

Monochrome Bitcoin ETF: A New Era in Cryptocurrency Investment

Jeff Yew, CEO of Monochrome, expressed optimism about the new ETF, noting the increasing interest in direct Bitcoin investments as opposed to the previously available indirect options or offshore Bitcoin products. These indirect routes did not provide the benefits of investor protection afforded by the directly held crypto asset AFS licensing framework. The direct holding feature of the new ETF allows for in-kind redemption, which is not typically available in its U.S. counterparts that operate on a cash creation basis.

In an interview, Yew revealed that his firm is not only prepared to launch the IBTC but is also gearing up to introduce an Ether ETF that will similarly hold the asset directly. Furthermore, Monochrome is exploring additional thematic opportunities within the digital asset sector to cater to growing investor demand.

This initiative comes shortly after the introduction of four spot Bitcoin ETFs in Hong Kong on April 30. Despite these, three of the four Hong Kong ETFs experienced cumulative net outflows, with only Bosera’s spot Bitcoin ETF showing positive results. Contrastingly, Bitcoin ETFs in the U.S. have seen substantial activity with $13.9 billion in inflows, although this was accompanied by $17.9 billion in outflows from the Grayscale Bitcoin Trust.

Yew mentioned that Australia, having a robust crypto engagement, anticipates that the local spot Bitcoin ETFs could attract between $3 billion and $4 billion in net inflows over the next three years, reflecting strong investor confidence in the Australian cryptocurrency market

Monochrome was proud to host 120 guests in Sydney last week as we celebrate the upcoming launch of the Monochrome Bitcoin ETF.

This milestone marks a significant step in our journey empower investors with the tools and confidence to navigate the digital financial landscape. pic.twitter.com/tfWGzYwl3R

— Monochrome (@MonochromeAsset) June 2, 2024

Sealana: The Rising Star of Solana Meme Coins in the Presale Arena

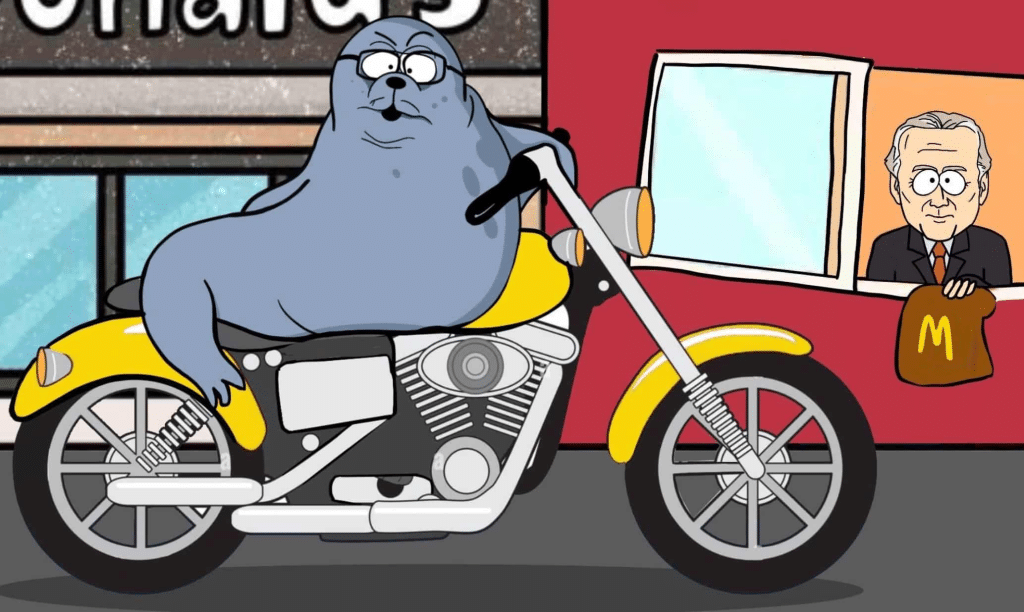

Sealana has emerged as a new highlight in the realm of Solana-based meme coins, captivating the hearts of daring investors known as degens. These enthusiasts eagerly search for the latest and greatest opportunities in meme coins. As a fresh contender in the market, Sealana is inspired by a character from South Park, depicted as a seal engaging in the typical trader’s diet of tuna and Coke, while on the lookout for the next big hit in the Solana meme coin scene.

This new token is being marketed purely on the excitement surrounding meme coins, with no actual utility offered. It relies on the adventurous spirit of its investors, who are drawn to the high-risk, high-reward nature of such ventures. Following a straightforward presale approach, Sealana asks investors to send SOL directly to a specified address to acquire $SEAL tokens, a method previously employed by Slothana during its highly successful presale that amassed over $15 million swiftly.

Within the first 24 hours, Sealana has already generated significant buzz, accumulating over $125k, and it appears set to match or even surpass the rapid fundraising achievements of its predecessors. Despite the lack of inherent utility, the project’s potential to go viral is significant, making it a tempting prospect for short-term investors looking for quick gains in the meme coin market.

Related News

- How to Buy Bitcoin in Australia: A Beginner’s Guide

- Investing in Cryptocurrencies in Australia

- Australian Treasury consults citizens on Bitcoin tax exclusion

- Australian Securities Exchange Gears Up To List Spot Bitcoin ETFs This Year

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users