The cryptocurrency market cap hit the much-awaited figure of $3 trillion in November 2021, showing the potential of decentralized currency. It has consolidated and held above $2 trillion heading in 2022.

While Bitcoin has been a trendsetter, cryptocurrencies like Ethereum, Litecoin and others also deserve everyone’s attention as they support a wide range of use cases such as data storage, gaming, finance and the like.

Knowing this, should you invest in cryptocurrency in the year 2024? In this guide we’ll give an overview of the most important questions concerning Web3, how to invest in cryptocurrencies in Australia, how to build a good crypto investment portfolio, and the future of the best-performing financial asset of the last decade.

Best Australia broker to invest in Cryptocurrencies

How to invest in cryptocurrencies in Australia?

Beginner Investors should purchase cryptocurrencies from a platform that is licensed by top global authorities and allows to make transactions in simple steps.

We recommend eToro as the best place to invest in cryptocurrency, which provides you with expert insights, trade-related information, educational courses, and more.

This investing site has gained operational licenses from regulatory agencies in Australia, the United Kingdom, US, and Cyprus. Trusted by 20 million users, it’s a user-friendly cryptocurrency exchange, as well as a social trading platform where you can read expert comments, price analysis, trade news, and so on.

Its Copy Trader feature aids newbies in learning about crypto investing by allowing them to mimic the trades of the industry’s top traders. Any beginner would have no trouble navigating this trading platform and learning the intricacies of the digital finance sector by connecting with specialists and other traders.

Many cryptocurrencies have been listed on eToro, and you may purchase your favorite crypto asset from this reputable exchange by following these simple steps:

Step 1: Create your account with eToro

Sign-up on the eToro website, and give your necessary details by clicking on the “Join Now” button. It only takes a few minutes to open an account.

Open a free eToro account

The user will be required to provide its complete name, mobile number, email, password, and username. One can skip this process by directly registering with Facebook or Google.

Step 2: Get your identity verified

Complete the know-your-customer (KYC) process by providing your identity proof with necessary documents. Your account will be verified within minutes.

Invest in cryptocurrency and other asset classes on eToro

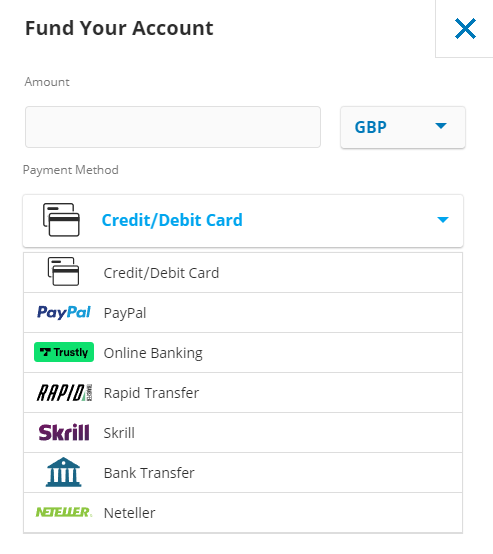

Step 3: Deposit money into your account

Once you have completed the KYC process, you are supposed to deposit money in your account by pressing the ‘Deposit Fund’ button.

You can choose any payment method from the following to make your deposit. These options are credit / debit cards, PayPal, Bank transfer, E-wallets Skrill and Neteller, Trustly, Rapid transfer and more.

Step 4: Purchase your cryptocurrency

Now, it’s time to buy your favorite cryptocurrency.

Search for the required cryptocurrency in the search box at the top – for example ‘Bitcoin’ – and then click on the trade button on the next screen. Enter the amount you want to buy on the box that pops up, and open the trade.

You can safely hold your crypto on eToro as a long-term investment, as its a regulated exchange (overseen by the ASIC in Australia) and provides a free secure crypto wallet.

Your capital is at risk

Why invest in cryptocurrencies?

If you are excited about digital currencies but are unsure about investing in them, here are some reasons, which can make you start investing in cryptocurrencies as soon as possible:

Decentralization of cryptocurrencies gives you control over your assets

Trading in cryptocurrencies is decentralized in nature, which means that there is no involvement of any third party in your trading transaction. You have complete control over your assets, and you can store these cryptocurrencies without any external influence. Further, its prices are also not determined by any exchange or broker.

Cryptocurrencies are mostly deflationary in nature

Cryptocurrencies are usually limited in supply, which makes them deflationary in nature. In other words, purchasing power gets increased with time. Most cryptocurrencies are pegged with an algorithm that puts a maximum limit on their total supply.

Cryptocurrencies are transparent and secure

The popularity of cryptocurrencies has skyrocketed because of their transparency and security. The usage of blockchain technologies in crypto transactions makes them secure and transparent and enhances investors’ confidence to make a humongous investment. Further, the presence of open-source and publicly-verifiable technology makes cryptocurrencies the favorite among all traders.

Crypto investment could give you big returns

The fact that cryptocurrencies give lucrative returns on investment is not unknown among the general public. If one can make an informed investment based on expert advice, price history analysis, and other important factors, then one could reap humongous returns on its investment in both short-term and long-term.

The availability of different cryptocurrencies like Dogecoin, Ripple, Binance Coin helps in diversifying the portfolio of the investors and also increases the probability of gaining wealth in their transactions.

Crypto trading provides you with the necessary independence and flexibility

Every trader wants to dive into the world of trading at a convenient time. The 24/7 accessibility of the crypto market allows all investors and traders to make their trading decisions at their convenient timings after doing proper research and analysis.

These things provide you with some amazing reasons to start investing in cryptocurrencies soon.

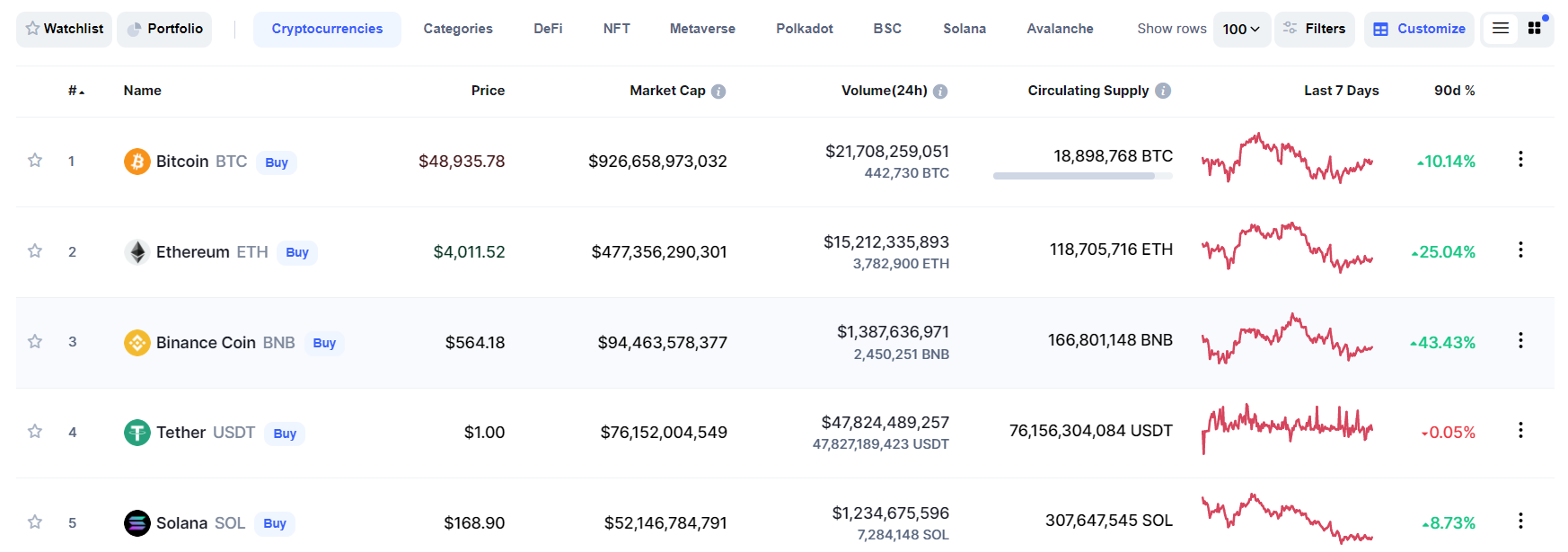

Major cryptocurrencies and their market cap

Where can you buy crypto in Australia?

Finding the right trading platform can sometimes be a tough task for beginners. Therefore, we have compiled a list of places that provide a user-friendly interface for cryptocurrency trading.

eToro

Overall, this platform is the best place to buy cryptocurrency in Australia. It was established in 2007 with its head office in Canary Wharf, London. This licensed platform generates investors’ confidence as it operates under the supervision of the Australian Securities and Investment Commission (ASIC), and other global bodies.

One can easily buy cryptocurrencies by making their account with some simple steps. Further, it uses Secure Socket Layer (SSL) technology to make sure that users’ transactions are safe and secure on their platform.

Apart from all these features, this reputable crypto broker charges competitive fees, operates low minimum deposit, and ensures a healthy trading experience by its user-friendly design.

Your capital is at risk

Evonax

If you want to experience crypto trading by maintaining your anonymity on the trading platform, then Evonax is the right trading platform for you. Founded in 2016, Evonax allows its users to deal in cryptocurrencies with zero trading fees. This feature of zero transaction fees distinguishes its platform from other service providers.

This platform has its presence in more than 100 countries all over the globe, and investors from different regions have reposed their trust in this platform. Its user-friendly interface is backed by secure technology that keeps the sensitive data of its users safe.

As mentioned earlier, there is no requirement of giving your Know Your Customer (KYC) information to this platform. This information would only be required in case users require any assistance from their customer support program.

Coinbase

Founded in 2012, Coinbase operates not only as a trading platform but also as a crypto wallet. It has over 73 million verified users in over 100 countries. Further, it is trusted by more than 10,000 institutions and 185,000 ecosystem partners.

For a beginner, this is one of the easiest places to buy, sell, or deal in cryptocurrencies. It ensures that users’ information remains safe and secure on its platform, and provides a healthy trading experience to all its users. For ensuring extra security, it deploys two-factor authentication (2FA) for storing the bulk of cryptocurrencies.

It charges fees for trading on its platform and is home to a plethora of digital currencies. Users have to submit a minimum deposit to start trading on this user-friendly platform.

Binance

Binance is the world’s largest crypto exchange as far as the daily trading volume of cryptocurrencies is concerned. Founded in 2017, Binance company has made humongous success within just 4 years from its inception.

Users do not have to pay any fees for their deposits on this crypto exchange, however, fees are generally charged whenever users do any trading on this platform. This fee gets reduced whenever BNB is used by the investors on this platform.

Known for its liquidity, this exchange uses high safety and security standards to ensure the non-tampering of any users’ sensitive data. It allows trading in more than 500 cryptocurrencies like Bitcoin, Ethereum, Litecoin, Dogecoin, etc.

Users are required to submit their KYC information to start trading on the Binance exchange. Apart from its exchange-specific services, this platform also provides services related to staking, conversion of cryptocurrency into fiat currency, etc.

Best cryptocurrency to invest in

What should be the best cryptocurrency to invest in? Every beginner has this same question whenever he starts planning his investment in the crypto market. Looking at the current price trends, Bitcoin should be the ideal investment avenue for every trader if he is planning to earn enormous returns on his investment.

Ever since its launch in 2009, Bitcoin has always made headlines on the crypto price charts. Its popularity is the reason why cryptocurrencies have made their mark in the financial market in recent times. If any investor wants to have a stronghold in the crypto market, then Bitcoin should come out as its obvious choice since this single most currency accounts for around 40% of the overall market capitalization.

Bitcoin price chart on eToro

With a market capitalization of about $3 trillion, this cryptocurrency has recently hit an all-time high in 2021 (AUD 95,000 in November 2021). Often recognized as the leader of the pack, Bitcoin has been accepted by many businesses, including Visa and Tesla, for making payments. Its feature to get accepted in form of a currency distinguishes it from many other currencies and brings multiple benefits to its users.

Since Bitcoin long-term price predictions expect its price to go as high as AUD 450000 by the end of 2025, it remains the best one to go for investment in terms of long-term growth. The deflationary tendencies of this currency have ensured that it retains its price dominance on the crypto charts.

Though this crypto has also seen bearish trends, however, it is less vulnerable to price crashes than other altcoins because of its strong fundamentals, and old market presence. Given the increasing adoption of this currency in mainstream use, this currency unravels enormous prospects for its investors and traders.

This digital gold has seen the rise of more than 9 million percent from its meager launch value of $0.08 in 2009. For all the above reasons, you should buy Bitcoin at the earliest before its price crosses $138,000.

Your capital is at risk

Major cryptocurrencies to invest in

Apart from Bitcoin, crypto price predictions of many digital currencies have made headlines in recent times, which have them a lucrative investment avenue.

Ethereum (ETH)

Ethereum comes second to Bitcoin in terms of its market capitalization in the entire crypto ecosystem. It is the front runner altcoin in the decentralized financial market, which uses a proof-of-work (PoW) consensus mechanism, though it is planning to make a switch proof-of-stake platform.

This decentralized, open-source blockchain network allows the creation and usage of many smart contracts and decentralized applications (dApps) without any third-party interference.

These all features make Ethereum the best alternative to Bitcoin. Ethereum has come a long in its aim of creating a decentralized collection of financial products which could be accessed by any person around the world irrespective of nationality, faith, or any other parameter.

It has been one of the best performing cryptocurrencies since its launch in the financial market. Having seen a rise of over a hundred thousand percent in value from its launch, Ethereum has been able to bring a smile to the face of its investors many times.

Experts believe that this crypto price would increase in the upcoming years as Ethereum long-term price predictions suggest that it would cross the figure of AUD 20,735 towards the end of 2025.

The recent price trends show the bullish run of this crypto in the crypto market. With the increasing application of decentralized financing in every sector, Ethereum would continue to make its mark with the use of its DApps and DeFi technology.

Many investors are keeping their eye on Ethereum 2.0 as it is expected that this upgradation would give stiff competition to the king of the cryptocurrency market, Bitcoin.

Considering the chances of huge gains in the forthcoming years, investing in Ethereum could provide a high ROI.

Your capital is at risk

Cardano (ADA)

Cardano is one of those cryptocurrencies that operates on a proof-of-stake blockchain platform called Ouroboros. This cryptocurrency is ranked 6th in terms of its market capitalization in the cryptocurrency market. It is a popular alternative to Bitcoin and uses fewer energy costs for validating transactions.

Cardano was founded by Charles Hoskinson, the same man who founded Ethereum. Despite their similar founder, these two currencies operate on a different system. Cardano uses a proof-of-stake Ouroboros consensus mechanism, while Ethereum uses a proof-of-work blockchain system.

Cardano aims to be the “most environmentally sustainable blockchain platform”. The proof-of-stake mechanism provides Cardano a competitive advantage over other Blockchain technology. The goals of this cryptocurrency are to increase interoperability, scalability, and sustainable development.

This year saw a great run of this crypto on the market chart where Cardano was seen overtaking Litecoin, Dogecoin, and even Ripple to becoming, at one point, the third-largest cryptocurrency in terms of market capitalization. Cardano is forecasted to have positive momentum in the crypto market due to its increasing presence in the smart contracts arena.

Should you invest in Cardano? Yes, Cardano’s price will soon be in two digits as per the expert’s predictions. Cardano long-term price predictions show that it would get to the figure of $10 by the end of 2025. Further, this crypto also invites investors’ attention due to its resilient nature as its price does not fluctuate much in the event of a market crash. Because of its promising performance in the last few years, Cardano finds a good place in your investment portfolio.

Your capital is at risk

Ripple (XRP)

XRP is the native cryptocurrency of the Ripple network. XRP Ledger uses this currency to make international currency exchange and remittances. This crypto is generally utilized as a form of a bridge between transactions involving different currencies on the XRP network. XRP is currently the 8th largest cryptocurrency in terms of its market capitalization.

XRP is generally very speedy, less expensive, and more scalable when compared to other digital currencies and payment methods like SWIFT. The proficiency of Ripple in making payments can be estimated from the fact that it could process 1,500 transactions per second when compared against Bitcoin (7 transactions per second) and Ethereum (15 transactions per second).

XRP is impossible to mine as is a pre-mined asset and already 100 billion tokens of XRP were created by its ledger. Coming to the long-term price predictions for Ripple, it is expected to reach AUD 6.33 by the end of 2025.

Should Ripple find a place in your portfolio? Yes, Ripple is a promising investment as this crypto will play a big role with the increasing adoption of cross-border payments and with the growing integration of finance with technology.

Your capital is at risk

Small cryptocurrencies to invest in

Every investor needs to keep track of prominent small cryptocurrencies which can be a good source of revenue if invested smartly. Given below are some important cryptocurrencies which should be followed on regular basis:

Dogecoin (DOGE)

The year 2021 has been the year of Dogecoin. Based on the popular “doge” meme, this crypto bears the picture of a Shiba Inu on its logo. Dogecoin did not receive much attention from the investors during the beginning of 2021.

The tweets of Elon Musk on this meme coin brought bullish growth on its price charts. Soon, its listing on popular trading platforms like Coinbase generated the confidence of the traders for this cryptocurrency. Consequently, this year saw the all-time highest figure of this crypto, i.e. $0.74 (AUD 1.02), thereby registering over a twenty thousand percent rise in its value from its launch in 2014.

Currently, this cryptocurrency has been ranked 11th in terms of its market capitalization. This open-source digital currency has an uncapped supply, which means there is no upper limit on the number of Dogecoins that could be mined.

Its popularity has made its usage possible for mainstream purposes, for instance, social media platforms like Twitter and Reddit use Dogecoin for the purpose of rewards and tipping systems respectively.

The potential future trends for this crypto signal a positive sign towards the investors. The meme coin is expected to go as high as AUD 0.88 by the end of 2025. However, the nature of the cryptocurrency market is unpredictable, and one could not invest in any digital currency by merely considering the immediate past performance and potential future trends.

Therefore, consider investing in Dogecoin only after doing the background research, price analysis, and after considering the experts’ advice and market trends.

Your capital is at risk

Shiba Inu (SHIB)

Shiba Inu was launched in August 2020 for giving some competition to Dogecoin in the crypto market. It was founded on the Ethereum blockchain with a total supply of 1 quadrillion coins. Within a short period, this cryptocurrency has gained significant traction in the digital finance market.

The fact that it has been launched to give competition to Musk’s favorite coin has provided it the much-needed attention of the investors. It is currently ranked 13th in terms of its market capitalization in the crypto market. Further, its recent listing on the largest US-based crypto exchange, Coinbase, increased its value by the whopping figure of 40%, thereby bringing this coin into the spotlight.

The price of this cryptocurrency varies between the amount of $0.00000667 and $0.00000701 with an average daily trading volume of $219 million. The thing which makes this token more unique is its special dog icon. This icon has motivated many artists around the globe to ensure that it gets secured in the non-fungible token market.

Despite the entire buzz around this coin, a lot of work is required to make sure that it becomes a promising asset in the eyes of investors. Though it is predicted that its price would touch the mark of $1 in the upcoming years, however, the long-term investment could only be made in this crypto after carefully assessing its prospects, price history, and other important trade-related factors.

From the angle of short-term investment, this token becomes the right place to pour money as its price usually gets high whenever this coin is in the headlines.

Your capital is at risk

Polkadot (DOT)

DOT is the native token used in the Polkadot network. Polkadot is a protocol that enables the transfer of any data or asset across the blockchains. It unites multiple blockchains across its network and ensures high security and scalability. DOT is used on this platform for securing the network or for connecting new chains.

Unlike Bitcoin and Ethereum, Polkadot uses a proof-of-stake consensus mechanism for securing its network and validating its transactions. Further, users on this network have the opportunity to earn rewards in DOT by staking and participating in the network.

Currently, this cryptocurrency has been ranked 9th in terms of its market capitalization. A total of 1 billion DOT tokens have been allocated by Polkadot currently. Its first initial coin offering (ICO) took place in October 2017. It was launched with a total of 2.24 million tokens for AUD 0.40.

Experts believe that DOT price would highlight a bullish run on its price chart. Its value is expected to reach AUD 201 by the end of 2025. Since DOT is a more sustainable project with strong fundamentals, it is better to invest in this crypto from the long-term perspective.

Your capital is at risk

New cryptocurrencies to invest in

The advantage of making an early investment in new cryptocurrencies is unparallel as it allows you to get potentially strong crypto at a low price, which later on gives you humongous returns when the digital currency displays soaring prices on its market charts.

Given below are some of the new cryptocurrencies which are having the potential to be in the top 10 cryptos in the upcoming years:

Cosmos (ATOM)

Cosmos is a decentralized blockchain system that allows scalability and interoperability among multiple blockchains. ATOM is the native cryptocurrency of this platform. It is a proof-of-stake chain, which allows its users to stake ATOM tokens for maintaining the network.

This blockchain system aims to allow faster and cheaper decentralized applications to run on their blockchains. Interchain Foundation (ICF) has backed Cosmos by financing its blockchain projects.

The native Tendermint BFT byzantine fault-tolerant consensus engine is used by Cosmos for ensuring that the processing time of blockchain transactions does not take longer time. Further, the Cosmos SDK platform allows developers to develop convenient frameworks for integrating blockchain technology with real-life projects.

Similarly, the IBC protocol from Cosmos promotes compatibility among the blockchains by allowing easy transfer of data or communication.

Cosmos is currently ranked 33rd in terms of market capitalization with its value predicted to increase in the upcoming years. The second half of 2021 saw this crypto hitting its all-time high figure of AUD 61.93. It has witnessed tremendous growth of more than 400 percent from the beginning of this year.

Experts have predicted a decent future for this digital asset. It is believed that ATOM would cross the boundary of $100 by the end of 2026. Considering the huge prospects of this crypto, investors will start investing in Cosmos to ensure high returns in the forthcoming times.

Your capital is at risk

Curve (CRV)

Founded by Michael Egorov, a Russian physicist in 2015, Curve DAO is a newly founded decentralized finance (DeFi) protocol that is built on the Ethereum network. This automated market maker protocol has its token, CRV, that was recently launched in 2020. The native token is used for voting on governance by getting locked for a while.

Further, this decentralized finance platform allows its users to swap between ERC-20 tokens, for instance, stable coins (USDC and DAI) and Ethereum-based Bitcoin tokens (WBTC and renBTC).

Curve allows users trading of cryptocurrencies using pools of these digital assets maintained by the users. Users could also earn fees through their deposits on this platform. Currently, this token is having a market capitalization of $1,740,403,258 and is ranked 73rd in terms of its market cap.

By 2025, the price of Curve is predicted to reach the lowest possible figure of AUD 19.96. Looking at its current trading price of AUD 5.56, its value is expected to multiply three times of its current figure. Therefore, this crypto comes out as a good investment option for all those investors who are planning to invest in new cryptocurrencies for longer periods.

Your capital is at risk

Solana (SOL)

Solana has been touted as the “Ethereum Killer” by many crypto enthusiasts. It is a decentralized computing platform that attempts to sort out the limitations of Ethereum. This platform uses SOL to pay for transactions.

A combination of a proof-of-stake consensus mechanism and a proof-of-history system is used to enhance the scalability of this blockchain. It is estimated that Solana could execute around 50,000 transactions in a second without compromising with decentralization.

SOL saw its dream run in the year 2021 where it provided enormous profits to its retail investors. This crypto has witnessed a huge price rise from AUD 1.04 to AUD 297.15. in early September. The launch of the Degenerate Ape Academy NFTs, a prominent NFT project, on its platform has provided a huge impetus to Solana in terms of its growth and popularity.

Apart from this project, Solana also allows the running of many crypto apps on its platform like Ethereum. SOL has seen a growth of over 100% since August 2021, and experts believe that its bullish run on the price chart would continue for some period.

Further, its price is predicted to reach over AUD 5800 by the end of 2023. Within a short period, it has managed to rank 5th in the market capitalization index of the crypto industry.

SOL looks to be a good long-term investment, however, from the point of short-term investment, investors have to do some background research and monitor the market before taking any immediate call.

Solana, as a platform, is also having a bright future in the crypto industry as it is already a host to a plethora of projects on its platform. Projects like Serum, Chainlink, and Audius are quite well known in the digital finance industry.

These all things clearly indicate that Solana is having huge potential for being a long-run player in this volatile market.

Your capital is at risk

Best cryptocurrencies to invest in 2024 for the long-term

The Crypto industry is known for its price fluctuations or volatility. Over the years, this industry has seen both significant price rises and heart-rendering market crashes.

In light of the variable nature of this market, it is necessary to not pump your entire resources into a single currency as you stand the possibility of losing everything in case that currency crashes on the market chart.

For all these reasons, experts have always advised you to diversify your portfolio if the investors are opting for long-term investments. Here, we will give you some recommendations regarding what all cryptocurrencies are best suited for your long-term investment, and how much percentage of your money you should allocate to every single crypto.

Bitcoin will be the obvious first choice if any investor is aiming for long-term growth. Market projections show that the Bitcoin price could cross the mark of $300,000 by 2025 and $380,000 by 2027.

With an increase in acceptance of cryptocurrencies in mainstream usage, Bitcoin’s importance will continue to soar as this is the widely known crypto among the general public after all.

However, you can’t risk out your entire investment on Bitcoin, therefore, Ethereum should be the next in line for your crypto investment. Ethereum has been one of the best performing digital currencies in recent times. It has recently witnessed its all-time high of $4,850 in 2021.

Considering its promising future, it comes out as the best alternative to Bitcoin and may overtake BTC one day in what traders call ‘the flippening‘.

Almost every investor who bought Bitcoin or Ethereum has minted profits whereas many altcoin projects have failed and been abandoned. Therefore, it would be a smart move if you keep the majority stakes of these currencies in your portfolio, let’s say, 40% each.

For the remaining ones (20%), you can go for majors like Cardano, or invest in some newer small marketcap coins like SOL or CRV, which can give you a high return on investment (ROI) in a bull run.

Best cryptocurrencies to invest in 2024 for short-term

If you are planning to make a short-term investment in cryptos, you should target those coins whose prices get increased whenever they are in the headlines. One could invest in Shiba Inu the price of which pumped significantly when it got listed on a recognized crypto exchange.

The popularity of crypto gaming has also led Axie Infinity to come into the eyes of investors. Axie Infinity provides opportunities to its users to earn tokens by showcasing their gaming skills. As crypto gaming is becoming popular among all gaming enthusiasts, this crypto is bound to display positive growth in upcoming years.

Further, one could also watch out for Floki Inu, which is an ERC-20 token on the Ethereum blockchain technology. It is dubbed as the next Shiba Inu by all dog-themed meme coin lovers. Floki Inu is also in the area of play-to-earn gaming through its flagship product called Valhalla. This meme coin has managed to pull on steady growth since its inception.

Considering the new blend of the crypto market and gaming industry, Floki Inu comes out as a good alternative to other altcoins in terms of short-term investment.

How to build a good crypto investment portfolio?

How to assess an investment portfolio in cryptocurrency? This question is common among all beginners. You must understand that it is important to have a diversified portfolio whenever you are dealing with volatile assets.

If one allocates its entire money on a single digital currency, then one stands a chance of losing its entire amount in the case that currency crashes. Therefore, it is advisable to ensure that you pour reasonable money into different stocks so that you could minimize the risk of losing your complete investment.

As a beginner, you could learn the art of developing a good crypto portfolio by learning from the experts through eToro’s copy portfolio feature. This feature allows users to replicate the portfolio allocation of a professional investor.

How many cryptos do you need to invest in?

Having too few cryptocurrencies or too many cryptocurrencies in your wallet can be risky. An ideal blend of having volatile and stable coins in your wallet guarantees you good profit in the long run. Many investors open accounts on several crypto exchanges and brokers to access different altcoins.

Though there is no set in stone way to build a crypto portfolio, as an example you might consider having a 40% share of Bitcoin and Ethereum in your portfolio, with the other 20% invested either in small market cap altcoins and speculative new meme coins.

How long would you need to hold your investment?

The cryptocurrency market is volatile and unpredictable. One can’t set any time limit for a specific set of investments as the duration of every investment is dependent upon factors like the nature of crypto, market factors, trade-related news, etc.

However, in case of cryptocurrency price crashes, one must understand that bear markets can last for 2-3 years. Having said that, the duration of crypto investment can only be decided after proper research and analysis.

How much you would need to invest?

Don’t put all your eggs in one based and invest your entire net worth in cryptocurrencies, especially volatile and unpredictable altcoins. Even if you’re bullish on crypto as a long-term investment, you should keep some capital aside to buy the dips.

To be on the safer side, some investors put 20-30% of their savings into these digital currencies and also diversify into other assets. Alongside crypto, eToro offers stocks, forex, commodities, and ETFs.

In case you have excess or less disposable income, then that figure can be adjusted accordingly. However, don’t pour too much money into cryptocurrency as that would bring unnecessary risk to you, and don’t invest too little (say $50) expecting to become a millionaire.

If you are willing to take on more risk open accounts on several cryptocurrency exchanges to split up your funds and keep some of your funds in Bitcoin, which has never had a 90% or higher price correction, as many altcoins have.

For example, the bear market from $20,000 to $3,000 was an 85% drawdown and took three years to recover. Some altcoins lost 95-99% of their value and never recovered (Ethereum was one that did).

How to store your crypto investment in a secure wallet?

Cryptocurrencies are generally like computer codes. They can’t be saved in a physical location, unlike traditional fiat currencies. That is why we need crypto wallets which are hardware or software that allows storing or trading of cryptocurrencies by interacting with blockchains.

One needs to have dedicated crypto wallets for storing these virtual currencies. Though there are a lot of platforms available in the market which provides storage services for crypto, however, we have compiled a list of some best crypto wallets that are secured and trusted by many investors.

eToro Money Wallet

The eToro money wallet is very convenient to install as it is available on both Android and iOS devices. It allows storing of over 120 cryptocurrencies and is inbuilt with a feature that offers conversion functionality.

The digital wallet is a highly secured on-chain private key service, which makes sure that users do not lose their backup phrase. Further, the Guernsey Financial Sector Commission (GFSC) regulates this wallet, and it is provided by eToroX Limited, a limited liability company incorporated in Gibraltar.

Its easy and simple-to-use interface makes it the best choice among all crypto enthusiasts. A conversion fee of 1% is charged on the eToro wallet, and the amount of minimum transaction on this wallet comes out at $125. So far, this is the best wallet that provides well-secured storage services to your digital assets.

Your capital is at risk

Coinbase Exchange Wallet

The reputable crypto exchange, Coinbase, also has a separate crypto wallet. The best part of this wallet is that users do not need to have an account on Coinbase to utilize this wallet. However, it allows the transfer of money to your Coinbase account quickly.

You can store over 500 different cryptocurrencies on this wallet along with many different NFTs. Further, this wallet ensures the high security of your information and funds through biometric authentication and optional cloud backups.

Your capital is at risk

Binance Exchange Wallet

Binance crypto wallet allows you to store your digital currencies and provides you with an opportunity to earn rewards through staking.

This wallet is available in form of a mobile app and is used by about 10 million people around the world.

With its easy interface, you can easily buy, send trade, or exchange, hundreds of cryptocurrencies with this wallet.

Your capital is at risk

Responsible investing

You have to be careful whenever you are dealing with cryptocurrencies due to the unpredictability of this market. If you are making your first-time investment, then it becomes more important to carry due diligence because you stand a big chance of losing tremendous money in case you make an irresponsible investment.

You have to do the necessary research, monitor market conditions, and then take your call regarding where you have to invest your money.

Further, you have to limit your exposure. A smart investor will never stake too much of his capital into virtual currencies. Therefore, it is advisable to distribute your investment in different currencies and have a balanced division between stable assets and volatile currencies.

You can refer to eToro, which offers all beginners and investors a variety of insights and expert comments on topics such as how much to invest in cryptocurrencies and when to buy, hold, or sell it strategically.

Also, read our guide to responsible investing for the warning signs of developing a gambling addiction when investing in cryptocurrency.

Security and risks of crypto investing

The first and foremost risk associated with cryptocurrency is its volatility. Unanticipated changes in the market could lead to a huge change in its price. It should not be forgotten that it is common for cryptocurrencies to lose their value in hundreds, if not thousands of dollars.

Another risk associated with cryptocurrencies is that they are not regulated by any government, central bank, or monetary authority. Further, they are at risk of getting banned in countries by the government due to a lack of regulation by any competent authority.

Trading on cryptocurrencies is also susceptible to technical glitches, hacking, error, and any other human mistake. Since the market is not regulated, there stands a possibility of scams, corruption, etc. For instance, hackers stole more than $450 million amount of cryptocurrencies from Mt Gox in 2011, though steps are being taken to repay all those people who have lost their money during that scandal.

Similarly, crypto trading carries the additional risks of hard forks or discontinuation. Whenever hard forks happen, significant price variation is observed on the price charts. For a beginner, it becomes more important to avoid pump and dump groups, obvious Ponzi schemes, leverage trading as a beginner is more vulnerable to frauds or scams in crypto trading.

Considering all these risks, it is essential to deal with a secured crypto exchange and have a high security-proof wallet. All these essentials are found in the eToro platform, which offers a wallet with a secured private key and free recovery service, and while crypto itself may not be regulated, that exchange is regulated by the ASIC, FCA, and CySEC.

Compare Australian Cryptocurrency Exchanges

Is cryptocurrency mining a better investment?

Mining is the process of validating and recording transactions on the blockchain platform. There are different ways of mining in the crypto industry. Many famous cryptocurrencies like Bitcoin and Ethereum, use a consensus mechanism called proof-of-work, where miners are required to show proof of work to ensure that a block is added to the blockchain.

This entire process provides rewards to the miners for their services. However, this process is very costly as it requires special equipment, huge computing power, and an ample amount of electrical energy from the end of miners.

Another famous cryptocurrency mining mechanism includes proof-of-stake. In this mechanism, miners allocate some amount of crypto coins in the network to have the responsibility of adding a new block to the blockchain. This process requires miners to store their cryptocurrencies, which is done through a process called staking. A miner must have ample coins to be able to mine adequate cryptocurrencies.

Proof-of-space protocol requires miners to allot some spare hard disk space in the network. Consequently, they get rewarded with new coins for this. The more space you allocate, the more coins you get. For earning more coins, miners buy extra hard disk space for allotting them in the network.

From the above description, all mining mechanisms are time-consuming and require a significant amount of investment from miners for getting more currencies mined. In the case of Bitcoin and Ethereum, it becomes more cumbersome as it requires a lot of resources and time.

Therefore, cryptocurrency mining is not a better alternative to crypto investment. Crypto trading is an easier and simpler way of making money with the help of virtual currencies. Though there are risks associated with trading, however, it gets significantly reduced if one invests responsibly.

Is cryptocurrency staking a better investment?

Staking is the process of storing your cryptocurrencies on a platform and earning interest or rewards on them over time. This is the process by which proof-of-stake technology works. The annual percentage yield earned by you would be dependent upon the number of cryptocurrencies you have in your staking pool.

To increase your earnings, you have to stake more coins. In recent times, staking has become very famous among crypto enthusiasts as many traders use this method to earn some passive income in the form of rewards or interest. The launch of the Ethereum 2.0 staking model is ready to take this industry by storm.

However, there are some risks associated with staking too. In the last few years, there have been some incidents of hacking on small crypto exchanges and decentralized protocols.

Whenever a user locks up the asset whose price has been on the decline, it faces the risk of sustaining an impermanent loss in case the price of that asset does not bounce back. Further, when staking has been done by an investor through a SaaS platform, the investor bears the risk of incurring losses if the transaction is not processed due to the inefficiency of the validator.

Considering all these things, staking can’t be considered at par with crypto trading as the former requires a huge amount of investment in terms of time in staked assets, while trading in cryptocurrencies is comparatively easier, faster, and simpler to staking.

On eToro users can stake ETH, ADA and TRX to earn passive income, simply by holding those coins. So as well as investing in cryptocurrency in terms of speculating on the valuation rising over time, you also compound your portfolio by earning extra coins.

Your capital is at risk

What are the expert opinions on the crypto market?

Cryptocurrencies are the future of the finance industry. One has to accept this fact. Many leading industrialists and market experts share the same opinion. In the words of Elon Musk, founder and CEO of Space X, “To clarify speculation, Tesla has not sold any Bitcoin. I have not sold any of my Bitcoin. Tesla has diamond hands.”

Further, billionaire Barry Silbert has been the frontrunner investor in Bitcoins since 2012. His love for cryptocurrencies can be predicted from his tweet, “In 2013, everybody thought we were crazy for launching a Bitcoin investment fund. Well, look at us now.”

The founder of Grayscale has also predicted the market situation at the time when cryptocurrencies would be there on the lists of the prominent stock exchange and important banks, “Once Wall Street starts putting money into Bitcoin – we’re talking about hundreds of millions, billions of dollars moving in – it’s going to have a pretty dramatic effect on the price.”

Similarly, Mark Cuban, a billionaire TV personality, has gone to the extent of comparing Bitcoin with Gold. His statement that smart contracts would change everything has proved to be true in light of the fintech revolution brought about by these contracts with the creation of DeFi and NFTs.

Cryptocurrency market cap – currently over $2 trillion

The Winklevoss twins have become billionaires by buying Bitcoin. Their prediction for Bitcoin has been expressed in the following remarks, “Our thesis is that Bitcoin is Gold 2.0, that it will disrupt Gold as a store of value. If it does that, it has to have a market cap of 9 Trillion, so we think it could price one day at $500,000 a Bitcoin.”

While Bill Miller, a legendary Wall Street value investor, has also commented that every major bank, every major investment bank, every major high net-worth firm will eventually have some exposure to Bitcoin, which is Gold or some kind of commodities.

The above opinions show how much acceptance cryptocurrencies have received in mainstream society. Almost everyone is sharing the same thoughts that cryptocurrencies, mainly Bitcoin, will bring storm in the finance market, and every institution including a major bank, major investment firms, should start acknowledging this fact.

Selling your cryptocurrency investment

In crypto investing it’s especially important to take profits on the way up and de-risk once you’ve made a high return on your investment, as the price can always crash back to your entry. Every cryptocurrency can be instantly converted into either cash, Bitcoin or stablecoins like Tether (USDT).

You should always sell cryptocurrency on a regulated trading platform to ensure your transaction is secure and safe. eToro is our top recommended exchange to sell cryptocurrency since they are internationally licensed and accept withdrawals via bank wire, VISA, Skrill, Neteller, and other methods.

eToro allows the selling of cryptocurrencies in simple steps. You first have to input the withdrawal channel on your account. Then, close your active positions (open trades), and ensure that you have the minimum withdrawal value in your account ($30).

Once funds are reflected on your available balance, you can start the withdrawal process by clicking on withdraw funds on the bottom left corner of the menu. Make sure you enter the funds keeping in mind that a fixed fee of $5 is charged for withdrawals. Choose your desired withdrawal amount and channel, and complete the process to have your money out of the investment.

If you want to short sell cryptocurrency, i.e. open a short position with leverage on an asset you think will drop in price, we recommend Bybit exchange as it pays a 0.025% maker rebate, meaning you get paid to open limit orders on their futures exchange.

KuCoin and Bitfinex also offer margin trading with a slightly smaller maker rebate of 0.02%, and a slightly smaller taker fee than Bybit.

Taxes and regulations regarding crypto in Australia

The increasing adoption of cryptocurrencies has made many countries make laws regarding their taxation. Such is also the case of Australia.

The Australian Taxation Office (ATO)s mandates a person buying, selling, or earning interest from cryptocurrency in the last financial year to declare their crypto totals the Income Tax Return.

Different taxations provisions apply for traders and investors.

An investor is required to pay tax as capital gains in the following scenarios-

- Selling crypto for fiat currency

- Swapping crypto for crypto, including stablecoins

- Spending crypto on goods and services (if not seen as a personal use asset)

- Gifting crypto

The percentage of capital gains tax is the same as your income tax rate.

The Australian government offers certain threshold options to assesses to cut down their taxes:

- CGT Discount: If you hold your cryptocurrency for more than a year before selling or trading it, you can get a 50% CGT discount.

- Personal use asset: You can get exemption from capital gains tax crypto is held as a personal use asset. If you purchase not more than AU$10000 cryptocurrency to buy something over a short time period, you’re eligible for this exemption.

Tax on losses

If you make a net capital loss after selling your crypto then you can deduct the loss from the gain earned from any other class of asset. You can also carry over the loss to future years.

Tax on lost or stolen crypto?

If you lose your private key or your crypto is stolen, you may be able to claim a Capital Loss on providing evidence of the loss or theft to the ATO.

Income Tax for traders

Proceeds from crypto are treated as income for a trader and taxed as income tax.

Conclusion

Cryptocurrencies are here to stay and shape the future of the finance industry. The crypto market has witnessed exponential growth in the last few years. This trillion-dollar industry is impossible to be overlooked by the regulators. Perhaps this is the reason why governments of many countries are recognizing these digital currencies formally or informally.

It has to be noted that investment institutions who were once suspicious of crypto, such as Goldman Sachs, have now indicated in publications that allocating a percentage of your portfolio to these blockchain-based assets is a wise investment plan. It is just a matter of time before cryptocurrencies completely revolutionize the way we buy and sell goods and services.

Though crypto assets are volatile in nature, however, investors have realized that they could make huge returns on their investment with proper market research and analysis.

For doing all background research behind any crypto, we propose using social trading leader eToro that will provide you with expert opinion, trading strategies, crypto prices analysis, and other amazing stuff which would help you in making an informed decision regarding your investment.

This regulated online broker is also beneficial for new investors learning how to invest in cryptocurrency in Australia. It is well-known for its copy trading feature, which allows you to connect with experienced traders and mimic their trades.

eToro - Our Recommended Australia Crypto Platform

- Millions of Users Trading Crypto, Stocks, ETFs

- Free Crypto wallet and Demo Account

- Deposit via Debit or Credit card, Bank wire, Paypal, eWallet

FAQ

Do you pay for holding cryptocurrency in Australia?

No. You are liable to pay Capital Gains Tax only when you sell your cryptocurrency holdings.

Is it possible to invest in cryptocurrency risk-free as a beginner?

The crypto market is highly volatile or unpredictable. Though you cannot invest in cryptocurrencies risk-free as a beginner or even as an experienced trader, you can make use of the available resources and tools offered by the top platforms. You must carry out the necessary research and be diligent before making any investment. To know more details about cryptocurrencies and their investments, refer to the eToro platform and invest responsibly.

How do I start investing in cryptocurrency?

To start investing in cryptocurrency, visit the eToro platform. It is our top recommendation if you are looking to trade cryptocurrencies. Simply follow a few steps to start trading in cryptos. To do so, create your eToro trading account, verify your identity, and finish the KYC process. Thereafter, add funds to your account and choose the cryptocurrency you wish to buy. Enter your desired amount and complete the transaction.

What is the best cryptocurrency to invest in this year?

The present price graphs indicate Bitcoin as an ideal investment option for traders. With BTC investments, you can hope to make huge returns if the market fairs well. The crypto is expected to go beyond $450,000 by the end of 2025. Although the future price predictions for BTC are promising, the risks related to the volatility of the market still exist.

Should I consider investing in cryptocurrency?

If you haven’t considered investing in cryptocurrency yet, it is not very late. The crypto industry is a trillion-dollar industry already and this has happened in just a few years. Experts believe that cryptocurrency is here to say and you can expect massive returns if you choose the right cryptocurrency and time the market well. With effective trading tools and good investment strategies, investing in cryptocurrency is worth the deal.

How much to invest in cryptocurrency?

While the amount of investment depends totally on the individual, experts suggest that you should not be investing more than 1% of your total investment capital on cryptos. The risk appetite is another aspect to be considered. You should not be spending too much money nor you can expect good returns with too little investment.

Is it safe to invest in cryptocurrencies?

It is not unsafe to invest in cryptocurrencies despite the crypto market being unregulated and volatile. While many feel the decentralized nature of the crypto market harms the security aspect, many feel that it in fact makes the market safer. There are people who have earned billions of money by investing in cryptocurrencies. Effective trading skills and strategies are essential keys to performing better in the crypto industry.

How to learn to invest in cryptocurrency?

Open your account on eToro and make use of the information it offers on starting your crypto investments. Use these resources to have a well-structured portfolio and build on your trading strategies. It will also help in price analysis and market speculation by offering opinions of experts, market-related news, etc.

How many people are investing in cryptocurrency?

Approximately 100 million people have started with cryptocurrency investments. There are also opinions that over 10% of the global population is investing in cryptocurrencies.

What should I keep in mind as a beginner to invest in cryptocurrency?

eToro is recommended as the best trading platform for beginners who are looking to invest in cryptocurrencies. Its user-friendliness offers a good trading experience to start with. You can start investing in cryptos on eToro by simply creating your account and depositing funds after you verify your identity. The KYC process on the platform is mandatory. Once you have deposited money on your eToro account, buy cryptocurrency by selecting one that suits your requirements.

How do I invest in cryptocurrency ETF?

After creating your account on eToro, go to the markets page. Select ETFs, and the fund you want to invest in. To start dealing in that particular ETF, simply click on the trade button.

Are banks investing in cryptocurrency?

Many big banks have started investing in cryptocurrencies. These are globally reputed names that include CBA, Standard Chartered Bank, Citibank, BNY Mellon, etc.