Join Our Telegram channel to stay up to date on breaking news coverage

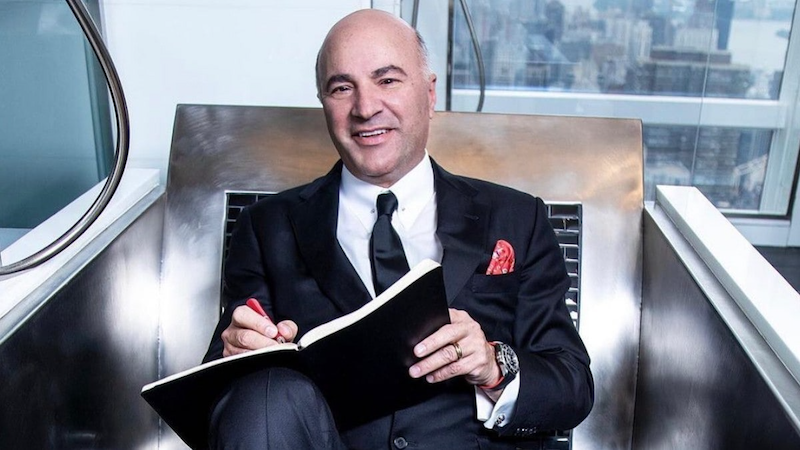

Kevin O’Leary, the celebrated Canadian entrepreneur and “Shark Tank” personality, has suggested that the era of crypto cowboys is nearing its end. His comments follow the unveiling of consecutive lawsuits by the U.S Securities and Exchange Commission (SEC) against leading cryptocurrency exchanges, Binance and Coinbase. O’Leary spoke to publication Decrypt, offering his perspective on this pivotal moment in the industry which could steer cryptocurrency away from its current Wild West perception towards more mature regulation and acceptance.

O’Leary said that:

“There’s a massive potential in this technology, yet it continues to be steeped in an uncontrolled, Wild West scenario”

He emphasized his belief that the industry is moving towards a new future, distancing itself from its past. According to him, the increase in regulatory oversight after FTX‘s downfall, a matter which he was personally involved in as an investor and spokesperson, is a positive development. He expressed his fatigue over the constant negative portrayal of cryptocurrencies in headlines and government discussions.

O’Leary was implicated in a class-action lawsuit for endorsing the collapsed cryptocurrency empire of Sam Bankman-Fried, alongside other celebrities like Tom Brady, Larry David, and Shaquille O’Neal. He defended his involvement in FTX, stating, “I am deeply involved in funding startups,” and declared his disagreement with the lawsuit’s allegations. “I am backed by competent lawyers […] However, the court will have the final say,” he added.

Binance, the largest global exchange, and its CEO Changpeng Zhao, were recently hit with 13 civil charges by the SEC. The regulatory body accused Binance of mingling customer funds and deliberately breaching U.S. securities laws, among other charges, framing it as a vast “web of deception”. The company has called the lawsuit “misguided” and “unwarranted,” but O’Leary believes that the SEC’s action will probably deprive Binance of crucial capital, regardless of the company’s stance.

O’Leary explained,

“A legally compliant exchange is generally less lucrative than a rogue, unregulated one. That is, until you face severe lawsuits from the SEC. That’s the situation Binance is currently grappling with.”

A Cascade Effect?

He also brought up the SEC’s suggestion to freeze Binance’s assets, which he thinks will influence customer behavior as they start pulling out their funds in caution. This situation, according to O’Leary, could also affect Binance’s ability to expand into other regulated territories. “You might fade into the shadows, and only operate in unregulated markets—but eventually, you’ll be deprived of lifeblood,” he added.

On the other hand, the issues faced by Coinbase, according to O’Leary, are different from Binance’s. He explained that the top U.S. cryptocurrency exchange is up against a less severe uphill battle. The SEC charged Coinbase with multiple offenses, accusing it of failing to register as an exchange, clearing house, and broker. Coinbase’s staking products and several tokens traded on the platform were also labeled as unregistered securities by the SEC.

In response, Coinbase has challenged the SEC in court over its request for more explicit cryptocurrency regulations, claiming that the agency’s regulatory strategy has been stifling the industry. The company’s CEO, Brian Armstrong, amplified this message on Twitter, indicating that Coinbase is ready to defend itself. “If we have to resort to the courts to gain clarity, we will not shy away from it,” Armstrong declared.

Regarding the SEC complaint against us today, we’re proud to represent the industry in court to finally get some clarity around crypto rules.

Remember:

1. The SEC reviewed our business and allowed us to become a public company in 2021.

2. There is no path to “come in and…— Brian Armstrong 🛡️ (@brian_armstrong) June 6, 2023

However, O’Leary pointed out that Coinbase’s decision to challenge the SEC is not appealing to institutional investors. He referred to the company’s declining stock price and expressed his concern about Coinbase’s choice to proceed with litigation rather than reaching a settlement with the SEC, indicating a lack of confidence among shareholders.

Related

- Celebrity investor Kevin O’Leary to invest in crypto after discussions with regulators

- The collapse of FTX was criminal, not accidental

- Best Web3 Projects

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage