Join Our Telegram channel to stay up to date on breaking news coverage

“The Rat of Wall Street”, as the top regulatory figure Gary Gensler is sometimes known, has made his stance towards cryptocurrency clear and unwavering since he took the reins two years ago. He has consistently compared the crypto world to “the Wild West” and committed himself to bringing order to this landscape. This week, he showed his dark side again by having the Securities and Exchange Commission (SEC) launch lawsuits against the major cryptocurrency exchanges Coinbase and Binance.

Are They Serious?

The essential question that needs answering is: Who has the authority to regulate cryptocurrency companies?

Cryptocurrency, since its inception, has dwelled in an area of regulatory ambiguity. The laws governing finance as we know it were established before the concept of digital currencies was conceived.

Coinbase and Binance have a notable presence in the cryptocurrency world. They handle billions in digital asset transactions daily for a global customer base. An ongoing dispute exists between the SEC and another federal regulatory body, the Commodity Futures Trading Commission (CFTC), over which one has the jurisdiction to regulate these entities and the wider sector.

Gensler’s claim is that the majority of cryptocurrencies are securities, implying that they fall under the SEC’s jurisdiction as per current laws, along with the platforms and apps where they are traded. Both Binance and Coinbase are accused in these lawsuits of failing to register their exchanges with the SEC.

There are notable differences between the two lawsuits, but this allegation remains consistent. Cryptocurrency companies have been vehement in their resistance to this, asserting that the nature of cryptocurrency is to function outside of traditional financial systems. The ideal scenario for many cryptocurrency companies is the creation of regulations specific to the cryptocurrency sector.

The SEC’s victory in court could lead to a requirement for crypto companies to register with the SEC, marking a significant shift in the sector. “These cases will be integral to the shape of crypto regulation,” suggests Timothy Massad, the ex-chairman of the CFTC.

Who is Gary Gensler?

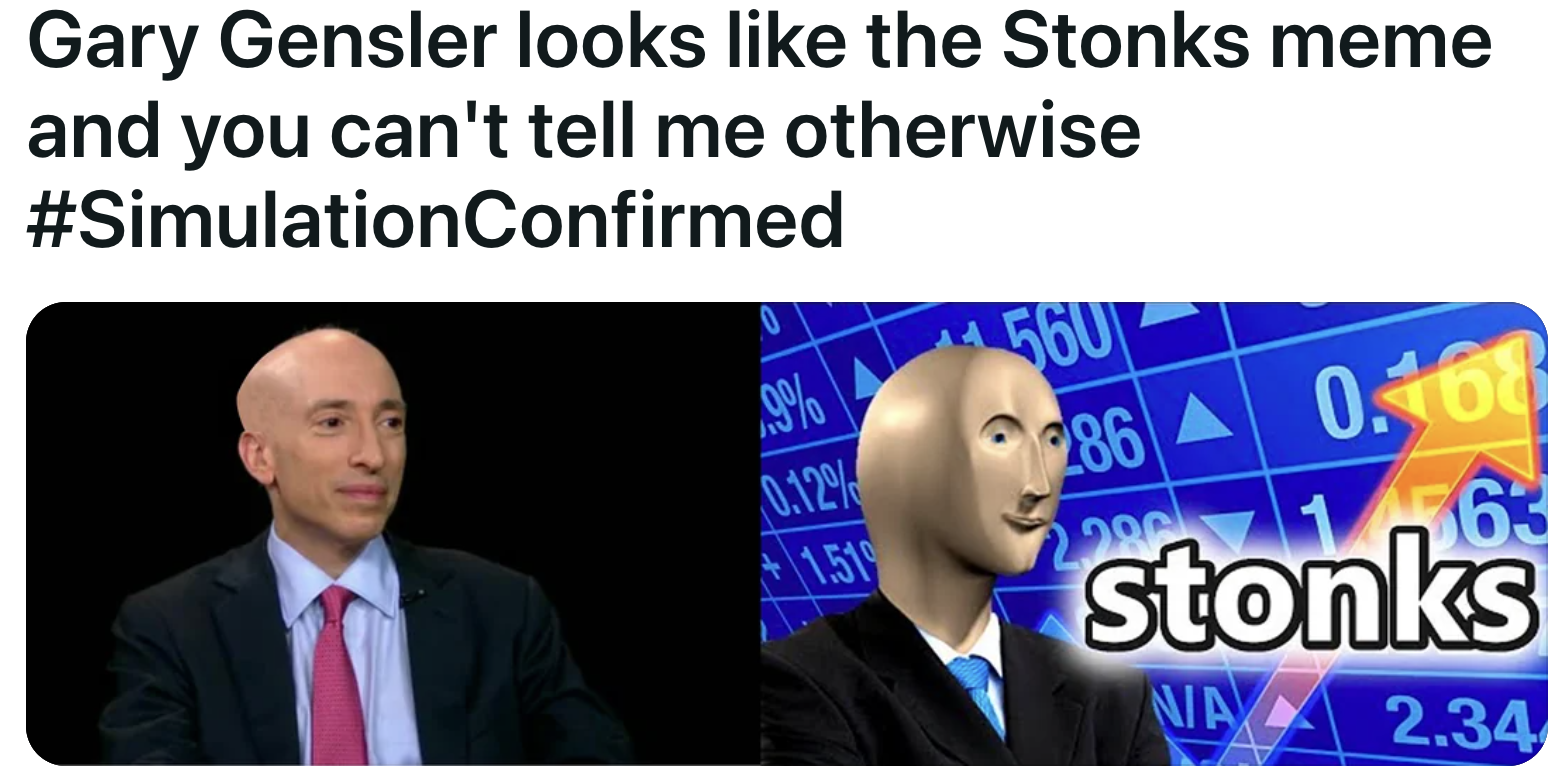

Often referred in Reddit circles and Twitter media as the “Mr Burns” or the “Stonkman” of the crypto world, due to his apparent lack of proper understanding of the space, he started last year an all-out war against crypto companies, affiliated banks and exchanges, in what was termed “Operation Choke Point 2.0“. Of note from Gensler’s history is that he spent time working on Hillary Clinton’s 2016 presidential campaign.

Widely condemned even within the SEC, this operation has been recognized as an attempt to drive cryptocurrency out of the US and protect the entrenched interests of the existing financial system.

Redditors quickly jumped in to ridicule Gensler for his apparent lack of knowledge of the space he is attempting to regulate, as can be shown by the numerous memes that were created about him.

Upon taking over the SEC, Gary Gensler quickly developed a reputation for being sceptical of the crypto industry, and he expanded the enforcement division’s crypto unit. Subsequently, the SEC has brought several enforcement actions against minor crypto firms, and he urged his team to take a closer look at the platforms enabling transactions.

As Gensler’s SEC tenure coincided with several key events in the crypto space, it sparked friction with the Commodity Futures Trading Commission (CFTC), which he had once led. There were disagreements over the classification of certain tokens, such as ether, as securities or commodities.

What happens next?

This legal battle could potentially be existential for these companies. Binance faces severe allegations, including that the exchange and its CEO, Changpeng Zhao, deceived investors regarding the exchange’s capacity to identify market manipulation and misappropriated customer funds.

TD Cowen’s analyst Stephen Glagola, who covers Coinbase, a publicly traded entity, asserts that the company could potentially evolve into a fundamentally different business as a result of this confrontation. Both companies have committed to fighting the charges and are readying themselves for a drawn-out legal battle.

The protracted nature of these lawsuits could influence how investors perceive these two companies. Following the announcement of the lawsuits, significant withdrawals from both Coinbase’s and Binance’s exchanges were observed.

How will this impact the wider crypto landscape?

The uncertainty and potential lack of confidence the lawsuits might generate won’t only impact Coinbase and Binance. It extends to the broader crypto industry. Other companies against which the SEC has acted include Kraken, Genesis, and Gemini.

However, the business models of Coinbase and Binance extend beyond just running exchanges; they also act as brokerages and clearing agencies. This is a unique aspect of crypto businesses that Gensler is not particularly fond of, as it diverges from traditional financial practices.

The industry sentiment has been on a downward trajectory since the collapse of FTX last year, and the legal proceedings might worsen it. The downfall of FTX, whose ex-CEO Sam Bankman-Fried faces charges from both the SEC and the CFTC as well as criminal charges from the Justice Department, triggered a “crypto winter,” and the chilly season hasn’t ended yet.

“Since the FTX debacle, the general sentiment around crypto has continued to sour,” points out Glagola. Trading volumes have shown a downward trend since the fall of FTX, a trend that seems to persist.

Future prospects for crypto

While the ongoing legal battles may appear daunting, there’s a school of thought suggesting that this could bring about much-needed regulatory clarity. Giagola remarks that the crypto industry is often marked by a “lack of transparency,” a trait that could change as these legal proceedings unfold.

Not just the courtrooms, but the legislative branches may also have a significant role in determining the future of cryptocurrencies. There is a general consensus among crypto companies like Coinbase and regulatory bodies like the SEC that legislative intervention from Congress could help to define laws governing the sector. However, such a process might take considerable time.

Cryptocurrencies like Bitcoin have seen a surge in popularity, even though they are not as widespread as traditional stocks. A recent research report estimated that only 12% of the population has investments in crypto, which pales in comparison to the number of households owning stocks.

This potential for growth may become reality with more transparency and confidence in the sector. It might attract more investors to cryptocurrencies, but the journey to that point might be riddled with challenges.

What does all of this mean for Coinbase and Binance? Both companies seem to be committed to fighting the charges, irrespective of how long it takes. “We continue with our operations as usual,” says Paul Grewal, Coinbase’s chief legal officer, highlighting that such cases can take not just months, but years to resolve.

The impact of these lawsuits on investors’ sentiment is yet to be fully understood. Timothy Massad speculates that the lawsuits could make Coinbase reassess its stance. He muses, “Can Coinbase afford to simply battle this out, or does it have a reason to negotiate a settlement?”

Overall, these lawsuits and the subsequent events could fundamentally alter the landscape of cryptocurrency regulation. The road ahead may be convoluted, but it could also lead to greater clarity and potentially broader acceptance of this form of digital asset.

Related

- U.S. Firms Looking for Greener Pastures Abroad as Regulatory Action Strikes Home

- Ripple CEO Criticizes Gensler, SEC Chair, for Deciding Which Crypto Coins Are Securities

- Operation Choke Point 2.0: US goes after crypto amid confusion and uncertainty

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage