Join Our Telegram channel to stay up to date on breaking news coverage

Thanks to its unprecedented growth over the years, the blockchain industry has managed to gain worldwide popularity. The demand for cryptocurrencies keeps on rising, despite the fluctuating price levels. With festivals, events and meets being set up globally to attract the attention of investors and propagate the advantages of blockchain tech, the community also seems to be growing constantly. One of the most recent was the Web3 Festival in Hongkong, which may be an indicator of Hongkong potentially becoming the next crypto hub.

The biggest challenge within the blockchain sector has always been establishing a regulatory framework. The lack of this has even caused several countries to completely abandon the technology despite being aware of its advantages as a concept. However, discussions about the implementation of the technology are still in the works for several nations worldwide, which could serve as a good headstart for the sector.

Why is Hong Kong Leading the Race Against the US

The US is without a doubt, one of the biggest markets for any fintech giants to invest their money and time in, which would ideally make it the first choice for companies. However, the condition of the US economy seems to be dire, along with the government’s interest in letting cryptocurrency become a significant part of their operations.

Hong Kong was previously a centre for cryptocurrency companies, which has grown tremendously back when the rules around blockchain weren’t as tight as they are now. Companies like FTX got a headstart while operating within Hong Kong, along with many other now-successful entities. But since the cryptocurrency ban in China, the winds shifted to the West, where the US took over as the favourite place for investors to park their funds again.

But as mentioned, the current economy of the US along with growing concerns from the government has caused the blockchain domain’s growth to stunt in some ways. Over the past year, the cryptocurrency market has been under significant pressure from U.S. authorities, which has exacerbated the market’s already tumultuous state.

The FTX collapse also had a severe impact on the market, causing major banks that focused on crypto, such as Silvergate Capital and Signature, to fold this year. Silvergate’s decline was especially apparent as it lost more than 60% of its deposits in a single quarter following the FTX crash. The downward trend in the cryptocurrency market has been a persistent issue, and it has become increasingly dire due to the U.S. government’s crackdown.

The United States Commodity Futures Trading Commission (CFTC) recently filed a lawsuit against Binance for violating trading and derivative laws. The global crypto exchange was accused of providing derivative trading services to U.S.-based customers without obtaining a derivative license.

All this allows Hongkong to take over as the centre for cryptocurrency companies to grow at drastic speeds, which is now starting to look like a real possibility.

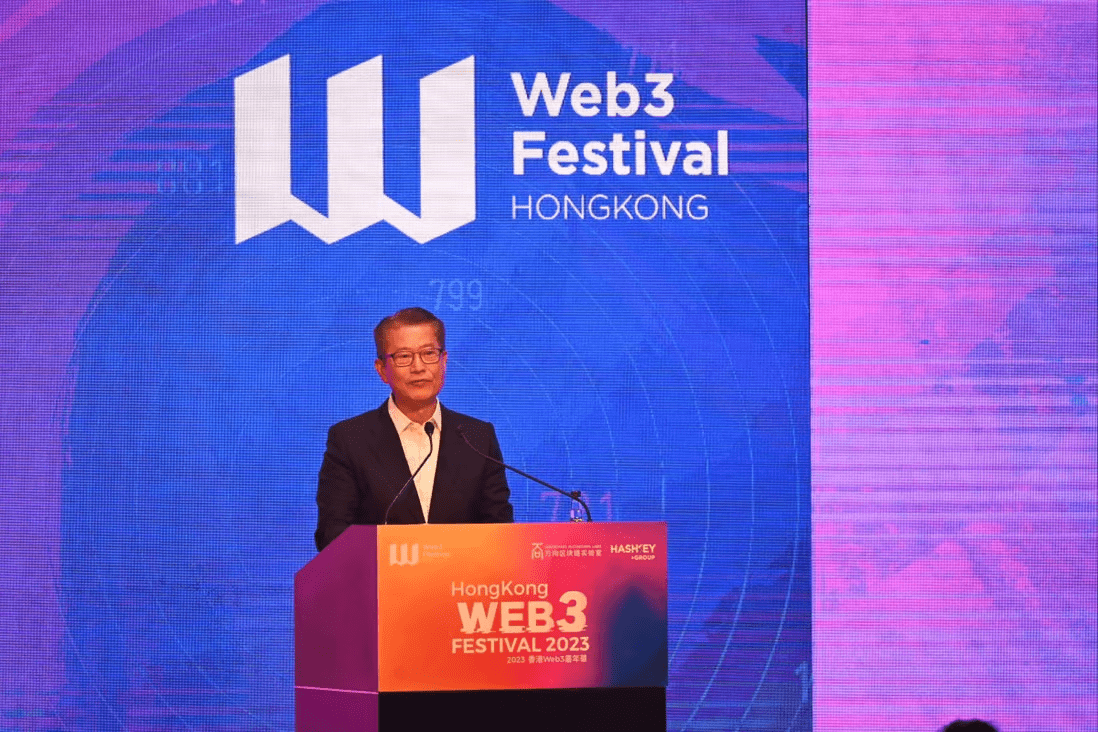

Hong Kong’s Recent Web3 Festival Could Help in Attracting Companies

At the Web3 Festival, Hong Kong officials made a bold declaration of their commitment to crypto and the broader digital asset sector. While the Western world’s stance on crypto continues to grow more antagonistic, Hong Kong is taking a page out of Singapore’s book by pinning its hopes on this emerging sector to revitalize its ailing economy. In 2020, the former British colony suffered a severe setback when Beijing introduced the controversial National Security Law, which prompted a mass exodus of expats, international firms, and wealthy locals.

The new initiative aims to remedy this by offering clear regulatory guidance on digital assets, with the goal of luring crypto businesses to set up shop in the city. In doing so, Hong Kong hopes to usher in a fresh wave of tax revenue, talent, and financial activity, thereby restoring its status as a thriving economic hub.

Hong Kong will clearly be facing stiff competition from not just Singapore but also Dubai in its quest to secure a slice of the lucrative crypto tax revenue. With the recent issuance of licenses to crypto exchanges, Dubai has already emerged as a formidable challenger in the race for dominance in this space. For instance, Bybit, a major player in the crypto industry, has recently established its global headquarters in Dubai. Therefore, the country is sure to face an uphill battle in attracting crypto firms and generating tax revenue from this thriving sector.

For those worried about the ban on cryptocurrencies in China, last week’s newly announced regulations reflect the “One Country, Two Systems” principle, which dictates that Hong Kong remains a part of China while retaining some degree of autonomy. As is customary with Hong Kong, it has been granted certain policy exemptions. In the case of the crypto industry, while mainland China continues to prohibit cryptocurrencies, Hong Kong has seemingly been given permission to openly attract and regulate the sector.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage