Join Our Telegram channel to stay up to date on breaking news coverage

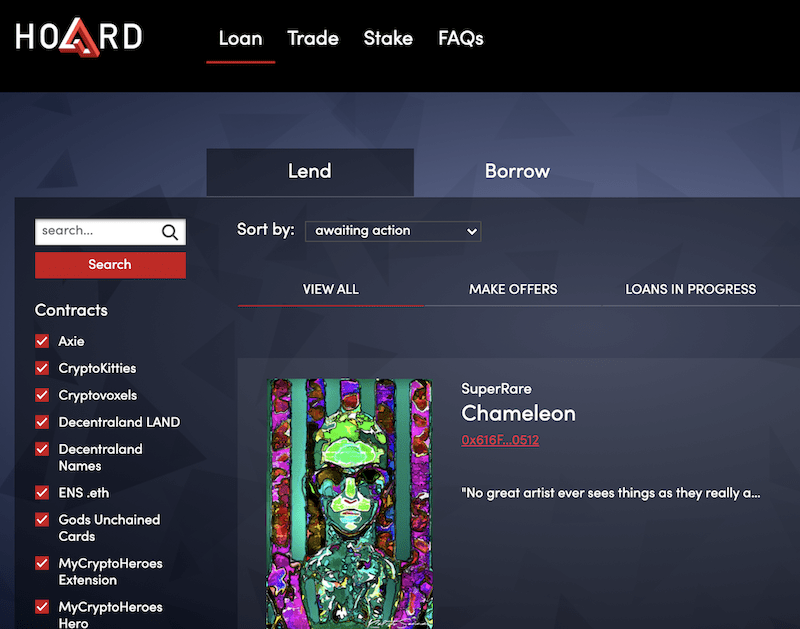

Hoard Marketplace, the much anticipated NFT trading venue, is now live. In fact the new exchange is a first of its kind, as you can now lend and borrow by leveraging NFTs as collateral.

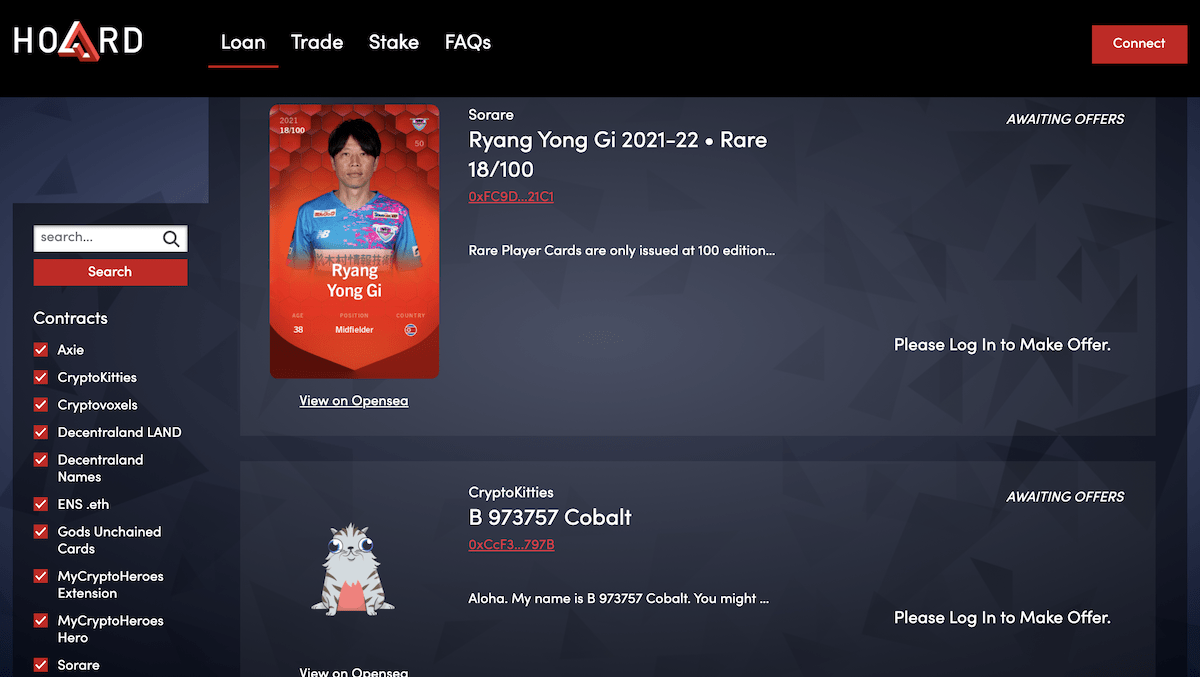

Users of Hoard will be able to lend, borrow and rent NFTs, regardless of whatever form or industry they reside in, be they in-game items, digital art, digital trading cards/videos or other collectibles.

Hoard is based on the Ethereum blockchain.

Hoard in NFT first: collateral for loans is new

The Hoard Marketplace adds another layer to the value proposition of NFTs by introducing the concept of NFT collateralisation into the ecosystem. This could be a major development for the nascent sector of the crypto world, which has penetrated the mainstream as a viable and growing use case for crypto.

NFT stands for non-fungible tokens and are tokens that are unique as compared against each other. Because of this property they can be used for assigning ownership to individual digital items, as well as non-digital items by creating a blockchain reference and oracle connection.

So in addition to listing your NFT in the Hoard marketplace and being able to browse the catalogue of all listed NFTs to find ones you may wish to purchase, Hoard takes this all a step further by allowing platform participants to bring forward the value represented by their NFT as collateral for loans, “depending on supply and demand”, as the statement accompanying the announcement explains.

Rent out your art NFT or hire one to project at a dinner party!

Lending and borrowing are key offerings in the burgeoning DeFi space and Hoard is positioning itself at the intersection of NFTs and DeFi.

Hoard also provides a renting facility. So if, for example, you want to display to your friends ownership (albeit temporary) of a sought-after piece of digital art by projecting it on to your white-walled dining room at your next party, with proof of ownership alongside as recorded by Hoard, then this could be the premier NFT trading venue to facilitate that.

The marketplace will no doubt be attractive to those seeking to secure a passive income. “Hoard’s solution offers lenders a tool to yield high profits and an opportunity to acquire desired NFTs in case of a foreclosure,” reads the statement from the company.

Hoard has been working on its solution for a number of years and the launch widens the opportunities available to NFT owners to monetise their otherwise idle assets.

Perhaps taking its cue from the slick interface to be found at NBA Top Shot, it looks like the Hoard team has put the work in on delivering a user-friendly interface.

Anyone with NFTs and/or stablecoins can access the marketplace. The native token of the exchange is HRD.

The platform’s advanced liquidity features include access to flash loans and it also supports a host of ERC20 compliant tokens for marketplace transactions.

You can stake the HRD derivative token too

Alongside income from borrowing and lending functionalities, platform users will also be able to stake HRD and claim rewards in the cryptocurrencies supported on the marketplace, proportional to the amount staked. As per usual, the longer you stake your coins for, the higher the reward. Depending on the time duration staked, rewards can withdrawn at any time, says the information on the site.

HRD token holders stake the HRD derivative token (ETHHRD UNIV2) which is obtained by adding liquidity to the ETH/HRD pool on Uniswap.

How much does it cost to transact on Hoard Marketplace?

There are platform fees charged for every transaction that takes place on the marketplace and 100% of fee revenue is used to fund staking rewards.

It is only the borrowers that pay fees, which kick in when a borrower accepts a loan. The fee is 0.1% of the value of a transaction in HRD and 0.2 % of a value of a transaction in all other cryptocurrencies.

In a nice touch, borrowers can decrease their platform fees if they stake their HRD derivative token on the marketplace; in this way, part of a borrower’s fees will be returned to them in the form of staking rewards.

More novel NFT functionalities in the pipeline

Radek Zagórowicz, chief executive officer of Hoard, commenting on the launch, said: “The Loan feature on the Hoard Market opens new possibilities for NFT holders. This is the first step of further development of novel NFTs functionalities/utilities which Hoard is going to introduce in the coming months.”

In terms of the contracts supported on the marketplace, in addition to CryptoKitties (do you still have one?) and Decentraland (LAND and ‘names’), the platform is interoperable with Gods Unchained Cards, SuperRare and many others.

Get Free Crypto Signals for NFTs – 82% Win Rate!

3 Free Crypto Signals Every Week – Full Technical Analysis

Join Our Telegram channel to stay up to date on breaking news coverage