Join Our Telegram channel to stay up to date on breaking news coverage

Internal US Security and Exchange Commission (SEC) discussion documents, which were unsealed on June 13, have shed light on contradictions and concerns related to a statement made by Bill Hinman, the former director of SEC’s corporate finance division, regarding the classification of Ether as a security.

The documents, which feature edits made to Hinman’s 2018 speech, indicate that the SEC editors were cautious about the potential consequences of the statement, as it could solidify a position that might be challenging to modify down the line.

Potential Locking of SEC’s Position

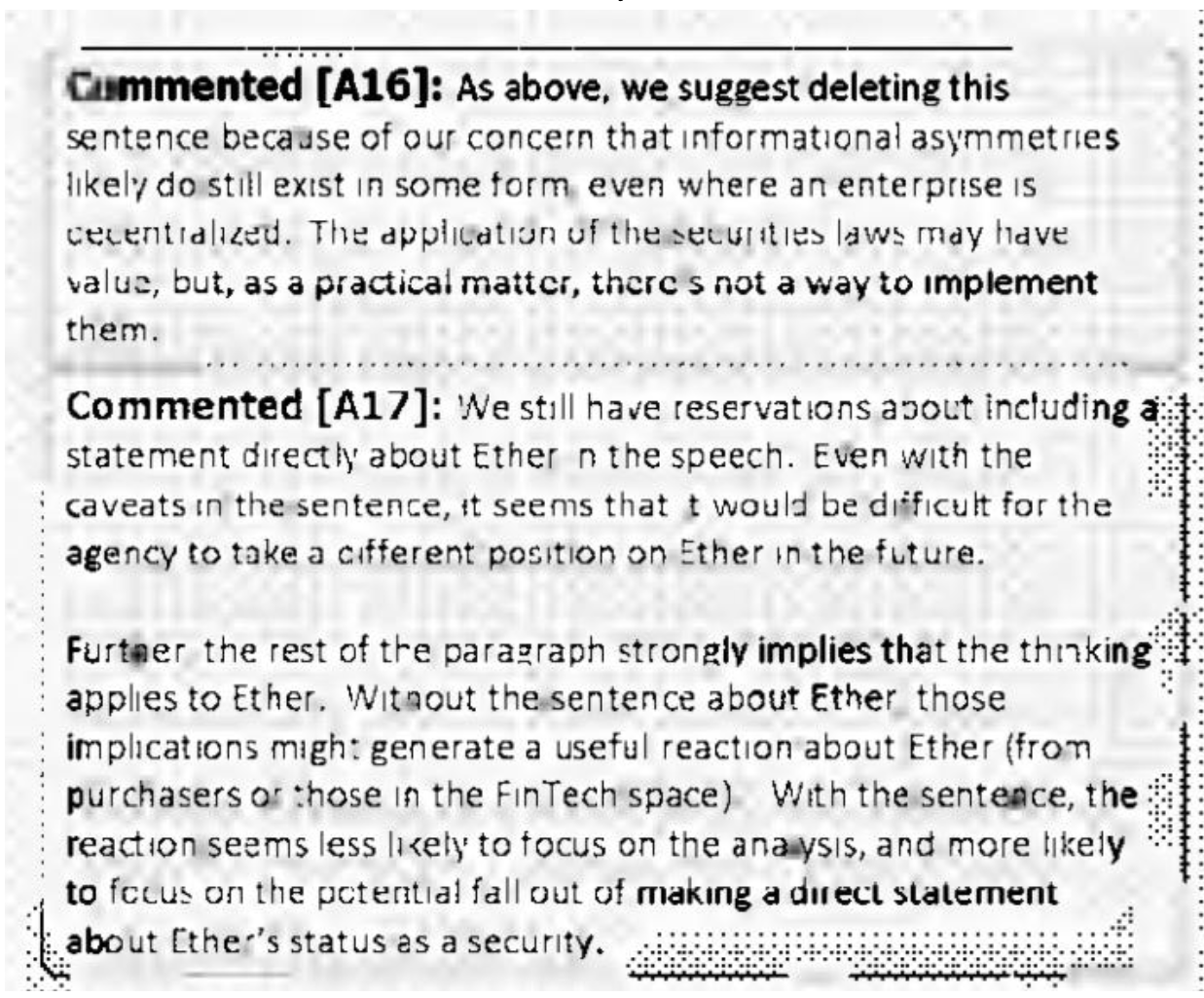

In the edited documents, SEC comments express concerns about the risk of being locked into a specific position regarding Ether’s classification. The editors noted:

“Even with the caveats in the sentence, it seems that it would be difficult for the agency to take a different position on Ether in the future.”

They further highlighted that the rest of the paragraph strongly implied the thinking applied to Ether. This cautionary note indicates the editors’ worry about the potential challenges the SEC may face if it seeks to alter its stance on Ether at a later date.

The documents in question pertain to internal SEC messages regarding a speech delivered by Bill Hinman in 2018. During the speech, Hinman stated that cryptocurrencies like Bitcoin and Ether may initially be considered securities but could transform into commodities once they achieve sufficient decentralization.

The unsealing of these documents comes at a tumultuous time for the crypto industry, coinciding with the federal court’s hearing on the SEC’s motion to freeze Binance.US assets following a series of legal actions against the exchange.

The SEC’s legal action against Ripple in December 2020, alleging the unregistered securities offering through the sale of its XRP token, has also prompted anticipation regarding the unsealed documents. Ripple advocates believe that these documents will offer further clarity on the legal status of Ripple’s native XRP.

Ripple Labs CEO Brad Garlinghouse expressed his discontent, stating on Twitter that it was “absolutely unconscionable” for Hinman to proceed with his speech despite pushback from SEC staffers. He also highlighted the irony of the SEC suing Ripple Labs and its founders while their division head created confusion on the matter.

Internal Discussions on Crypto Regulation

The internal emails exchanged in the days leading up to Hinman’s appearance at the Yahoo Finance All Markets Summit shed light on the extensive discussions between staffers and the then-director.

The drafts of Hinman’s speech explored the SEC’s stance on crypto regulation and addressed suggestions for clarifying the application of the Howey Test, a crucial factor in determining whether a financial instrument qualifies as a security.

Among the exchanges, ideas were also proposed to add a catchy title to the speech, with the final choice being “When Howey Met Gary.”

Various versions of the speech drafts reflected the ongoing debate among SEC staffers regarding the classification of Bitcoin and Ether. In an early draft from May 24, Hinman expressed his belief that federal securities laws’ disclosure requirements did not apply to Bitcoin or Ether compared to other tokens.

However, on June 13, the day before the speech, a staffer cautioned against categorically stating that Bitcoin was not a security, concerned about its potential impact on future SEC actions. Discussions ensued to find the appropriate phrasing to qualify the SEC’s views on Ether.

Ultimately, Hinman concluded that Ether should not be considered a security, disregarding the fundraising aspect associated with it.

Hinman’s Speech at Summit

During the Yahoo Finance All Markets Summit, Hinman delivered a slightly modified version of the section in question, incorporating additional information on disclosure requirements. The final speech aimed to provide insights into the SEC’s perspective on cryptocurrencies and their evolving regulatory landscape.

On June 14, Hinman said:

“As with Bitcoin, applying the disclosure regime of the federal securities laws to current transactions in Ether would seem to add little value.”

The unsealing of the Hinman documents has raised important questions about the SEC’s position on Ether and its potential impact on the classification of other cryptocurrencies. As the crypto industry continues to navigate regulatory challenges, the contents of these documents may have far-reaching consequences.

Observers eagerly await further developments in ongoing legal battles, such as the SEC’s motion to freeze Binance.US assets and the potential implications for Ripple’s legal status.

Related Articles

- Where to Buy Ethereum (ETH)

- Crypto.com Shutting down US Exchange After Recent Regulatory Issues

- Where to Next for Bitcoin? Bulls Propel BTC Price Up from $25,000 Trough: A Forecast

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage