Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum Price Prediction – February 7

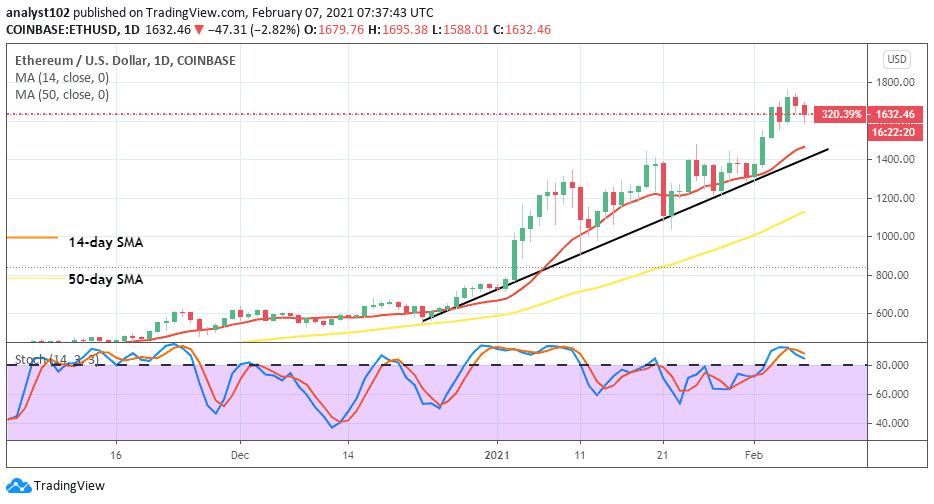

After a sizeable number of price-convergences lately in the ETH/USD trading activities, the crypto’s worth has eventually up-surged beyond the resistance. successfully surges northward past a resistance point around $1,400

ETH/USD Market

Key Levels:

Resistance levels: $2,000, $2,200, $2,400

Support levels: $1,200, $1,100, $1,000

ETHUSD – Daily Chart

During the recent ETH/USD market convergences, the 14-day SMA trend-line has been trending around price-moves. On February 2, a spike emerged to signal a break above the resistance at $1,400. That has led the market-value to average closer to high resistance at the $1,800 mark. The 14-day SMA and the 50-day SMA are both pointing towards the north-direction with a pace within. The Stochastic Oscillators have moved into the overbought region to cross the hairs. That could in the near time result in seeing a line of consolidation moves. Partially, an indecision myth may play along for a while.

Will the ETH/USD market sustain the current upsurge?

A break above the resistance level at $1,400 has a potent power of either settling a new baseline for getting to see more ups in the ETH/USD trading operations. In the worst scenario, a down-push may further find support at the $1,200 level. At that point, bulls will have to re-energize their stands in the crypto-market to hold back the value upward.

On the downside, bears will have to mount pressures around the current averaged-line of $1,800 and $2,000 resistance levels to at least put a stop to the bullish trend. However, it may not come to the past, considering the pace of the bullish trading cycle that the crypto-economy is witnessing. Sellers need to be on the lookout for a timely entry while price reverses from a notable high-value to avoid the possibility of getting whipsawed..

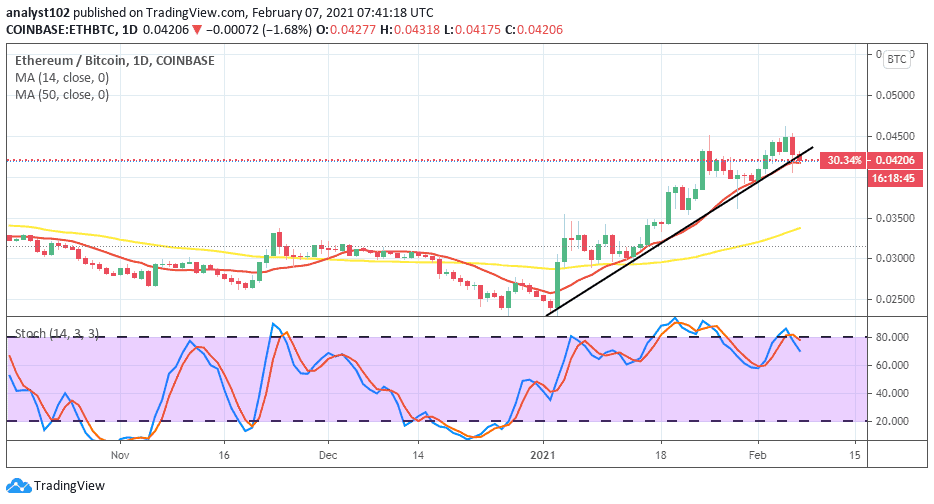

ETH/BTC Price Analysis

In comparing the price-weight of Ethereum with that of Bitcoin, the worth of BTC is under-valued as paired to the ETH’s. The crypto-base still holds strong along with the north trading-path of the 14-day SMA. The 50-day SMA trend-line is below the smaller SMA with a visible space within them. The Stochastic Oscillators have briefly crossed hairs around range 80 to point down. That signifies that the counter-crypto is also struggling to regain a stand in the market. In the meantime, indication shows a consolidation move may soon come to play in a near trading session around the B0.045 mark and, that when happens, could cause sideways.

Join Our Telegram channel to stay up to date on breaking news coverage