Governance tokens are a major part of decision-making in many decentralized crypto projects. Instead of centralizing all of the power in the hands of a few developers or team members, governance tokens give the community a voice.

Governance tokens allow their holders to vote on proposals, influence protocol upgrades and changes, and help shape the direction of decentralized projects.

In this guide, we will break down how governance tokens work, what makes them valuable, and why they matter.

Key Takeaways

- Governance tokens give holders the right to vote on protocol decisions, such as upgrades, treasury allocations, or parameter changes in a decentralized system.

- Voting power is usually proportional to the number of tokens held. More tokens often mean more influence over decisions.

- Governance tokens may not grant ownership or profit rights since their primary purpose is to enable community-driven decision-making.

What Is a Governance Token?

A governance token is a type of cryptocurrency that grants the holder voting rights. Governance token holders can vote on changes to a protocol, decide where funds in the treasury are allocated, and even weigh in on new features or upgrades.

Governance tokens are often linked to decentralized autonomous organizations (DAOs). Decentralized autonomous organizations are community-run projects that have no central leadership. In a DAO, the rules are enforced using smart contracts, and the members (token holders) steer the direction of the project by casting votes.

Governance tokens are common in decentralized finance (DeFi), blockchain gaming, NFT projects, and even some metaverse worlds. They play a vital role to ensure that the platforms stay decentralized, giving users a direct say in how platforms evolve.

What Makes Governance Tokens Valuable?

At first glance, a governance token might not seem especially useful. Unlike utility tokens, they don’t always grant access to services, yield rewards, or other immediate functionality. So, why are they valuable?

In a word: influence. Holding a governance token gives you the power to help shape the future of a project. You can vote on integral protocol upgrades, fee changes, or even vote on major treasury allocations. In some cases, this influence is tied to billions of dollars of assets.

Take Uniswap’s UNI token as an example. Uniswap gave UNI holders the ability to vote on how protocol’s treasury, which holds over $3 billion of dollars in assets as of early 2025, is managed. This kind of decision-making power can carry major weight.

Another notable example is Compound Finance’s governance token, COMP. Launched in 2020, COMP was one of the first major governance tokens, allowing the community to shape interest rate models, protocol upgrades, and supported assets. The more COMP you hold, the more influence you can wield. Here is an example of a successful, executed proposal on Compound, utilizing the voting power of the majority of governance token holders.

Even when tokens don’t generate direct income or utility, they can appreciate in value if the protocol is successful and community engagement is strong. Many crypto investors like to speculate on these tokens when they expect the protocol to grow and succeed in the future, even if they have no reason to cast votes. This is especially true for tokens in projects with large treasuries and future cash flows, like popular DeFi protocols.

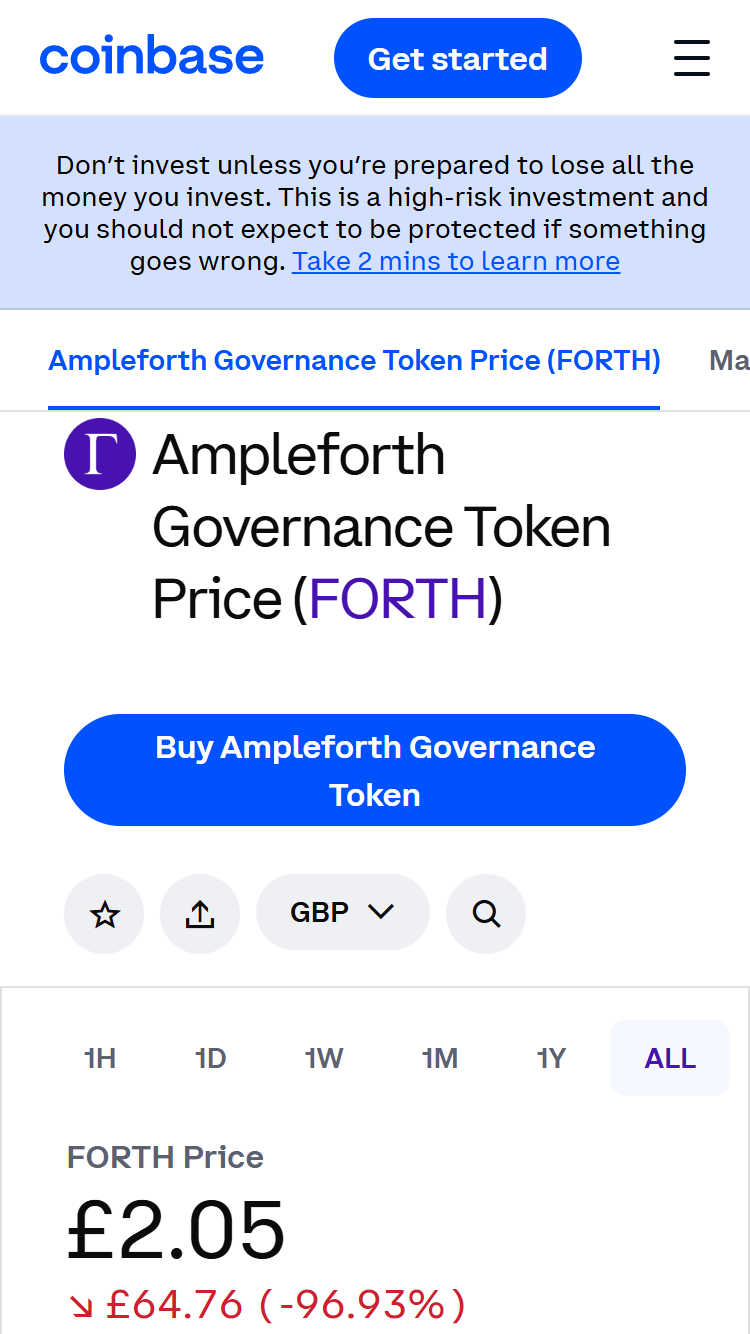

It’s important to remember that governance tokens, like all cryptocurrencies, are not without risk. Their value can be extremely volatile and driven more by hype than fundamentals. If the governance system is taken over by a handful of whales or if voter turnout is low, the token’s value can crash quickly.

Governance Tokens vs. Utility Tokens Explained

Not every crypto token is designed to do the same job. The two most common types in the industry are utility tokens and governance tokens. While the two sometimes overlap, they actually serve fundamentally different core roles in the blockchain ecosystem.

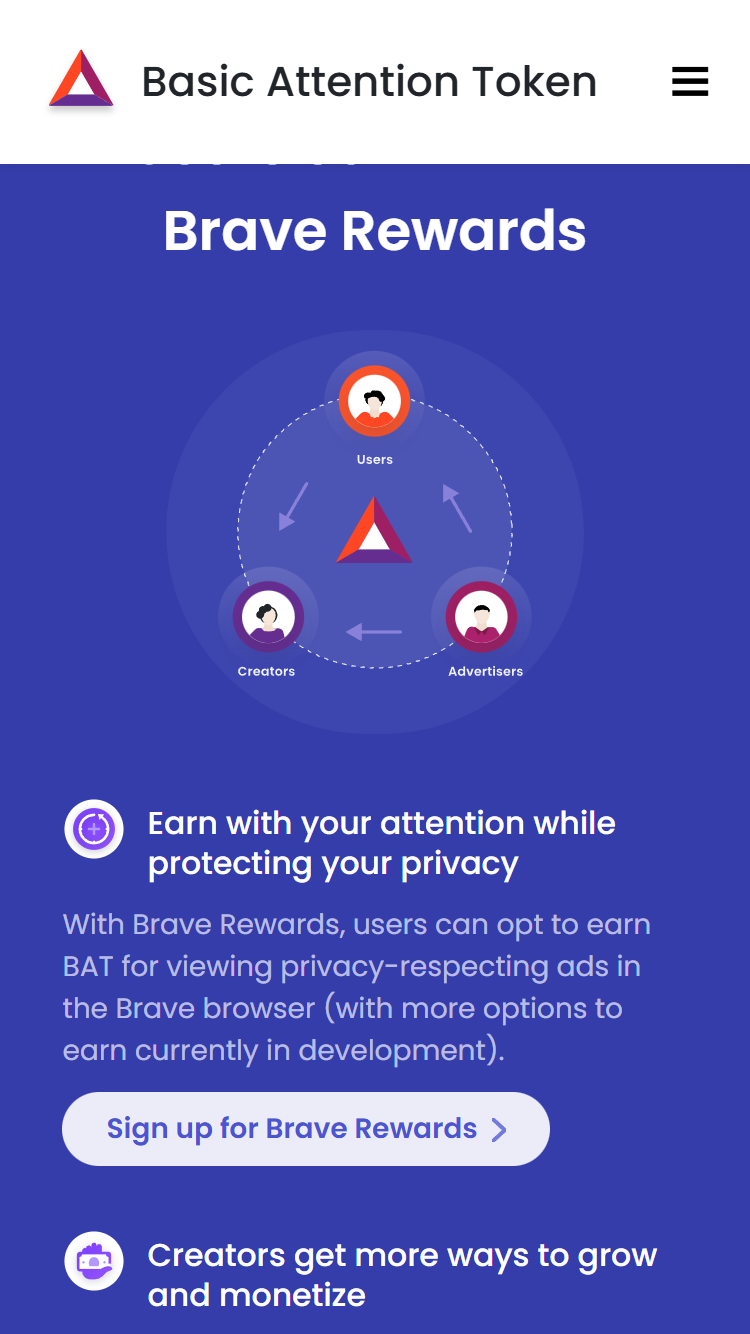

A utility token is mainly used to access a product or service within a blockchain-based platform. For instance, the Basic Attention Token (BAT) is used in the Brave browser to reward users for viewing ads and supporting content creators. Token holders don’t get voting rights.

Governance tokens, on the other hand, are all about participation and control. When you hold a governance token, you help guide the project’s direction through voting. You might vote on whether a new feature should be added, how fees are handled, and how funds are distributed. The MakerDAO project, for instance, uses the MKR token to govern the DAI stablecoin protocol. Decision-making is left to MKR token holders, who govern the DAI stablecoin protocols.

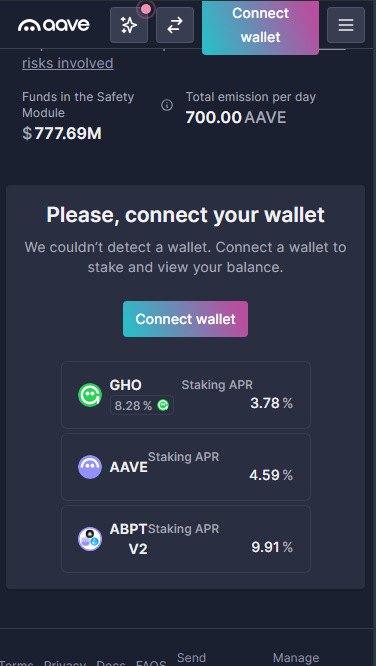

The line between governance and utility tokens can get blurry. This is because some tokens do double duty. For instance, AAVE is a governance token that allows holders to vote on protocol decisions, but it also functions as a utility token. Holders can stake AAVE to earn rewards and help secure the lending system.

In the early days of crypto, most tokens fit neatly into either the governance or utility box, but nowadays, many new projects give their tokens both governance rights and some other form of utility or staking reward. Similar to AAVE, Balancer’s BAL can be used for both liquidity and governance incentives.

So, while the terms “governance” and “utility” describe different concepts, in practice, many tokens will wear both hats. Understanding how the token functions in context and whether it gives you power, access, or both is critical.

How Governance Tokens Work

Governance tokens are used in several main ways across platforms, with some variations depending on the project’s unique needs.

1. One Token, One Vote (Direct Democracy)

This is the most straightforward and common model. Each token represents one vote, so the more tokens you hold, the more voting power you have. In direct democracy, decisions like protocol upgrades are made based on the majority vote of token holders.

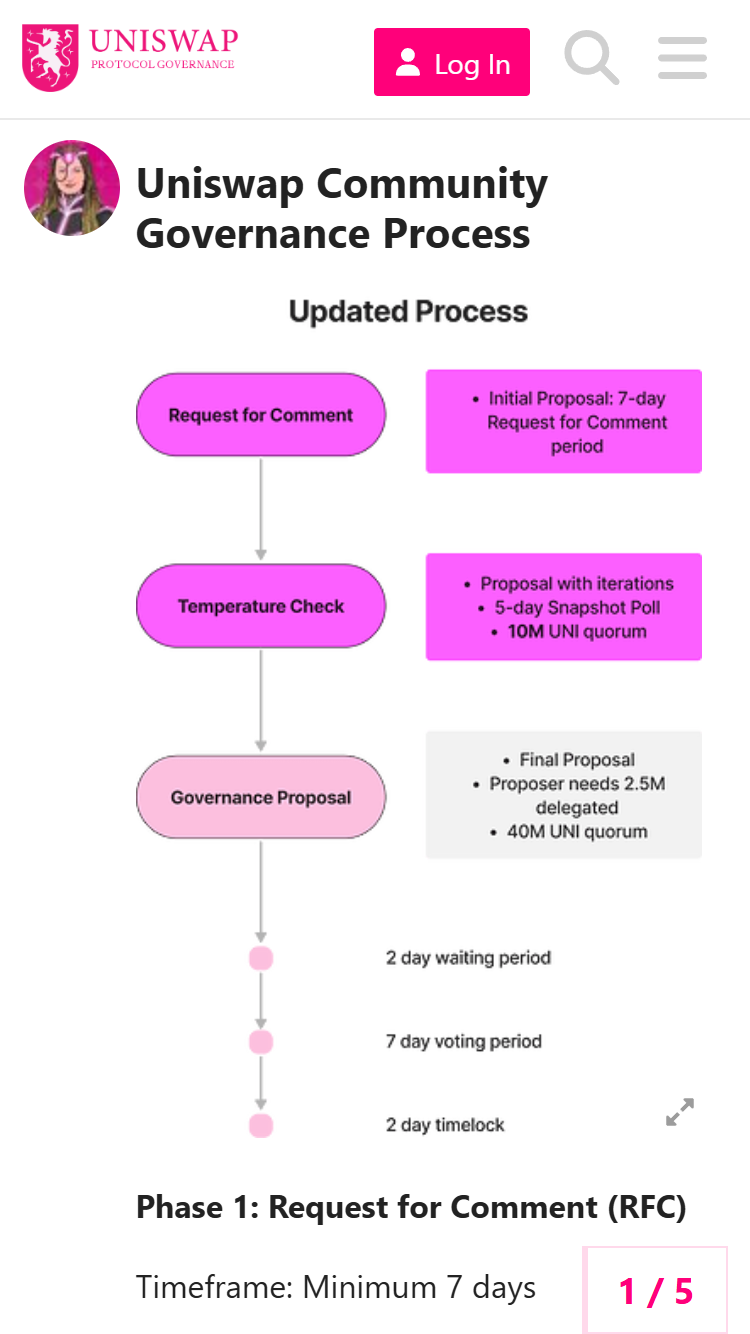

Example: Uniswap, the popular decentralized exchange, uses this model. UNI token holders vote on governance proposals that affect the direction of the platform. The more tokens you own, the greater your influence in voting.

2. Quadratic Voting

Quadratic voting, popularized by Ethereum cofounder Vitalik Buterin, is a model designed to reduce the dominance of large token holders. In this system, the cost of additional votes increases quadratically. For example, casting four votes might require 16 tokens, not just four.

Example: Gitcoin uses quadratic voting to fund open-source projects. This system gives smaller holders more meaningful influence and prevents whales from taking over the entire process.

3. Delegated Voting

Delegated voting, also known as liquid democracy, is a model that allows token holders to delegate their votes to a trusted representative, similar to how a democratic republic functions. This way, the holders don’t have to take the time to review and vote on proposals themselves and can pass on their rights to someone more knowledgeable on the topic.

Example: Aragon uses a delegated voting model where users can delegate their votes to trusted agents to vote on their behalf.

The choice of a governance model will depend on the project and its goals. More centralized projects might use a simple one-token-one-vote system. Others might go for quadratic or delegated voting to reduce the centralization of power.

How to Get Governance Tokens

Whether you want to acquire governance tokens to help shape the future of a crypto project or simply want to invest in a governance token for speculative purposes, there are a few different ways to acquire them.

1. Buying Them on an Exchange

One of the most straightforward ways to acquire governance tokens is to purchase them on a crypto exchange. Major platforms like Binance, Coinbase, and Uniswap list many governance tokens for direct purchase.

Centralized exchanges like Coinbase and Binance allow you to purchase governance tokens with fiat currencies, though they may not offer smaller tokens. Decentralized exchanges like Uniswap and Raydium offer many more tokens, though you will have to purchase some cryptocurrency and set up a crypto wallet before you can use them.

2. Earning Tokens Through Staking

Some projects release governance tokens as rewards for staking other tokens. In this model, you can lock up a certain amount of cryptocurrency in a protocol for a period, and in return, you’ll receive governance tokens.

This is a common practice in DeFi platforms where users can stake tokens like DAI or ETH and earn governance tokens like AAVE or SUSHI in return. For example, AAVE staking returns just over 4.5% at the time of writing (though this will likely vary over time).

3. Airdrops

Perhaps one of the best ways of getting governance tokens is through token airdrops. Airdrops have become a very popular method for projects to reward early adopters and distribute their tokens. If you meet certain criteria, like holding a specific token at a particular time or interacting with a specific protocol, the project will send free tokens to your wallet address.

For instance, Uniswap famously airdropped 400 UNI tokens to anyone who had used the platform before a certain date, even if they didn’t hold any UNI tokens at the time. 400 UNI was worth nearly $18,000 at the token’s all-time high, making it an extremely lucrative airdrop. Unfortunately, protocols never reveal the specific requirements before the cutoff for eligibility, which can make securing airdrops tricky. Most don’t even let it slip that they are planning an airdrop before the cutoff.

4. Participating in DAO Voting

Some projects will distribute governance tokens as rewards for participation in governance or community engagement. If you engage with community members, vote on proposals, and participate in forums, you might be rewarded with governance tokens.

By doing this, the projects encourage active participation and governance involvement. DAOstack is one example of this. It gives out governance tokens to users who engage in community decisions.

5. Liquidity Mining

Another method to earn governance tokens is through liquidity mining. In this setup, you provide liquidity to a decentralized exchange (DEX) or lending platform in exchange for governance tokens.

The idea here is that, by adding liquidity, you help maintain the operations of the platform. In return, the platform rewards you with governance tokens. Countless DeFi apps, including Curve Finance and Balancer, use this method because it’s a great way to incentivize liquidity provision.

How to Vote With Governance Tokens

All legitimate governance tokens give their holders some kind of voting power. However, the voting process can differ dramatically depending on which token or platform you are using. Let’s take MakerDAO as an example. It is one of the most important platforms in DeFi that uses its MKR token for governance decisions related to its DAI stablecoin. Here is how the process works:

-

- First, you must hold MKR tokens in your wallet (and not an exchange). The more you hold, the greater your voting power.

-

- Access the voting platform. MakerDAO uses Oasis, a platform where you can view ongoing proposals and vote on them.

-

- Vote on proposals. These can include changes to the DAI stability fee, adjustments to the risk parameters of certain collateral types, or decisions about MakerDAO’s treasury. As a token holder, you can vote by selecting “approve” or “reject” on the proposals.

Once the proposal reaches the necessary threshold of approval, the changes will be implemented on the Maker protocol. For a more in-depth explanation of how to vote on MakerDAO, check out their step by step video guide.

The Pros and Cons of Governance Tokens

| Advantages | Disadvantages |

| The community can make decisions without relying on a central authority. | Large token holders (whales) can disproportionately influence decisions. |

| Holders are more likely to actively participate in the project’s future. | Low voter turnout can lead to decisions being made by a small set of token holders. |

| Proposals and votes are typically public. | The voting process can be technical and tough for non-expert users. |

| Many projects reward active participants with tokens. | Voting systems and proposals can be exploited if the platform isn’t well-secured. |

| If the project grows and succeeds, the value of governance tokens may increase. | In many cases, governance tokens offer little immediate utility beyond voting. |

Most Popular Governance Tokens

Here are some of the most popular governance tokens in use today by market capitalization and general popularity:

Uniswap (UNI)

Market cap:

Uniswap Price Chart

(UNI)Uniswap (UNI)

Governance overview: UNI holders can vote on proposals such as changing liquidity provider fees or governance model adjustments. Uniswap follows a one-token, one-vote model.

MakerDAO (MKR)

Market cap:

DAO Maker Price Chart

(DAO)DAO Maker (DAO)

Governance overview: MKR holders can vote on critical decisions such as adjustments to the system’s risk parameters and updates to the DAI stablecoin. MakerDAO also uses a one-token, one-vote model but involves various levels of governance.

Aave (AAVE)

Market cap: $3,860,975,988

Aave Price Chart

(AAVE)Aave (AAVE)

Governance overview: AAVE holders can vote on protocol upgrades, treasury management, and other critical decisions. They can also stake AAVE to help secure the network. Aave has a liquidity mining program where holders not only govern but can also earn rewards by participating in the platform.

SushiSwap (SUSHI)

Market cap: $125,739,656

Sushi Price Chart

(SUSHI)Sushi (SUSHI)

Governance overview: SUSHI holders vote on issues like protocol upgrades and fee distribution. The platform also has liquidity incentives.

Compound (COMP)

Market cap:

Compound Price Chart

(COMP)Compound (COMP)

Governance overview: COMP holders vote on protocol changes, including adding and removing assets from the platform. The protocol is governed by liquidity providers who receive tokens as rewards for their participation.

Conclusion

Governance tokens are the foundation of the decentralized governance model, where decisions are made by the communities rather than CEOs or centralized teams, and are closely tied to the health, credibility, hype, and potential of the project they govern.

As the crypto market continues to evolve, on-chain governance will likely become even more important. Projects are slowly leaning into transparency and decentralization, moving more and more of their decision-making onto the blockchain, where everything is traceable and community-oriented.

However, decentralized governance is far from perfect right now. We have voter apathy, whale dominance, and numerous technical barriers that still pose major problems. A few supposedly decentralized projects even disregard their governance models entirely when they disagree, rendering the entire system moot.

Still, the idea of building a community-led ecosystem remains powerful and, when it is implemented well, it will help create more user-focused and resilient platforms in the future.

FAQs

What are governance tokens?

Governance tokens are a central part of the decentralized finance ecosystem, giving holders voting rights to influence the decisions and future of a decentralized project.

Is Aave a governance token?

Yes, AAVE is a governance token that gives holders the right to vote on proposals. However, it is also a utility token with various uses in the Aave platform.

Is Solana a governance token?

Yes, Solana is a governance token, allowing holders to vote on on-chain proposals that impact the blockchain's future, though it is primarily used for transaction fees, staking, and payments.