Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market is facing extreme uncertainties from the global economy as the United States Federal Reserve mulls a massive interest rates hike – larger than what market watchers expected for March. Ethereum price action is inclined to the downside, although for now, support at $1,550 is intact and allowing bulls to hang in there.

Although the crypto market kicked off the year with an aggressive push, cryptocurrencies started to give back the gains in early February. A changing regulatory landscape in the United States and Asia coupled with tighter monetary measures to combat inflation have left a gust of turbulent forces in their wake.

“Today you will see more hints from Jerome Powell during his speech regarding a 0.5 rate hike increase on 22nd March,” Doctor Profit told his 196k followers on Twitter.

Ethereum price has lost approximately 8.52% of value since February 1 to exchange hands at $1,554 at the time of writing. Investors are now worried about ETH price with some experts predicting another sell-off toward the end of March.

-Understand that this probably isn’t ‘the bottom’ and price trades lower eventually.

-Alts maybe have 1 more run in the coming months and then likely steep retrace

-$ rotation rn isn’t fresh participants coming in. Retail is not buying your bags— Altcoin Sherpa (@AltcoinSherpa) March 7, 2023

Ethereum Price Weakens as Investors Face Increasing Losses

Crypto investors are literally walking on eggshells amid regulatory pushback from the US, the ballooning inflation, and the ghosts of the fallen FTX exchange that keep coming back to haunt crypto giants like Silvergate bank.

As reported earlier in the week, Silvergate may be facing receivership after its capital position weakened significantly following the previous monthly filing with the Securities and Exchange Commission (SEC) in January.

Silvergate is one of a handful of crypto-focused banks in the United and its financial woes are pushing the market on the edge.

Meanwhile, the pressure Ethereum and other cryptos are facing is both from within and outside the industry’s purview. However, retail investors are likely to be holding the fort, which explains the support at $1,500.

That situation could change for the worst if Ether’s technical outlook does not change positively and fast. Market participants are already expecting higher interest rates on March 22 when the Federal Open Market Committee meets to deliberate on the state of the economy.

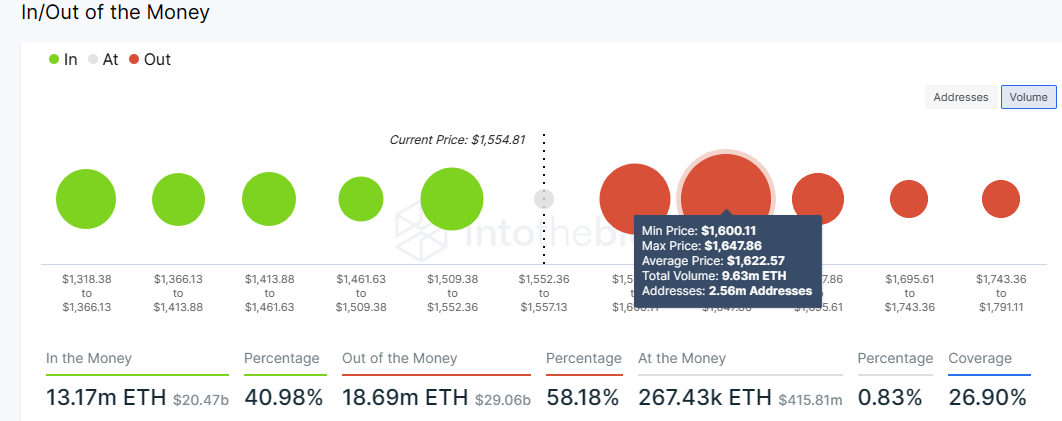

According to on-chain data, as presented by IntoTheBlock, approximately 18.69 million ETH addresses are out of the money. In other words, if these investors decided to sell at the current market value, they would incur a loss relative to when they bought ETH.

Although no investor wants to sell at a loss, some unfavorable factors can push some to do so, especially retail investors who want to protect their capital – possibly to invest in other better-performing tokens.

From the same chart, we can say that Ethereum price sits on relatively weak support areas while facing a robust hurdle. The small green circles represent addresses in the money (with unrealized profits). If selling pressure intensifies, ETH price could drop to retest downstream levels at $1,400 and $1,338, respectively.

On the upside, the large circle running from $1,600 to $1,647 is home to 2.56 million addresses that previously scooped 9.63 million ETH in the range. This represents the seller congestion zone bulls are likely to face as they push for the resumption of the uptrend.

As Ethereum price recovers, investors in that cohort will likely sell at their respective breakeven points. Their selling activities could absorb ETH’s upside momentum to either pause the uptrend or trigger another retracement.

On the bright side, a break above the same region between $1,600 and $1,647 could blast Ethereum price toward $1,800 and bring $2,000 within reach.

Ethereum Price Upholds The 200-day EMA Support – But For How Long?

Ethereum price is trading at $1,554 while holding support at $1,550, provided by the 200-day Exponential Moving Average (EMA) (line in purple). Its immediate upside has been capped under the 50-day EMA (line in red).

Although Ether turned bearish after brushing shoulders with $1,744 – the new 2023 high, declines started to intensify as soon as the support provided by the ascending multi-month trend line broke.

Now the ball is in the bulls’ court to ensure Ethereum does not slide below $1,550, otherwise, odds will quickly flip against them as the price tumbles to $1,400 and $1,338, respectively.

Short positions taken in Ethereum after the pullback started may stay profitable as long as the Moving Average Convergence Divergence (MACD) indicator sticks with the sell signal. Remember, the movement of the MACD into the negative region below the mean line at 0.00 implies bears have the upper hand.

That said, the critical levels traders should keep in mind are the immediate support at $1,550 and two likely points of control for Ethereum price in March: The resistance at $2,000 and the crucial support at $1,400.

A break above the upper limit would open the door and push ETH toward $3,000. On the other side of the fence, losses below $1,400 could force the second-largest cryptocurrency to test $1,200 and $1,000 support levels.

Ethereum Alternatives To Buy Today

Before buying ETH, you may want to check out some of the best crypto presales for 2023. A dedicated team reviews the list of the best altcoins to buy, bringing to your attention possible options to diversify your crypto portfolio.

Fight Out (FGHT) is an upcoming yet revolutionary bridge between Web2 and Web3. As a move-to-earn (M2E) project, Fight Out will be the ultimate game changer in traditional gaming using the power of blockchain technology.

Investors scooping up FGHT tokens in the presale have so far raised $5.26 million and hope to capitalize on available revenue-generation models and earn rewards for completing workouts and challenges.

Similarly, Metropoly stands out among other 2023 crypto presales for embracing a new approach to investing in the global real estate economy. With METRO, investors can buy fractional ownership rights in real estate properties around the world.

An NFT marketplace drastically changes the propriety landscape by cutting the time needed to invest from 60 days to under 20 seconds. Investments start with the purchase of an NFT with as little as $100 – allowing everyone to earn rental income monthly. The team has so far raised $602k selling METRO in a fast moving presale.

Related Articles:

- Cardano Price Prediction As $215 Million In Trading Volume Rushes In – Can NFTs Supercharge ADA Rally?

- Curve Price Prediction for Today, March 7: CRV/USD Resumes Upward as Price Hits $1.00

- SBF’s Alameda Rese Yuarch Wants $9 Billion From Grayscale

Join Our Telegram channel to stay up to date on breaking news coverage