Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Analysis – September 23

Ethereum loses more than 1% in one day and goes below $210 level. The next target support for ETH/USD may come at $200.

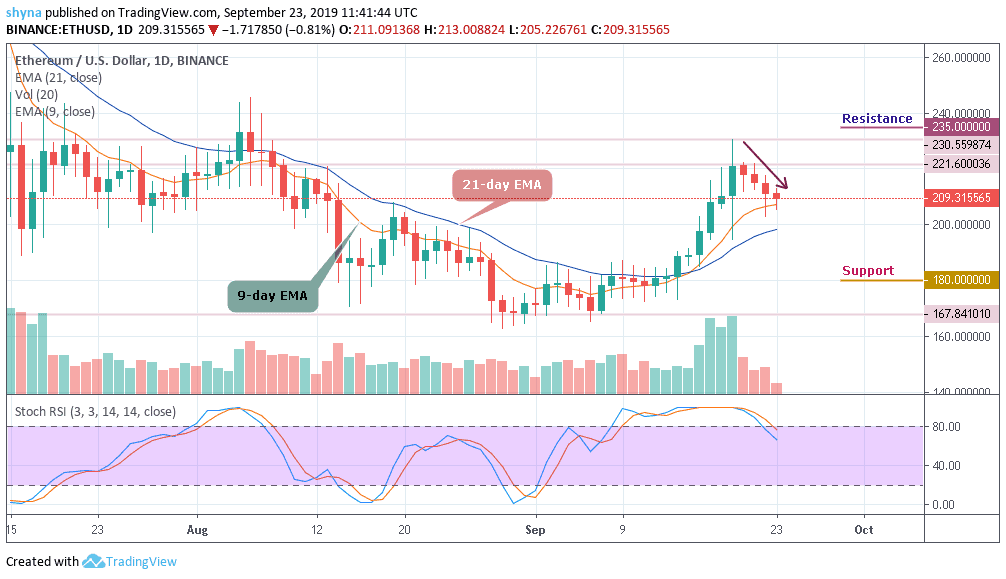

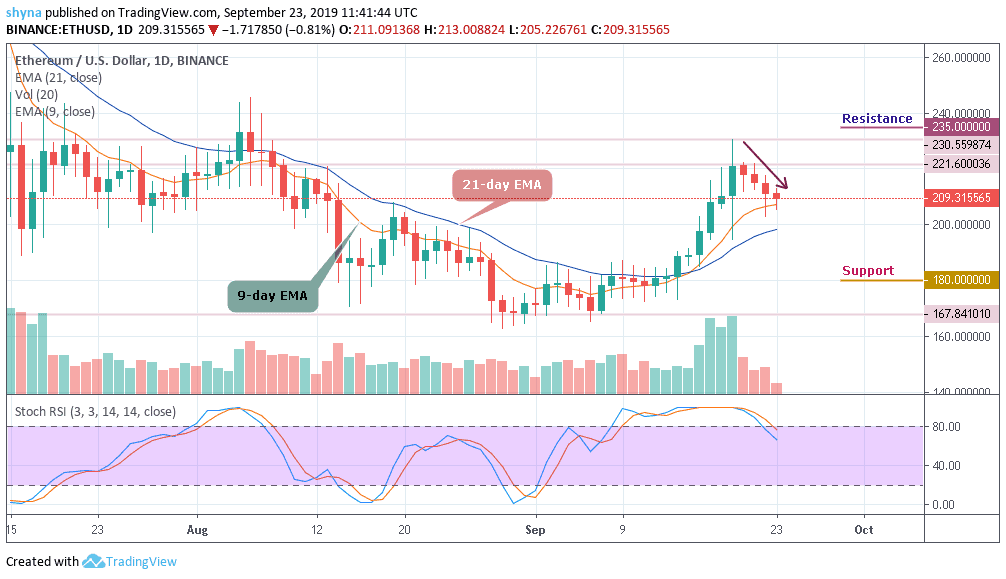

ETH/USD Market

Key Levels:

Resistance levels: $235, $245, $255

Support levels: $180, $170, $160

Ethereum (ETH) was easily among the best-performing crypto-currencies of last week. In addition, hitting a one-month high of around $230, buyers blamed the $200 critical support for boosting bears’ pressure on the market. Several areas of support have failed, including $215 and $210. However, the support areas of between $205 and $200 have been well established.

Nevertheless, the daily chart still shows that Ethereum’s price is trading at $209.4 in a downtrend towards the 9-day and 21-day EMAs and should the price move below $200, there is a possibility that the price could hit the critical support levels at $180, $170 and $160 as the stochastic RSI signal-line faces down.

However, in as much as the $200 support level could halt the bear’s pressure, the price may likely continue its upward movement. More so, if the bulls put more effort, the price can reach the potential resistance levels of $235, $245 and $255 respectively. Therefore, investors are advised to wait a little longer before reorganizing their investments as Ethereum (ETH) may witness a rally before the end of the year.

There is a belief that Ethereum could soon target $260 despite the current bearishness in the aggregated crypto markets, which will probably only happen if Bitcoin (BTC) is able to maintain some stability or start climbing higher in the short term.

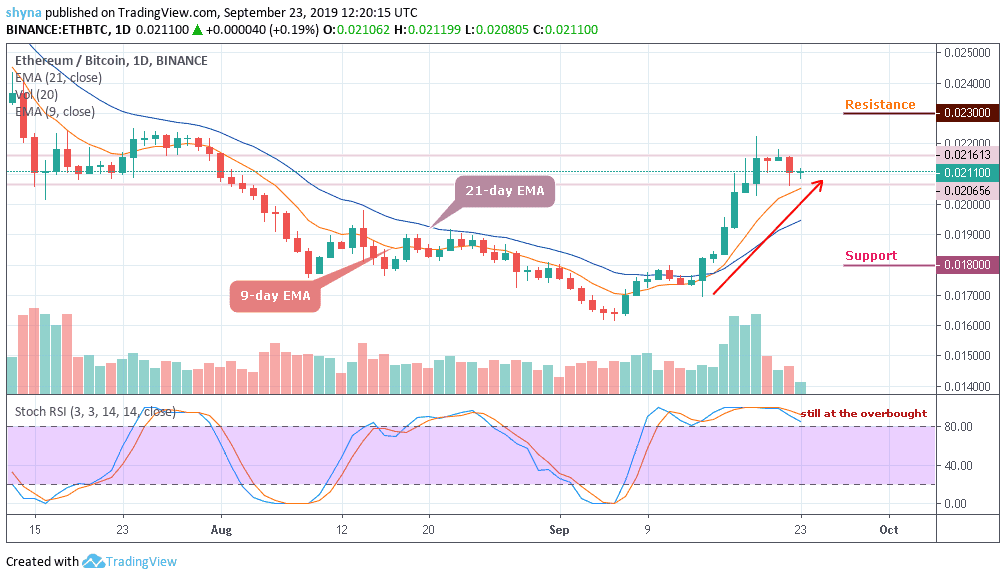

Looking at the ETH/BTC daily chart, the pair has seen a bullish momentum in recent days, and it has been able to maintain some stability around 0.021 BTC despite the aggregated crypto markets facing some downward pressure as Bitcoin moves below $10,000. However, if the bulls can put-in more effort, the price may likely reach the resistance level of 0.023 BTC. But, the stochastic RSI is still moving at the overbought zone, a sign of selling pressure in the market soon.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Read more:

- Ripple Price Prediction: XRP/USD Rebounds, Lacks Buyers at Higher Price Levels

- Cardano Price Prediction for Today, July 28: ADA Stays Above $0.50 Level

Join Our Telegram channel to stay up to date on breaking news coverage