Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum (ETH) price is trading with a bullish bias. It is attempting to recover after a 7% slump following a rejection from the $1,736 resistance level. This level constitutes equal highs, thereby passing as a formidable supplier congestion area.

With the Relative Strength Index (RSI) trying to restore its position above the 50 level, Ethereum’s price could increase. Tailwinds from the demand zone (green order block) add to the bullish momentum, considering this area is characterized by aggressive buying.

With this outlook, the Ethereum price could overcome the resistance presented by the 50-day Exponential Moving Average (EMA) at 1,664. A sustained buying momentum could see the price of the second-largest cryptocurrency by market capitalization shatter the 100-day EMA at $1,710.

In highly bullish cases, the gains could catapult the Ethereum price to the resistance confluence between the 200-day EMA and the horizontal line around 1,736. A decisive daily candlestick close above this hurdle could kickstart a continuation rally, as it marks the last higher high.

The Awesome Oscillator (AO) is still in the positive territory, whereas the RSI is about to signal a call to buy ETH. This will activate once it crosses above the signal line (yellow band). If traders heed this call, the ensuing buying pressure could increase the upside momentum for ETH.

Converse Case

On the flip side, increased seller momentum could send Ethereum price into the demand zone, with a break and close below its midline (mean threshold) at $1,585, confirming the downtrend. In the dire case, the downtrend could see the demand zone, which is currently a support zone, fail, making it a bearish breaker. The next logical target for ETH would be the $1,551, or a liquidity sweep, extending below the aforementioned level to collect sell-side liquidity resting underneath.

Why Ethereum Price Could Rise

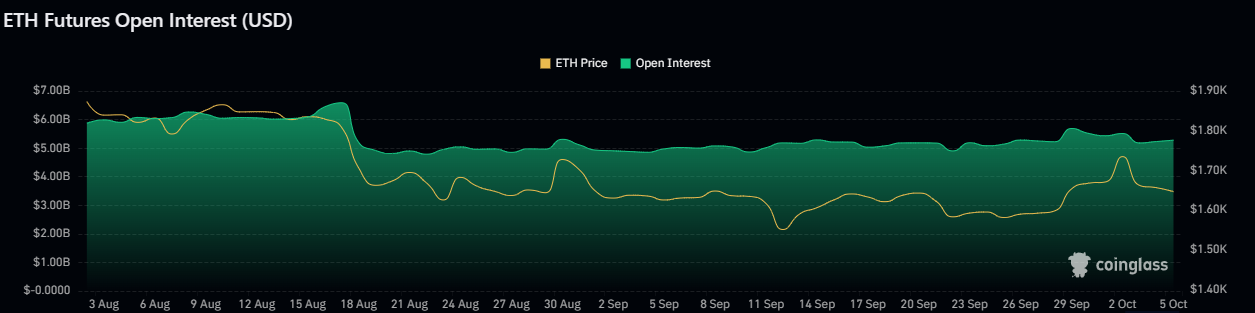

The Ethereum trade volume has recorded a steady fall alongside the open interest. It points to investors shifting interest to other, more actionable alternatives for volume. Regarding open interest, the drop points to the number of long and short positions dropping.

Between August 5 and October 5, open interest dropped from $6.07 billion to $5.28 billion, constituting a 15% drop in two months. Over the same timeframe, the price has dropped by around 10%.

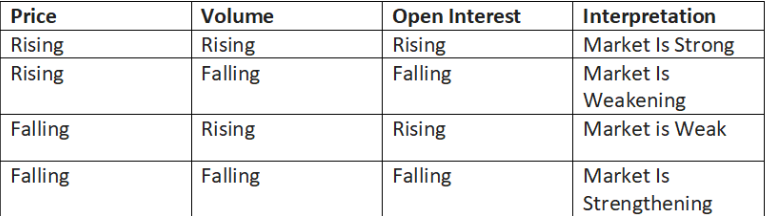

As the chart above indicates, research shows that the ETH market could gain strength when price, volume, and open interest fall. As prices, volume, and interest dwindle, traders with long open positions could lose heart. In response, they could liquidate or close their positions. A continuation of such a trend is a bearish sign.

However, it reaches a point when open interest stabilizes at a low level and liquidations end. Prices could begin to rally again at this point.

Shifting lanes from Ethereum, consider TGC, the gambling token that powers the TG.Casino ecosystem. It is the leading Telegram casino presale, making headlines on Crypto X.

https://www.youtube.com/watch?v=2_qjQmqU2Cc

Ethereum Alternative

TG.Casino has gambling hobbyists enthused, having found an exclusive place for online, anonymous crypto gambling. The platform gives players access to tier-one online casino games while at the same time fostering an ecosystem defined by values of loyalty. This loyalty is best demonstrated in the project’s decision to allow a buy-back option, where you can reacquire part of the casino revenue.

Happy Humpday. 🐪 pic.twitter.com/uQG1LMadCQ

— TG Casino (@TGCasino_) October 4, 2023

You should buy TGC for many reasons, but the primary one is that it allows you to play with many top cryptocurrencies. More intricately, only a TGC token will give you access to incredible rewards. This applies to staking and token-holding options. Even so, while TGC is not required for playing in the casino, it can be used to bet on games, the same as every other currency.

Always time for a quick play. 🎰 pic.twitter.com/PLRJS44KeE

— TG Casino (@TGCasino_) October 3, 2023

The project is still in the presale stage, so you can buy at affordable rates of just $0.125. More than $443,000 is already in the bag, with eyes peeled on the $1,000,000 soft cap. Noteworthy, the presale will end once the hard cap is reached.

TG.Casino Tokenomics

The project upholds transparency, prioritizing the general public, unlike the many projects that put investors at the center. Based on its tokenomics, a significant portion (40%) of the token supply goes to the public. There is also 20% set aside for the decentralized exchange (DEX) liquidity and an equal portion towards staking rewards. The remaining 15% is split between marketing and allocation to project affiliates on a 2:1 ratio.

Buy TGC using Ethereum (ETH), Binance Coin (BNB) and Tether (USDT). It is also worth mentioning that the TG.Casino Smart Contract outsources its auditing from top deck blockchain security firm Coinsult, which points to the project upholding accountability.

Also Read:

- Casino’s Presale Surges: Grab $TGC Before the Boom!

- Best Bitcoin Casinos for Crypto Gambling in 2023

- Best Ethereum Casinos – Ethereum Gambling Guide

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage