Join Our Telegram channel to stay up to date on breaking news coverage

DYDX price exploded on the last day of January rallying as much as 49.86% brushing shoulders with $3.5. This was after the release of the project’s first-ever Annual Report presenting highlights from the DYdX ecosystem throughout 2022.

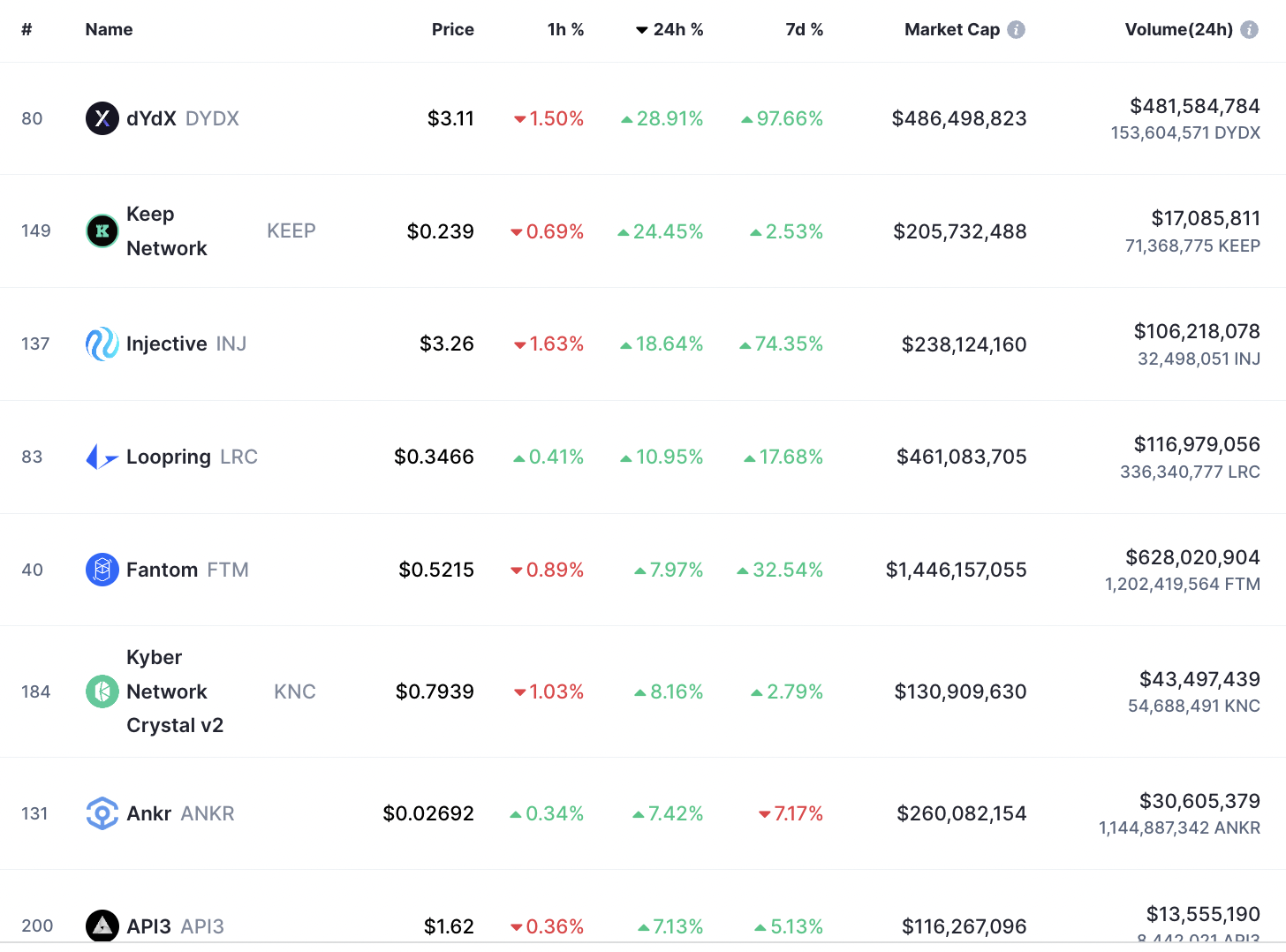

At the time of writing, the token of the non-custodial decentralized cryptocurrency exchange (DEX) DYDX was exchanging hands just above $3, up 28.91% in the past 24 hours leading the gains in the crypto market. Other top gainers were Keep Network (KEEP) which was up 24.45% on the day to trade at $0.239 and Injective (INJ), up 18.64% to $3.26. Loopring (LRC) and Fantom (FTM) also posted impressive rallies of $10.95% and 7.97% respectively, over the same time frame.

Top Gainers February 1

The release of the dYdX’s Annual Report pointed to increased transparency and accountability which is expected to reinforce investor confidence in the project.

dYdX’s 2022 Ecosystem Annual Report

The dYdX foundation has released its inaugural Annual Report giving highlights from the ecosystem as it happened in 2022. The report was published on January 30 and shared with crypto Twitter the following day.

dYdX Foundation is excited to share the inaugural ecosystem annual report 🔥

Despite the challenging market conditions in 2022, stakeholders in the dYdX ecosystem persevered and continued to build toward the future of finance – one block at a time 💪🏾https://t.co/NPKPOdEpeG pic.twitter.com/hwz8mgOQOW

— dYdX Foundation 🦔 (@dydxfoundation) January 30, 2023

Covered in the report is information about the dYdX Foundation, the DYDX token, the dYdX community, governance of the dYdX protocol, details on the dYdX Grants Program, and the dYdX Decentralized Autonomous Organization (DAO).

In the report, the dYdX foundation says that the DeFi ecosystem persisted and continued to build in spite of the crypto winter experienced throughout 2022.

Despite the challenging market conditions in 2022, stakeholders in the dYdX ecosystem persevered and continued to build toward the future of finance – one block at a time.

According to the report, the “challenging market conditions in 2022” proved how resilient decentralized finance (DeFi) is and demonstrated its clear advantage over centralized finance (CeFi). According to the organization, “principles of trustless technology, self-custody, and decentralization are key to the dYdX protocol’s success in the future.”

The report also highlighted what the team believes to be the strength of the dYdX ecosystem. These are categorized as DAO contributors and endorsed delegates, market makers, infrastructure, security and audit providers, researchers, and builders in DAO tooling and analytics.

The dYdX ecosystem is rich in:

🔴 DAO contributors and endorsed delegates,

🔴 market makers,

🔴 infrastructure, security and audit providers,

🔴 researchers, and

🔴 builders in DAO tooling and analytics.Congratulations to all dYdX ecosystem stakeholders for a successful 2022 pic.twitter.com/S0bJkMsyR1

— dYdX Foundation 🦔 (@dydxfoundation) January 30, 2023

The company has grown to a team of “12 full-time employees and 7 part-time contractors ” and looks forward to more partnerships and collaborations to accelerate growth in 2023.

DYDX Price Uptrend Is Intact As Bulls Target 56% More Gains

The $1.0 support floor provided a launching pad for the DYDX price on January 1 lifting the token 307% to yesterday’s high at $3.51. At press time, DYDX was flashing red but the technical setup showed that the path with least resistance was upward.

The moving average convergence divergence (MACD) indicator was moving upward in the positive region, a suggestion that the market conditions still favored the bulls. In addition, the moving averages were tipping upward and the Relative Strength Index (RSI) was positioned at 75 in the overbought region, reinforcing the buyers’ grip on the dYdX price.

DYDX/USD Daily Chart

Further validating the bullish narrative for the DEX coin was the strong support provided by major moving averages and Fibonacci retracement levels on the downside. Note that the simple moving averages (SMAs) were about to produce a bullish cross. This may happen in the near term when the 100-day SMA (red line) crosses above the 200-day SMA (purple), adding credence to the positive outlook.

As such, the price may turn up from the current levels to revisit the local high at $3.51. Shattering this barrier could see the dYdX price rise first toward the 123.6% Fibonacci retracement level at $4.1 and later the 150% retracement level at $4.75. This would bring the total gains to 56% from the current price.

On the downside, a daily candlestick close below the immediate support at $2.9, embraced by the 78.6% Fibonacci extension level could see the price drop lower, retracing all the levels and revising the SMAs as shown on the chart above. In highly bearish cases, a full retracement to the $1 support floor would be the next logical move.

DYDX Alternatives To Consider

Investors seeking to buy the dYdX token could be cautious because the RSI is turning down and the overbought conditions mean that the price may continue correcting in the near term. Such investors may want to consider getting in on new projects before they hit the public market.

Meta Masters Guild is one such project. It is a new play-to-earn platform built on innovative Web-3 technology. The project’s team believes it is well-positioned to chart the future for the best gaming crypto coin on the market.

Meta Masters Guild will debut with three well-crafted games: Meta Kart Racers, NFT Raid, and Meta Masters World. Users on this network will be able to generate revenue in Gems, an in-game currency.

Investors are booking positions in its native token MEMAG which is currently in presale where more than $2.26 million has been raised in just a few weeks.

Read More:

- Will Jim Cramer’s Bitcoin Price Prediction Be Wrong Again?

- Calvaria P2E Presale Finished Raising $3 Million – BKEX IEO 7th February

- Meta Masters Guild Clears $2.3 Million In Presale – Less than 4 Days Remain in Stage 4

- How To Buy Meta Masters Guild

Join Our Telegram channel to stay up to date on breaking news coverage