Join Our Telegram channel to stay up to date on breaking news coverage

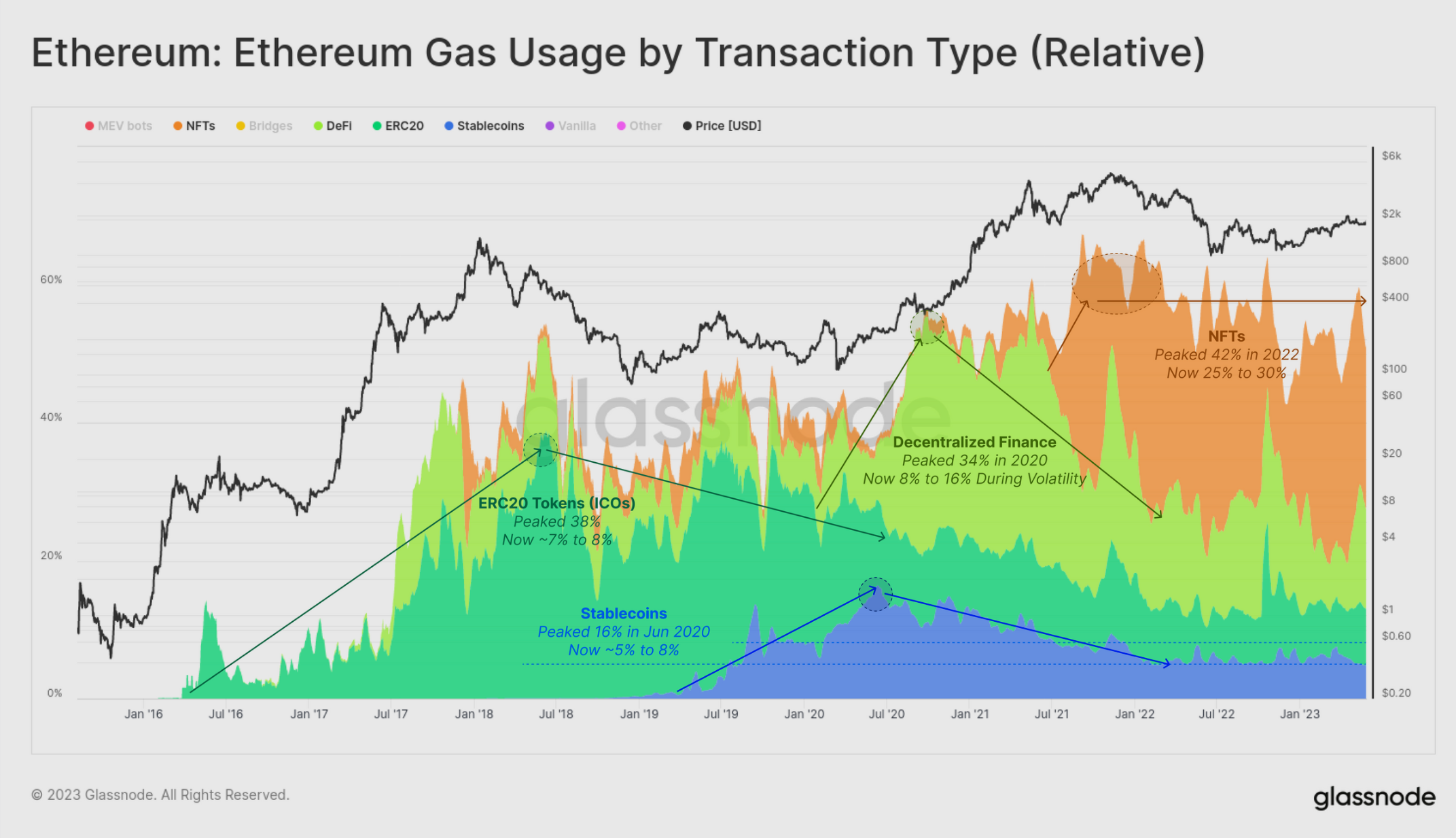

Decentralized finance, also known as DeFi, played a significant role in sparking the bullish trend of 2020. Now, however, investor enthusiasm for blue-chip tokens such as Uniswap and Maker has significantly waned, as revealed by blockchain data firm Glassnode.

The Evolving Landscape of DeFi – Exploring Investor Sentiment and Ethereum’s Impact

Glassnode’s report, published on Wednesday, attributed this downturn primarily to Ethereum’s enticing new staking feature, which offers returns of up to 4% APR. The firm emphasized that investors can now earn rewards on cryptocurrency with reduced risk and increased potential gain.

According to the report, the underwhelming performance of DeFi tokens in the last couple of years, along with the rise of native ETH staking yield, has played a role in this transition. Glassnode emphasized that the current market capitalization of DeFi represents merely 12% of its highest value recorded in November 2021.

DeFi encompasses various crypto projects that aim to revolutionize traditional finance by eliminating intermediaries and automating processes like lending and borrowing. Many of these projects operate on Ethereum’s blockchain.

During the DeFi boom of 2020, investors poured billions of dollars into reputable “blue-chip” DeFi tokens, such as Uniswap and Aave, which enjoyed widespread popularity.

Glassnode clarified that the market capitalization of these projects has experienced a notable decline as they face stiff competition from Ethereum, which offers stable returns with apparently reduced risk.

Ethereum’s successful upgrade in April allowed investors to securely lock up their ETH and receive returns on the cryptocurrency they pledged to the network. Consequently, investors can now enjoy greater rewards with reduced risk compared to blue-chip DeFi tokens. Glassnode highlighted that while the downside performance and volatility are equivalent to ETH, the upside performance is noticeably lower.

ZoomerAnon, the head of research at blockchain data app Cielo, commented that for DeFi to retain its appeal, it must adopt liquid staking, which Ethereum already offers. Liquid staking enables investors to swiftly access their pledged crypto by providing tokens redeemable for staked assets, which they can transfer to other platforms.

Glassnode further stated that there is likely an ongoing effort to revive enthusiasm for DeFi tokens. However, given the introduction of the ETH token’s new hurdle rate, it is anticipated to be a difficult undertaking.

Pioneering DeFi Strategies Target $17 Billion Liquid Staking Market

Liquid staking tokens (LSTs) have quickly gained popularity in the DeFi space as a lucrative source of yield. The value of the liquid staking sector has witnessed a significant surge in recent months, with Lido leading the market with a total value locked (TVL) of $13 billion, surpassing even MakerDAO, the second-largest DeFi protocol.

Currently, over 19 million ETH, accounting for 15.7% of the total supply, is staked. LSTs make up a remarkable 47% of the staked Ether, indicating intense competition among LSTfi protocols to tap into the potential $17 billion market at present prices.

LSTs represent staked Ether in the Beacon chain and allow users to earn rewards without running their own nodes. They can easily buy or sell these tokens to enter or exit their staking positions.

With the introduction of staked ETH withdrawals in April, several innovative protocols have integrated LST tokens into DeFi, offering novel strategies to earn additional yields on top of staking rewards.

LST holders can deposit their tokens in popular DeFi protocols like Aave to earn extra yield while also receiving staking rewards. Furthermore, LSTs can be used as collateral to borrow other assets, leveraging the combined rewards and yield to surpass accrued interest. This opens up opportunities for recursive lending strategies.

The growing popularity of LSTs has led to the emergence of new protocols capitalizing on this trend, with some offering inflationary tokens as bonus rewards.

Lybra Finance, for instance, achieved a TVL of $183 million within five weeks by allowing users to mint its eUSD stablecoin against stETH collateral, utilizing ETH staking rewards to provide yields to eUSD holders. Origin OETH, a yield-aggregating LST, also experienced rapid growth, accumulating $15 million in TVL within two weeks of its launch.

However, while new protocols may offer potentially higher Annual Percentage Yields (APYs), protocols that lack well-established security measures may be more susceptible to exploits compared to their more established counterparts. Recent incidents, such as the hacking of UnshETH, an up-and-coming LST liquidity marketplace with $32 million in TVL, highlight the risks associated with lesser-known protocols.

Some protocols combine various DeFi components to create intricate LST strategies. Oasis.app, a front-end for MakerDAO, introduced a service allowing users to leverage their exposure to stETH. By borrowing ETH against stETH collateral and using the funds to purchase additional stETH in a single transaction, Aave users can maximize their positions.

Gearbox Protocol offers leverage of up to 10x on stETH. Meanwhile, the community eagerly awaits the launch of EigenLayer, a “restaking” protocol set to debut on the Ethereum mainnet in Q3. EigenLayer will allow Ethereum stakers to secure additional services while participating in the validation of the Ethereum blockchain, providing them with extra rewards.

However, concerns have been raised regarding the potential centralization of LSTs, with the dominance of Lido Finance controlling a significant portion of staked Ether and attracting a large number of validators.

The Ethereum community emphasizes the importance of balancing the promotion of DeFi and ensuring the security and health of the Ethereum network.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage