Join Our Telegram channel to stay up to date on breaking news coverage

Binance, the world’s largest cryptocurrency exchange, has experienced a significant drop in its market share over the past three months. This, coupled with the regulatory scrutiny for the exchange in Canada and news surrounding job cuts has left investors worried.

Binance’s Market Share Declines Amidst Regulatory Pressure and Competition

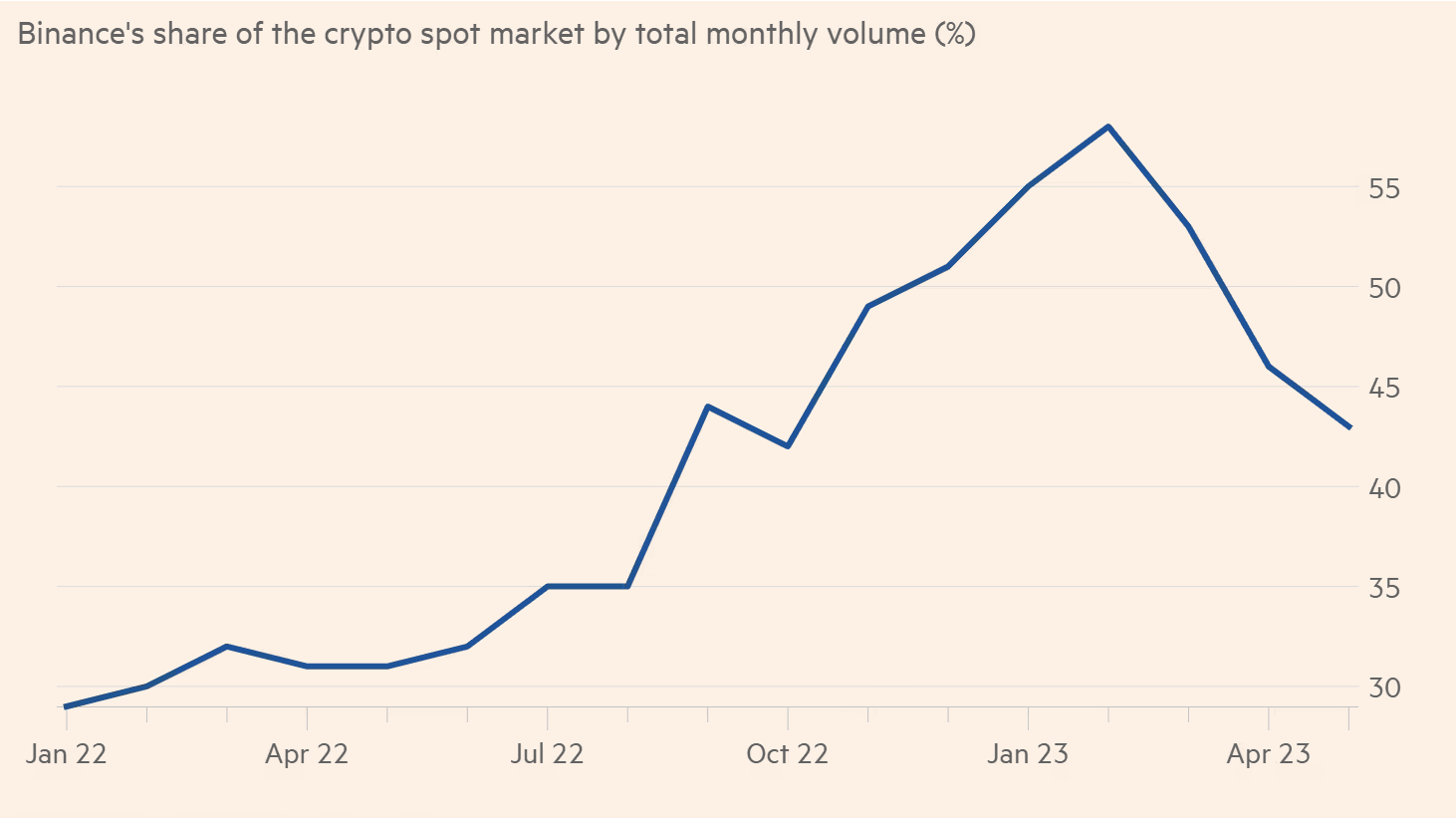

At its peak in February, Binance controlled 57.5% of the average monthly volume on crypto exchanges worldwide. However, according to research provider CCData, this figure has now decreased to 43%. The decline can be attributed to a combination of factors, including heightened scrutiny from US regulators, tougher competition in the market, and the conclusion of a free trading promotion.

These challenges have had a notable impact on Binance, leading to a loss of market share and a need to reevaluate its business strategies.

One specific setback for Binance occurred when New York regulators halted the issuance of a Binance-branded stablecoin, known as BUSD. This stablecoin accounted for approximately 40% of the company’s monthly trading volume.

With the discontinuation of BUSD and the subsequent decrease in liquidity on the exchange, Binance faced additional pressure, especially considering the attention drawn to the situation and the necessity to abandon its branded stablecoin.

Furthermore, the Commodity Futures Trading Commission (CFTC), a US derivatives regulator, filed a lawsuit against Binance, alleging that a significant portion of its reported trading volume and profitability resulted from soliciting and accessing US customers.

Binance, however, expressed disagreement with the CFTC’s accusations. These regulatory challenges and negative developments have impacted Binance’s market share, creating an opportunity for other exchanges to gain ground in the crypto market.

Binance Announces Job Cuts and Adapts to Crypto Market Conditions

In response to the evolving landscape and operational challenges, there have been reports surrounding Binance’s plans for job cuts. The company clarified that this was not merely a case of downsizing but rather a reassessment of talent and expertise in critical roles.

Having grown from a modest team of 30 individuals since its inception in 2017, Binance has now burgeoned into a workforce of over 8,000 employees. Nonetheless, as the company confronts a dynamic market environment and internal deliberations, it acknowledges the necessity to assess its workforce needs.

The exact number of employees affected by the job cuts remains undisclosed, although sources familiar with the matter suggested that previous cuts ranged between 5% and 12% of the workforce.

Binance’s decision to trim its headcount can be partly attributed to recent market conditions in the cryptocurrency industry. The volatility and downturn experienced last year, where token values, including bitcoin, significantly dropped, affected many crypto companies.

In response, several industry players, such as Coinbase and Crypto.com, have implemented substantial workforce reductions. Binance, despite the challenges, continued to hire for numerous positions during this historic downturn.

The company’s CEO, Changpeng Zhao, stated that those who were not strong fits would depart as part of their “bottom out” policy. These adaptations reflect Binance’s efforts to navigate the ever-changing crypto landscape and ensure the optimization of its resources.

Regulatory Scrutiny Intensifies for Binance in Canada’s Crypto Market

Binance’s trouble doesn’t just stop at losing 25% of its customers. The exchange has confirmed that it received an order from a Canadian securities regulator to investigate potential violations of local regulations and compliance controls during its approval process in the country.

Binance has come under investigation by the Ontario Securities Commission (OSC) in Canada. The OSC issued an order on May 10, prompting an inquiry into whether Binance had attempted to bypass local regulations and compliance controls while seeking approvals in the country.

According to Binance’s legal counsel, Borden Ladner Gervais LLP, the investigation order granted expansive authority to scrutinize potential breaches of Ontario’s securities legislation and regulatory adherence.

This development adds to the growing regulatory and legal challenges that Binance and its CEO, Changpeng Zhao, have faced globally.

In the United States, Binance and Zhao were recently sued by the Commodity Futures Trading Commission (CFTC), with the OSC reportedly using this lawsuit as a basis for its order. Binance has been served with summonses to provide documents for the investigation, but the exchange has expressed reservations about the scope and specificity of the requests.

Binance Withdraws from Canadian Market Due to Regulatory Changes

As a consequence of new regulatory guidance related to stablecoins and investor limits, Binance announced its decision to withdraw from the Canadian market. The platform’s CEO, Changpeng Zhao, a Canadian citizen himself, explained that the new regulations had made it financially unviable to continue operating in Canada.

The move comes amid increased regulatory scrutiny on crypto companies in the country, following the collapse of FTX, a trading platform, in the previous year.

Binance is not the only major exchange to exit the Canadian market, as OKX and Bybit have also made similar decisions. However, other platforms like Coinbase Global Inc. have chosen to comply with the tightened rules and remain active in Canada.

Citing a settlement agreement signed in 2022, Binance has expressed its opposition to the investigation order issued by the OSC, arguing that it was intended to halt any additional investigations while the exchange focused on its registration process.

In response, the Capital Markets Tribunal has mandated that Binance reveal comprehensive particulars regarding the investigation order and the information it has been called upon to furnish. Currently, the case remains unresolved, and a jurisdictional hearing is slated for June 2, marking the next step in the legal proceedings.

Binance has been actively seeking registration in multiple locations worldwide, but it has not designated an official headquarters, stating its incorporation and business operations are conducted through a registered office in the Cayman Islands.

Related Articles

- Canadian Regulator Investigates Legality of Binance Serving Clients from Canada

- Coinbase CEO: China Expected to Benefit Most from US Crypto Regulations

- Best Crypto Exchanges

Join Our Telegram channel to stay up to date on breaking news coverage