Join Our Telegram channel to stay up to date on breaking news coverage

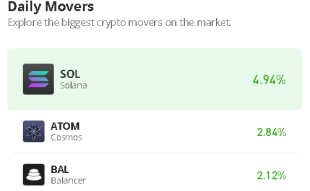

Like many other cryptocurrencies, the Curve DAO token (listed as a CRV) had a difficult 2022. The coin started its 2022 run at $6 and has ended it at a little over the $0.5 mark. Having lost more than 90% in the previous year, CRV finally seems to be making a move in the right direction, as it gained approximately 2% in the past 24 hours.

CRV is a utility-based ERC-20 token launched in 2020 to control the activities of the Curve DAO. The coin could be acquired either by contributing to the liquidity pools of Curve Finance or from other crypto exchanges.

Despite showing signs of recovery, CRV continues to trade below its 200-Day Simple Moving Average and 50-Day simple moving average.

About Curve Finance

Curve Finance is a decentralized exchange operating over the Ethereum Blockchain. The exchange is popular among investors as it allows them to trade stablecoins at low transaction fees (a common feature of decentralized exchanges).

Launched in 2020, Curve Finance uses Automated Market Maker (AMM), which makes a trade at market price without involving an intermediary. This technique helps the platform to reduce its transaction costs significantly. The lesser fees make purchasing stablecoins using Curve Finance more attractive.

The AMM model is powered by the platform’s large Liquidity pools and a Decentralized Autonomous Organization (DAO).

Decentralized Exchange

Decentralized exchanges are much easier to log into than their centralized counterparts. They do not ask for a user’s KYC information and hence, are less vulnerable to data theft. However, a decentralized exchange might face difficulty in meeting the demands of its users as it may not have a regular supply of coins to purchase from.

Liquidity Pools

Curve Finance needs to maintain a regular supply of stablecoins (to handle the demands of users), which it does through liquidity pools. Liquidity pool refers to the pool of a particular cryptocurrency/pair of cryptocurrencies which provides liquidity to the exchange.

Curve Finance incentivizes liquidity contributors by awarding them CRV tokens for their contribution. Their share in the award is directly proportional to their share in the liquidity pool.

A user can swap one stablecoin with the other coin it has been paired with. The real-time demand and supply, as per the liquidity pool, determines the price of the coin.

The Curve DAO Model

Curve DAO was created as an ecosystem of liquidity contributors, investors and users, which ensures a regular supply of stablecoins in its liquidity pools.

The governance of Curve Finance is shared between its founders and the Curve DAO. Founded in 2020, Curve DAO allows the various stakeholders of the platforms to conduct polls and make proposals which are then assessed by the Curve Finance team.

Purchasing a CRV token enables a member to participate in the activities of the DAO. All Liquidity contributors become a member of the DAO by default (as they earn CRV through their liquidity pools).

Members are supposed to convert their CRV token into Voting Escrow CRV (veCRV) by locking them for a specified period. The weight of a member’s vote depends on the amount he has locked in as well as the time for which he has locked that amount.

CRV Price History

CRV was launched at an initial value of $60.50. Its initial value turned out to be way above its market value (as the coin dropped by more than 80% in the first week). Despite being a utility token, the coin has not been able to perform up to the mark over the years.

It had its best run in the year 2021 as it steered above the $1 mark for the whole year (except at the beginning of the year). By the end of 2021, CRV had grown almost 20 times in value.

CRV’s upward momentum from the previous year helped it reach an all-time high of $6.80 in the first week of January 2022. However, the coin has since witnessed a decline which again pushed it under the $1 level.

CRV’s decline in 2022 could be credited to multiple factors like the collapse of the crypto market in December 2021, the Luna crash in May 2022 and the recent collapse of the FTX exchange (one of the biggest cryptocurrency exchanges in the world).

Like the year 2021, CRV has started 2023 below the $1 mark ($0.53), but whether it would be able to replicate its golden run of 2021 still stands as a big question mark.

CRV Price Prediction

CRV, after falling below the $0.60 level, has discovered a new local support level of $0.52. As far as its performance goes, the coin has remained below its 200-day simple moving average for almost a year and its 50-day simple moving average for the last 55 days. The 50-day SMA moves below the 200-day SMA indicating a bearish market.

The coin’s recent growth could lead it to rally above the $0.70 resistance level and enter a bullish market. However, this growth, like many others in the past, could also be a short sprint. The coin might tumble down below the $0.52 support level and even cross its all-time low of $0.34.

As far as the predictions go, various crypto analysts believe that CRV could once again rise above the $1 level and go up even further, given this year is nothing like the previous one.

In the long run, CRV, being a utility token, could be a good investment option as it not only could help in earning profits but also encourage decentralized and democratized governance of the platform.

Conclusion

Despite being a utility token, CRV was not spared by the bearish crypto market. A possible reason behind its decline could be the industry it belonged to. Curve Finance’s growth is dependent on the growing demand for cryptocurrencies (which was hardly the case last year).

The overall crypto market is bound to dictate the performance of a crypto exchange (be it centralized or decentralized). As the crypto market recovers, we can expect the CRV to move towards the $1 mark and above.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage