Join Our Telegram channel to stay up to date on breaking news coverage

Cardano (ADA) price has been on an uptrend since the New Year, with bulls dominating the trading sessions for most of January. The price action has been characterized by bull runs or investors waiting to buy ADA at low prices. This is evident from the dominance of green bars on the daily chart (below) and the price breakouts immediately after every dip since the onset of 2023.

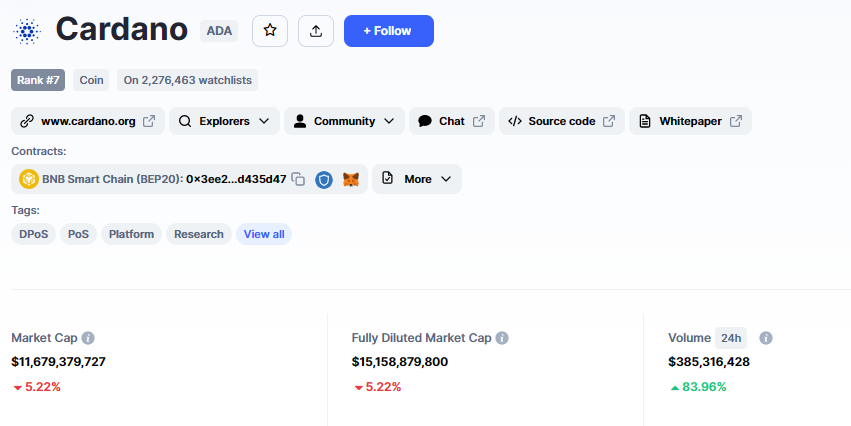

At the time of writing, ADA was trading at $0.3365 after losing 5.5% on the last day. The token’s market cap was also down 5.22% to $11.679 billion consequence of the price drop, with evidence of increased trading activity on the Cardano network.

Based on CoinMarketCap data, trading activity on the Cardano network was up 83.96% in the last 24 hours to $385.316 million.

Cardano Becomes A Longer Term Investment For Many Holders

Based on a recent report on U.today, “Cardano (ADA) is becoming a longer-term investment for many holders, with an increasing number of people choosing to hold onto their coins for more than a year.”

Cardano (ADA) Becoming Long-Term Investment: Number of 1+ Year Holders Reaches New ATH: Correction on market continues, but most assets remain in prolonged uptrend https://t.co/TaEqdGEhkW #Bitcoin #Crypto #Nft pic.twitter.com/1TNz23fwGi

— Rewards Farm (@Rewards_Farm) March 2, 2023

This is a positive trend for ADA, a top ten crypto, as it signifies growing confidence among investors for its long-term potential.

With more people holding on to their Cardano tokens, the cryptocurrency’s circulating supply reduces. This has the potential to cause demand to increase for the rest of the coins, hence surging prices. Chances are very slim that long-term holders will sell their coins even during market volatility. This has a stabilizing effect on the price of ADA.

The continued development of the Cardano network is among the main reasons why the number of long-term ADA holders continues to increase. The ecosystem has been taking significant steps to become a decentralized smart contract platform capable of competing against giants like Ethereum.

Discover the #CardanoFoundation’s 3 core focus areas: #OperationalResilience, #Education, #Adoption. Each has multiple aspects and interacts with the others.

📰Read more: https://t.co/zoBL68fGCG

📺Watch the video: https://t.co/bo9pa0S0Hm#Cardano #CardanoCommunity #blockchain pic.twitter.com/48JUPLbA6c— Cardano Foundation (@Cardano_CF) February 18, 2023

The progress has attracted mainstream attention from traders and investors, who believe in Cardano’s long-term potential. Notwithstanding the recent price dip, fundamentals for the Cardano blockchain remain solid. The network has a dedicated team of developers who are proactive toward development.

We recently shared some of our ongoing activities to drive #blockchain technology and increase adoption.

We are working to make the #Cardano blockchain a base layer for current and future financial and social systems.

📺 https://t.co/MIBbu1Sjxo#CardanoFoundation pic.twitter.com/f6arhTCiwy— Cardano Foundation (@Cardano_CF) February 9, 2023

In the same way, the crypto community reveres Cardano’s technology, with the ecosystem boasting a strong community of active supporters promoting and building on the platform.

Cardano Price Readies For Breakout Above $0.4275 Barrier Level

ADA price has come under heavy selling pressure since mid-February, characterized by value drops from $0.4275 to support at $0.3264. The buyer congestion around this level is critical for Cardano to resume its uptrend, which means bulls must defend it by all means necessary.

The same support draws energy from the 100-day Simple Moving Average (SMA) at $0.3318, a steadfast multi-week support. This means there is a possible trend reversal in the near term.

ADA/USD Daily Chart

At press time, ADA was auctioning for $0.3365 and sitting on the 100-day SMA for support. An increase in buying pressure among Cardano bulls from this level could make this the turnaround point for ADA price. The price was also confronting immediate resistance at around $0.3517. A daily candlestick close above this level could increase the breakout chances.

There were several other roadblocks for Cardano northward besides the immediate hurdle. Among them, the $0.3748 and the $0.4044 before it finally breached the major resistance at $0.4275. Above this level, ADA price would have an easy homerun to its $0.5121 target, which would signify a 52.27% increase from current levels.

ADA Price Calls A Golden Cross

A golden cross formation on the daily chart above supports the bullish overview for Cardano at around the $0.3748 level. To authenticate this, the 50-day SMA at $0.3750 must cross above the 200-day SMA at $0.3749.

A golden cross is a technical indicator that manifests in the market when an asset’s shorter-term moving average (50-day in this case) rises above a longer-term moving average (200-day in this case). When traders see this technical formation occur, it indicates a strong bull market.

On the downside, investors could delay the trend reversal for ADA price if they continued to wait for more dips. In such a case, the price could dip further toward the $0.3 support level or, in a worst-case scenario, extend to the 0.2495 support floor before a correction.

Both the relative strength index (RSI) and the moving average convergence divergence (MACD) indicators were moving downwards. This showed increasing overhead pressure as sellers flooded the market.

The RSI price strength at 37 and the Stochastic RSI at 47 showed that the downtrend was not over for Cardano price. Similarly, the MACD had just crossed over to the negative territory while the histograms were soaked and splashing red to show bears were in control.

While the overall chart pattern hints at an upcoming trend reversal, investors should acknowledge that the downtrend for ADA price might continue a bit longer. Those waiting to buy the dip should probably start now because the golden cross signal suggests a looming correction. This could end up being the much-anticipated bull run for Cardano.

ADA Alternatives

While waiting for Cardano’s trend reversal, consider CCHG, the native token for EV-proponent ecosystem C+Charge.

What are some benefits of driving an #EV?

💸Cheaper to fuel and maintain

💨Lower emissions

🔊Reduce noise pollutionJoin our #presale and assist in this green revolution⬇️https://t.co/ixe18bPqzI#cryptocurrencies #ReFi #greenenergycrypto pic.twitter.com/3gzqyseAKC

— C+Charge (@C_Charge_Token) March 2, 2023

C+Charge addresses major concerns in the electric vehicle (EV) market, such as transparency and efficiency challenges in charging payments. The project developers are setting up charging stations and working with existing stations. This will see EV owners enjoy a centralized payment solution powered by the CCHG token.

Did you know that now you can buy CCHG using Ethereum (ETH), Tether (USDT), and Binance Coin (BNB)? The token is now available for presale, and it has already collected over $1.73 million, with the presale stage set to end on March 29.

📣BIG NEWS

We're happy to announce that from today, you will be able to purchase $CCHG using $ETH during our #presale 🙌

Join the presale now and celebrate this next milestone with us🔽https://t.co/ixe18bPqzI#ReFi #GreenEnergyCrypto #cryptocurrencies pic.twitter.com/8uozO8nJB2

— C+Charge (@C_Charge_Token) February 27, 2023

Moreover, the team has begun a weekly token-burning mechanism for tokens that went unsold during the past presale stages.

CCHG is among the best crypto to buy in March 2023 and is a deflationary token. This means that the circulating supply of the CCHG token reduces as more units continue to use them in processing charging payments. This mode of operation will help the token improve its profitability and pricing in the future. Use this guide to learn how to buy CCHG tokens here.

Read More:

- Bitcoin Price Dropped to $22,353- Can PMI News Be The Catalyst?

- Solana Price Drops 3.72% To $21 – What Next SOL?

- Biggest Crypto Gainers Today, March 3- PERL, CFX, FGHT, CCHG, METRO, TARO

Join Our Telegram channel to stay up to date on breaking news coverage