Join Our Telegram channel to stay up to date on breaking news coverage

The year 2022 has been one of the most turbulent years for the global financial economy, including the crypto industry. With the crypto market already suffering the consequences of a severe bearish trend, things worsened further at the start of this year. As the world was recovering from the realities of the Covid industry, things worsened further with Russia’s invasion of Ukraine.

All these factors significantly impacted Bitcoin’s performance in the market. It is surprising considering Bitcoin attained its all-time high value exceeding the $60k mark in just November last year. Unfortunately, the fall of FTX also resulted in adverse consequences for the token bringing its value down to a two-year low in recent times. But will BTC exceed the $17k mark this weekend? Continue reading to find out.

What Is The FTX Collapse, And What Does It Mean For Bitcoin?

If you have been keeping up with the developments in the crypto industry, you must have attended to the news about FTX’s collapse. The entire fiasco went on for a couple of weeks until recently, when FTX’s Sam Fried-Bankman had to file for Chapter 11 bankruptcy.

As you know, FTX was one of the leading crypto exchanges operating in the market at the start of this year. The CEO of the exchange had, in fact, earned himself the reputation for being the savior of the industry. He did so by acquiring many other crypto projects that were suffering due to the bearish performance of the market.

The good times for FTX went on for quite some time until a new report from CoinDesk spilled out all the beans in front of the world. The report featured a leaked balance sheet from Alameda Research, FTX’s trading company. The balance sheet brought forward many unanticipated truths that swept the crypto industry.

The balance sheet highlighted that most of Alameda’s assets were FTT tokens, the native currency of the FTX exchange. This meant trouble since the CEO was using this asset holding as collateral for funding many risky projects.

Following this revelation, Binance came into the picture with an announcement that it shall be liquidating all its FTT holdings. This struck fear among investors and traders, given Binance is by far one of the largest investors in the exchange. Consequently, people went into a mode of panic and started withdrawing funds from the exchange and selling all their FTT holdings.

However, FTX decided to close down its withdrawal processing, which only worsened things. But things looked like they would change for good after Binance announced its plans to acquire FTX. Unfortunately, even this deal fell apart as even Binance could not handle the mess FTX had in its books.

Quite a few officials from Binance even went on to call FTX’s books a black hole where one cannot make sense of almost anything. Following these developments, the FTX CEO, Sam Bankman Fried, filed for bankruptcy.

Of course, Bitcoin is still the dominant player in the crypto market, and it has the potential to set trends in the crypto world. But that does not mean it is independent of all other developments in the industry.

Following the collapse of FTX, almost every token in the market felt the heat, including Bitcoin. One of the primary rationales behind this is that people are now very reluctant in many ways and are somewhat wary about investing in cryptos. This evidently resulted in a huge drain of capital in the market, further deteriorating the overall aggravating situation. Hence, the collapse of FTX has had a direct or indirect impact on Bitcoin’s value.

Bitcoin (BTC) Price Prediction – Technical Analysis

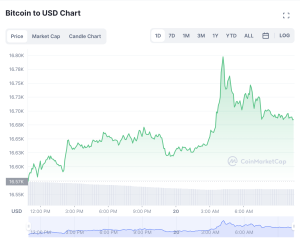

The recent developments in the crypto industry have devastatingly impacted Bitcoin’s overall valuation. Things went so bad so quickly that the token fell below the $18k mark after months and plunged into a new two-year low. However, as Bitcoin prices are picking up once again, things seem to change with each passing day.

While the token has dabbled between low price ranges of $14k to 15k in the past couple of weeks, this week, Bitcoin reached over $16k after quite a long time. At the time of writing this, Bitcoin is priced at $16,665, and this has left many wondering if the token will break the $17k mark this weekend.

There can be many factors fueling this rise, but the most important factor has something to do with the country of El Salvador. The president of the country, Nayib Bukele, recently announced they would be buying Bitcoins on a daily basis starting from the 17th of November. The country currently has 2,381 BTC worth a total investment of $39.4 million, down from $103 million due to recent developments.

Following this, President Bukele declared the country would start buying more BTC every day starting from the 17th of November. This news came three months after the last BTC acquisition of the country. The stakeholders welcomed this move as it will put the demand and supply equation into play and change things for good.

While Bitcoin started the day with a good announcement, the token’s price has remained the same. The best one can do now is wait for the weekend to be over and see if the token can break the $17k mark.

Bottom Line

The crypto world is volatile, and stakeholders are well aware of the nature of the market. Thus, it is never always possible to predict the future of a token since anything can change at any given time. But that does not mean you should stop investing in this market and go home.

Instead, you must learn lessons from these developments and use these situations to your advantage. The collapse of FTX highlights the significance of more intelligent trading platforms like Dash 2 Trade that will help one find the right opportunities and make the most of them.

Besides that, there is RobotEra with its native token, $TARO, ideal for beating the next price rise with its new $100k milestone. Also, Calvaria is nearing its $2 million mark, while IMPT is nearing the staggering $13 million benchmark. This shows that the crypto industry is not short of opportunities as long as you can find the right one.

Related Articles

- Dash 2 Trade Price Prediction

- Calvaria Price Prediction

- Here is Why Top Crypto Gainers Have Held Firm for The Past 24 Hours

Join Our Telegram channel to stay up to date on breaking news coverage