Join Our Telegram channel to stay up to date on breaking news coverage

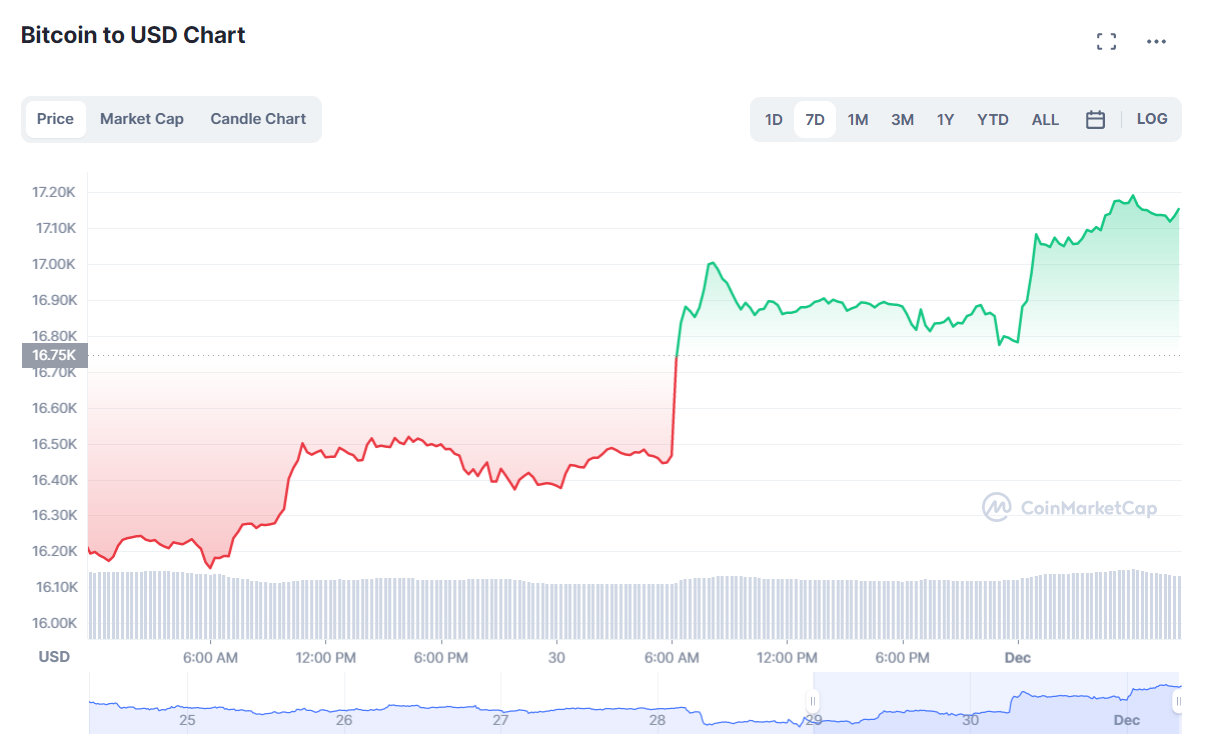

The BTC price is back above $17k for the first time since mid-November. It happened in response to Fed Chair Powell setting grounds for a 50 BPS hike, stating that now might be the time to increase the interest rates at a moderate pace. These dovish comments leave buyers more time with their current buying power — which has directly translated to a happy December entry for Bitcoin as more investors turned up.

BTC Price Trajectory In November

November was nothing but a bucket of bad news for the crypto market. As Sam Bankman-Fried’s fake facade of the most charitable billionaire came to light soon after the FTX collapse, Bitcoin became a seller’s market.

After riding the highs of above-$20k due to the Fed’s earlier minutes of the meeting, and the CPI data, FTX’s betrayal proved to be the second bomb to implode crypto prices this year. The BTC price quickly went down to its 2-year low, lower than what it broke through in the first bear season that started in June.

Give consecutive reds led to Bitcoin crashing through $16k and dropping to $15.5. Panic hit the bulls. Acting quickly, they pushed the Bitcoin price above $17k, but more corrections came as soon as more issues about FTX were revealed.

From Alameda Research’s ex-CEO’s comment about her love for amphetamine to the revelation that most FTX leads were having the times of their lives in the Bahamas, every piece of news coming in led bears to take control of the bitcoin market. As a result, Bitcoin has struggled to stay above $16k.

Fed’s New Statement Breathes Live into the Global Market

Two things happen after Bitcoin’s fall this November. One, people started to pay more attention to stablecoin — assets pegged to a dollar that many consider relatively stable, being “mostly” backed by deserves. Secondly, the search for stability moved investors to invest in traditional assets.

For the first time, the price charts showed Bitcoin decoupling from the S&P 500 graph. However, contrary to people’s expectations, it showed the traditional markets performing a tad bit more than bitcoin. As a result, people started to focus more on traditional assets.

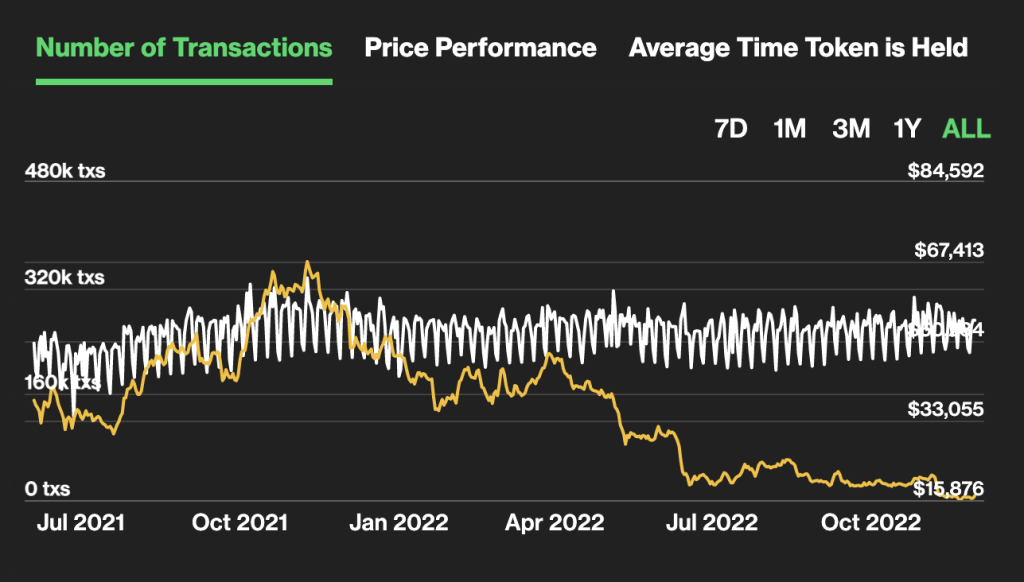

But that’s not to say that Bitcoin isn’t trending at all. Coindesk shows that the number of transactions has accumulated within the same range for Bitcoin. As of today, this number rests at 271.42k.

So, it was great news for the global financial market when Powell cited the need to “moderate” the pace of rate increase. This dovish tone drove brought buyers to the market, leading to S&P and Nasdaq going up by 2.18% and 4.41%, respectively.

Bitcoin Price Hit a Three-Week High

Jim Wyckoff was first to break the news that Bitcoin price has reached a three-week high as BTC bulls stepped to the scene to stabilize and push BTC above its $16.5 barrier.

But it is too soon to party, as the bears still hold the technical advantage. That said, those looking at Bitcoin as a short-term investment must pay attention as a near-term bottom is on its way.

What’s Next for BTC Price? Bulls Have Work to Do

Crypto Twitter is rushing on their social media handles and writing, “the bottom is in”. They know better and are saying that looking at the market is a must before investing. One investor who goes by the name Crypto Tony has said that traders must wait for the market structure to be bullish first.

I mean personally if we have bottomed on the macro, great ♥️

However I will not be tweeting the bottom is in for more followers until at least :

– Market structure is bullish

– Clear demand coming in via spot buys and volume

– Bullish OBV 9On balance volume)Until then CALM IT

— Crypto Tony (@CryptoTony__) November 30, 2022

Additionally, the bulls have their work cut out for them if they want to put it above its pre-FTX-betrayal support. The Fibonacci retracement chart shows that the BTC price must find support at $19,413 (0.382 fibs) to test $20k. That said, it may be entirely possible since the current RSI is at 48.64, signaling stability.

Investors Must Look to Presale Cryptos for Reprieve

While the current BTC price prediction shows positive days ahead, we have to wait. As mentioned, bears are still controlling the market. All it would take is one long red, and Bitcoin will be back on its bearish tracks again. That is why presale coins are the best bet for traders.

One of them is called Dash 2 Trade. It powers a crypto analytics platform featuring tools that investors need to make informed investment decisions. The token is in presale and has raised upwards of $7.5 million.

Other presale cryptocurrencies to keep an eye on are IMPT, Calvaria, and RobotEra. IMPT has crossed its $13.4 million threshold, Calvaria has raised upwards of $2.1 million, and RobotEra presale is above $300k now.

Check out our presale guide to know how to invest in them.

Related Articles

- How to Buy Dash 2 Trade

- How to Buy Calvaria

- Kraken Fires 30% of Its Employees Weeks Before Christmas

Join Our Telegram channel to stay up to date on breaking news coverage