Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – March 28

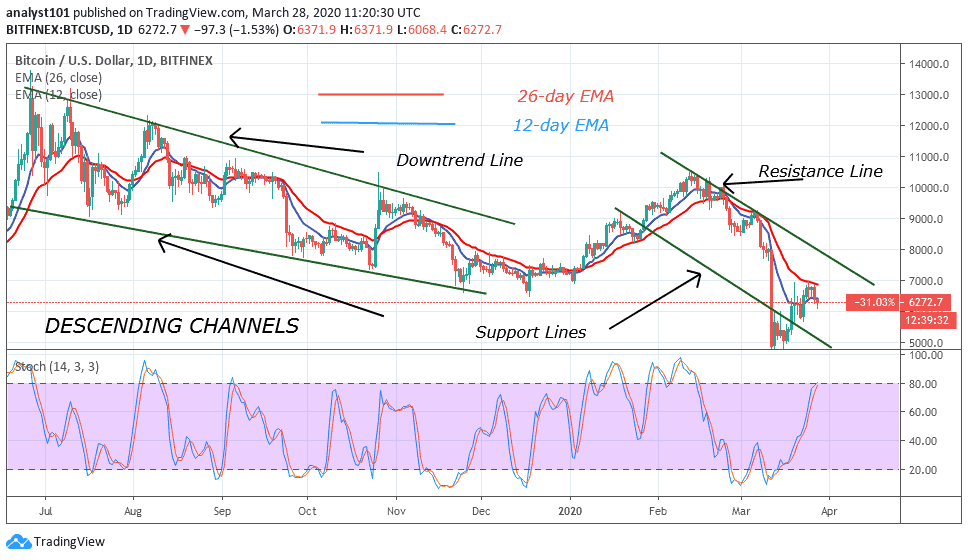

BTC/USD pair is finally on a downward move because of it’s inability to push above $7,000. The downward move became necessary because BTC has fallen below the breakout level of $6,400.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

Bitcoin drops after one week of unsuccessful attempts to trade above $7,000 overhead resistance. The bears have provided stiff resistance at the $7,000 price level. The selling pressure has overwhelmed the bulls as the market begins to drops. At the moment, BTC has fallen to a low of $6,200, and a further downward move to $5,500 is expected. On the other hand, the pair rebounding at $6,200 low cannot be ruled out. A possible move to $7,500 and $8,000 is likely if the pair bounces at $6,200 low. Meanwhile, Bitcoin is below 80% range of the daily stochastic. The stochastic bands are making U-turn indicating the downtrend. The bullish momentum is subsiding

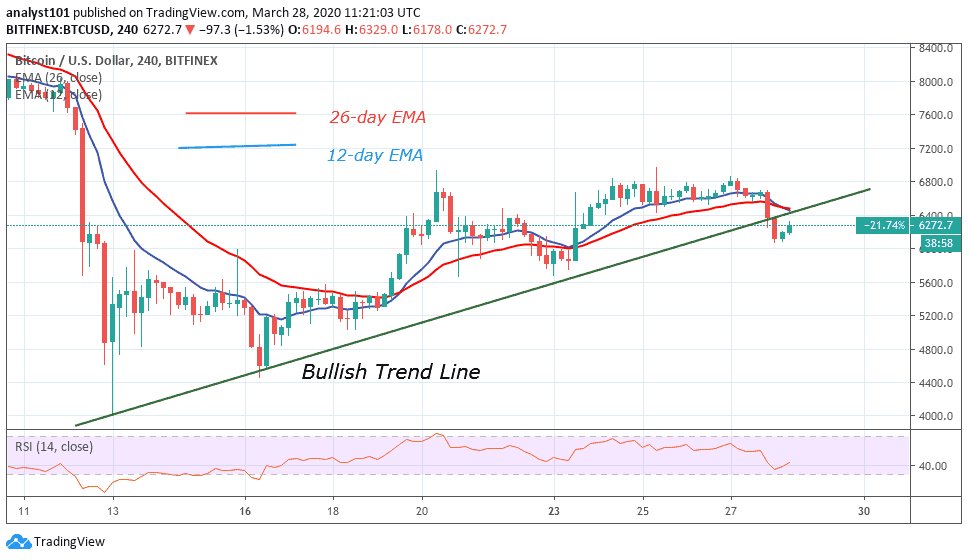

BTC/USD Medium-term Trend: Ranging (4-Hour Chart)

On the 4-hour chart, Bitcoin is making a series of higher highs and higher lows. On March 28, the bears broke the bullish trend line and closed below it.

The implication is that the uptrend is terminated. Bitcoin may probably resume a downward move. Nonetheless, if the breakout that occurs is partial, price will return above the trend line. Possibly, a fresh upward move will resume. Bitcoin is presently at level 42 of the Relative Strength Index. This indicates that Bitcoin is still in the downtrend zone and below the centerline 50. Bitcoin may likely fall in the downtrend zone.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage