Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – March 14

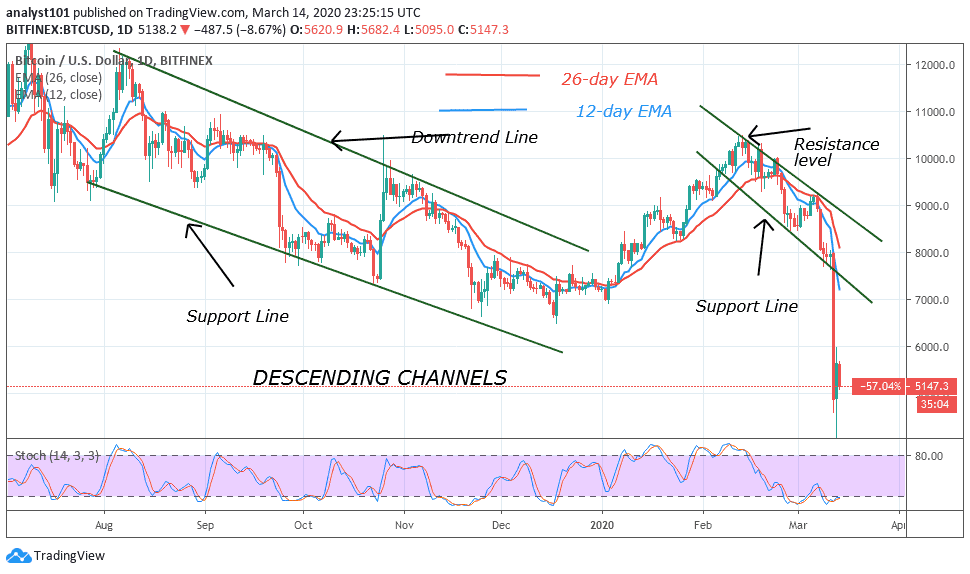

BTC/USD pair faces resistance at $6,000, as the market attempts to fluctuate between $4,500 and $5,500. The bulls will have the advantage if the market is above $6,000.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

After the price breaks down from the high of $8,000, BTC /USD pair has been consolidating between $4,500 and $5,500. The bulls could not trade above $6,000 because of its inability to buying power at a higher level. This also translates that the selling pressure may not have ended. Meanwhile, the market is consolidating between $4,500 and $5,500. In this tight range, the price can either way.

Assuming we have another price break down, BTC will fall to the low of $3,800. On the upside, if price breaks above $5,500, there is the likelihood of the market reaching a high of $6,500. In December, the market fell to the low of $6,800 before the resumption of an uptrend. Bitcoin is still below 20% range of the daily stochastic. It means that BTC is in the oversold region suggesting buyers take control of price.

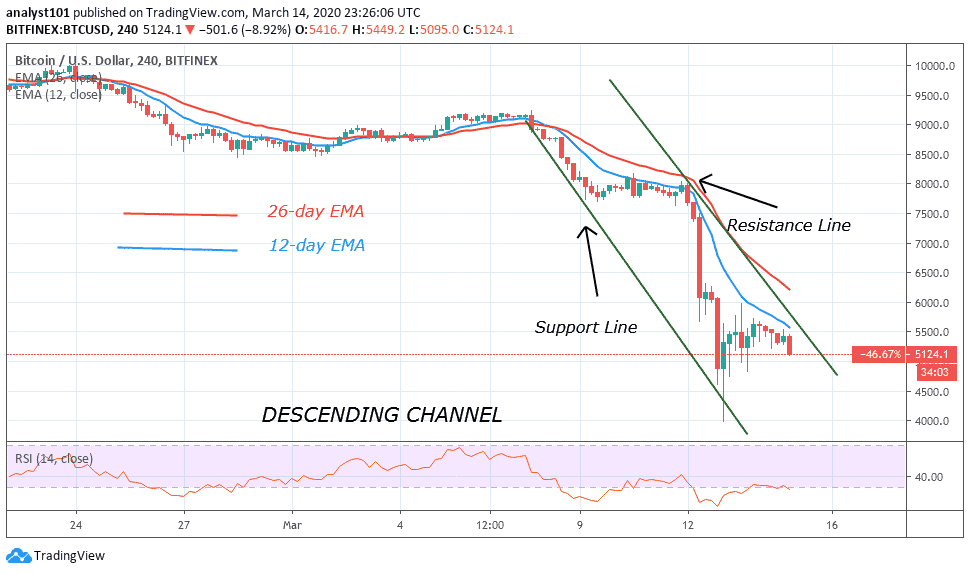

BTC/USD Medium-term Trend: Ranging (4-Hour Chart)

On the 4-hour chart, Bitcoin is in a descending channel as the price is making a series of lower highs and lower lows.

If the price breaks the lower support level, the downward move will continue. On the other, if price breaks the resistance line, the upward move will resume. Meanwhile, Bitcoin is at level 31 of the Relative Strength Index level. This indicates that Bitcoin is getting closer to the oversold region of the market. It is also below the centerline 50 which invariably indicates that it may further fall.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage