Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is down 1% in the last 24 hours to trade for $42,205 as of 5:50 a.m. EST time on trading volume that climbed 8%.

It comes after the Federal Open Market Committee (FOMC) meeting on January 31, where Fed chair Jerome Powell dashed March rate cut hopes.

9/ FOMC GUIDE:

▸ Short-term impact

▸ Source of price shocks (elevated risk)

▸ Trading on volatile days is not safe

▸ Most often: coin flip

▸ If windfall profit: exit

▸ “Buy the rumor, sell the news”

▸ Disparity (expectations vs. reality) -> volatility

Finally👇 pic.twitter.com/7Yfumz7VTK

— Adrian Zduńczyk, CMT (@crypto_birb) January 30, 2024

Key Takeaways From Latest FOMC Meeting

During the Wednesday FOMC meeting, Fed chair said that the interest rates would remain unchanged.

Today was the 4th FOMC in a row where they paused.

Since 1990 the average length between the last rate hike and first cut is 10 months.

If the Fed waited until June to cut it would put it in line with history. pic.twitter.com/sOBAwDiIfb

— QE Infinity (@StealthQE4) February 1, 2024

He added that the first rate cut is likely to happen in May. While keeping the rate cuts unchanged was expected, market participants expected a possible cut in March. According to Powell, however, there may be no rate cuts until such a time when the Fed has greater confidence that inflation is moving toward its 2% target.

Read Chair Powell's full opening statement from the #FOMC press conference (PDF): https://t.co/jqzufcumTC pic.twitter.com/U9OU6M6uvV

— Federal Reserve (@federalreserve) January 31, 2024

One trader and analyst, @Ashcryptoreal believes the possibility of a rate cut in May is very bullish. This is because this would be right after the halving event in April.

🚨 BREAKING 🚨

FOMC : THE FED HAS ANNOUNCED

NO RATE HIKE. RATES UNCHANGEDTHE 1ST RATE CUT IS EXPECTED TO

HAPPEN IN MAY WHICH IS AROUND

BITCOIN HALVINGTHIS IS VERY BULLISH 🔥

— Ash Crypto (@Ashcryptoreal) January 31, 2024

Bitcoin Price Outlook After FOMC Kept Interest Rates Unchanged

The Bitcoin price faced a rejection from the ascending trendline, with Powell’s remarks about March sending BTC price lower. Judging from the outlook of the Relative Strength Index (RSI), momentum is falling. If the trajectory continues, the RSI could soon execute a sell signal by crossing below the signal line (yellow band).

Its position below the 50 midline is also concerning, pointing to a bearish cycle. The Moving Average Convergence Divergence (MACD) accentuates this as it is also in negative territory. If the bears have their way, the Bitcoin price could extend the fall to the $40,726 support level. A break below this buyer congestion level could see the fall extend to the 100-day Simple Moving Average (SMA) at $40,293.

Below the aforementioned levels, the Bitcoin price could roll over into the demand zone between $38,496 and $39,895. A breach of the midline of this order block at $39,196 could confirm the continuation of the fall for the Bitcoin price, sending it to the critical support at $37,800. Beyond here, the cliff could send BTC to $30,000. A break and close below this level would invalidate the big-picture bullish outlook.

TradingView: BTC/USDT 1-day chart

Converse Case

On the flipside, if the bulls increase their buying pressure, the Bitcoin price could push north, flipping above the ascending trendline and making the $43,750 blockade a support floor. Enhanced buyer momentum could catapult BTC to the $48,000 resistance level, or in highly bullish cases, reach for the $50,000 psychological level. This would constitute nearly 20% in gains above current levels.

On-chain Metric Perspectives Of The Bitcoin Price

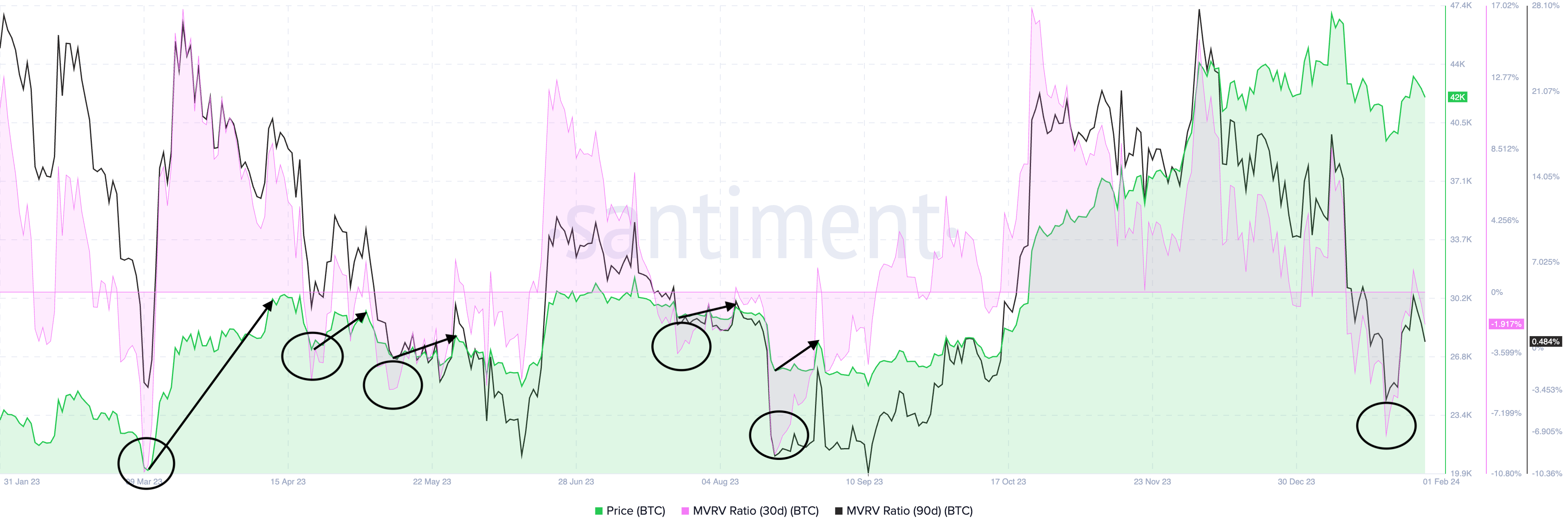

Despite the bearish outlook in the Bitcoin price, on-chain metrics from Santiment suggest a buy signal for BTC. Specifically, the Market Value to Realized Value ratio (MVRV) shows BTC is ripe for buying. A close examination of this metric shows that every time the 30-day MVRV dipped below the 90-day MVRV ratio, the Bitcoin price rallied within the next 10 days. See between January 22 and 25 on the chart below, which indicates there is a “buy the dip” window that traders could take advantage of to achieve short-term gains. The MVRV metric checks the average profit or loss of traders in a given time period,

Bitcoin Santiment: MVRV ratio 30-day and 90-day

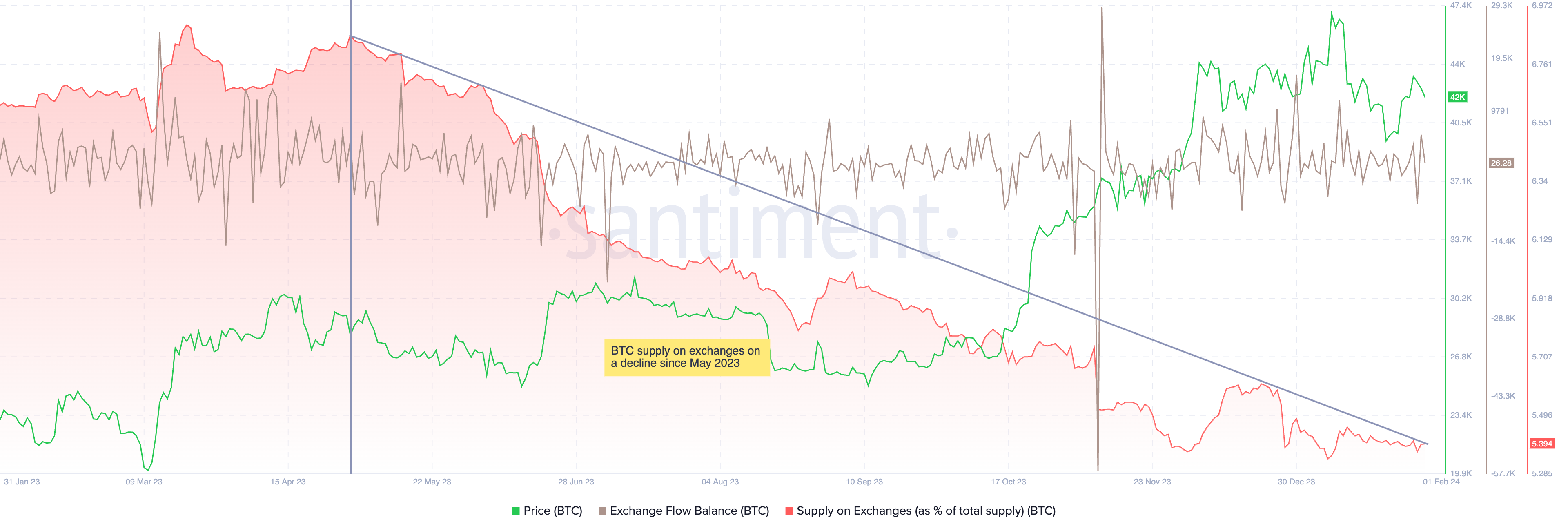

In addition, the BTC exchange supply metric has been on a steady descent since May last year. Representing dwindling reserves, it points to easing selling pressure on BTC, thereby giving the bulls a chance to take over. The exchange flow balance metric has also been showing spikes as of late.

This represents outflows from exchange wallets. It means traders are likely withdrawing their BTC from exchanges in favor of private custody.

BTC Santiment: Supply on exchanges and exchange flow balance

With @Ashcryptoreal already anticipating the impact rate cuts and halving could have on Bitcoin price, forward-looking investors are already growing their BTC portfolios. One way to do that is through the Bitcoin Minetrix ecosystem’s innovative cloud-mining technique.

Experiencing an easy entry into cloud mining through #BTCMTX! 💻⛏️

Leveraging advanced equipment for cost efficiency, avoiding concerns about electricity bills or bulky setups.

No resale worries either – letting mining companies handle hardware upgrades. 🚀 pic.twitter.com/tT804GCHWu

— Bitcoinminetrix (@bitcoinminetrix) January 17, 2024

Promising Alternative To Bitcoin

Bitcoin Minetrix provides you with arguably the best alternative to Bitcoin and analysts rank BTCMTX among the best penny cryptos to buy now. The token, which powers its ecosystem, is available for purchase at $0.0132, which will increase in less than four days.

#BitcoinMinetrix Stage 23 is wrapping up in just 4 days!

Can you explain the role of hashing in $BTC mining? 🤔💻 pic.twitter.com/zRpeBVcg1O

— Bitcoinminetrix (@bitcoinminetrix) February 1, 2024

Presale sales have reached upwards of $10 million, with the $10.928 target objective now in sight.

Big Announcement! 🎉#BitcoinMinetrix has hit a phenomenal milestone, raising over $10,000,000! 🪙 pic.twitter.com/toEsT1NvWv

— Bitcoinminetrix (@bitcoinminetrix) January 31, 2024

For investors that already hold BTCMTX, you do not have to wait for the presale to end. The same applies to anyone looking to buy BTCMTX. Stake your holdings for mining credits and thereafter redeem or burn these credits for mining hash power.

🔍 Delving into the disparities between #BitcoinMinetrix and Conventional Cloud Mining!

Lock In Period: ⏰#BTCMTX: Variable dependent on staking.

Traditional Cloud Mining: Fixed timeframe.Choosing wisely for your mining journey! 🛠️💰 #CryptoMining #CloudMining pic.twitter.com/9GN0FEbu8n

— Bitcoinminetrix (@bitcoinminetrix) January 29, 2024

That’s the mechanism that underpins the project’s cloud-mining approach, which decentralizes and tokenizes the entire process for maximum user convenience.

Visit Bitcoin Minetrix website to buy BTCMTX in the presale here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Best Meme Coins to Buy Now – Keep an Eye on These 100X Potential Cryptos

- Bitcoin Price Prediction: Rich Dad Poor Dad Author Robert Kiyosaki Expects To Make A Fortune From His BTC As This Bitcoin Cloud Mining Platform Soars Past $10 Million

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage