Join Our Telegram channel to stay up to date on breaking news coverage

As the crypto market shows signs of renewed momentum, investors are paying close attention to digital assets with strong fundamentals, rising user activity, and strategic development plans. With Bitcoin consolidating near key levels, many traders are turning to altcoins and presale tokens for higher potential returns.

Recent trends suggest that traders are looking beyond short-term price swings and focusing on long-term potential, especially in projects with utility. This article highlights some of the best crypto to buy right now.

Best Crypto to Buy Right Now

Sei has experienced increased market attention recently, with its token trading at $0.2199, marking a 28.89% rise over the past 30 days. Meanwhile, Solaxy continues its presale phase, which is expected to end in 26 days. Investor interest remains strong as the project approaches its token sale deadline.

At the same time, SAND is currently valued at $0.3022 and has posted a monthly gain of approximately 12.35%. In other news, Bitcoin has struggled to surpass its all-time high, on-chain data centered around its “realized price” indicates potential for continued upward momentum.

1. Sei (SEI)

Sei is a Layer 1 blockchain designed to offer high-speed, cost-efficient transactions while remaining compatible with Ethereum. The platform allows multiple transactions to be processed at once rather than in sequence, reducing network congestion and speeding up performance. This approach helps Sei deliver faster transaction finality and supports complex decentralized applications (dApps) with lower fees.

The platform is preparing for a major upgrade, known as the Giga update. This update aims to increase Ethereum Virtual Machine (EVM) throughput by up to 50 times. It will also target improvements across execution, consensus, and storage, aiming to close the performance gap between blockchain infrastructure and traditional web technologies.

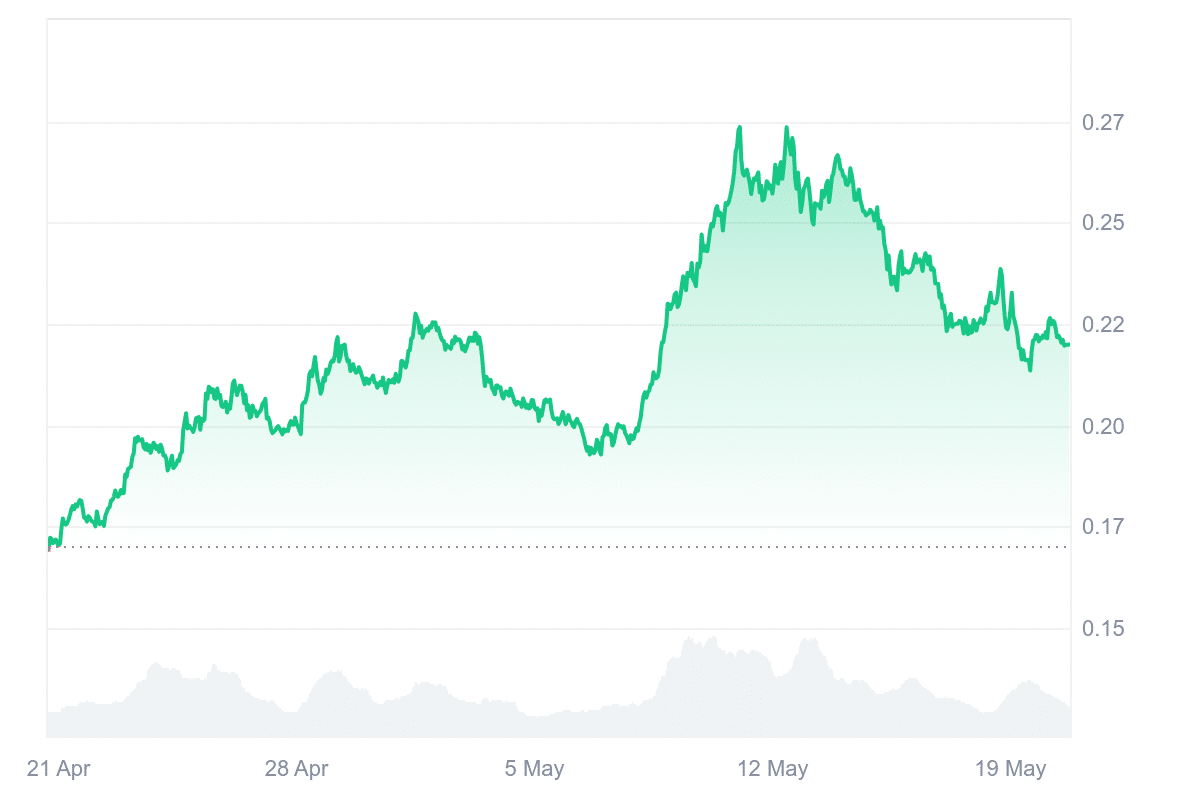

Sei’s market activity reflects a growing interest, with the token currently priced at $0.2199 and showing a 28.89% gain over the past month. It maintains a high liquidity level, with a 24-hour volume to market cap ratio of 0.0925. Technical indicators suggest neutral momentum, as the 14-day Relative Strength Index sits at 48.79, typically associated with sideways trading.

ICYMI: 'State of Sei' Messari Report Insights

'Gaming continues to be Sei's highest-growth sector by transactions' with sector-related transactions increasing 79.8% QoQ.

EVM-compatibility, sub-second finality, and continued sector momentum make Sei the place to bring great… pic.twitter.com/dbaZFcZBlu

— Sei 🔴 (@SeiNetwork) May 15, 2025

According to a recent Messari report, gaming drives much of Sei’s network usage. Transactions linked to the gaming sector increased by nearly 80% quarter-over-quarter, making it the platform’s fastest-growing area. Sei’s EVM compatibility and sub-second finality support this trend, offering a favorable environment for developers building blockchain-based games.

2. BNB (BNB)

Binance has established itself as a major player in the crypto ecosystem, not just as an exchange but as a broader network of blockchain-based services. The BNB token, central to Binance’s ecosystem, has seen notable growth since its launch. Its role extends beyond simple trading; it fuels various functions across Binance platforms, including transaction fee discounts, participation in token sales, and ecosystem governance.

Currently, BNB trades at $645.12, reflecting a slight intraday dip of 0.21%. However, BNB shows a 9.44% gain over the past month. This positions the token closer to the upper end of its recent trading range, between $584.61 and $690.38. The token has recorded positive daily performance in 16 of the past 30 days, suggesting steady interest from market participants.

Sentiment around BNB appears bullish, supported by a Fear & Greed Index reading of 71, indicating strong market confidence. Technical analysis also shows that BNB is trading 5.10% above its 200-day simple moving average, signaling long-term strength. The 14-day Relative Strength Index (RSI) stands at 67.21, placing it in the neutral zone. This suggests price movement may stabilize soon without clear upward or downward pressure.

3. The Sandbox (SAND)

The Sandbox is a blockchain-based platform that merges gaming with decentralized technology. It focuses on giving players tools to create, own, and trade digital assets within a virtual world. Unlike traditional games where users have limited control over in-game items, The Sandbox uses blockchain to allow users to truly own and transfer digital content, making it part of the broader trend of user-generated economies.

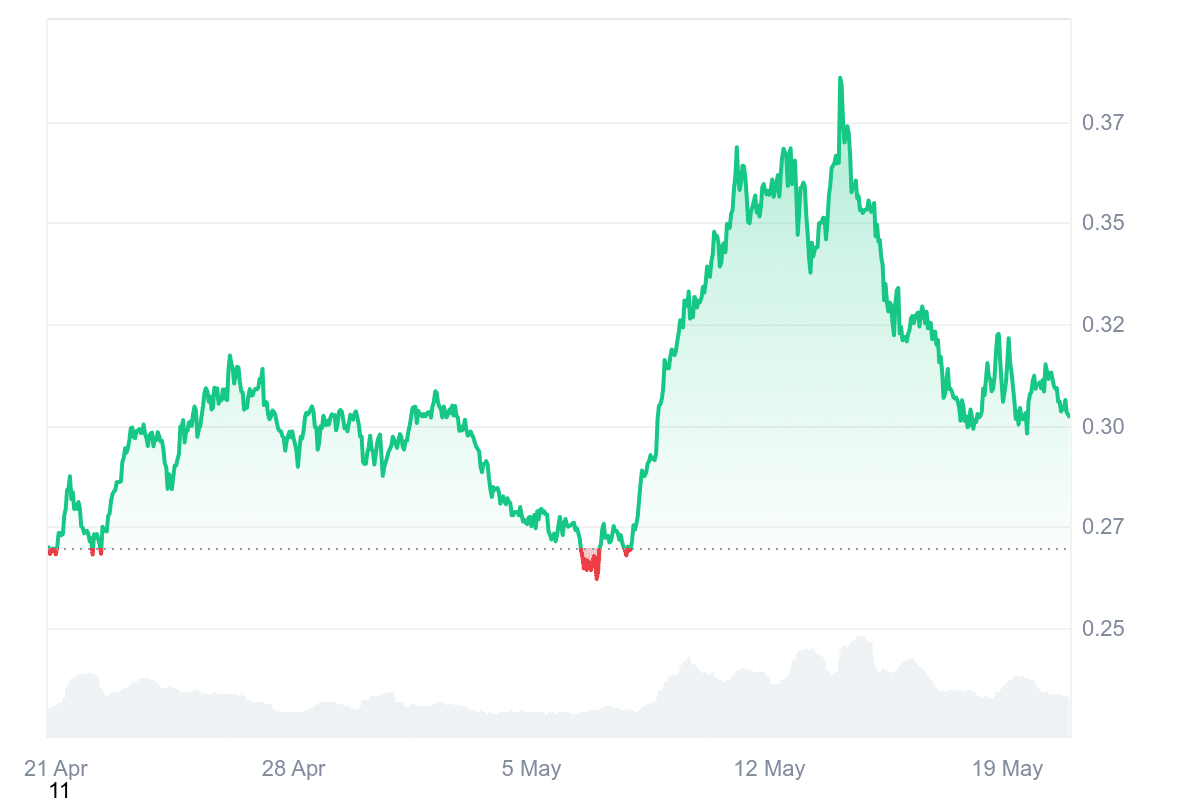

The current price of its token, SAND, stands at $0.3022. Over the past month, it has gained around 12.35%. Despite this recent upward movement, market sentiment remains bearish. This suggests traders may anticipate limited short-term gains or are cautious about volatility. However, the Fear & Greed Index indicates market optimism, currently reading 71, which falls into the “greed” range.

On-chain data points to moderate liquidity. The 24-hour volume to market cap ratio is 0.1510, meaning the token experiences relatively active trading for its market size. The 14-day Relative Strength Index (RSI) is 47.69, placing it in neutral territory. This implies the token is neither overbought nor oversold. Over the last 30 days, volatility sits at 9%, which is relatively stable for the crypto market.

Two is always better than one ✌️

Double jump was part of our latest batch of Abilities in The Sandbox 🚀 Higher leaps, cooler moves, more ways to explore 🎮

Learn how to reach new heights here: https://t.co/Ycek0Tsj76 pic.twitter.com/R2A9O05BKQ

— The Sandbox (@TheSandboxGame) May 17, 2025

In terms of user activity, the token saw 16 green days in the last month, suggesting a mixed performance. While The Sandbox aims to carve out a space in the growing blockchain gaming niche, the current data reflects a cautious but engaged market outlook.

4. Monero (XMR)

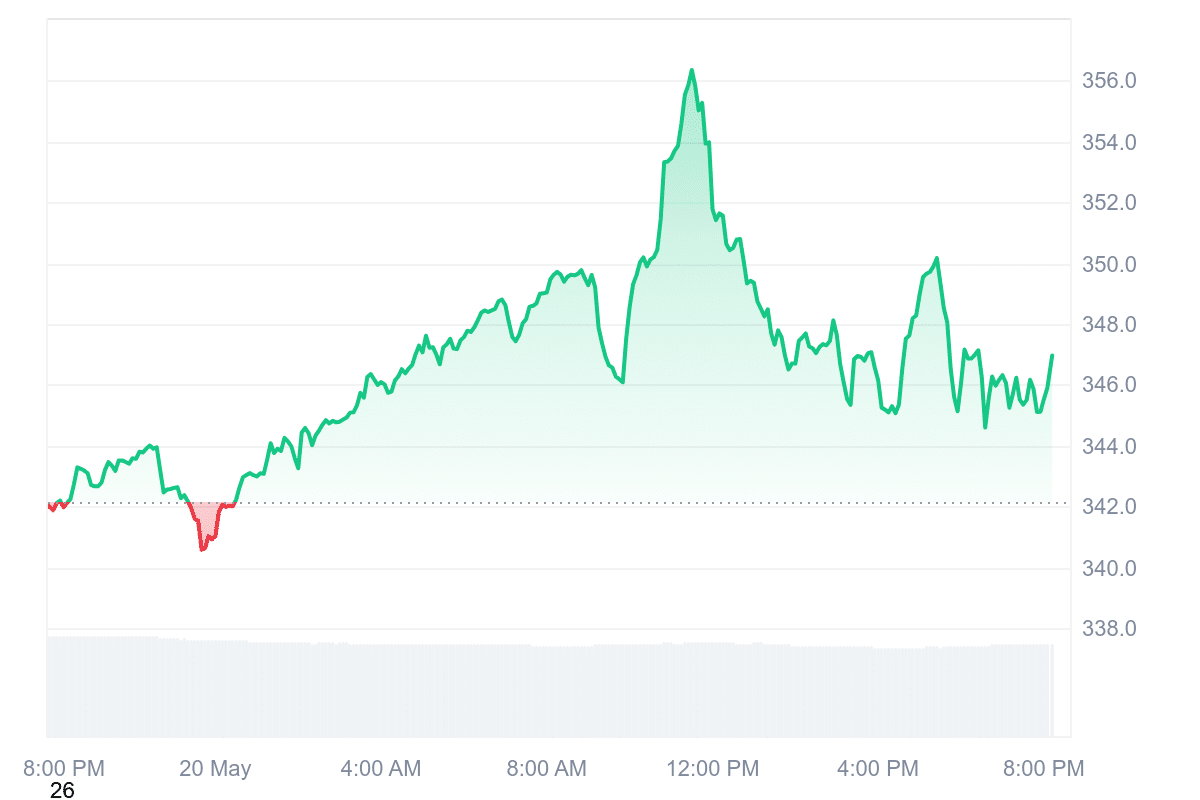

Monero (XMR) has shown strong price activity recently, rising 4.6% over the past week and currently trading at $350. It has gained 1.82% in the last 24 hours, with a monthly increase of over 63%, reflecting growing interest in privacy-focused cryptocurrencies. The market sentiment appears bullish, and the Fear & Greed Index registers at 71, indicating investor confidence.

XMR is trading well above its long-term trend, sitting 102% higher than its 200-day simple moving average (SMA) of $173.50. This suggests sustained momentum over a longer time frame, which traders often interpret as a sign of underlying strength. However, the 14-day Relative Strength Index (RSI) stands at 45.60, placing it in a neutral zone.

Furthermore, Monero has recorded 21 green days out of the last 30, showing consistent short-term gains. Its 24-hour volume to market cap ratio sits at 0.2498, indicating healthy liquidity relative to its size. Additionally, the 30-day volatility is at 16%, well below typical crypto market fluctuations, which indicates more stable price behavior during this period.

Monero’s performance reflects a steady rise supported by trading activity and long-term price trends. While it maintains strong upward momentum, technical indicators suggest a balanced market without extreme conditions.

5. Solaxy (SOLX)

Solaxy ($SOLX) is a blockchain project currently in the final stages of its token presale, which is set to conclude in 26 days. Since the announcement of the closing timeline, investor interest has increased. Over $500,000 in new funds were raised overnight, pushing the total to more than $38 million. At the time of writing, the token is priced at $0.00173, with planned incremental price increases every two days until the presale ends.

We’re going interstellar! 🛸

38M Raised! 🔥 pic.twitter.com/udfUBJ0GBC

— SOLAXY (@SOLAXYTOKEN) May 20, 2025

The platform’s tokenomics suggest a development-focused approach. Out of the total 138 billion token supply, 30% is allocated to support ongoing technology upgrades and decentralized application (dApp) development. Another 20% is reserved to maintain the project’s long-term financial stability. Additionally, 25% of the supply is designated for staking rewards and broader ecosystem incentives to keep the network active and user engagement high.

Moreover, the platform offers staking opportunities, allowing users to lock their SOLX tokens in return for additional rewards. The annual percentage yield (APY) stands at approximately 105%. However, this figure is expected to decline as more participants join during the final presale phase.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage