Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price plunged 7.4% in the last 24 hours to trade for $42,591 as of 7:35 a.m. EST time, with trading volume rising a fraction.

But there was better news for the king of cryptocurrencies when BlackRock CEO Larry Fink said that BTC is an international asset class, adding that investors should consider it an alternative to gold as a hedge against inflation.

“It’s no different than what gold represented over thousands of years,” said Fink in an interview with CNBC. “It is an asset class that protects you.”

CEO of BlackRock, Larry Fink, on Bitcoin:

"I believe it goes up if…people are more frightened of the geopolitical risks, they're fearful of their own risks…

…It's no different than what gold represented over thousands of years. It is an asset class that protects you…" pic.twitter.com/4ogmhANppi

— Bitcoin Bites (@BTC_Bites) January 12, 2024

This is not the first time Fink has expressed such a belief. In an interview in December, the BlackRock executive said that Bitcoin’s rally in October indicates that investors are seeing BTC as a mature asset that can serve as a store of value in times of crisis.

Indeed, BlackRock CEO, Larry Fink, reflected similar claims in an interview from earlier this month

Fink noted that #Bitcoin’s rally this month is an indication that investors are seeing #BTC as a mature asset that can serve as a store of value in times of crisis pic.twitter.com/o1skgg7aU3

— Wakem Capital Management (@WakemCapital) October 31, 2023

Elsewhere, in the wake of open redemption options, the Bitcoin price suffered in the aftermath of Grayscale Bitcoin Trust (GBTC) investors exiting the market. They redeemed their GBTC, selling Bitcoin to the open market. This saw the Bitcoin price dump almost 10% at one point.

Bitcoin Price Drops As Investors Redeem Their Grayscale GBTC Trusts

The Grayscale Bitcoin Trust (GBTC) held more than $25 billion worth of BTC. Selling of those assets may be partly to blame for the downward pressure on Bitcoin’s price.

Bitcoin Price is dumping as people are dumping their GBTC shares.

GBTC held $25bn+ worth of Bitcoin that has been locked up for years with no option to be sold. As soon as the redemption option opened, for the first time people are starting to exit – as they exit the Bitcoin… pic.twitter.com/EqHgpHyVdd

— Ran Neuner (@cryptomanran) January 12, 2024

Arkham Intelligence data shows that Grayscale sent 4,000 BTC worth $183 million to a Coinbase Prime deposit address. This shows investors switching their assets to other ETFs or selling normally.

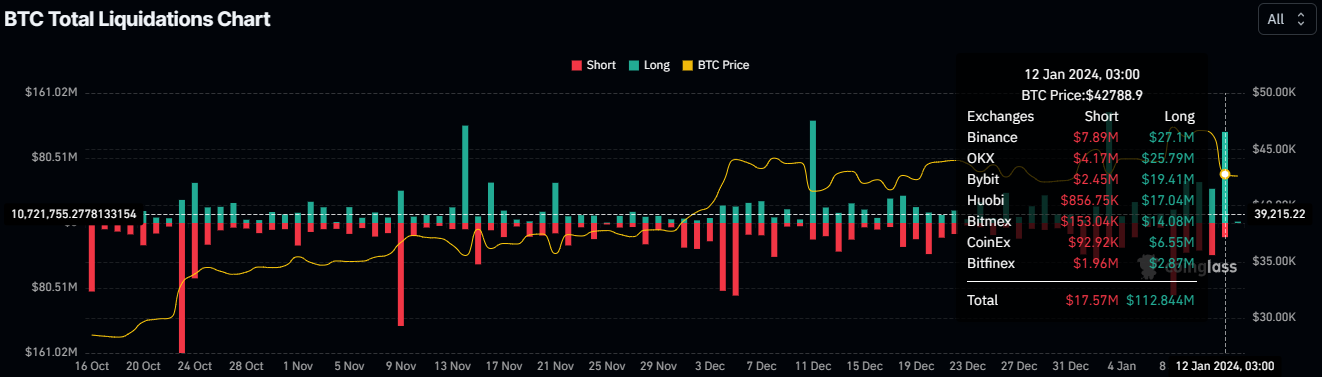

Millions In Liquidations As Bitcoin Price Slumps

With Bitcoin price dumping, around $130 million in total liquidations were recorded. This comprised $112.84 million longs and $17.57 million worth of short positions.

Along with the liquidations, up to $1.19 billion in open interest was wiped out.

Bitcoin Price Outlook As BlackRock CEO Larry Fink Says BTC Is Similar To Gold

With increasing selling pressure, Bitcoin price broke below the lower boundary of the bullish technical formation. There is potential for an extended drop with buyer momentum still dwindling. This is seen in the falling Relative Strength Index (RSI). However, a closer look at this momentum indicator shows an attempt to deviate north as bulls try to reclaim their position in the BTC market.

Enhanced seller momentum could see Bitcoin price drop, first losing the support due to the $50-day SMA at $42,485. Further south, it could test the $40,726 support, or in the dire case, extend the fall to the $37,800.

Nevertheless, for the big picture bullish outlook to be invalidated, Bitcoin price must break and close below the $30,000 psychological level.

The red histogram bars of the Awesome Oscillator (AO) support the bearish thesis, suggesting the bears have a presence in the BTC market. The Moving Average Convergence Divergence (MACD) indicator has also crossed below the signal line, which is a bearish crossover. These accentuate the bearish thesis.

Converse Case

It is impossible to ignore the fact that Bitcoin price enjoys robust support against a downward move. The 50-day SMA at $42,485 presents the first line of defense to the south. Buying pressure above this level could see BTC price push north.

Enhanced buying pressure could see Bitcoin price reclaim back into the fold of the ascending channel above the $44,135 level. Further north, BTC could confront the midline of the channel and potentially go as high as the $48,000 psychological level. In a highly bullish case, the gains could see BTC market value flip the $48,969 range high into support, before using it as the jumping off point to target the $50,000 psychological level. Such a move would constitute a 16% climb above current levels.

Meanwhile, amid the fluctuations in Bitcoin price, much attention is turning to BTCMTX as investors rush to buy the Bitcoin derivative ICO. The token first pumped in value on the back of spot BTC ETF hype, and now also benefits from the expectation of the halving. It also stands among the top three crypto presales to buy now.

A Promising Alternative To Bitcoin

BTCMTX is the ticker for the Bitcoin Minetrix ecosystem, a stake-to-mine project that has analysts enthused. In their opinion, it is one of the best Web 3 projects to buy and a top choice for 2024 ICOs.

Exploring the advantages of #BTC cloud mining!

🚀 Beginner-friendly experience: no need for technical expertise.

💸 Budget-friendly: avoid hefty electricity and hardware costs.

🌐 Bid farewell to space constraints, noise, and heat disturbances.

🔄 Forget about resale concerns! pic.twitter.com/MlwYKwoKLa— Bitcoinminetrix (@bitcoinminetrix) January 13, 2024

Bitcoin Minetrix is in the presale stage, recording upwards of $8.338 million out of a target objective of $9.103 million. Investors looking to buy BTCMTX can do so on the website, where it currently sells for $0.0128.

The #PhoenixGroup secures a $187 million deal with @BITMAINtech for #Bitcoin mining machines, following their recent IPO and partnerships.

What's your take on their strategic moves?💡#BitcoinMinetrix also achieves another milestone and surpasses $8,200,000! 🎉 pic.twitter.com/zoLvO5vxw6

— Bitcoinminetrix (@bitcoinminetrix) January 11, 2024

Visit Bitcoin Minetrix to buy BTCMTX in the presale here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- SEC Approves Bitcoin ETFs, But Gary Gensler Makes It Clear His War On Crypto Isn’t Over

- Bitcoin ETF Hype Helps Attract $151 Million In Inflows To Crypto Funds In The First Week Of 2024

- Bitcoin Price Prediction: As BTC ETFs Usher In A New Era For Crypto, This Bitcoin Derivative Looks Poised To Explode

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage