Join Our Telegram channel to stay up to date on breaking news coverage

The US Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs (exchange-traded funds) on Jan. 10 in a landmark development for crypto, but its chair Gary Gensler made it clear that his war on war on the industry isn’t over.

“While we approved the listing and trading of certain spot Bitcoin ETP shares today, we did not approve or endorse bitcoin,” he said in a statement. “Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

Gensler said it was a court ruling in a case against Grayscale Investments last year that forced his agency’s hand. In that case, a judge ruled that the regulator’s decision to approve Bitcoin Futures ETFs, but not spot Bitcoin ETFs, was ”arbitrary and capricious” in what was a stinging rebuke for the agency.

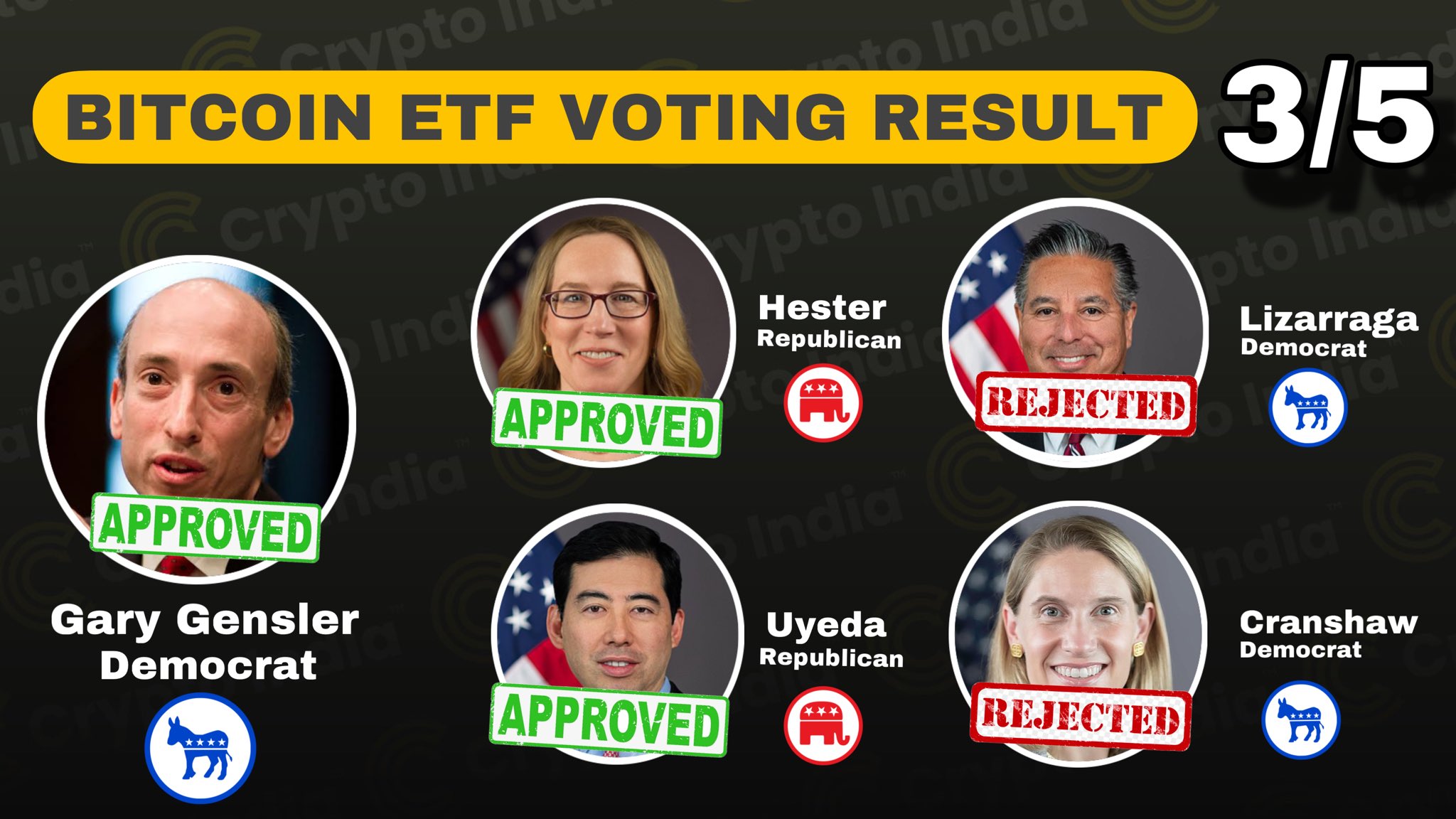

SEC Spot Bitcoin ETF Approval Vote Was 3 Versus 2

The decision to green-light spot BTC ETFs came after a split vote by the five commissioners. Gensler cast the deciding vote on grounds that approvals were “the most sustainable path forward.”

The SEC spot bitcoin ETF approval passed with a 3-2 vote

3 approved:

– Gary Gensler

– Hester Peirce

– Mark Uyeda2 against:

– Caroline Crenshaw

– Jaime Lizárraga— Jacquelyn Melinek (@jacqmelinek) January 10, 2024

Gensler’s underlying opposition to the new investment vehicles received strong support from commissioner Caroline Crenshaw, and also Jaime Lizárraga.

“I am concerned that these products will flood the markets and land squarely in the retirement accounts of U.S. households who can least afford to lose their savings to the fraud and manipulation that appears prevalent in the spot bitcoin markets,” said Crenshaw.

SEC Warned Of Crypto Risks Ahead Of Bitcoin ETF Approvals, Too

The approvals came barely a day after Gensler again criticized the crypto industry in comments on X, warning of ”serious risks.”

If you're considering an investment involving crypto assets, be cautious.

Crypto asset securities may be marketed as new opportunities but there are serious risks involved.

Read @SEC_Investor_Ed's Director Take:

— Gary Gensler (@GaryGensler) January 9, 2024

Cathie Wood, founder and CEO of investment management firm Ark Invest, was among industry figures taken aback by Gensler’s comments yesterday on the ETF approvals.

“He just denigrated the whole crypto space,” she told Bloomberg radio. “I couldn’t believe it. This is par for the course in disruptive innovation. It’s the old DNA basically bashing the new DNA.”

Also Read:

- SEC Ushers In New Era For Crypto With Landmark Bitcoin ETF Approvals For Fund Management Giants

- Bitcoin ETF New Era – 5 Best Cryptocurrencies To Hold In A Traditional Investment Portfolio

- X Blames SEC For Hacked Account That Led To Fake Announcement Of Spot Bitcoin ETF Approvals, Says Regulator Didn’t Have 2FA

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage