Join Our Telegram channel to stay up to date on breaking news coverage

BCH Price Prediction – February 25

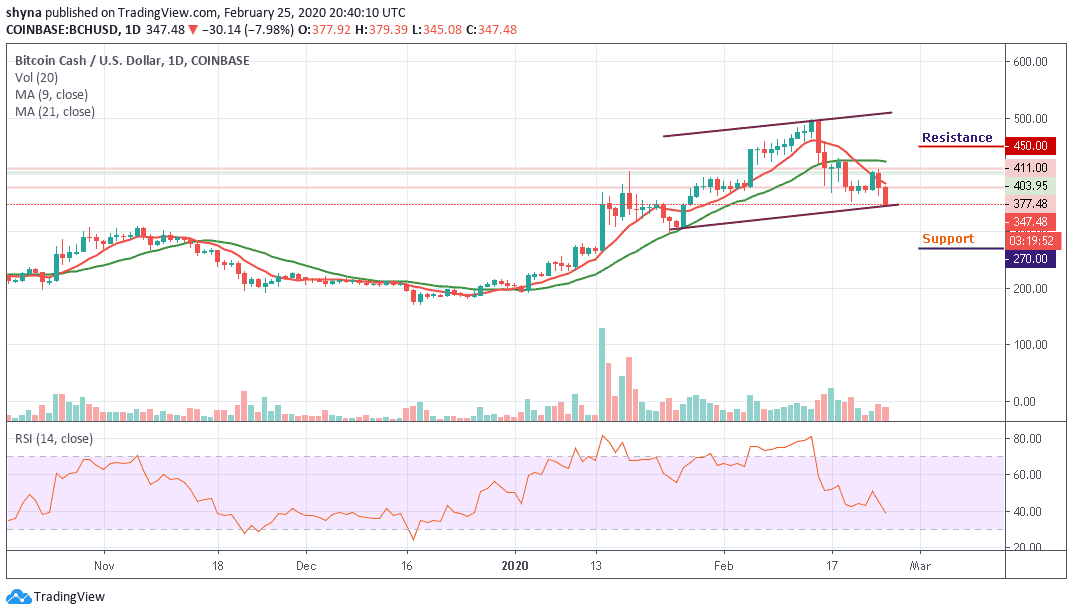

The Bitcoin Cash (BCH) is trading in the red, with losses of 7.98% in the second half of the session.

BCH/USD Market

Key Levels:

Resistance levels: $450, $470, $490

Support levels: $270, $250, $230

At the time of writing, BCH/USD has adjusted lower from $377.48 which is the opening value to trade at $373.11. An attempt to pull upwards has been capped under $400 with $381.01 being the intraday high achieved so far. However, the Bitcoin Cash price upside is limited under $350 as well as the descending trend line resistance. The path of the least resistance remains to the south amid growing selling activities.

Since Bitcoin Cash couldn’t break above the 9-day and 21-day moving averages to move out of the channel for the price has had a bearish inclination for the past few days. It became an uphill task to sustain the gains above the critical $400 due to the renewed bearish momentum emanating from the rejection around $495.

However, if the market drives below the $300 support, BCH price could slump to $270, $250 and $240 support levels, bringing the price to a new low as the RSI (14) prepares to cross below the 40-level. Meanwhile, a strong buying pressure may take the price to $420 resistance. While trading at $420, a bullish continuation is likely to touch the $450, $470 and $490 resistance levels.

Against Bitcoin, the BCH market has evolved for a while in a very different way. But currently, the sellers are gaining control of the market as they move below the 9-day and 21-day moving averages around the lower boundary of the channel while the RSI (14) moves below the 40-level, indicating more bearish signals.

Similarly, the downtrend is seen giving the sellers the confidence to increase their entries. More so, if the bears succeeded in breaking below the channel, one would expect the market to fall to the support level of 0.033 BTC and 0.031 BTC. In other words, a rebound could increase the price to the resistance level of 0.043 BTC and 0.045 BTC.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage