Join Our Telegram channel to stay up to date on breaking news coverage

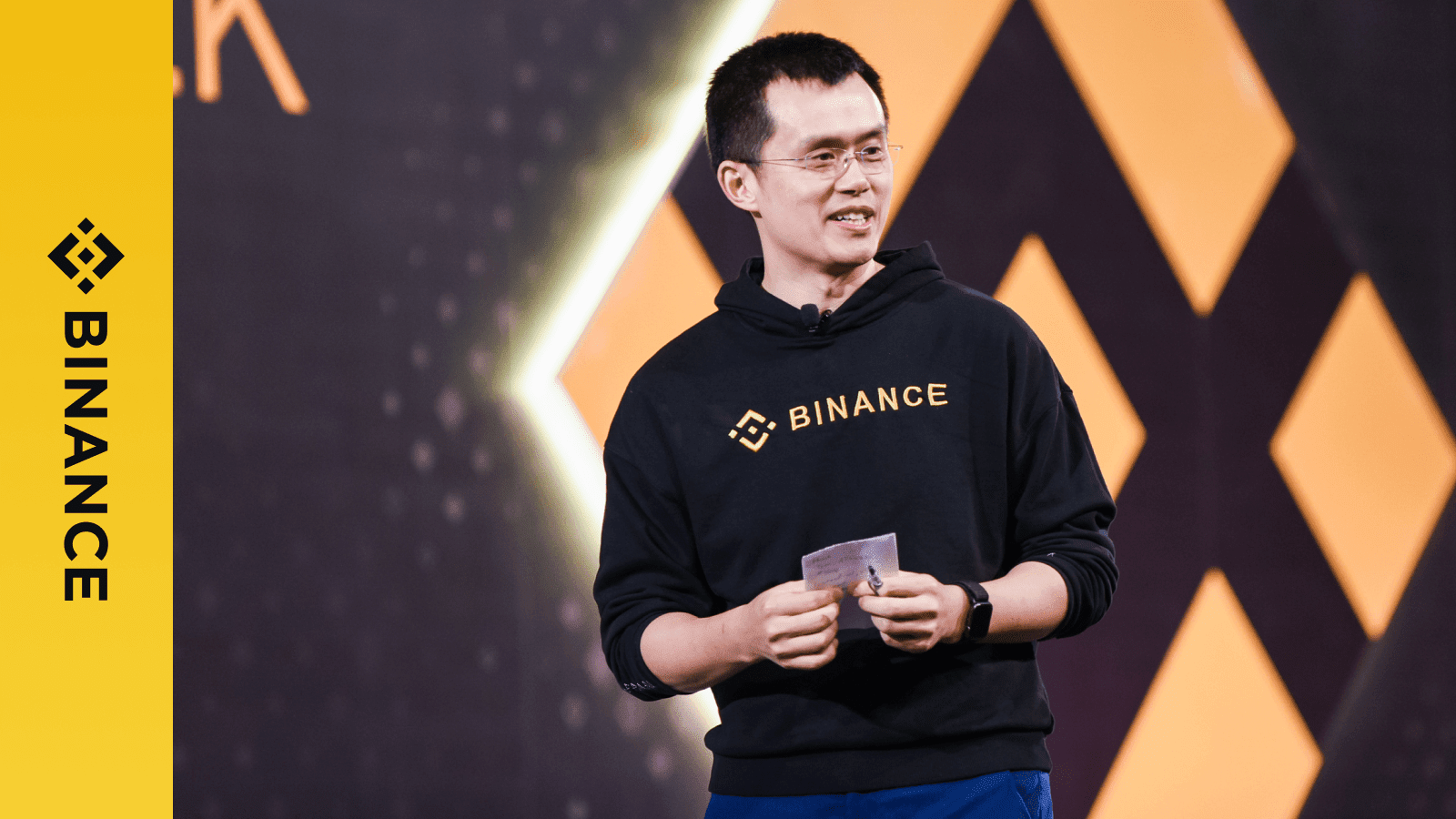

Tesla sold nearly $1 million worth of Bitcoin, according to its Q2 2022 filings. The sale has triggered mixed reactions from the crypto community, including from the CEO of Binance. Changpeng Zhao. Zhao has dismissed Tesla’s sale of most of its Bitcoin, saying it had little to no impact on the market.

Binance CEO dismisses Tesla’s Bitcoin sale

According to Zhao, Elon Musk’s decision to offload 75% of its Bitcoin holdings “does not mean much.” He said that this sale would not harm Bitcoin’s fundamentals, adding that he was still holding most of the coins he bought while venturing into crypto.

During the Q2 earnings call, Musk explained why the company had dumped most of its Bitcoin holdings. He said that the company needed cash to support the newly opened factories in Germany and the US. Part of the cash would also provide increased cash flow for Tesla’s operations in China affected by COVID-19 lockdowns.

Your capital is at risk.

Tesla was one of the largest corporate Bitcoin holders. The company announced it would enter into Bitcoin early last year. In March, the company had even reported plans to accept Bitcoin payments, but it halted the plans because of environmental concerns.

In a CNBC interview, Zhao confirmed that he was still holding Bitcoin. He said he was still in possession of almost all the original coins he bought when entering the marketing, adding that less than 1% had been spent from his Bitcoin holdings.

In early June, Zhao also said that he did not hold any fiat currencies, and all his holdings were in cryptocurrencies. He said that crypto was the only financial asset he used to make all his life purchases, and he did not have to sell his crypto assets to cover any of his expenses.

Binance distances itself from failed companies

During the interview with CNBC, Zhao said that Binance had very little exposure to failed cryptocurrency lending companies such as Celsius and Voyager Digital. He said Binance was not a creditor or a debtor in the crypto space.

In response to whether Binance detected any risks within these companies and avoided them, Zhao said Binance preferred to operate simply. Therefore, the company only facilitated crypto trading and was not involved in any crypto lending business

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage