Join Our Telegram channel to stay up to date on breaking news coverage

When considering the best cryptocurrencies to invest in right now, it’s essential to analyze the current market trends, technological advancements, and overall project potential. With the cryptocurrency market constantly evolving, investors are drawn to projects that demonstrate strong fundamentals, active development teams, and practical use cases.

Several altcoins and Layer 2 solutions are gaining traction due to their innovative approaches. This article will explore a selection of cryptocurrencies that have shown promise in recent months, offering insights into why they might be worth considering for your portfolio.

Best Cryptocurrencies to Invest in Right Now

Monero has recently begun to show signs of recovery, experiencing a 4.86% increase in value over the last 24 hours. This uptick has led to cautious optimism among its supporters. Meanwhile, Polygon has demonstrated resilience, maintaining its relevance in the market. Additionally, Memebet has attracted considerable interest within the cryptocurrency community, successfully raising over $391,000.

1. Monero (XMR)

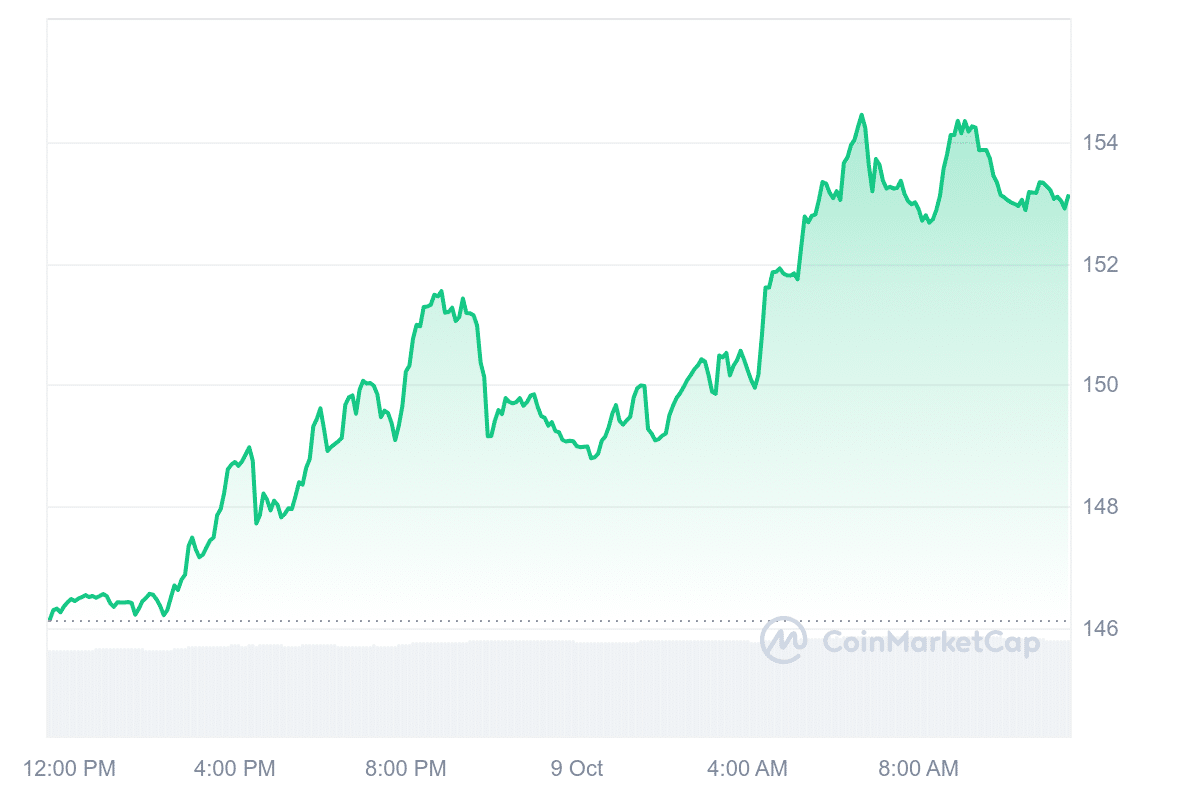

Monero has shown early signs of recovery, rising 4.86% in the past 24 hours. This increase has sparked cautious optimism among supporters of the token. The 24-hour price chart shows a general upward trend with some noticeable volatility. Despite fluctuations, Monero’s price climbed from $146 to about $154, suggesting positive market momentum.

The sudden rise indicates potential resistance at this level. As of the latest data, Monero is trading at $153.10, reflecting a bounce from its monthly low. This price movement has been accompanied by a 10.29% increase in daily trading volume, surpassing $57 million, according to CoinMarketCap. The increased volume hints at growing liquidity and trading interest, suggesting the market could be experiencing renewed activity.

Despite this short-term recovery, Monero is still far below its all-time high of $542.33 in January 2015. The current price represents a 71.5% decline from that peak, highlighting the asset’s long-term challenges in regaining previous levels.

However, broader market sentiment toward Monero remains positive. According to CoinMarketCap’s community poll, more than 83% of 2,084 respondents expect further upward movement in its price. This optimism may reflect confidence in Monero’s token.

2. Flare (FLR)

Flare aims to improve blockchain functionality by providing developers with decentralized access to reliable data from other blockchains and the internet. This feature allows new use cases for decentralized applications (dApps) and enables solutions to serve multiple blockchains through a single deployment.

As decentralized finance (DeFi) grows, the need for secure, scalable, and cost-effective oracle systems becomes more critical. Oracles provide external data to blockchains, and Flare addresses this by incorporating built-in oracles within its platform.

Flare’s ecosystem is expanding, supported by over 150 strategic partners, including significant infrastructure providers such as Google Cloud, Figment, and Ankr. Recent integrations with LayerZero V2, Stargate, and Polyhedra have introduced secure bridging solutions, enabling seamless transfers of assets like USDT, USDC, and ETH into the Flare network.

As onchain finance continues to expand, the demand for secure, cost-effective, and scalable oracle systems rises ☀️@FlareNetworks is creating a new DeFi Hub with a full-stack EVM L1 featuring built-in oracles and a robust ecosystem, opening up exciting opportunities for devs… pic.twitter.com/X14RNz12mA

— Flare ☀️ (@FlareNetworks) October 8, 2024

At press time, Flare’s price is $0.01459, down 2.17% in the past 24 hours. However, the market cap is up 0.40%, hitting $731.8 million. Furthermore, Flare’s price has fluctuated between $0.014 and $0.017 in the past month, recording an increase of 0.66%.

Over the past year, the price has increased by 50%, and it has experienced 15 positive trading days out of the last 30. According to Coincodex, Flare’s price is predicted to rise by 227.1% to $0.048388 by November.

3. Polygon (MATIC)

Polygon has experienced significant price volatility in recent weeks, resulting in a bearish trend and a negative return on investment (ROI). Despite this downturn, there remains optimism among investors and analysts who believe in its long-term potential. Several industry experts have continued to back Polygon, emphasizing its ability to recover as a key player in the Ethereum ecosystem.

One of the main drivers of confidence in POL is its active developer community, which remains committed to improving the platform. This optimism is further supported by the token’s price surge in July, indicating its potential for upward movement. As of now, POL is trading at $0.376, with a minor fluctuation of 0.15% over the last day.

In terms of performance, Polygon has demonstrated some resilience despite recent challenges. It has had 16 green days in the last 30 days, making up 53% of that period, and maintains high liquidity in relation to its market cap.

.@xaltsio and Polygon Labs have recently joined the Qatar Financial Centre Authority (@QFCAuthority) Digital Assets Lab to test and commercialize use cases in real-world asset tokenization 🌟

the future is RWAs on Polygon https://t.co/qO5L1vk658

— Polygon | Aggregated (@0xPolygon) October 8, 2024

Further solidifying its position in the market, Polygon has partnered with Xalts and Polygon Labs to join the Qatar Financial Centre Authority’s (QFCA) Digital Assets Lab. This collaboration aims to explore real-world asset tokenization. This initiative reflects Polygon’s focus on expanding its use cases and commercial applications in emerging digital asset markets.

4. Memebet (MEMEBET)

Memebet has generated notable interest within the cryptocurrency community, raising over $391,000. This growth has signaled attention to its unique approach that blends the meme coin and GambleFi sectors.

The platform operates through web and Telegram-based gaming channels, offering decentralized betting options. The use of decentralized channels allows for greater user autonomy and reduced reliance on intermediaries, aligning with the principles of blockchain technology.

Furthermore, the project’s slogan, “The casino for meme degens,” encapsulates its mission to merge the excitement of gambling with meme culture. This approach highlights its goal to appeal to users who enjoy both online gaming and the whimsical, sometimes unpredictable nature of meme tokens.

Beyond betting, MEMEBET offers incentives to token holders, including exclusive bonuses and challenges within the casino. The platform also features a play-to-earn system, where users receive airdropped rewards. This mechanism aims to increase user engagement by offering continuous rewards, which are designed to keep participants active in the platform’s ecosystem.

In addition, Memebet stands out through its integration of meme culture into the gambling space. By focusing on meme tokens and implementing decentralized gaming, the platform targets a specific demographic while also benefiting from strategic marketing efforts.

5. Arweave (AR)

Arweave is a decentralized storage network focused on offering permanent data storage solutions. The native cryptocurrency of Arweave, known as AR, is essential for the network’s operations. It incentivizes participants to host and secure data, rewarding them with AR tokens for their contributions.

Recently, Arweave has seen a surge in attention, with its price experiencing an intraday increase of 4.60%, bringing it to $19.55. This uptick reflects a growing interest in decentralized storage options, likely fueled by rising demand from individuals and businesses for data storage.

In terms of performance, The AR token has recorded a significant increase of 379% over the past year. It has outperformed 87% of the top 100 cryptocurrencies during the same period. The coin is currently trading above its 200-day simple moving average, indicating a positive trend. Over the past month, 16 green days have been recorded.

The 14-day Relative Strength Index (RSI) is at 41.65, suggesting that Arweave is currently in a neutral state and may experience sideways trading in the near future. Its market capitalization indicates high liquidity, which supports stable trading conditions.

Arweave’s inflation rate is relatively low, at 0.30% annually, which may help preserve the value of the AR token over time. According to recent predictions from Coincodex, the price of Arweave is expected to rise by 39.14%, potentially reaching $26.21 by November.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage