Join Our Telegram channel to stay up to date on breaking news coverage

Explore the best cryptocurrencies to invest in now, highlighting strong potential and market performance in today’s market.

The crypto market has experienced fluctuations and is currently showing a neutral outlook. Following the release of U.S. CPI data and the FOMC meeting last week, Bitcoin displayed positive movements, influencing the broader market. Meanwhile, certain altcoins, including Arweave, Akash Network, and Uniswap, have all gained momentum recently. These altcoins have garnered attention for their relevance and have exhibited significant volatility in their respective portfolios.

Best Cryptocurrencies to Invest in Right Now

Ondo Finance has partnered with Drift Protocol to integrate Real-World Assets (RWAs) into the Solana DeFi ecosystem. Also, Arweave recently launched the AO Computer, a system designed for scalability through the parallel processing of tasks. Meanwhile, UNI continues to demonstrate a strong market presence and positive trajectory.

1. Ondo (ONDO)

Ondo Finance recently announced its partnership with Drift Protocol, a decentralized trading platform on Solana. This collaboration aims to introduce Real-World Assets (RWAs) into the Solana decentralized finance (DeFi) ecosystem. With this partnership, USDY, a stablecoin, can be used as collateral on Drift’s marketplace.

This integration allows Drift users to engage in margin trading and borrowing using USDY, which could enhance trading volume and liquidity on the platform. Additionally, it may pave the way for more RWA-based tokens to be used as collateral in DeFi, offering traders greater variety and reliability.

The announcement by Ondo Finance was made via an X post on June 18, marking a milestone in the DeFi space. For the first time, yieldcoins will be accepted as collateral on a platform focusing on perpetual contracts.

MANTRA's $USDY Vault, which the Ondo Foundation and MANTRA have incentivized with $ONDO and mainnet $OM, is now live!

(NOTE: USDY is not, and may not be, offered, sold or otherwise made available in the US or to US persons. USDY also has not been registered under the US… https://t.co/GKKI1zidxo

— Ondo Foundation (@OndoFoundation) June 18, 2024

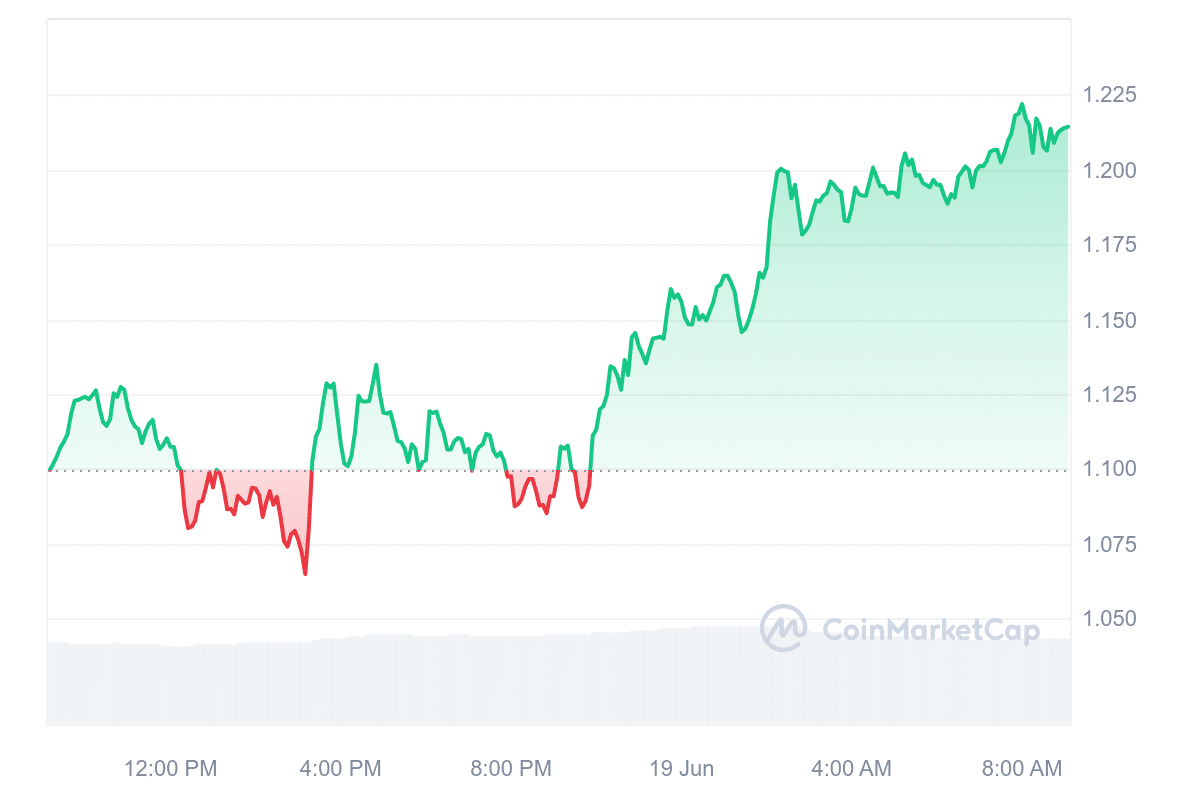

Furthermore, ONDO’s price increase coincides with the recent development, causing its price to surge by 5.55% over the past 24 hours, currently trading at $1.18. The market sentiment around the token’s price shows rising optimism among investors. Similarly, the token’s Fear & Greed Index at 64 indicates rising optimism among investors.

Moreover, the token exhibits high liquidity, reflected in its volume-to-market cap ratio. Also, the coin has experienced 15 green days in the last 30 days and is trading near its cycle high.

2. Akash Network (AKT)

Akash Network is restructuring cloud computing with its unique use of blockchain technology. This platform is designed to be more efficient, secure, and cost-effective than traditional cloud services. It empowers users to buy and sell computing power, making it a valuable tool for website hosting or complex calculations.

Recently, the platform’s token caught traders’ attention after a long period of declining value. AKR’s value was down by about 46% in the past month, but yesterday’s trading session ended on a high note, making many investors optimistic.

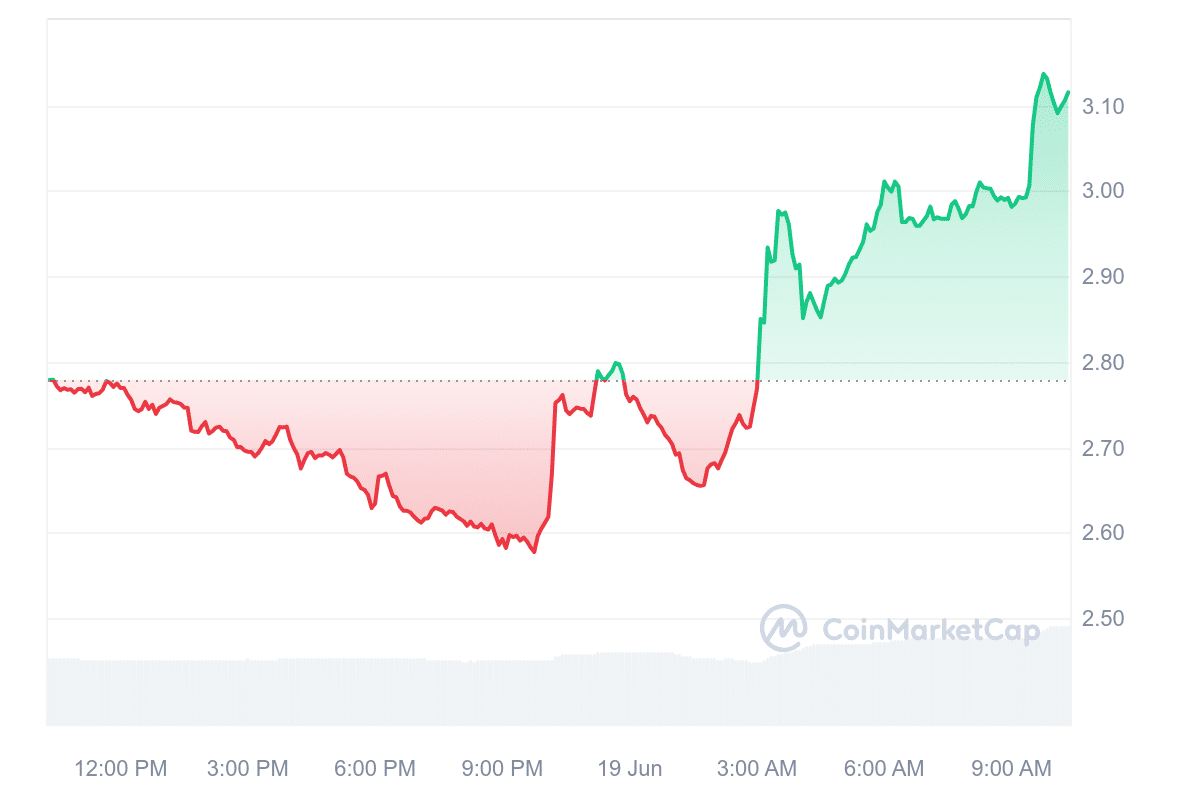

The price of AKT at press time is $3.12, indicating an intraday rally of 12.10%. Its market cap has also increased by 11.45%, reaching $750 million. Moreover, investor sentiment is positive, with the Fear & Greed Index scoring 64, indicating greed.

Meanwhile, the token trades are above its 200-day simple moving average and have high liquidity based on its market cap. With solid fundamentals and support from its community, Akash Network has the potential to grow. If the current bullish trends continue, analysts believe that AKT could surpass $4.08 by the end of the year.

3. Uniswap (UNI)

Uniswap is an Ethereum-based DEX protocol that facilitates cryptocurrency trading through a decentralized authority. The decentralized network allows users to swap digital assets directly from their wallets using a DeFi approach.

Uniswap has generated more fees month-to-date than other decentralized exchanges (DEXs). Insights from Token Terminal show that the network has generated twice the combined total of the next four top DEXs.

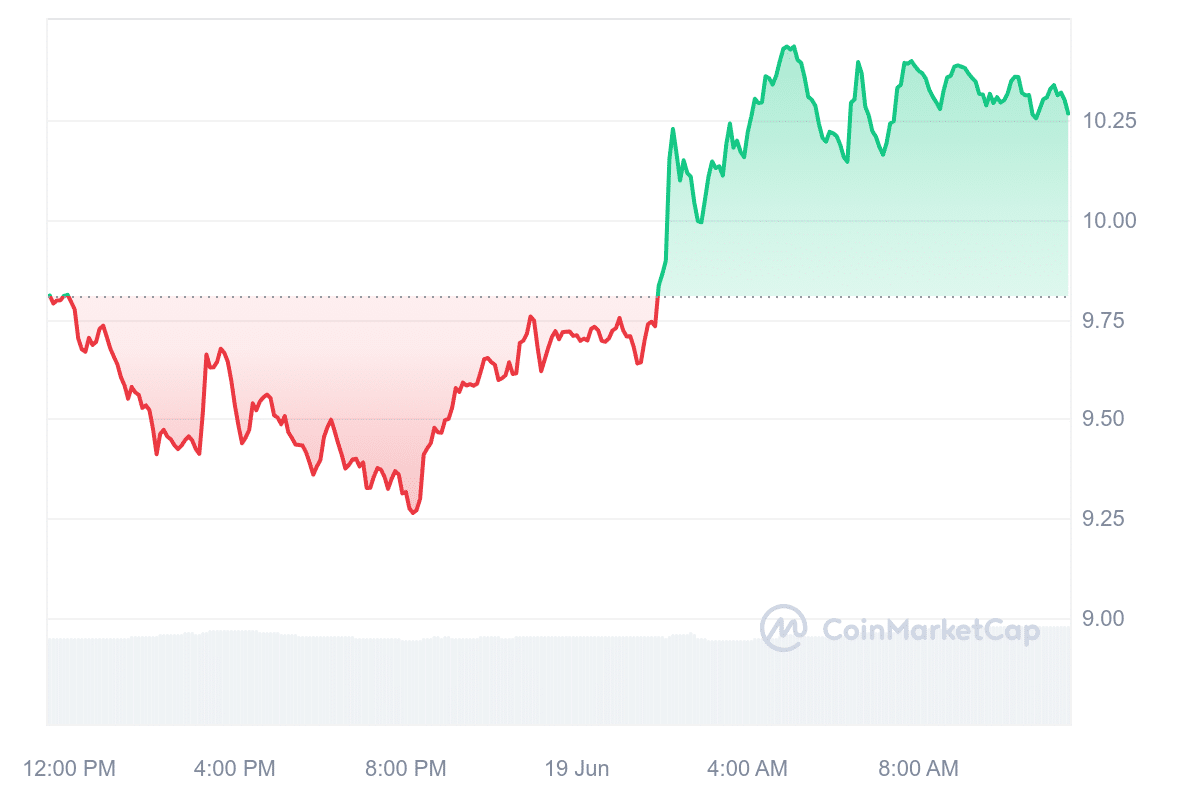

Meanwhile, UNI’s recent market trend reinforces its favorable position and trajectory. UNI trades at $10.27 as of press time, reflecting a 4.55% intraday rally. It has also increased by 6.08% and 32.21% in its weekly and monthly charts.

Over 3.5M addresses have swapped on multiple chains with Uniswap 🤯 pic.twitter.com/IxOL25Tf0w

— Uniswap Labs 🦄 (@Uniswap) June 11, 2024

Moreover, Uniswap’s Greed score of 64 reflects optimism among investors and growing market sentiment. UNI is positioned 94.64% above its 200- SMA of $5.28, indicating a bullish trend. Meanwhile, Uniswap recently unveiled its V2 protocol across several blockchains, including Arbitrum, Polygon, and Optimism.

This expansion seeks to broaden accessibility, functionality, and user interaction within the network. With these positive performances and recent developments, analysts predict a further increase, projecting the token to exceed $17.22, with an average price of $15.62 by year-end.

4. WienerAI (WAI)

WienerAI integrates artificial intelligence (AI) with blockchain technology to offer a unique trading platform to enhance user trading experiences. The platform serves as a personal crypto trading assistant, where users input criteria such as risk tolerance and target gains. The AI then scans the market to identify optimal buying opportunities, leveraging its speed and accuracy to detect market trends effectively.

Moreover, WienerAI’s interface allows users to execute trades directly within the chat system and monitor their positions, simplifying the trading process for users of all experience levels. Furthermore, WienerAI announced the launch of its new trading bot, which is still in development but nearing completion.

We've just raised $6M 🌭🚀

Thank you to our incredible community! Get ready for more exciting adventures with this little Wiener 💥🐾 pic.twitter.com/O6AdG6xrhE

— WienerAI (@WienerDogAI) June 18, 2024

Unlike traditional trading bots that offer simple responses, this bot provides potential trading opportunities based on predictive technology. Users can type in trading queries, and the bot analyzes the market to suggest profitable trades.

It also offers detailed analysis and reasoning for its suggestions, identifying the best prices across various decentralized exchanges (DEXs). The trading bot’s impending launch has significantly boosted the project’s fundraising. At press time, the project has successfully raised $6 million, a testament to the strong investor interest and confidence in the platform’s potential.

Additionally, the platform’s native WAI token is sold at $0.00072 per token, with an anticipated price increase. Early investors who purchase WAI at the current presale rate may see gains when the token becomes available on global exchanges.

In addition, WAI uses AI and blockchain technology to provide a sophisticated yet user-friendly trading experience. By combining market analysis, trading execution, and user-defined criteria, the platform seeks to empower traders with tools that enhance their decision-making processes and improve trading outcomes.

5. Arweave (AR)

Arweave is a decentralized network that offers permanent data storage and hosting services. It operates similarly to Bitcoin, using an open ledger system. The protocol is well-established and widely adopted, ensuring a fully decentralized ecosystem.

Moreover, its primary use cases include preserving critical data and hosting web applications. The platform provides robust learning, utilization, and development opportunities.

Recently, Arweave introduced the AO Computer, designed for high scalability by enabling parallel processing of tasks. Unlike traditional smart contract platforms like Ethereum, applications on AO Computer operate independently without needing a shared global state. The introduction of AO tokens, retroactively minted to AR holders, has garnered significant attention.

The trick to understanding @aoTheComputer?

Changing how you think about consensus.

A quick explainer about how Arweave + AO = Computation.

— Only Arweave (@onlyarweave) June 18, 2024

The total supply of $AO tokens is capped at 21 million. In conjunction with this development, SevenX Ventures, everVision, and BuidlerDAO have collaborated to launch a $10 million ecosystem fund supporting early-stage projects. These projects aim to expand infrastructure, develop applications, and explore other innovations within the AO ecosystem.

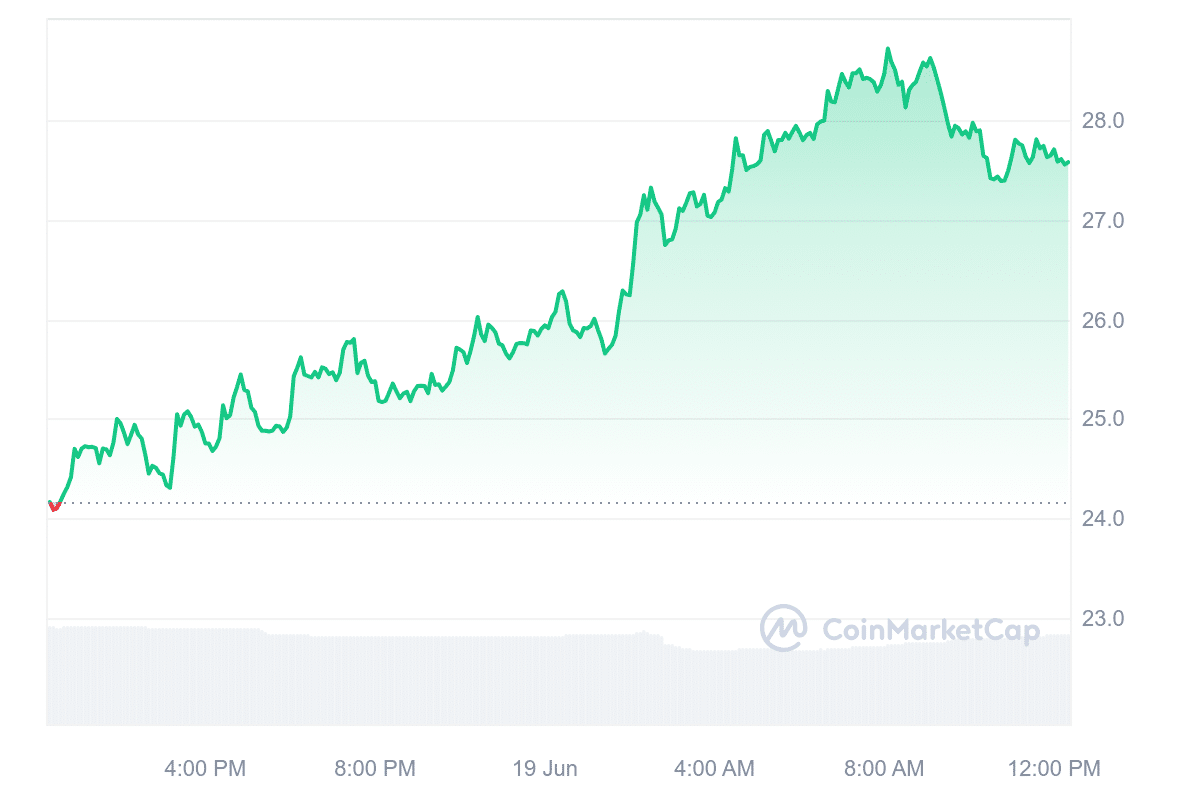

The market response has been notable, with the price of AR increasing intraday by 11.57% to reach $27.52. Sentiment in Arweave’s price prediction is currently bullish, supported by a Fear & Greed Index indicating a level of 64 (Greed). Furthermore, Arweave’s current trading price is 332.31% above its 200-day Simple Moving Average (SMA), which is $6.37.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage