Join Our Telegram channel to stay up to date on breaking news coverage

On the global market trend, Bitcoin miners are gearing up for a potential shift in fortunes as North American summer approaches. Forecasts of intense heatwaves are expected to impact operations, potentially leading to a slowdown in Bitcoin’s unprecedented growth in hashrate.

This anticipated reduction comes at a critical juncture for miners. They have been contending with tightened profit margins since the halving event slashed mining rewards by 50%. This strategic adjustment could offer a brief respite to miners in North America, where a substantial portion of Bitcoin mining occurs, as they navigate the complexities of maintaining profitability in a competitive market environment.

Biggest Crypto Gainers Today – Top List

Today’s crypto market presents a dynamic spectrum of movements, where 21% of cryptocurrencies display positive gains. Amidst this volatility, Convex Finance emerges as the highest gainer, with a remarkable 36.64% surge in the last 24 hours, showcasing robust market momentum. Conversely, Aelf faces the steepest decline, with a 7.57% decrease in value over the same period. Alongside these movements, let’s explore today’s top gainers’ impressive performance and unique market strategies: 1inch Network, Arweave, Maker, and The Graph.

1. 1inch Network (1INCH)

The 1inch Network unites decentralized protocols to provide the most efficient, fast, and secure DeFi operations. Its flagship protocol is a decentralized exchange (DEX) aggregator that sources deals from over 400 liquidity sources across 12 blockchain networks, including Ethereum, BNB Chain, and Polygon. Utilizing the Pathfinder algorithm ensures users obtain better rates than any individual exchange.

The network is secured by non-custodial protocols, with trades executed in a single transaction from users’ wallets. Security audits by firms like OpenZeppelin and Consensys ensure robust smart contracts, highlighting 1inch’s commitment to a decentralized and secure ecosystem.

Furthermore, the 1INCH token, central to the network, serves governance and utility roles. Token holders can stake their tokens to participate in the 1inch DAO governance, influencing decisions like treasury management.

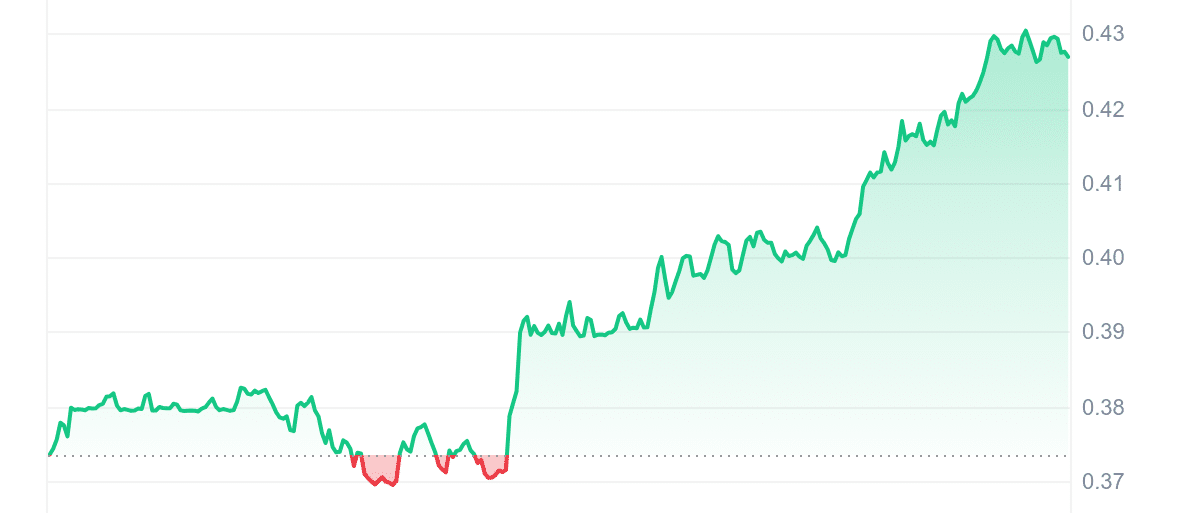

The current price of 1INCH is $0.428027, reflecting a 14.48% increase in the last 24 hours and a 54% rise over the past year. 1INCH is trading 25.37% above its 200-day simple moving average (SMA) of $0.341001, indicating a bullish trend. The token’s 14-day Relative Strength Index (RSI) stands at 53.10, suggesting a neutral market position with potential for sideways trading.

⚡️ Top 10 dApps on #Base by Users Activity (30d)

We present the top dApps on @Base by users activity in the last 30 days, according to the data from @DappRadar.$UNI #1INCH #LAYER3 #ODOS #Jumper $DMAIL #Bungee $MINT $MAV $AERO pic.twitter.com/ANvtmdg7JU

— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) June 12, 2024

In the last 30 days, the token experienced 15 green days, equating to 50% of the period, and maintained a low volatility of 8%. Despite this, 1INCH outperformed only 35% of the top 100 crypto assets by market cap over the last year, showing moderate relative performance.

2. Arweave (AR)

Arweave is a decentralized storage network offering indefinite data storage. Described as “a collectively owned hard drive that never forgets,” it hosts “the permaweb”—a permanent, decentralized web with community-driven applications. Arweave aims to preserve information across generations using its “blockweave” technology, linking each block to the previous one and a random earlier block. It also uses Wildfire to incentivize good behavior among miners.

Arweave’s proof-of-access algorithm secures the network by linking each new block to two previous blocks. Miners must access old blocks to mine new ones, incentivizing extensive data storage. Furthermore, users pay for 200 years of storage upfront, costing $0.005 per megabyte. This affordability stems from declining storage costs. Arweave conservatively estimates a 0.5% annual decline, ensuring long-term data storage.

$100m pre-bridged to AO after <12 hours of rewards.

Devs: This is your signal to build. AO opens an entirely new design space for creation, as well as a wide capital base for your services.

These incentives are with us for the long haul.

100% fair launch. 21m. 4 year halving. https://t.co/3hYWuqtpnz

— 🐘🔗 sam.arweave.dev (@samecwilliams) June 19, 2024

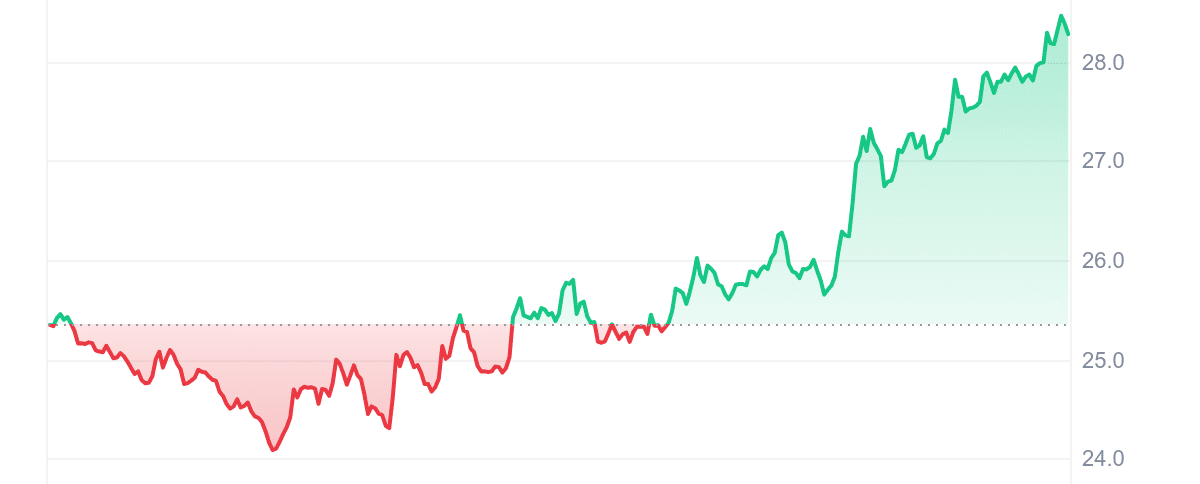

AR’s latest trading price is $28.51, reflecting a 12.33% increase in the last 24 hours and 477% over the past year. It is trading 346.12% above its 200-day SMA of $6.37, highlighting a long-term upward trend. The 14-day RSI for Arweave is 41.65, suggesting the token is in a neutral zone and may trade sideways in the near term. However, in the last 30 days, it has had just 10 positive days, with a volatility of 16%. Nonetheless, Arweave has outpaced 89% of the top 100 crypto assets by market cap over the last year, indicating its competitive edge and strong market presence.

3. Mega Dice (DICE)

Mega Dice Token is causing a stir in the gaming world, having raised over $1.7 million in its presale with a current price of $0.075. As a global brand with over 50,000 players, Mega Dice offers a range of casino games powered by cryptocurrency, such as blackjack, roulette, and slots. The DICE token integrates seamlessly with the casino, offering holders exclusive benefits such as daily investment rewards, limited edition NFTs, and a generous referral program.

The tokenomics of DICE are crafted to align interests and profits for all stakeholders. Of the total supply of 420 million tokens, 35% is allocated to presale buyers, while 15% will be distributed to the player base via airdrops. Notably, 10% is reserved for staking rewards, allowing players to lock their tokens and earn passive income. The remaining tokens are designated for liquidity, partnerships, and marketing.

#DICE presale has raised $1.5 MILLION! 🚀🚀

This milestone brings us closer to revolutionizing GameFi. Remember 👇

Current tier price: 0.075

Current presale target: $2M

We're implementing multiple tiered price increases, so make sure to secure your $DICE early – we've now… pic.twitter.com/1rSyxvY8HU

— Mega Dice Casino (@megadice) June 17, 2024

Mega Dice’s presale success marks just the beginning. The team has launched a $2.25 million airdrop campaign spread across multiple seasons. The first season allocates $750,000 to active users who reach a $5000 spending threshold within 21 days. The second season rewards bettors from the presale to the token launch date, with the third season also offering $750,000 to encourage continued betting. With these initiatives, Mega Dice is set to solidify DICE as a significant player in the GameFi space.

4. Maker (MKR)

Maker is the governance token for MakerDAO and the Maker Protocol, decentralized entities operating on the Ethereum blockchain. These platforms allow users to issue and manage the DAI stablecoin, a cryptocurrency with a stable value that is soft-pegged to the US dollar. MKR tokens act as voting shares for the organization, giving holders a say in the development and governance of the Maker Protocol.

These votes cover several vital areas, including adding new collateral asset types, adjusting risk parameters, and modifying the DAI Savings Rate. They also involve selecting trusted oracles to supply off-blockchain data and implementing platform upgrades. Additionally, MKR, as an ERC-20 token, is secured by the Ethereum blockchain’s Ethash proof-of-work function, leveraging the security and robustness of the Ethereum network.

Recently, MakerDAO deployed a D3M to Spark’s MetaMorpho Vault, enabling @sparkdotfi to allocate 500 million DAI to Ethena’s USDe and sUSDe markets paired with DAI.

In collaboration with @BlockAnalitica, this thread details how top-tier risk management ensures the financial… pic.twitter.com/urUQW5OtKC

— Maker (@MakerDAO) June 14, 2024

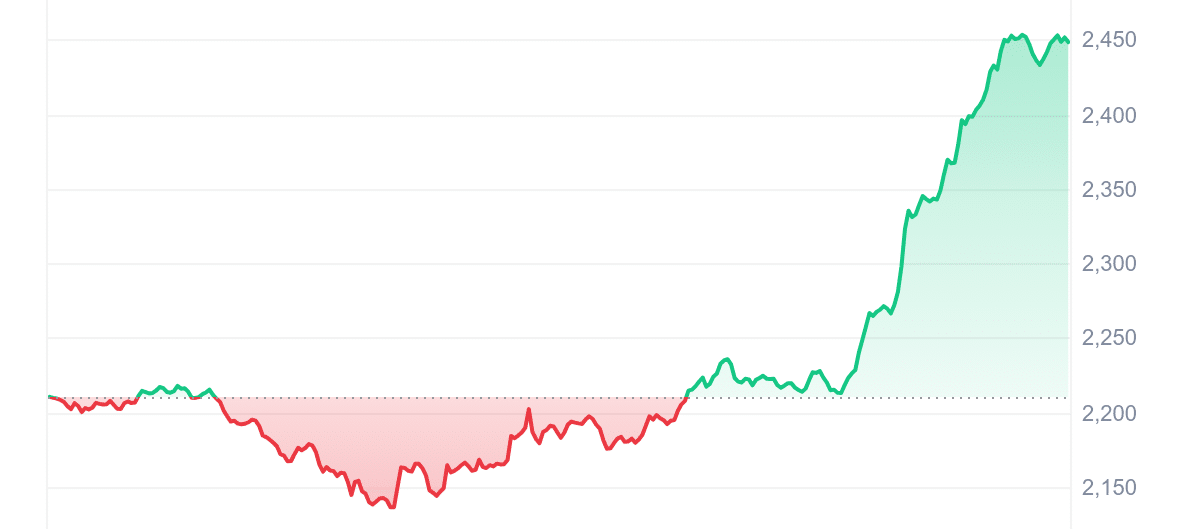

MKR is valued at $2,445.74, having experienced a significant 10.59% surge in the last 24 hours. Over the past year, its price has increased by an impressive 245%, reflecting strong market confidence and demand. Also, the gainer is trading 40.09% above its 200-day SMA of $1,747.94. The 14-day RSI is at 58.74, suggesting that the token is in a neutral position. In the past 30 days, MKR had 12 positive trading days, with a low volatility rate of 9%. Furthermore, MKR surpassed 76% of the top 100 crypto assets by market cap over the last year, showing its market relevance.

5. The Graph (GRT)

The Graph is an indexing protocol designed to query data from networks like Ethereum and IPFS, facilitating the operation of many applications in decentralized finance (DeFi) and broader Web3 ecosystems. By allowing developers to build and publish open APIs, called subgraphs, The Graph enables applications to retrieve blockchain data using GraphQL efficiently.

The Graph Token (GRT) is critical to the network’s functionality and security. As an ERC-20 token on the Ethereum blockchain, GRT allocates resources within the network. Participants, including Indexers, Curators, and Delegators, lock up GRT to provide indexing and curating services. They earn income based on the amount of work they perform and their GRT stake.

Indexers receive rewards from indexing new data and fees from query requests, while Curators earn a portion of query fees for the subgraphs they support. Delegators earn a share of the income generated by the Indexers to whom they delegate their tokens, promoting a collaborative and economically secure ecosystem.

The Graph’s Sunrise of Decentralized Data is here 🌅

The hosted service has officially upgraded to The Graph Network, now the exclusive home of The Graph’s data services. Experience web3 data with ultra-fast syncing, reliable uptime, global redundancy and much more – all secured… pic.twitter.com/e1HBc6d8YR

— The Graph (@graphprotocol) June 12, 2024

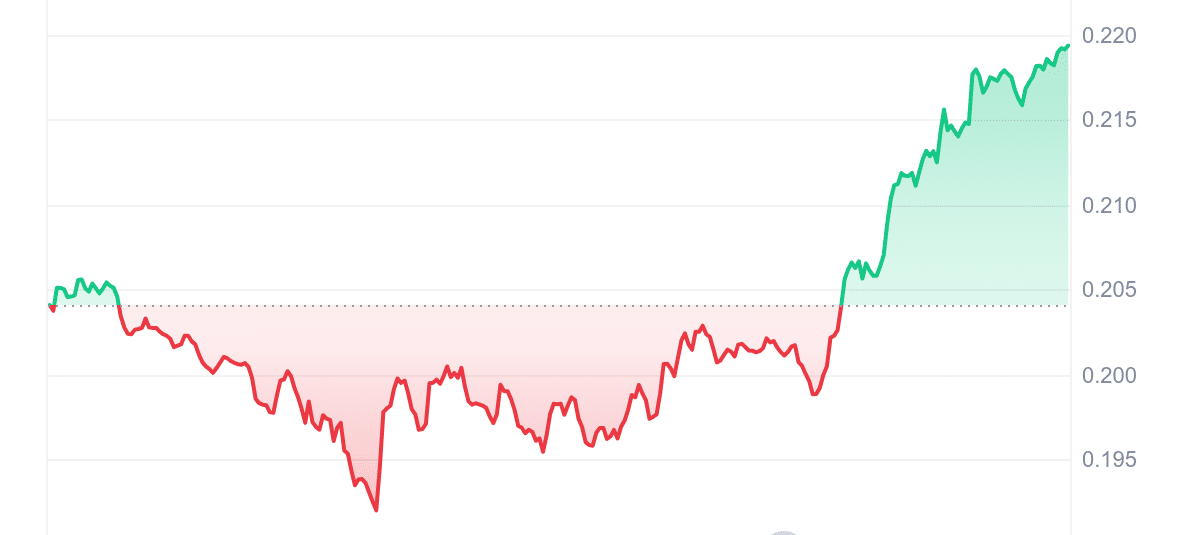

GRT has surged to $0.219408, marking a 7.55% increase in the last 24 hours and a 120% rise over the past year. It trades 87.00% above the 200-day SMA of $0.117455. Also, the 14-day RSI is 42.34, indicating a neutral trend. In the last 30 days, 40% were up days, with a 30-day volatility of 13%. The Graph has high liquidity with a volume-to-market cap ratio of 0.0805. Interestingly, it bested 59% of the top 100 crypto assets by market cap in the last year.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage