Join Our Telegram channel to stay up to date on breaking news coverage

We cover some contenders for the best cryptocurrency to buy right now, potentially worth adding to your watchlist over the coming days.

In the latest developments within the cryptocurrency market, the total market capitalization has reached $1.67 trillion, reflecting a modest increase of 2.34% over the past 24 hours. However, the 24-hour trading volume for cryptocurrencies has experienced a decline of 12.17% during the same period, resting at $204.32 billion.

Best Crypto to Buy Now

Bitcoin costs $43,917, indicating a 1.50% gain in the last 24 hours. Concurrently, Bitcoin dominance has seen a marginal decrease of 0.45% over the same timeframe, settling at 51.56%. These figures highlight the dynamic nature of the cryptocurrency market, showcasing both positive and negative movements in market capitalization, trading volume, and individual asset performance. Market participants must stay informed about these fluctuations as they contribute to understanding the market’s trends and conditions.

1. Stacks (STX)

Over the last year, Stacks (STX) has seen a substantial 291% increase in price, surpassing 92% of the top 100 cryptocurrencies. On October 10, 2021, it reached its all-time high at $3.31, and its lowest point was on March 13, 2020, at $0.044267. Since its peak, Stacks hit a cycle low of $0.199932 and a cycle high of $1.297850.

Figment announces support for Stacks, will become a Signer on the leading Bitcoin L2 🟧

⭐ @Figment_io is the complete staking solution for 250+ institutional clients including asset managers, custodians, exchanges, & more to earn rewards on their digital assets.

Read more 👇 pic.twitter.com/wKavpDmhB0

— stacks.btc (@Stacks) December 7, 2023

The current sentiment for STX is bullish, with a Fear & Greed Index scoring 73 (Greed). Stacks has consistently traded above its 200-day simple moving average and has seen positive trends, with 16 green days in the last 30 days. Thus, it represents 53% of the observed period. This suggests a favorable recent trading performance.

Additionally, Stacks maintains high liquidity based on its market capitalization. Moreover, the yearly supply inflation rate is 6.10%, creating 82.02 million STX tokens in the past year. Stacks holds the 15th position in the Ethereum (ERC20) Tokens sector and 26th in the Layer 1 sector based on market capitalization.

2. Beam (BEAM)

Beam has recently collaborated with Immutable and Polygon Labs, marking a significant expansion of its ecosystem. It is a stride forward in product development. The alliance integrates elements from the Beam SDK into the Immutable and Polygon ecosystems, with the inaugural focus on Sphere.

Over the past 30 days, Beam has displayed a positive trend, boasting 22 green days and a noteworthy 73% increase in value. The cryptocurrency hit its pinnacle on December 7, 2023, reaching an all-time high of $0.017403. However, the lowest recorded price post-ATH is $0.014455, signifying the cycle low. Presently, Beam’s price prediction sentiment leans bullish, aligning with a Fear & Greed Index score of 73, indicative of a market in a state of greed.

Breaking news.@MeritCircle_IO, @Immutable, and @0xPolygon are joining forces in a united front to take the gaming industry by storm ⚡️

Together we’re stronger, together we’re charting a bold new path for the future of gaming.https://t.co/03VVre7QOx

Learn more ⬇️ pic.twitter.com/zrpyu31ZEk

— Merit Circle (@MeritCircle_IO) December 6, 2023

Supply metrics reveal that Beam’s circulating supply is presently at 46.41 billion out of a maximum supply of 62.75 billion. The cryptocurrency ranks #3175 in the Ethereum (ERC20) Tokens and #502 in the Binance Smart Chain. It also ranks #311 in Gaming and #152 in the Metaverse sectors. Positioned near its cycle high, Beam showcases high liquidity based on its market capitalization.

3. Chainlink (LINK)

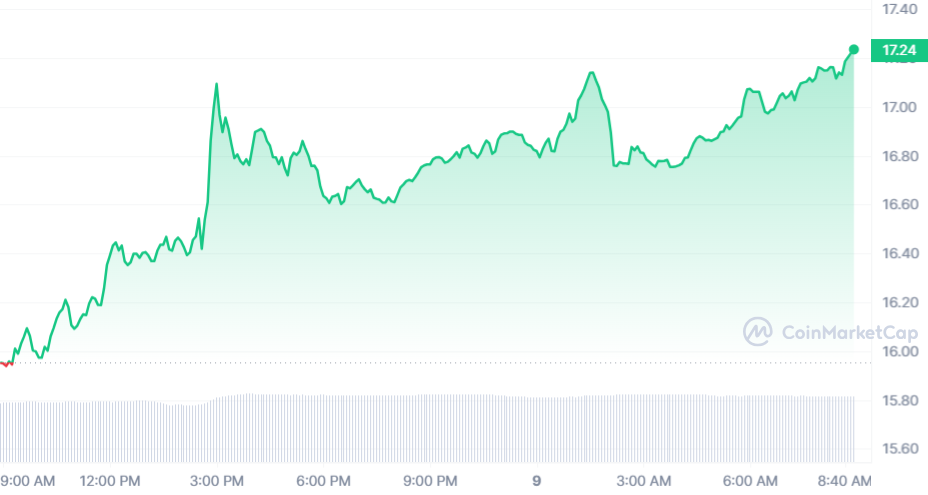

Chainlink, a decentralized oracle network, has demonstrated noteworthy performance over the past year. As of the latest data, its all-time high of $52.89 was observed on May 10, 2021, followed by a cycle low of $4.88. Currently, it hovers near its cycle high at $17.28. The Fear & Greed Index indicates a sentiment of 73, reflecting a market state leaning towards greed.

This sentiment aligns with the overall bullish outlook for Chainlink. Examining its price movement, it has experienced a substantial 146% increase over the last year, surpassing 77% of the top 100 crypto assets. Technically, Chainlink is trading above its 200-day simple moving average, a positive signal for its price trend.

It has sustained a positive performance relative to its token sale price. Chainlink’s market position is notable, securing the top rank in the DeFi Coins sector and claiming 2nd in the Ethereum (ERC20) Tokens sector. The circulating supply currently stands at 556.85 million LINK out of a maximum supply of 1.00 billion LINK.

The #Chainlink Staking v0.2 community pool has officially filled, with over 19M additional LINK staked in under 7 hours since Early Access opened ⬡

We want to thank the community—both v0.1 migrators and new stakers—for participating in the v0.2 launch and putting 40,875,000… pic.twitter.com/SpbFR7b7lX

— Chainlink (@chainlink) December 7, 2023

Over the past year, the project has seen a yearly supply inflation rate of 9.62%, creating 48.85 million LINK. Despite this inflation, Chainlink maintains high liquidity, supported by its substantial market capitalization.

4. Launchpad XYZ (LPX)

Launchpad XYZ is gaining recognition for its commitment to revolutionizing investor decision-making in the era of Web 3.0. At its core is an advanced dashboard that equips users with comprehensive data. It empowers users to make informed choices in the dynamic world of cryptocurrency investments.

🌍 Your dashboard, your way.

Customise your trading view with #LaunchpadXYZ for a personalised experience. 🖥️ #Trading #Crypto #Web3 #Presale pic.twitter.com/A7CsZWbKCD

— Launchpad.xyz (@launchpadlpx) December 7, 2023

So far, the project has successfully raised $2,143,319.44, with each token priced at $0.0445. The ecosystem’s native token, LPX, serves a dual purpose beyond reflecting the project’s growth. Users staking a minimum of 10,000 LPX tokens gain access to premium features, including reduced trading fees on Launchpad XYZ’s decentralized exchange.

The utility of LPX extends further, offering stakers privileged access to new NFT releases at competitive prices and early entry into exclusive presales. Additionally, LPX holders enjoy discounts on offerings from Launchpad XYZ’s partner entities. Furthermore, possessing LPX tokens provides users early access to beta versions of play-to-earn games. This enables them to closely track game development and make well-informed decisions about in-game crypto tokens.

5. Mantle (MNT)

Recently, MNT launched a liquid staking protocol on the Ethereum mainnet, following a proposal discussed at the Mantle governance forum in July 2023. This protocol enables users to engage in network staking by depositing ETH through validator contracts. The resulting token, Mantle-staked Ether (mETH), represents users’ staked assets.

This move signifies Mantle’s expansion of services, building upon establishing its Layer-2 network. The mainnet contracts for Mantle’s liquid staking protocol (LSP) entered a limited alpha phase in early October. It is moving towards a broader stage to enhance accessibility and participation.

However, a notable concern has arisen regarding asset centralization, particularly with major exchanges like Lido, Coinbase, and Binance heavily involved in this practice. This trend raises questions about decentralizing staked assets within the Mantle ecosystem. Market-wise, Mantle has shown positive trends, with 17 green days in the last 30 days, constituting 57% of the observed period.

We're also stoked to unveil a new segment — Ecosystem Voices — where we will feature monthly insights from some familiar Mantle team members!

🤝🏻 Find out what they have to say about current blockchain trends and Mantle's progress.https://t.co/1lefXMUquD

— Mantle (@0xMantle) December 8, 2023

MNT is trading near its all-time high, indicating a bullish sentiment. Additionally, Mantle attained its highest price on December 8, 2023, at $0.656937, while its lowest price remains unrecorded. The lowest price since its all-time high was $0.632229, representing a cycle low. The highest price since the last cycle low reached $0.640725, marking a cycle high.

The Fear & Greed Index, standing at 73 (Greed), reinforces this positive market sentiment. Mantle’s circulating supply is 3.13 billion MNT out of a maximum supply of 6.22 billion MNT. In market cap rankings, Mantle holds 11th position in the Ethereum (ERC20) Tokens sector and 3rd in the Layer 2 sector.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage