Join Our Telegram channel to stay up to date on breaking news coverage

Decentralized finance (DeFi) contributes $8.36 billion, accounting for approximately 12.74% of the total crypto market activity. Notably, stablecoins represent a significant portion, hitting $57.83 billion, encompassing around 88.11% of the total 24-hour crypto market volume.

Bitcoin holds sway at 52.47% in terms of dominance, albeit with a slight decrease of 0.18% in the day. This data shows increased market cap but reduced overall trading volume, with stablecoins and DeFi maintaining substantial market shares.

7 Best Altcoins to Invest in Right Now

However, the total market volume is $65.63 billion, an intraday decline of 11.66%. Understanding these trends provides a better understanding of the cryptocurrency market, emphasizing the role of stablecoins and DeFi alongside Bitcoin’s dominant position.

1. Decentraland (MANA)

The recent partnership between Decentraland Marketplace and Squid, facilitated by Axelar’s cross-chain liquidity layer, is a notable upgrade for users. This integration enables multi-chain purchases within Decentraland’s marketplace, allowing transactions using Ethereum or Polygon for any listed NFT.

Squid is a secure cross-chain router on the Axelar Network that enables token swaps across blockchains. It also allows users access to applications across chains through its API, SDK, and front-end tools.

Shopping in the Marketplace is now even more accessible. 🛍️

Announcing our new partnership with @squidrouter and @axelarnetwork enabling multi-chain purchasing. https://t.co/F6mlmo5Cj8

— Decentraland (@decentraland) December 6, 2023

Analyzing Decentraland’s market performance unveils several key indicators. Over the past year, the token’s price has increased by 35% and is presently trading above its 200-day simple moving average. Moreover, MANA has exhibited positive performance compared to its initial token sale price.

Furthermore, the token has experienced 15 positive trading days out of the last 30, indicating a 50% positive trend. Plus, Decentraland is trading close to its cycle high and is considered to possess high liquidity based on its market cap.

2. Filecoin (FIL)

Filecoin recently announced a strategic partnership with io.net, a platform focused on building a decentralized cloud for GPU computing power. This collaboration aims to benefit their communities by integrating Filecoin’s storage providers with io.net’s platform. The project has onboarded 1,500 GPUs from Filecoin’s Storage Providers out of over 17,000 live GPUs.

FIL’s partnership with io.net signifies a significant shift for decentralized storage providers, offering new income opportunities. Likewise, it allows storage providers to diversify their use cases within secure and reliable networks. Notably, the collaboration is community-centric, aiming to expand use cases, potentially enabling ventures into artificial intelligence through machine learning (ML).

Furthermore, market sentiments indicate a bullish prediction for Filecoin’s price, while the Fear & Greed Index registers 73 (Greed). The token has been on an upward trend, witnessing a 22% price increase in the past year.

Beyond @awscloud, @Azure, or @googlecloud—your data deserves more. Embrace a decentralized future with #Filecoin's storage solutions, perfect for individuals and businesses.

Take control of your data—store now with Filecoin: https://t.co/jTmSNl9g99 pic.twitter.com/LCyTUhCY1U

— Filecoin (@Filecoin) December 7, 2023

In addition, consistently traded above the 200-day simple moving average. FIL also experienced a positive trading trend, with 16 green days in the last 30 days, accounting for 53% of the period. The coin also maintains high liquidity based on its market capitalization.

3. Polygon (MATIC)

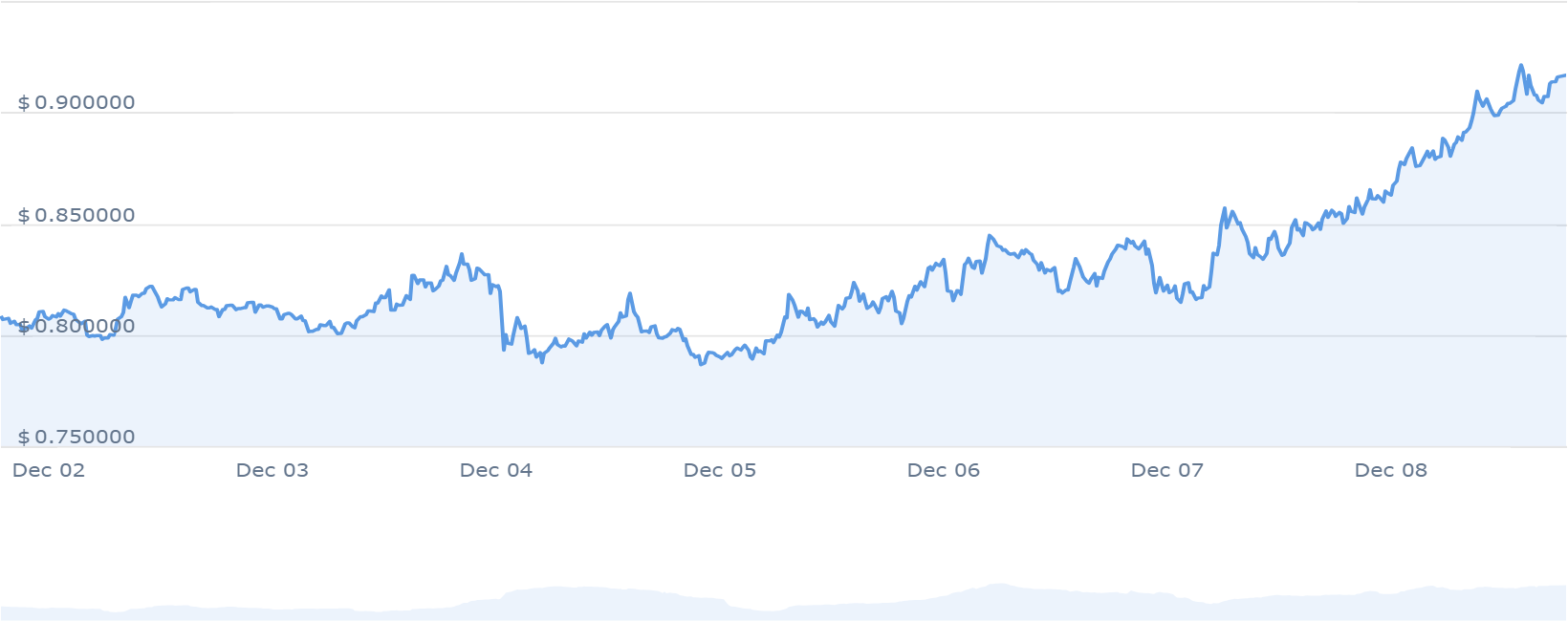

Polygon (MATIC) is an Ethereum-based Layer 2 scaling solution that addresses Ethereum’s scalability issues. Currently trading at $0.917469, it shows promising signs in its performance metrics. The token’s price trends above the 200-day simple moving average, indicating a positive trajectory.

Compared to its initial token sale price, MATIC showcases favorable performance. Over the last 30 days, it has observed 16 positive gains, accounting for 53% of the period. This recent trend reflects MATIC’s recent bullish momentum.

Polygon’s liquidity, reflected by its market cap standing at $7.35 billion, signifies a healthy level within the market. This is reinforced by a 24-hour trading volume of $1.28 billion, indicating active participation and trade activity.

Transactions in Polygon Miden can be understood as facilitating account state changes. Basically, these state changes take as input one single account and some notes and output the same account at a new state and some other notes.

In Miden, a tx only ever involves one account. pic.twitter.com/eoULauUDIw

— Polygon Foundation (@0xPolygonFdn) December 7, 2023

Furthermore, the sentiment around Polygon’s price prediction remains bullish. This sentiment is corroborated by a Fear & Greed Index reading of 73, indicating a sense of greed prevailing in the market sentiment.

4. Apecoin (APE)

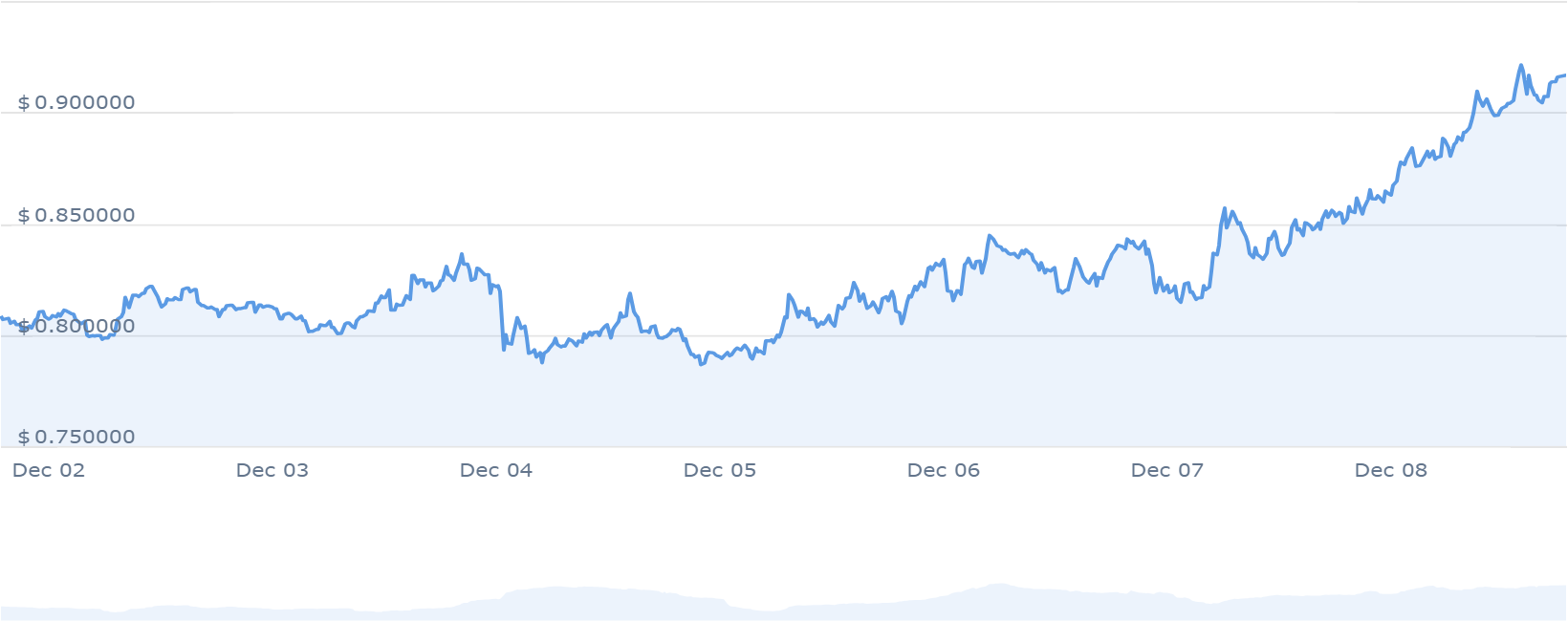

Over the last 30 days, ApeCoin has seen positive trends with 15 days of gains, marking a 50% green performance. It’s trading near its cycle high, indicating a potential upward trajectory. The token exhibits high liquidity based on its market capitalization.

ApeCoin’s price history reveals its all-time high of $26.80 on Apr 28, 2022, and its all-time low of $0.999513 on Oct 9, 2023. Since the lowest point, the token reached a cycle high of $1.825350. Present sentiment around ApeCoin leans bullish, coinciding with a Fear & Greed Index at 73 (Greed).

Here's our weekly update to keep you in the loop on what's happening in the ApeCoin DAO and the Governance Working Group (GWG)!

What to expect:

🎙 Community Highlights

🦍 GWG Updates

🧱 AIP Implementation News

📅 DAO Community Calendar

📰 Newsletter— ApeCoin (@apecoin) December 6, 2023

Furthermore, APE holds a circulating supply of 368.59 million APE out of a maximum supply of 1.00 billion APE. The token faces a yearly supply inflation rate of 2.03%, creating 7.34 million APE last year. In market cap rankings, ApeCoin positions #13 in the DeFi Coins sector.

5. Meme Kombat (MK)

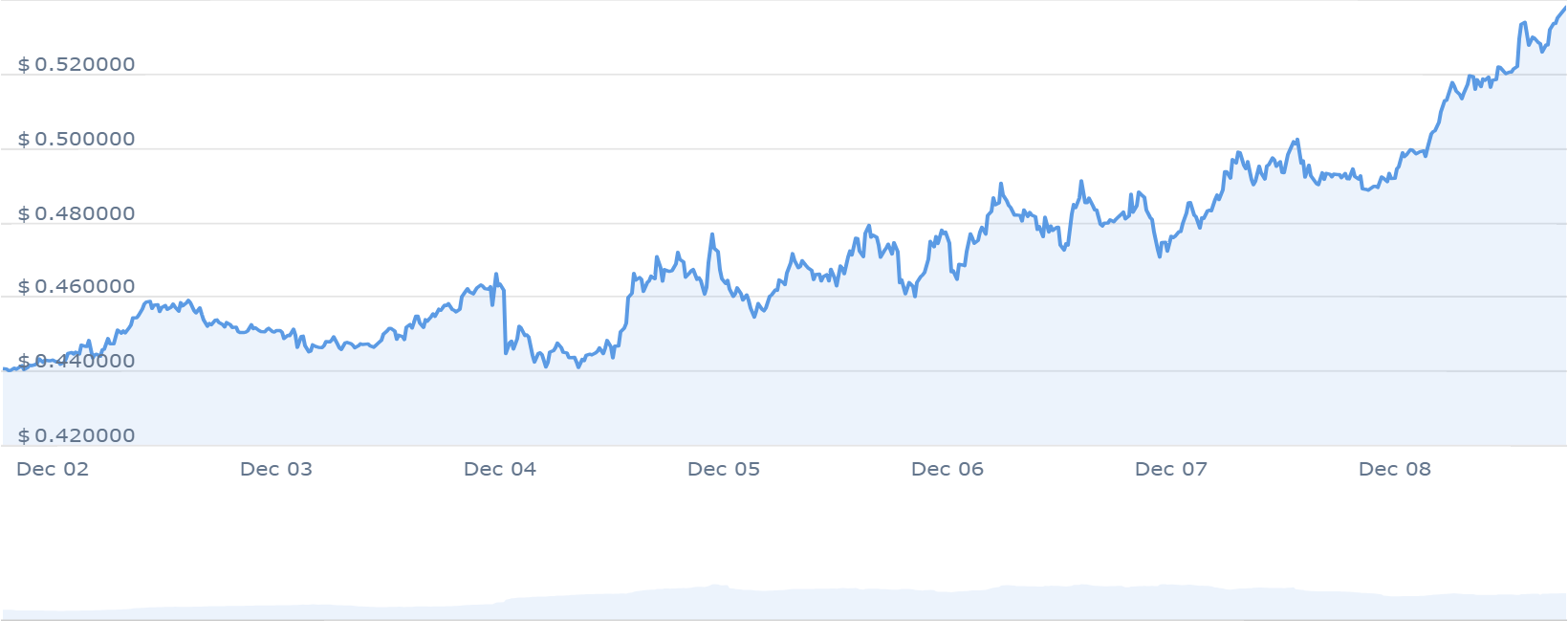

Meme Kombat, a recent addition to the cryptocurrency landscape, has witnessed a notable surge in value today. This upward movement has impacted the broader crypto market, placing MK among the best altcoins to invest in. According to current presale data, the project has successfully raised $2,729,620 out of its $3,500,000 goal, generating initial attention within the community.

We passed $2.7 million, fighters! 🥊

What a great way to go into the weekend🤩 pic.twitter.com/gnOF0ze1Fs

— Meme Kombat (@Meme_Kombat) December 8, 2023

One distinctive feature of Meme Kombat is its focus on providing an innovative gaming platform tailored for enthusiasts, emphasizing staking and betting as primary engagement avenues for users to earn rewards. Half of the MK token supply is available for $1.667 per token in the presale, with a specified hard cap of $10 million.

In its future roadmap, Meme Kombat intends to introduce its tokens onto a decentralized exchange, with approximately 10% of the total supply reserved to enhance liquidity. This allocation aims to facilitate faster and more efficient trading on the platform. The project’s commitment to enabling decentralized MK token trading is articulated in its whitepaper.

6. Aptos (APT)

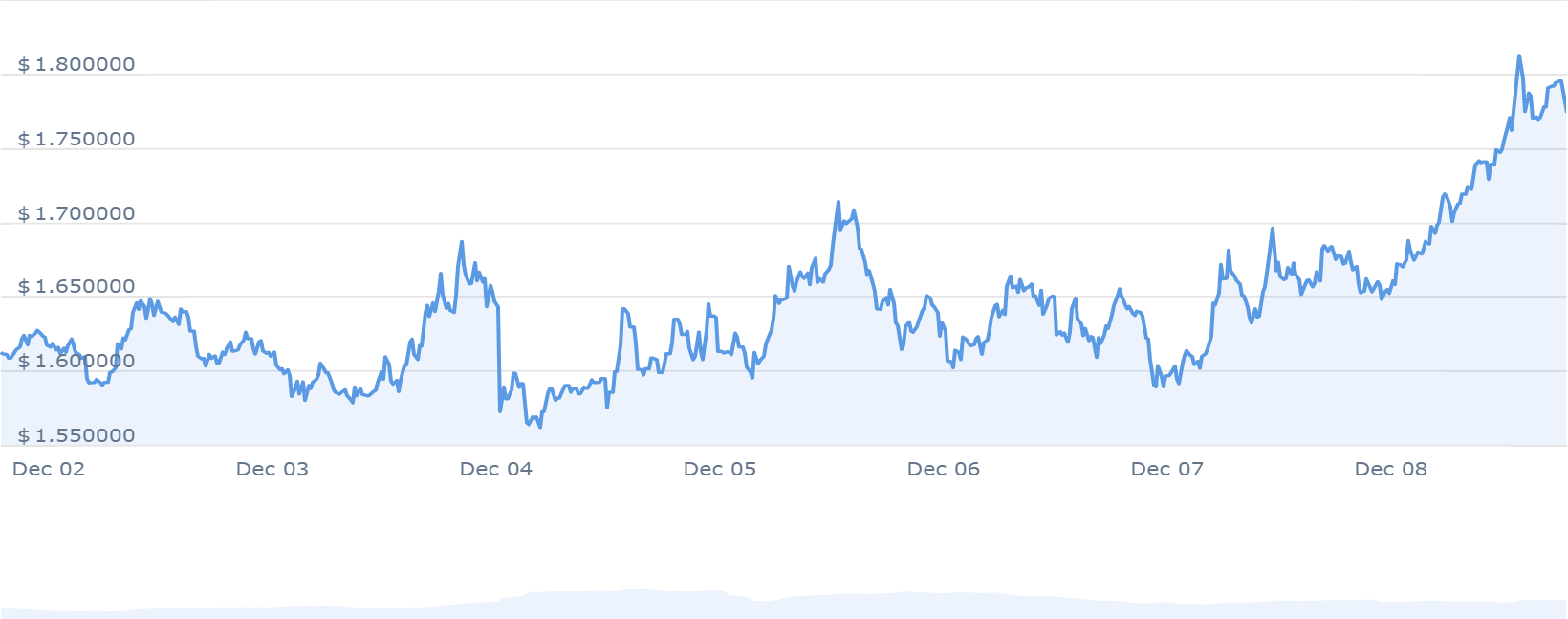

Aptos, a cryptocurrency in the Layer 1 sector, has demonstrated substantial price growth over the past year, marking a 76% increase. This growth outpaced 65% of the top 100 crypto assets during the same period.

Technical analysis indicates Aptos is trading above its 200-day simple moving average and is nearing its cycle high, reaching its peak price of $19.86 on Jan 30, 2023. The lowest recorded price after its all-time high was $4.72, indicating fluctuations within the market cycle. Aptos’s current value, at $8.57, sits close to its cycle high.

Congratulations to Aptos Labs CTO @AveryChing for their much deserved recognition by @CoinDesk.

With the incredible layer-1 blockchain benchmarks set by our developers this year, it’s no surprise that Avery’s fearless leadership landed him a spot on CoinDesk’s “Most Influential…

— Aptos Labs (@AptosLabs) December 8, 2023

Despite fluctuations, Aptos has maintained a bullish sentiment in its price prediction. The Fear & Greed Index registers at 73 (Greed), indicating a prevailing optimistic market sentiment.

7. Chainlink (LINK)

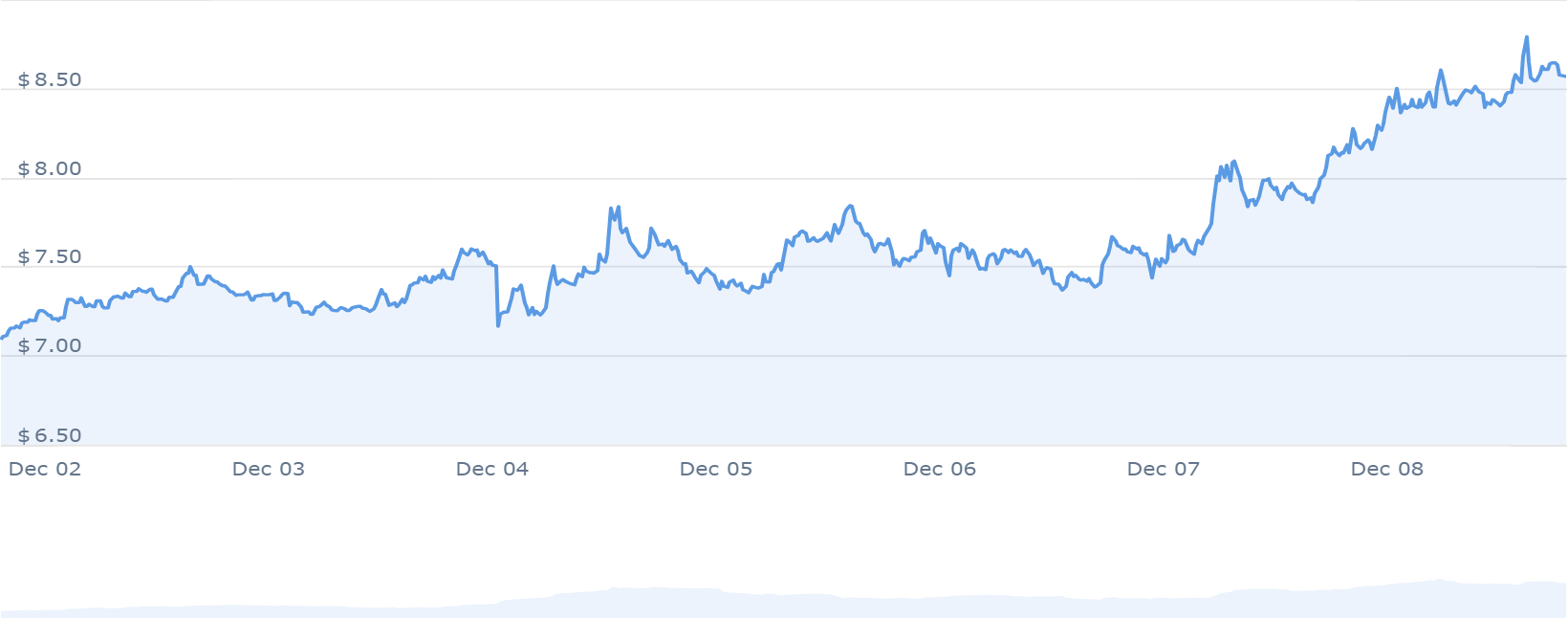

Chainlink recently upgraded its native staking mechanism known as Chainlink Staking v0.2. This upgrade garnered significant attention within the blockchain data oracle sphere. As such, it has accumulated over $632 million worth of LINK tokens in a notably brief timeframe.

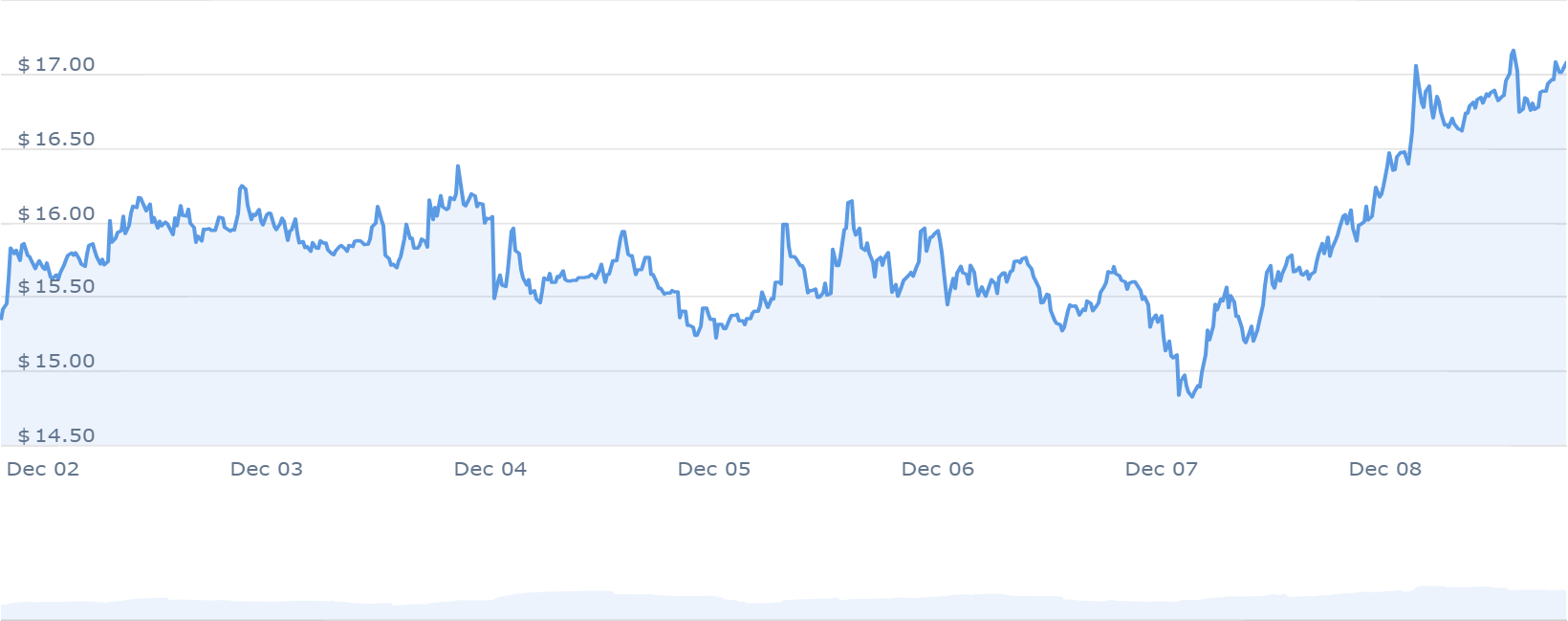

Due to this successful enhancement, the native token of the decentralized computing platform, LINK, observed a noteworthy surge of 12%, peaking at $17.305. This price level marks a high point not seen since April 2022, indicating a significant yearly milestone for the coin.

Furthermore, Chainlink experienced a 144% increase in price, positioning it in the upper percentile among the top 100 cryptocurrencies. It’s currently trading above its 200-day simple moving average, indicating a positive trend.

The #Chainlink Staking v0.2 community pool has officially filled, with over 19M additional LINK staked in under 7 hours since Early Access opened ⬡

We want to thank the community—both v0.1 migrators and new stakers—for participating in the v0.2 launch and putting 40,875,000… pic.twitter.com/SpbFR7b7lX

— Chainlink (@chainlink) December 7, 2023

Recent market sentiment appears bullish, corroborated by a Fear & Greed Index of 73 (Greed). Furthermore, the project has demonstrated liquidity strength based on its market capitalization.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage