Join Our Telegram channel to stay up to date on breaking news coverage

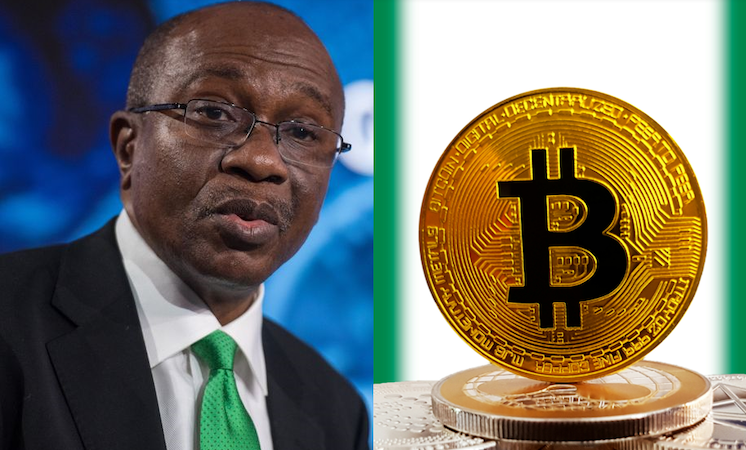

In an effort to increase market participation in the most populous nation in Africa, where the central bank forbids cryptocurrency trading, Nigeria’s Securities and Exchange Commission is currently evaluating applications for digital exchanges on a trial basis.

According to Abdulkadir Abbas, head of securities and financial services at the Abuja-based commission, the SEC is considering approving tokenized coin offerings on authorized digital exchanges that are backed by assets like as equities, debt, and property but “not cryptocurrency.” The regular stated that:

As a regulator, we always like to start with a very simple, clear proposal before we go into the complex ones.

The move could encourage digitally adept citizens of the more than 200 million-person country, 43% of whom are under the age of 14, to invest in local assets, including equities, which have been avoided for years. According to Paxful, an exchange that shut down in April, the West African nation represents the majority of cryptocurrency transactions carried out on peer-to-peer trading platforms outside of the US.

Nigerian crypto regulations

In December, we reported that the Nigerian government, which had been prohibiting cryptocurrency investments, was moving to modify the 2007 Investment Securities Act. Nigeria outlawed Bitcoin in February 2021 by forbidding any registered financial institutions from providing services related to cryptocurrencies.

Nigeria has continued to be one of the biggest crypto centers on the African continent despite this restriction. The amount of peer-to-peer Bitcoin transactions in this nation leads the world. Nigeria has significantly aided in fostering the adoption of Bitcoin, according to a Chainalysis analysis.

Even though authorities are cracking down on usage, there are still a lot of Bitcoin-related activities in the nation. The cryptocurrency community in Nigeria has established a Bitcoin town, where Bitcoiners have taken part in numerous charitable and development projects.

Attempt at creating CBDC

Following the ban on cryptocurrencies in Nigeria in 2021, the continent’s first CBDC, the eNaira, was introduced by the nation, making it the first in Africa. However, as anticipated, the CBDC has not experienced a high level of adoption. Although the Nigerian government has made an effort to encourage usage, adoption has been still noticeably low.

Nigeria has been one of the countries spearheading attempts to develop and advertise blockchain-based digital versions of their traditional currencies, but like most of them, it has struggled to find widespread support. However, numerous central banks worldwide are developing initiatives that are similar. The need to keep up with private sector innovations in digital payments, which have encouraged consumers to go cashless and given rise to cryptocurrencies and stablecoins, is what drives these people’s ambitions.

Asset-backed tokens in other countries

Similar tokens are also being tested in other countries. Singapore launched “Project Guardian” last year to look into possible applications for asset tokenization. A permissioned liquidity pool made up of tokenized bonds and deposits will be created as part of the pilot, which is being spearheaded by DBS Bank Ltd., JPMorgan Chase & Co., and Marketnode Pte.

The Nigerian Securities and Exchange Commission (SEC) wants to register fintech companies as digital sub-brokers, crowd-funding intermediaries, robo-advisors, fund managers, and issuers of tokenized coins. However, the SEC won’t register cryptocurrency exchanges until it has reached a standardization agreement with the central bank, which in 2021 ordered commercial lenders not to facilitate the transactions.

In order to investigate the pattern of their operations and determine if they are qualified to provide the services in the nation, intending digital exchanges will spend a year in “regulatory incubation” when they will only provide rudimentary services under SEC supervision. We should be able to decide by the 10th month whether to register the business, prolong the incubation period, or even request that the business cease operations.

yPredict Presale

Artificial Intelligence has been in the news recently, and every day we hear about another major accomplishment achieved through tools such as ChatGPT. In the crypto world, the A.I. industry is also having an impact, in the form of a project that is currently going through a presale and has the potential to be very profitable for early investors.

yPredict has created an ecosystem that combines financial quants, traders, and AI/ML experts in order to offer a variety of AI-based analytical tools and platforms for traders of all hues. The inventors of these products claim that by utilizing cutting-edge financial prediction algorithms and metrics produced from complementary data sources, they may provide sophisticated analytics and insights.

yPredict provides access to professional strategies and approaches to aid traders in navigating the complex financial markets of today. These challenges include an excess of noise and an absence of statistical advantage, which usually results in bad decisions. Many traders just rely on signals from dishonest suppliers or information from social media, such as news and public opinion. By utilizing yPredict‘s analytical tools and platforms, trading decisions may be made more intelligently and trading strategies can be optimized.

Visit the yPredict Presale Here

Related

- Nigeria seeks partners for a technological upgrade of its digital currency, the eNaira

- Nigeria Begins Process To Legalize Cryptocurrency Use

- YPRED, a token empowering world’s first All-in-One A.I. Ecosystem

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage