Join Our Telegram channel to stay up to date on breaking news coverage

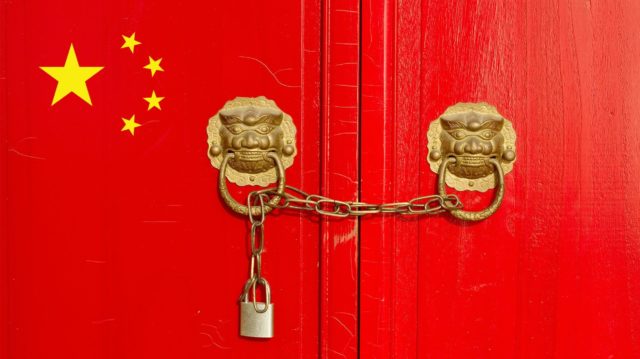

Earlier this week, United States President Donald Trump announced that he would be imposing a 10 percent tariff on the remaining $300 billion worth of goods entering the country from China. Beijing and Washington have been locked in a trade war for the better part of a year. Many have hoped that there will be a truce any day now, and several pointers have indicated an impending “ceasefire.”

However, the imposition of this tariff pretty much means that a truce is out the window. The announcement sent markets in turmoil, as stock trading experts, analysts, and others have been worried about retaliation from China. At press time, three main U.S. indexes have dropped, following sharp drops in Asia and Europe as well. The NASDAQ index fell 0.8 percent, as most tech companies indicated on the index will be particularly vulnerable to tariffs on Chinese goods.

The indexes took a dive on Thursday when Trump announced the tariffs, but the Dow Jones Industrial Average fell a further 0.5 percent, while the S&P 500 Index dropped 0.4 percent on Friday.

In Europe, the FTSE 10 Index (based in the United Kingdom) was down 1.8 percent, Germany’s Dax index dropped 2.3 percent, and France’s Cac 40 fell 2.4 percent. In Asia, the NIKKEI index in Japan fell over 2 percent as well.

The reason for all these reductions shouldn’t surprise anyone. Markets have been on high alert since the United States, and China began this trade war, and while things weren’t particularly bad, many hoped that things would be better once a compromise had been reached.

At this point, however, it’s no holds barred between the two economic powerhouses, and investors will be more than happy to sit this one out. China isn’t some country that Trump can issue sanctions on and not see any repercussions (like Venezuela or Iran); it’s the second-largest economy in the world, and given how much the major companies in the United States are dependent on both Chinese products and the Chinese market in general, you can understand why the U.S. markets are going down the drain.

However, there could be some reprise in Bitcoin. Despite the fact that markets are spiraling out of control, Bitcoin has been able to hold its own, trading at $10,586 (up 5.63 percent) at press time, according to CoinMarketCap.

Many also believe that China’s retaliatory effort could involve Bitcoin. There have been several signs that Beijing could be looking to legalize Bitcoin again, and if this does happen, there is no reasonable doubt that the world’s most popular asset would skyrocket in value.

It’s still too early to see how long this tariff announcement could affect the major markets, but as at now, it is safe to say that the effects could be sustained. If you’re an investor and you’re looking into something that would provide safety in the meanwhile, it might be time to buy cryptocurrency.

Join Our Telegram channel to stay up to date on breaking news coverage