Join Our Telegram channel to stay up to date on breaking news coverage

An anticipated price reversal for ARB could occur following an Ethereum (ETH) network upgrade. The promising advancements in the Arbitrum and Ethereum networks could boost the price of ARB. Meanwhile, future improvements in market conditions will also play a significant role.

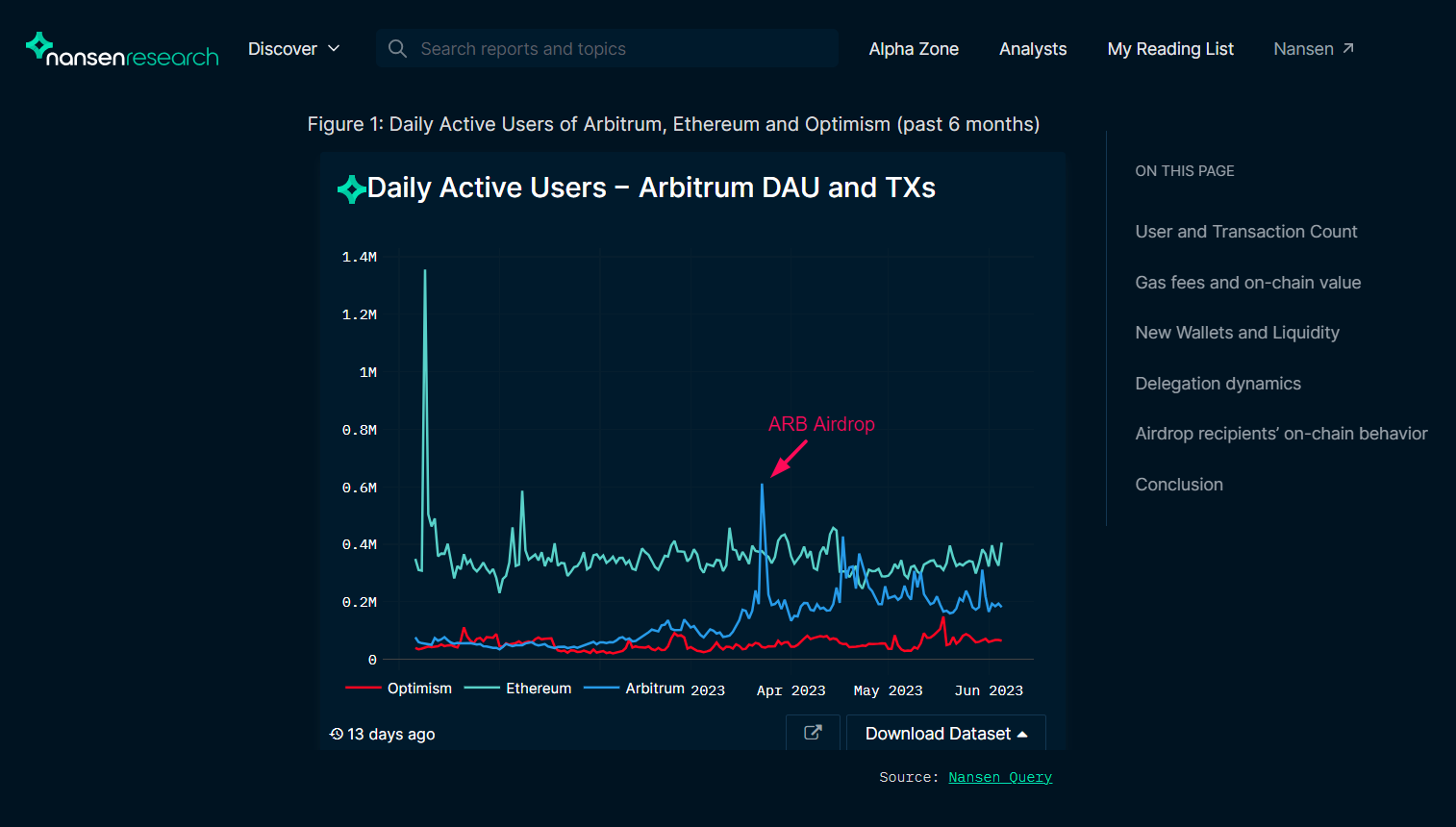

Recent evaluations by Nansen have demonstrated increased activity in Arbitrum post-airdrop, which has stabilized at a higher level than before. The evaluation report indicates consistent growth in the number of transactions, gas prices, and daily active users of ARB.

Furthermore, the disparity between the number of active users on Arbitrum and Optimism has widened, bringing them closer to Ethereum.

Nansen’s study results reveal that before March 2023, participants of the ARB airdrop constituted between 5% – 20% of total transactions. However, this proportion decreased to approximately 5% following the availability of claiming the airdrop.

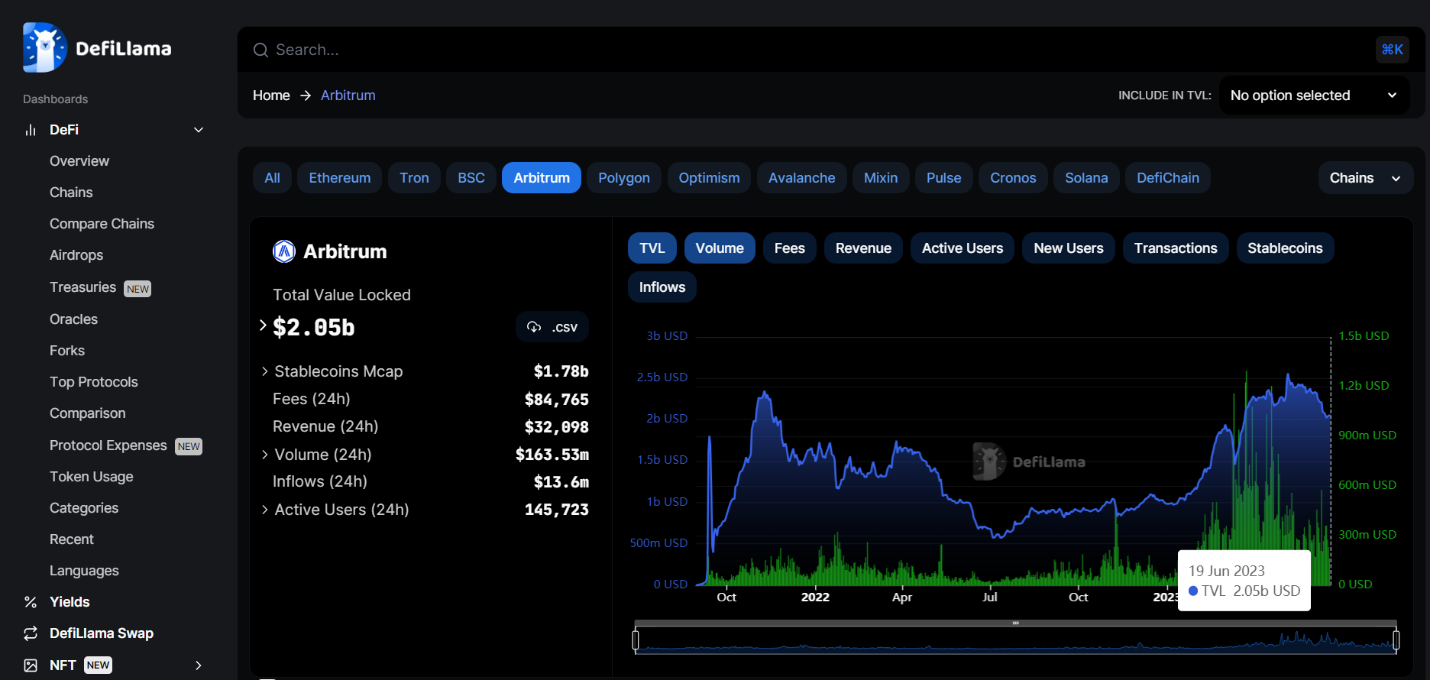

This trend also manifests in the increased number of trades on decentralized exchanges (DEXs) related to Arbitrum.

This experienced notable growth following the airdrop as shown in the above chart. The DeFiLlama chart above shows TVL increased rapidly after the airdrop in March 2023.

Potential Catalysts for Upside in Arbitrum Prices

The following are potential catalysts that could lead to an increase in Arbitrum price.

Dencun Upgrade

The growth drivers for ARB can be attributed to the upcoming Ethereum update known as Cancun-Deneb (Dencun). This has been scheduled for the 2023 second half. This update will introduce EIP-4844 (proto-Danksharding), which aims to lower transaction fees on Arbitrum and enhance the blockchain’s competitive edge.

Will “Dencun” Upgrade kill L1s?$ETH devs recently agreed to launch it by the end of 2023.

It will reduce fees and add more storage to $ETH blockchain.

L2s will benefit from this the most.

Is this the end of L1 era?

🧵 EIP-4844 $ARB $OP $METIS pic.twitter.com/yrkXp4d5K8

— Nikyous (@CryptoNikyous) June 13, 2023

The Arbitrum Foundation has recently released information obtained from its sequencer. This was funded partially by layer-2 costs paid by customers to publish data onto Ethereum. The foundation has decided to transfer the sequencer’s earnings, totaling 3,352 ETH or $5.4 million, to the Arbitrum DAO.

Big news Arbinauts!

Arbitrum is the only rollup that sends all surplus revenue generated by transaction fees to their respective DAO and it is time for the DAO to collect the funds so far!

Follow along to learn more about it.🧵👇

— Arbitrum (💙,🧡) (@arbitrum) May 10, 2023

ARB holders’ management of these funds remains unclear, as it depends on decisions made by the community and the DAO. If the community opts to allocate rewards to holders, the DAO may generate payments for ARB holders.

New Wallet Activity and Liquidity

Furthermore, the data from Nansen reveals valuable insights regarding the ecosystem’s growth and user engagement. By examining the number of wallets commencing their first-ever transactions on Arbitrum, an indication of the influx of new users into the ARB ecosystem can be observed.

On March 24, 2023, following the availability of token airdrops, Arbitrum witnessed an unprecedented surge in new wallets, reaching an “ATH.” Since then, the number of new users has consistently remained elevated, surpassing OP and approaching ETH regarding user adoption.

Turning attention to bridging activity from Ethereum, the overall volume has demonstrated relative stability compared to other Layer-2 and Layer-1 solutions. While the share of bridging activity on Arbitrum peaked in March, it currently ranks second, following Polygon.

Positive Funding Rate

Meanwhile, CoinGlass data indicates that the funding rate for ARB permanent swap contracts has turned positive.

Funding rates serve as remunerations that perpetual swap traders pay when engaging in short or long positions on assets.

It is contingent upon the prevailing demand. In situations where there is heightened demand for short orders, the associated costs increase. This then leads to short-side traders compensating long-side traders.

Currently, the funding rates have surpassed the threshold of $1, indicating that futures traders hold a positive outlook on ARB.

Analysis: Potential ARB Price Reversal on the Horizon

The ARB/USD pair has experienced a downward trajectory since mid-April, shortly after its launch in March. Between mid-May and mid-June, the altcoin displayed a range-bound movement.

It deviated from this pattern when the price fell below its critical support level of $1.1000 on June 9. Subsequently, the price found support at $0.9316 after reaching its all-time low of $0.90.

Since then, there have been indications of a recovery, including the fading of the MACD histogram and its approach toward the zero line. As well as the Stochastic Oscillator crossing above the oversold region line.

Furthermore, the appearance of a doji candlestick after three bullish candles suggests strength and the continuation of positive momentum. These factors imply that the downward movement may have reached its conclusion. Thus, ARB/USD could potentially experience a reversal to the upside.

ARB Price Analysis on ETH Scale

For the ARB/ETH pair, Arbitrum dropped below its lowest level from the previous month, record at 0.00058 ETH on June 11.

This decline was triggered by the SEC’s lawsuit against Binance and Coinbase. Presently, the token has returned to the same level where it previously experienced a significant fall.

The technical indicators suggest the possibility of a negative trend reversal for ARB in relation to ETH. The stochastic oscillator exhibits similar conditions to those observed before the last substantial decline in May.

After this pattern, ARB/WETH prices witnessed a recovery, indicating the potential for a similar rebound for Arbitrum.

Nevertheless, it is important to consider the effect of the upcoming Dencun update on the Ethereum network. It is also worth considering the decisions made by the Arbitrum Foundation regarding revenue allocation from the L2 rollup.

Traders and investors should monitor these developments closely for further insights into the potential future movement of ARB.

Related News

- Arbitrum Ranks #4 on DexTools Hot Pair List after Price Surged Amid Revived Interest of DeFi Whale

- Ethscriptions Unleashes Wave of Innovation on Ethereum Blockchain

- Growing Resistance at $1,750: Key Ether Price Metrics Highlighted

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage