Join Our Telegram channel to stay up to date on breaking news coverage

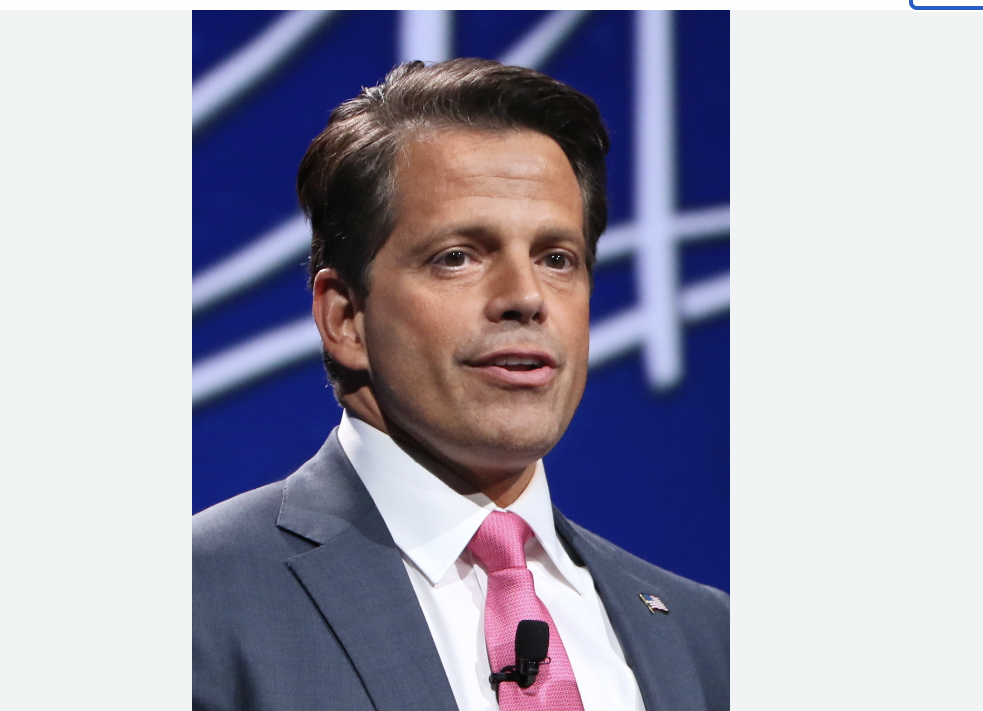

Anthony Scaramucci has said he is investing in a company established by Brett Harrison, the former president of inoperative crypto exchange FTX US, according to a Bloomberg report.

https://twitter.com/Coinzonestats/status/1614831098097291266

From the report, Scaramucci wrote an email saying he would use his own money for the venture as a show of support for Harrison. The development comes as Harrison has been looking for funding for a cryptocurrency software company with a valuation of up to $100 million, based on a December Bloomberg report.

Two people close to the matter have since revealed that the proposed idea was for software expected to serve cryptocurrency traders, enabling them to write algorithms for their strategies while at the same time allowing them access to different types of crypto markets, centralized and decentralized alike.

In reply to questions by Bloomberg News, Harrison said:

Anthony has been a true mentor and friend to me since I joined the crypto industry two years ago. I am honored to have him as an investment partner, and now his guidance will be invaluable as I begin this new chapter.

FTX Ventures Takes 30% Stake In Scaramucci’s Company

In a September announcement, the venture capital unit of Sam Bankman-Fried’s now-collapsed crypto firm, FTX Ventures, said it had taken a 30% stake in Skybridge Capital, a company owned by Anthony Scaramucci.

Caught up with @Scaramucci today. FTX and Sam Bankman-Fried bought a 30% stake in Scaramucci's SkyBridge Capital before FTX collapsed. Now Scaramucci says that he's confident he'll be able to buy that stake back. Given new facts, he also alleges SBF committed fraud pic.twitter.com/jxltXdjCKW

— Arjun Kharpal (@ArjunKharpal) January 13, 2023

According to the announcement, the two companies would upscale their collaboration on venture and digital asset investing.

In the wake of the recent collapse of FTX and its implosion to bankruptcy, Scaramucci said Skybridge would work to repurchase that stake, adding that he had performed some checks on SBF prior to the deal but that it was “not enough.”

Harrison worked at FTX US for almost 17 months before stepping down in September 2022. Before that, he had been at Citadel Securities and Jane Street, a quantitative trading firm, where he worked with Sam Bankman-Fried.

In reply to a Twitter thread by Harrison where he was speaking about his experiences at FTX US, Scaramucci commented, “Brett was a great developer and deeply understood FTX’s product.”

In a retaliatory comment by Sam Bankman-Fried, the since-shamed former CEO of FTX said in a comment to Bloomberg News:

While I strongly disagree with much of what he [Brett Harrison] said, I have no desire to get into a public argument with him, nor do I feel like it is my place to litigate his job performance in public unless he were to authorize me to do so.

Bankman-Fried also noted that he felt terrible about what happened to all of FTX’s employees, saying that he wished Harrison the best.

Scaramucci Sees Bitcoin At $50,000 To $100,000 In 2-3 Years As Market Hopes For Bull Run

In other news, Scaramucci referred to 2023 as a “restoration year” for Bitcoin (BTC), predicting the flagship crypto may commerce at $50,000 to $100,000 in two to a few years. In his words:

You take on danger; however, you are additionally believing in [bitcoin] adoption. So if we get the adoption proper, and I imagine we are going to, this might simply be a fifty to one hundred thousand greenback asset over the following two to a few years.

Scaramucci’s comments come as investors try to wave off the tumultuous 2022. The statement came during the final week of a crypto convention in St. Moritz, Switzerland, where CNBC spoke to business insiders who tried to paint an image of 2023 as a year of warning.

Among the business insiders featured were Anthony Scaramucci, enterprise capitalist and crypto veteran Bill Tai, international CEO of cryptocurrency alternate Bitstamp, and CoinShares chief technique officer Meltem Demirors. The general sentiment among the crypto pundits was that Bitcoin is predicted to be delicate to the macroeconomic scenario corresponding to the rate of interest rises and proceed to be risky.

Meanwhile, crypto traders are trying to determine when the next Bitcoin bull run might be. At the time of writing, the big crypto is trading at $21,167 after gaining almost 2% in the last 24 hours. The pioneer cryptocurrency is recording a 24-hour trading volume of $21.9 billion and a live market cap of $407.8 billion, which solidifies its #1 position on CoinMarketCap list of crypto by market capitalization. Noteworthy, the global market cap, at $996.2 billion as of press time, is fast approaching the 1 trillion mark.

More News:

- Crypto Zeus Reviews FightOut – New Move-to-Earn Crypto Presale

- SBF accused of “Gaslighting and Manipulation” by the former president of FTX US

- Next Big Crypto Game Presale Meta Masters Guild Hits $230k Raised

Best Wallet - Diversify Your Crypto Portfolio

Join Our Telegram channel to stay up to date on breaking news coverage