Join Our Telegram channel to stay up to date on breaking news coverage

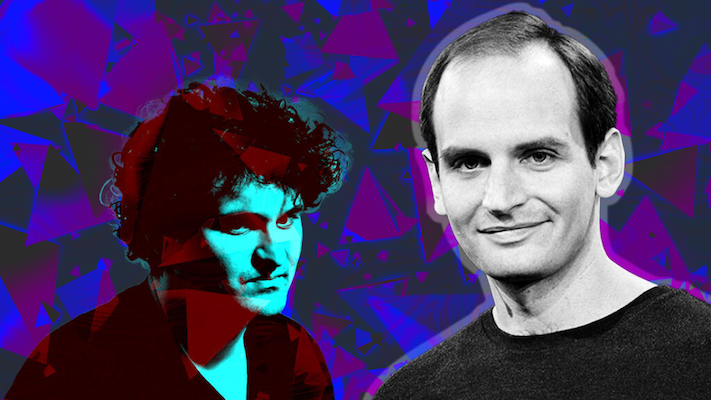

On Saturday, Brett Harrison, the former president of FTX US, provided information about his time working for Sam Bankman-Fried while separating himself from the disgraced crypto tycoon who has been accused of a number of financial offenses.

Harrison made a series of tweets on Twitter in which he accused Bankman-Fried of “gaslighting and manipulation,” stating that he was marginalized as a leader while attempting to expand the footprint of the now-defunct cryptocurrency exchange in the United States.

Even while Bankman-Fried’s crypto empire started to fall apart just weeks before Harrison left his position as head of FTX’s U.S. branch in September, Harrison claims that his relationship with the former CEO had already started to deteriorate months earlier.

After months of disagreements over FTX’s management procedures, “my relationship with Sam Bankman-Fried and his subordinates had reached a point of absolute degradation,” he wrote.

Harrison served as the head of FTX US for a total of 17 months, but according to a former high-ranking worker, he threatened to quit the organization in April of last year, after just 11 months in the position, because of “organizational flaws” he saw with FTX’s structure.

28/49 In early April 2022, my eleventh month, I made one last try. I made a written formal complaint about what I saw to be the largest organizational problems inhibiting FTX’s future success. I wrote that I would resign if the problems weren’t addressed.

— Brett Harrison (@BrettHarrison88) January 14, 2023

One problem, according to Harrison, was the division of FTX’s legal, development, and executive teams, which had an impact on both FTX US and the company’s international exchange.

Harrison described the FTX founder as obstinate and vindictive when his authority was questioned, adding that Bankman-Fried ultimately disagreed with the suggested structural adjustments early in his work at FTX US.

15/49 Six months into my time at the company, pronounced cracks began to form in my own relationship with Sam. Around then I began advocating strongly for establishing separation and independence for the executive, legal, and developer teams of FTX US, and Sam disagreed.

— Brett Harrison (@BrettHarrison88) January 14, 2023

Harrison stated that as president of FTX US, along with other staff members who worked within the bitcoin exchange’s U.S. business, he was under “tremendous pressure not to disagree with Sam.” He claimed that the team’s professional experience was “irrelevant and worthless.”

He said, “I wasn’t the only one at FTX US who didn’t agree with Sam and the people in his inner circle. “FTX US was staffed with skilled personnel from US legal firms, licensed exchanges, and financial firms.”

22/49 I wasn’t the only one at FTX US who disagreed with Sam and members of his inner circle. FTX US was staffed with experienced professionals from US finance firms, law firms, and regulated exchanges.

— Brett Harrison (@BrettHarrison88) January 14, 2023

The “delegation of administrative responsibilities and controls,” which Harrison claimed were handled by Bankman-Fried and other firm officials headquartered in the Bahamas, where FTX was based, were other sticking points he claimed to have uncovered.

The duties of FTX co-founder Gary Wang and former FTX engineering chief Nishad Singh, who is currently negotiating a cooperation agreement with federal prosecutors in New York over Bankman Fried’s criminal trial, were also something he wanted to make clearer.

Last month, attorneys in the Southern District of New York brought charges against Wang and Caroline Ellison, the former CEO of Alameda Research, the trading company Bankman-Fried formed before FTX. Ellison and Wang are both assisting with the FTX probe. No misconduct has been leveled against Singh or Harrison.

Bankman-Fried is facing eight criminal allegations from the prosecution, including fraud and money laundering. He is suspected of taking money from FTX customers worth billions of dollars to cover trades made by Alameda, support political causes, buy private property, and grow his company.

Harrison decided to leave the company after filing a formal complaint about problems he saw with FTX’s organizational structure. He claimed he was “threatening on Sam’s behalf” that he would be fired and have his professional image destroyed.

Harrison said he at first had sympathy for Bankman Fried’s poor leadership and that he believed “addiction and mental health problems” might have played a role.

18/49 Like many of us, I have family and friends who live with addiction and mental health problems, and I’ve seen how these problems often manifest without much warning in early adulthood. I thought that might be a contributing factor, and initially felt sympathetic.

— Brett Harrison (@BrettHarrison88) January 14, 2023

As a junior trader at the New York-based trading business Jane Street, where Ellison also began her career in finance as an intern, the former president of FTX US got to know Bankman-Fried. Before taking on positions at Headlands Technologies and Citadel Securities, Harrison had been employed there for more than seven years.

In addition to the competence Bankman-Fried demonstrated in a programming class he instructed, Harrison formed a favorable opinion of Bankman-Fried because senior traders “said he had promise” and because he was “tender and intellectually curious guy who cared about animals.”

9/49 Beyond that, he seemed like a sensitive and intellectually curious person who cared about animals, and that endeared him to me.

— Brett Harrison (@BrettHarrison88) January 14, 2023

The Federal Deposit Insurance Corporation sent a cease-and-desist letter to FTX US while Harrison was working there due to a false and deceptive statement Harrison made. Harrison claimed that “direct deposits from employers to FTX US are maintained in individually FDIC-insured bank accounts in the users’ names” in a since-deleted Tweet.

According to a recent post by EZPR founder and CEO Ed Zitron, when contacted about the statement through Twitter on Saturday, Harrison blocked Zitron’s account. Zitrion said that Harrison’s action was “laughable.”

In response to Zitron’s query, Harrison stated that “it’s impossible to have a good faith or fact-based debate” about the incident on Twitter. Harrison did not react to calls for comment right away.

The ceo of FTX US, after posting a 48 tweet long tweet storm about how sorry he was and how honest he is, blocked me for asking why he said FTX US accounts were FDIC insured. My guess is because he doesn’t want to say “I lied” or “I was lied to” or “hee!! im da hobgoblin!!” pic.twitter.com/PVVtSBlYq2

— Ed Zitron (@edzitron) January 15, 2023

Harrison said he would transition into an adviser role with the company over the next months but wouldn’t be leaving the cryptocurrency field in his next post when he left FTX US in September.

I have no doubt that the experiences I have in this job will rank among the most memorable in my professional life, he said. To make sure FTX finishes the year with all of its usual momentum, I’ll be helping Sam and the team with the changeover.

9/ I can’t wait to share more about what I’m doing next. Until then, I’ll be assisting Sam and the team with this transition to ensure FTX ends the year with all its characteristic momentum.

— Brett Harrison (@BrettHarrison88) September 27, 2022

According to Bloomberg last month, Harrison is presently starting a crypto software company for which he recently sought capital at a valuation of up to $100 million. American billionaire and former White House director of communications Anthony Scaramucci revealed himself as an investor in a response to Harrison’s post on Saturday.

In September, Bankman-Fried’s FTX Ventures gave Scaramucci’s investment company Skybridge Capital $40 million in exchange for a 30% share in the company. Last year, FTX was heavily highlighted as a sponsor at SALT New York, a networking function connected to Skybridge.

I am proud to be an investor in your new company. Go forward. Don’t look back

Brett I am proud to be an investor in your new company. Go forward. Don’t look back. Wishing you the best.

— Anthony Scaramucci (@Scaramucci) January 14, 2023

Related

- Bankman-Fried enters a not guilty plea

- Latest FTX and SBF news: “I didn’t move the funds”

- SBF’s Alameda Issues Started Long Before Crypto Crash

Join Our Telegram channel to stay up to date on breaking news coverage