Join Our Telegram channel to stay up to date on breaking news coverage

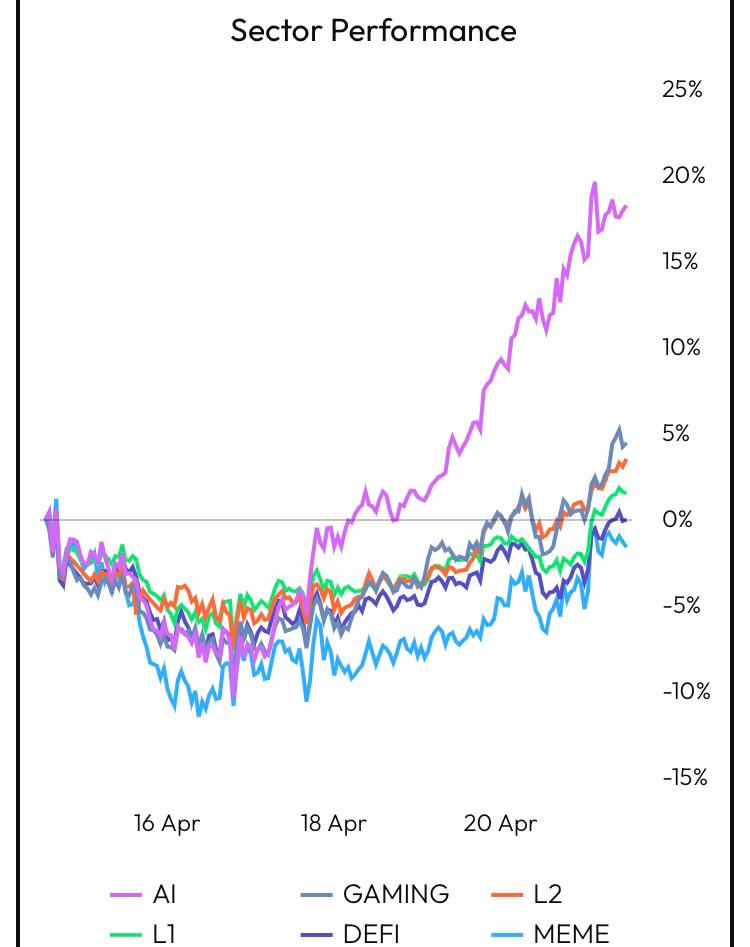

Decentralized Finance (DeFi) is rewriting the rules of traditional finance, offering a world where transactions happen directly between peers without the need for banks or intermediaries. Built on the power of blockchain, DeFi is unlocking a new era of transparency, accessibility, and financial freedom. Within this dynamic landscape, a select group of tokens are not merely participating but leading the way. From Uniswap’s collaboration with Across to introduce ERC-7683 to Pendle, offering a scalable, DeFi-native alternative to traditional over-the-counter (OTC) fixed-income markets, innovation in the DeFi space is accelerating.

Lido reinforces its network resilience and broadens its validator set with the launch of its new Community Staking Module (CSM). DeepBook’s recent deployment on the SUI Network is boosting accessibility and efficiency in on-chain trading, fostering a more decentralized ecosystem. These groundbreaking developments are reshaping the way we perceive financial markets. As DeFi continues to evolve, tokens like these are leading the charge, driving a new wave of innovation and growth that’s redefining the future of finance. Today, let’s dive into some of the leading DeFi tokens by market activity.

Biggest DeFi Token By Market Activity Today – Top List

Uniswap is a decentralized exchange (DEX) that enables seamless token swaps using the Automated Market Maker (AMM) model. Pendle is a DeFi protocol that tokenizes future yield streams, allowing users to trade or lock in yields without collateral. Lido enables liquid staking, allowing users to stake assets like Ethereum while maintaining liquidity through tokens and earning rewards without needing to run a validator. DeepBook is a decentralized order book protocol on Sui, offering low-fee, on-chain trading with improved liquidity for DeFi. Let’s dive in fully to unveil why these tokens are some of the Leading DeFi Tokens by Market Activity Today.

1. Uniswap (UNI)

Uniswap is a pioneering DeFi project that introduced the Automated Market Maker (AMM) model, transforming how users trade cryptocurrencies. As one of the largest decentralized exchanges (DEXs), Uniswap enables users to swap tokens directly from their wallets, eliminating the need for intermediaries. It has become a cornerstone of the DeFi ecosystem by offering seamless, permissionless trading and inspiring the development of numerous AMM-based platforms.

UNI, Uniswap’s governance token, was introduced to respond to rising competition from projects like SushiSwap. Its launch through a retroactive airdrop rewarded early users and set a new standard in DeFi token distribution. UNI allows holders to vote on key protocol upgrades and decisions, reinforcing community-driven development. Beyond governance, UNI represents an essential component in the decentralized finance landscape, symbolizing user participation and protocol sustainability.

Uniswap (UNI) trades at $5.437, marking a 3.77% increase in the past 24 hours. Its daily price performance ranged between a low of $5.159 and a high of $5.494. With a market capitalization of $3.44 billion, Uniswap remains a foundational pillar in decentralized finance, powering one of the largest decentralized exchanges on the Ethereum network. Its recent price movement reflects continued interest and trust in DeFi protocols amid a gradually strengthening market.

Less fragmentation, more liquidity

ERC-7683 is the first cross-chain standard designed to solve liquidity fragmentation through a universal filler network

Co-authored by Uniswap Labs and Across ⤵️

— Uniswap Labs 🦄 (@Uniswap) April 14, 2025

Uniswap Labs and Across have co-authored ERC-7683, a new cross-chain standard to solve liquidity fragmentation. It enables users to create secure, intent-based cross-chain orders that fillers compete to execute, streamlining the process and improving efficiency.

ERC-7683 reduces fragmentation and simplifies cross-chain transactions, thereby enhancing liquidity and improving the user experience across DeFi. With 70+ apps and chains already supporting it, the standard positions Uniswap and Across as leaders in DeFi infrastructure, potentially boosting adoption, developer activity, and long-term value for the ecosystem.

2. Pendle (PENDLE)

Pendle is an innovative DeFi protocol that introduces a new way to trade yield by enabling the tokenization and exchange of future yield streams through an Automated Market Maker (AMM) system. Built to enhance the utility of yield-generating assets, Pendle allows users to unlock additional value by either locking in future yields upfront or gaining direct exposure to them. It opens up a new layer of opportunity in decentralized finance by providing holders and traders with flexible access to future income streams without requiring underlying collateral.

PENDLE, the native token of the Pendle protocol, plays a crucial role in governance and incentivization within its decentralized finance (DeFi) ecosystem. It supports user participation in decision-making processes and helps secure liquidity across supported markets as Pendle continues to integrate with major protocols, such as Aave and Compound. Its token stands at the center of a unique value proposition, expanding the possibilities of yield management and trading in the DeFi space.

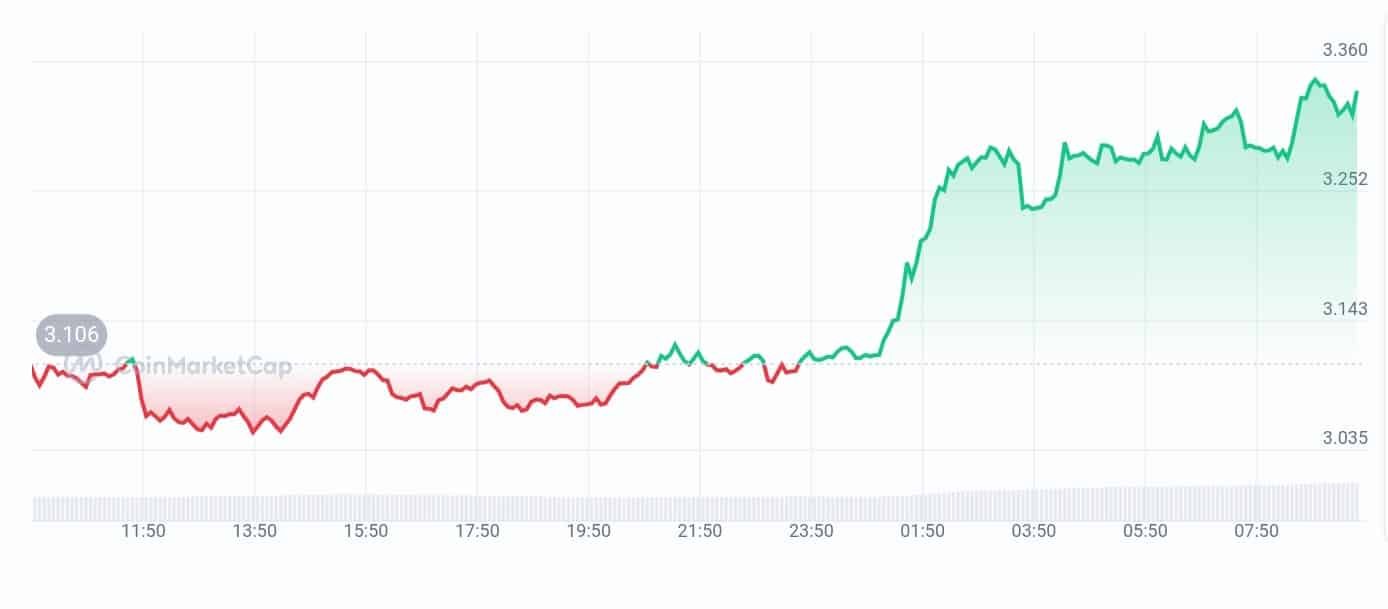

Pendle is trading at $3.336, showing a substantial 7.38% gain over the past 24 hours and an impressive 27.89% rise over the last month. Within the day, its price ranged from a low of $3.047 to a high of $3.345. Backed by bullish market sentiment, Pendle continues to gain momentum as more investors recognize its unique position in the DeFi space, enabling users to tokenize and trade future yields.

Fixed yield is here to stay, and Pendle is leading the way.

Last year, we settled over $21 billion of PTs, generating over $1.5 billion in yield and welcomed 320,000 new users, a five-fold increase from the year before.

Pendle is emerging as the de facto fixed-income… pic.twitter.com/pGSiZdGF3p

— Pendle (@pendle_fi) April 17, 2025

Pendle highlights its massive growth, having settled over $21 billion in Principal Tokens (PTs), generated a yield of over $1.5 billion, and onboarded 320,000 new users. With this momentum, Pendle is positioning itself as the leading fixed-yield marketplace in the DeFi space.

This growth solidifies Pendle’s role as a core component of DeFi infrastructure, providing transparent and efficient fixed-income opportunities. For users, it means reliable yield options. Pendle offers a scalable, DeFi-native alternative to traditional over-the-counter (OTC) fixed-income markets for investors and institutions, therefore making it one of the leading DeFi tokens by market activity today.

3. SUBBD (SUBBD)

SUBBD is an AI-powered platform revolutionising content monetisation in the creator-subscriber economy. Combining AI tools and Web3 enables creators to manage and monetise content, efficiently cutting out middlemen. With features like AI live streams, voice generators, and a 24/7 personal assistant, SUBBD offers a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055225, with over $212,610 raised, the token provides exclusive perks, VIP access, and a 20% annual return through staking. Ten per cent of the total supply is allocated for airdrops and rewards.

New milestone unlocked! ❤️🔥❤️🔥

More than $200,000 raised in the $SUBBD token presale!

👉 https://t.co/dLCKejpxpp pic.twitter.com/h1Zn6NA9aU

— SUBBD (@SUBBDofficial) April 19, 2025

It has also been featured on major cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, highlighting its growing presence in the AI and Web3 space. With its increasing influence, $SUBBD is gaining rapid traction. The launch of the AI Personal Assistant further strengthens its position, offering creators continuous fan engagement. As AI and Web3 redefine digital content, $SUBBD shapes the future of creator income.

4. Lido DAO (LDO)

Lido DAO is a DeFi protocol that offers liquid staking solutions, primarily for Ethereum and other Proof-of-Stake blockchains. It addresses a key limitation in traditional staking by allowing users to maintain liquidity while earning staking rewards. Through Lido, users receive tokens, such as stETH, that represent their staked assets and can be utilized across various decentralized finance (DeFi) platforms. This innovation enhances the flexibility of staking and lowers the entry barrier by enabling users to stake smaller amounts without needing to operate a validator themselves.

LDO is the governance token that powers the Lido protocol and decentralized autonomous organization (DAO). It gives holders voting rights on major protocol decisions, including validator management and upgrades. Functioning as an ERC-20 token, LDO plays a central role in maintaining the decentralized nature of Lido’s liquid staking system. LDO supports a model within the broader DeFi ecosystem that integrates staking and liquidity, driving increased participation and utility in decentralized finance.

Lido DAO is trading at $0.7474, marking a 5.57% increase against the dollar in the past 24 hours and a modest 1.01% gain over the week. With a market cap of approximately $671 million, the token’s price fluctuated between a low of $0.7003 and a high of $0.7513 within the day. As a leading liquid staking solution, Lido continues to draw attention, particularly as staking demand within the Ethereum ecosystem increases.

The evolution of Lido CSM in (almost) 5 min💡

Watch as @d_gusakov breaks down the proposed goals and high-level features of CSM v2.

— Lido (@LidoFinance) April 18, 2025

Since its launch in October 2024, Lido’s Community Staking Module (CSM) has allowed over 300 independent node operators to join its Ethereum protocol. By enabling permissionless validator access backed by stETH bonds, CSM has enhanced decentralization and security while bringing over 8,000 ETH into the network.

CSM strengthens Lido’s resilience and expands its validator base, signaling a shift toward greater decentralization. This evolution improves network health and long-term protocol sustainability for investors, laying the groundwork for CSM v2 and deeper ecosystem participation in 2025.

5. DeepBook Protocol (DEEP)

DeepBook is a decentralized central limit order book (CLOB) protocol designed to enhance trading performance within the DeFi space, leveraging the high-speed capabilities and low fees of the Sui blockchain. Unlike traditional AMM models,

DeepBook enables fully on-chain order routing, matching, and settlement, offering a robust and composable infrastructure for advanced trading strategies. Its design provides deeper liquidity and tighter spreads, making it an essential liquidity layer for Sui’s broader DeFi ecosystem and a suitable venue for institutional-grade market makers.

Should one be introduced, DeepBook’s token, though not yet specified, would likely play a vital role in governance, incentivization, and ecosystem participation. The protocol already contributes significantly to decentralized finance by providing traders and liquidity providers with more precise control and efficiency in price execution. Its fully on-chain architecture positions it as a foundational component in the future of DeFi on Sui, with the potential to redefine how liquidity is aggregated and utilized across decentralized markets.

Deepbook is currently priced at $0.09599, reflecting a substantial 14.75% increase in the past 24 hours and a 26.91% rise over the past week against the dollar. The token’s price performance has ranged from a low of $0.08104 to a high of $0.09632 over the last 24 hours. This upward momentum highlights the growing interest in Deepbook, which could indicate increased market activity or adoption.

DeepBook v3.1 is live on @SuiNetwork

Permissionless pools. Lower fees. Deeper liquidity.

This upgrade marks a new era for onchain trading — designed for builders, traders, and everyone in between.

Let’s break it down 👇 pic.twitter.com/Ke8zpMRiWA

— DeepBook Protocol on Sui (@DeepBookonSui) April 16, 2025

DeepBook v3.1 has been launched on the Sui Network, introducing permissionless pools, lower fees, and enhanced liquidity for on-chain trading. This upgrade caters to builders, traders, and users, offering a more efficient and scalable trading experience.

This update enhances the accessibility and efficiency of on-chain trading, fostering a more decentralized ecosystem. For traders and investors, it offers reduced fees and better liquidity, improving the overall user experience and attracting more participants to the Sui Network.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage